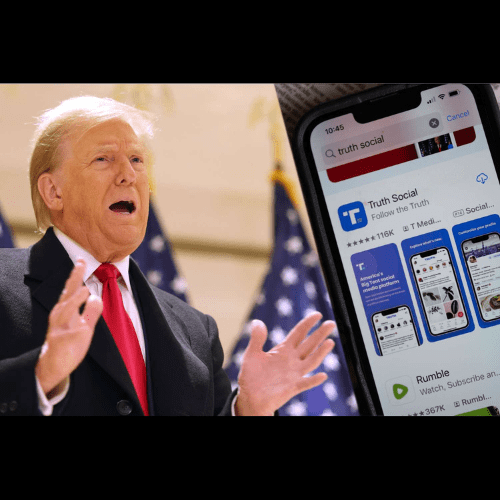

The Digital World Acquisition Corp. (NASDAQ: DWAC) has officially changed its name to Trump Media & Technology Group Corp. and is now trading under the new ticker symbol (NASDAQ: DJT) as of March 26, 2024. This move marks a significant transition for the company, reflecting its merger with Trump Media & Technology Group (TMTG), the parent company of Truth Social, a platform launched by former President Donald Trump.

The merger between DWAC and TMTG, which was approved by DWAC shareholders, has been a focal point for both current and potential investors, especially considering the speculative nature of the investment and its classification among “meme stocks.” These stocks are often driven by investor sentiment rather than company fundamentals. The approval of this merger is expected to provide a substantial financial boost to Trump, with his nearly 80 million shares in the merged company potentially worth around $3 billion or more, depending on the opening share price once the company begins public trading under the DJT ticker.

The journey to the merger has not been straightforward, fraught with regulatory challenges and legal hurdles. DWAC, a special purpose acquisition company (SPAC), aimed to take TMTG public through this merger. However, the process has been delayed multiple times due to various factors, including regulatory probes and legal issues surrounding Trump. Despite these challenges, the merger’s completion signals a new chapter for investors, who now hold shares in a company that operates in the highly volatile and politically charged social media landscape.

The financial performance and stock market behavior of DJT will be critical for investors to monitor. As of the last update, DJT was trading at a price that reflects a significant increase over its previous levels, demonstrating the stock’s volatility and the impact of investor sentiment on its valuation. This volatility underscores the speculative nature of the investment and suggests that investors should be prepared for a potentially bumpy ride.

Investors should also consider the broader implications of the merger and the role of TMTG within the digital media and technology sector. With Truth Social being a central aspect of TMTG’s portfolio, the platform’s ability to grow its user base and generate revenue will be crucial for the long-term success of the company. However, critics and analysts have raised questions about the platform’s valuation and prospects, with some considering it a “meme stock” that might not necessarily reflect the company’s underlying fundamentals.

In conclusion, the transformation of DWAC to DJT represents a significant development for investors interested in the intersection of media, technology, and politics. While the merger offers potential opportunities, it also comes with substantial risks due to the speculative nature of the stock and the challenges facing the social media platform at its core. Investors should closely monitor the company’s performance, regulatory developments, and the broader market dynamics that could influence the stock’s future trajectory.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: This article is intended for informational purposes only. It should not be considered financial or investment advice. We do not hold any form of equity in the securities mentioned in this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.