In a complex landscape characterized by persistent inflation, rigorous interest rate adjustments, and global uncertainties, the U.S. Federal Reserve has been navigating a challenging environment with a communication strategy that resonates well with financial analysts but struggles to connect with the general public, according to a recent evaluation. This assessment emerged from a survey conducted by the Brookings Institution’s Hutchins Center on Fiscal and Monetary Policy, which gathered insights from a diverse group of 31 academic and 24 private-sector Fed observers.

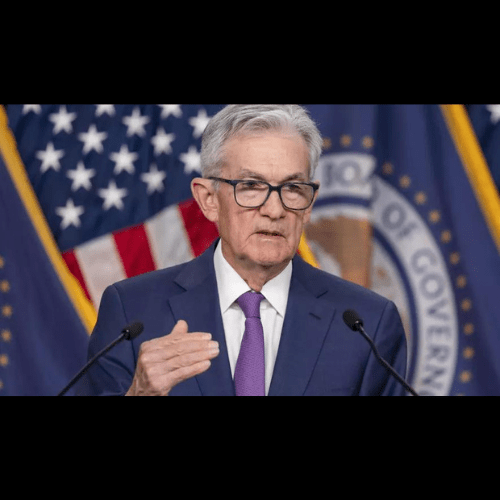

Despite the demanding conditions, the Fed, under the stewardship of Chair Jerome Powell, garnered a median grade of B+ for its communication efforts. This marks a slight decline from the A- rating received in a 2020 survey when the Fed was actively deploying a series of intricate measures in response to the COVID-19 crisis. However, the current rating still underscores the value of the Fed’s primary communication tools, notably Powell’s press briefings post-policy meetings, which a majority of survey respondents found to be “extremely useful” in clarifying the central bank’s policies and economic projections.

The quarterly economic forecasts and the policy statements from the Fed were also seen as valuable by over 70% of those surveyed. In contrast, the “dot plot,” which charts individual policymakers’ rate expectations, received a more lukewarm reception, with only about half finding it particularly enlightening, highlighting ongoing debates over its clarity and utility.

Recent remarks from Fed officials also reflect the intricate balance they maintain in steering economic perceptions. Over the past two days, the discourse has aligned with a cautious approach towards monetary tightening, as evidenced by various speeches aimed at tempering expectations for swift rate cuts amid ongoing economic pressures.

Moreover, the broader range of communications from the Fed’s regional bank presidents and other board members seemed to resonate less effectively, with a significant portion of the respondents viewing these as only marginally useful or not useful at all. This sentiment aligns with a broader public skepticism towards the Fed’s economic management, as reflected in a recent Gallup poll which revealed that only 39% of Americans hold a “great deal or a fair amount of confidence” in Powell’s economic leadership—a slight increase from the previous year’s historic low, yet still indicative of a significant trust gap across political lines.

The survey not only critiqued the Fed’s communication strategies but also touched upon broader policy considerations. There was a strong consensus against raising the current 2% inflation target, a stance the Fed has consistently maintained. Additionally, while the commitment to maximizing employment received substantial support, the strategy to manage inflation—which involves leveraging periods of above-target inflation to offset periods of weak inflation—received a mixed response. Approximately 60% of respondents suggested that this aspect of the policy framework requires significant revisions or at least some adjustments to remain relevant in the current economic context.

Overall, the findings highlight the delicate balance the Fed must maintain in its dual role of managing monetary policy and effectively communicating its actions and intentions to both the financial community and the broader public.

Monetary Magic: How the Fed’s Slower Pace Spells Relief for Market Liquidity

In a recent whirlwind of financial wizardry that might have even perplexed Harry Potter, Roberto Perli from the New York Fed took the stage to weave some monetary magic. He announced, with the solemnity of a Hogwarts professor, that the Federal Reserve’s mountainous pile of cash and bonds—previously growing faster than a teenager on a protein shake diet—will now be expanding more slowly. This revelation came with a side of metrics, served up to help gauge when the financial markets might be running dry, akin to a soda fountain after a Little League victory party.

Perli, who doubles as the guardian of the Fed’s System Open Market Account and possibly a secret financial sorcerer, revealed that the latest incantations from the Federal Open Market Committee have dialed back the speed at which Treasuries are set to vanish from the Fed’s holdings—from a sprint to a leisurely stroll. This change, he suggests, should keep the markets from throwing a tantrum akin to a toddler denied candy.

Since the onset of the pandemic in 2020, the Fed has been on a shopping spree, snapping up Treasury and mortgage bonds like they’re going out of fashion, ballooning its holdings to a hefty $9 trillion. However, with a new plan to let only $40 billion slip through its fingers each month, down from the $95 billion previous escapade, Perli hinted we might avoid repeating the financial equivalent of a surprise pop quiz, like the one markets flunked back in September 2019.

In his toolkit for watching the financial seas, Perli listed a few gadgets and gizmos worthy of any economic Batman: watching how banks play with federal funds, timing interbank payments, and keeping an eye on the shadowy world of repo volumes. It’s all part of his grand plan to ensure that, while the Fed’s balance sheet might be shrinking, it won’t vanish faster than a magician’s rabbit.

Stay tuned as we continue to decode the Fed’s financial spellbook, ensuring you’re not left wondering whether your wallet will pull a disappearing act!

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: This article is intended for informational purposes only. It should not be considered financial or investment advice. We do not hold any form of equity in the securities mentioned in this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.