Overview

Faraday Future Intelligent Electric Inc. (NASDAQ: FFIE), an electric vehicle (EV) manufacturer, has seen a dramatic increase in its stock price over the past three months. On February 15, 2024, FFIE was trading at $0.04 per share, but by May 17, 2024, the stock had skyrocketed to $2.75 per share, marking an astonishing rise of approximately 6,775% (TradingView) (MarketBeat).

Key Developments

Reverse Stock Split: Faraday Future announced a 1-for-3 reverse stock split effective February 29, 2024, aiming to increase the share price and regain compliance with Nasdaq listing standards (Stock Market News Live | Stock Titan).

Leadership Changes: The company appointed Werner Wilhelm as Executive Launch Director in April 2024, leveraging his extensive experience in the automotive industry to improve product launches and operational efficiency (Stock Market News Live | Stock Titan).

Middle East Expansion: In March 2024, Faraday Future established a sales entity in Dubai to tap into the Middle Eastern market. This move is part of their broader strategy to expand global presence and boost sales of their flagship model, the FF 91 2.0 Futurist aiFalcon (MarketBeat).

Legal Challenges: Faraday Future has faced legal issues, including a lawsuit against Ding Lei, a former executive, for trade secret infringement and unfair competition. This legal battle underscores the competitive pressures and internal challenges within the company (MarketBeat).

Nasdaq Compliance: The company received a letter from Nasdaq regarding delayed filing of its Form 10-K. Faraday Future has been granted 60 days to submit a compliance plan to avoid delisting (Stock Market News Live | Stock Titan).

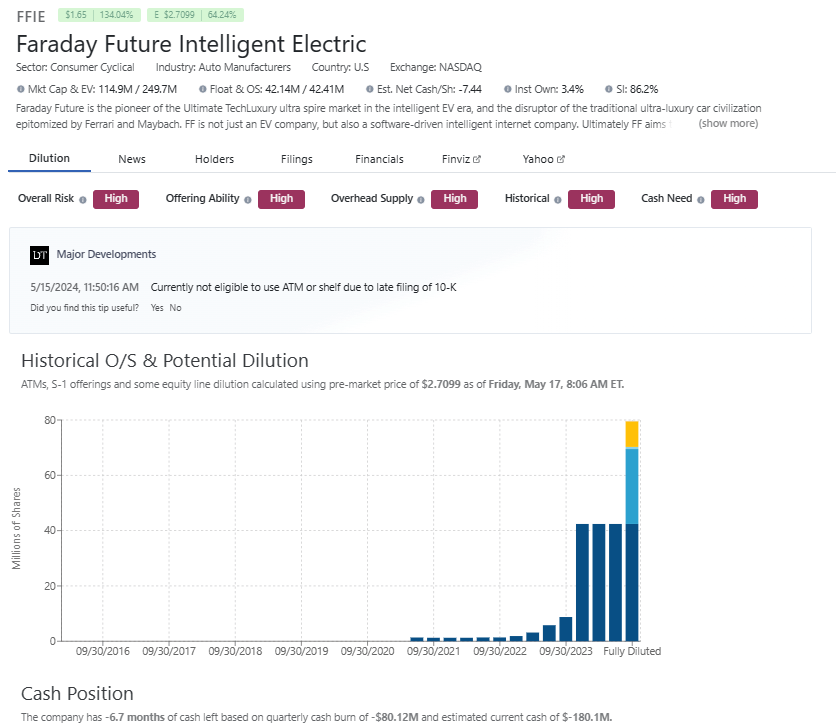

Share Structure, Cash Position, Short Interest and Tutes Ownership

Source: DilutionTracker

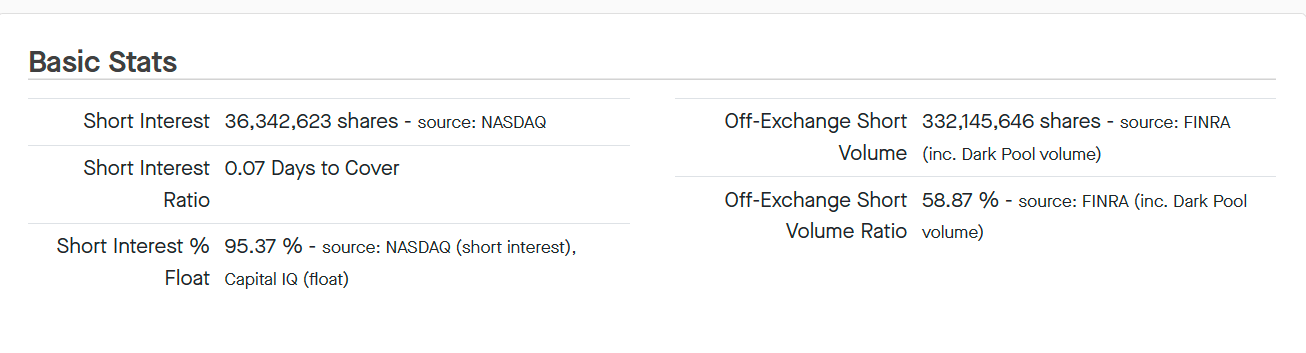

FFIE Short Interest According to Fintel

Meme Stock Phenomenon

Faraday Future’s recent price surge has been significantly influenced by retail investor interest, particularly from communities on Reddit (such as WallStreetBets) and Twitter. These platforms have seen increased discussions and speculative trading, contributing to the stock’s volatility and rapid price appreciation. The meme stock trend often involves coordinated buying by retail investors, driving up prices dramatically, as seen in FFIE’s recent performance.

Market Performance and Technical Analysis

Volatility: FFIE’s stock has been extremely volatile, with a beta coefficient of 2.84, indicating high sensitivity to market movements. Over the past week alone, the stock has risen by 134.04% (TradingView).

Trading Halts: Trading was temporarily halted on several occasions due to significant price movements and pending news, reflecting the stock’s speculative nature (MarketBeat).

Financial Health

Despite recent market enthusiasm, Faraday Future’s financial health remains precarious. The company has faced funding challenges, operational hurdles, and significant competition within the EV sector. It continues to work on securing additional funding and achieving cost reductions to sustain operations and growth (Stock Market News Live | Stock Titan) (MarketBeat).

Conclusion

Faraday Future’s stock performance over the past three months highlights both the potential and the risks associated with high-volatility, meme-driven stocks. While the company is making strategic moves to strengthen its market position, including leadership changes and international expansion, it still faces significant operational and financial challenges. Investors should approach FFIE with caution, considering the speculative nature of recent price movements and the underlying risks.

Risk Factors for Faraday Future Intelligent Electric Inc. (FFIE)

Market and Financial Risks

High Volatility and Speculative Trading

FFIE’s stock has experienced extreme volatility, driven in part by speculative trading from retail investors on platforms like Reddit and Twitter (TradingView) (MarketBeat). Such volatility can lead to rapid and unpredictable changes in stock price, posing significant risks to investors.

Liquidity and Funding Challenges

Faraday Future has faced ongoing liquidity issues, with substantial funding requirements to support its operations and growth plans (Stock Market News Live | Stock Titan) (MarketBeat). The ability to secure additional financing on favorable terms is uncertain, and failure to do so could severely impact the company’s ability to continue as a going concern.

Nasdaq Compliance

The company has received a notice from Nasdaq regarding delayed filing of its Form 10-K, risking potential delisting if compliance is not achieved (Stock Market News Live | Stock Titan). Delisting could lead to reduced liquidity and investor confidence, further exacerbating financial difficulties.

Operational and Strategic Risks

Product Launch and Delivery Delays

Despite appointing experienced industry leaders like Werner Wilhelm, Faraday Future has historically struggled with product launches and meeting delivery timelines (Stock Market News Live | Stock Titan). Any future delays could undermine customer confidence and market competitiveness.

Legal Challenges and Intellectual Property Disputes

FFIE is currently involved in a lawsuit against former executive Ding Lei and Human Horizons for trade secret infringement and unfair competition (MarketBeat). Legal disputes can be costly and divert management’s attention from operational priorities.

Competition in the EV Market

The electric vehicle market is highly competitive, with numerous established players and new entrants (MarketBeat). Faraday Future must continuously innovate and scale production to maintain a competitive edge, which requires significant investment and resources.

Strategic and Market Expansion Risks

Execution of Growth Strategy

While the company has ambitious plans for international expansion, including establishing a sales entity in Dubai, successful execution depends on effective management and market acceptance (MarketBeat). Failure to penetrate new markets or achieve projected sales targets could hinder growth prospects.

Supply Chain and Production Risks

Faraday Future’s ability to scale production and meet demand is contingent on a reliable supply chain and efficient manufacturing processes. Disruptions in supply chain or production inefficiencies could lead to increased costs and delayed deliveries, impacting profitability and reputation.

Financial Reporting and Corporate Governance

Financial Reporting Delays

The company has encountered issues with timely financial reporting, as evidenced by the delayed Form 10-K filing (Stock Market News Live | Stock Titan). Such delays can erode investor confidence and result in regulatory scrutiny or penalties.

Corporate Governance and Management Stability

Ensuring stable and effective corporate governance is critical, especially amid leadership changes and strategic realignments. Any instability or misalignment within the management team can negatively affect strategic decision-making and operational execution.

Conclusion

Investing in Faraday Future Intelligent Electric Inc. (FFIE) involves significant risks due to market volatility, funding challenges, competitive pressures, and operational uncertainties. Potential investors should carefully consider these risk factors in conjunction with their financial situation and investment objectives.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: This article is intended for informational purposes only. It should not be considered financial or investment advice. We do not hold any form of equity in the securities mentioned in this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.