XTI Aerospace Inc. (NASDAQ: XTIA) Growth Stock Report

About XTI Aerospace Inc.

XTI Aerospace Inc., following a merger with Inpixon, began trading on the Nasdaq under the ticker XTIA on March 13, 2024. The company is spearheaded by Scott Pomeroy as the Chairman and CEO, focusing on the aerospace sector, particularly on developing the TriFan 600 – a fixed-wing, vertical lift crossover airplane (VLCA). The leadership is composed of veterans from the aviation industry, aiming to transform private air travel with the innovative TriFan 600, capable of vertical takeoff and landing. This model targets various segments such as business, medevac, leisure, and cargo, holding over 700 conditional pre-order reservations potentially amounting to over $7 billion in gross revenue (XTI Aerospace, Inc.).

Recent News and Developments (01-01-2024 through 04-02-2024)

The significant development for XTI Aerospace within this period includes the successful merger with Inpixon, which has led to the rebranding and strategic reorientation towards commercializing the TriFan 600. The company held a business update presentation on March 25, 2024, detailing its corporate strategy post-merger, focusing on the development and future plans for the TriFan 600 (See catalysts below). Additionally, the company and Streeterville Capital, LLC, entered an exchange agreement, converting an outstanding promissory note into Series 9 Preferred Stock, part of the financial structuring post-merger (XTI Aerospace, Inc.).

Potential Catalysts

XTI Aerospace Inc. announced a business update presentation to outline the company’s strategy following the merger with Inpixon on March 12, 2024. The presentation, led by CEO Scott Pomeroy, will discuss advancements in the development of the TriFan 600, a vertical takeoff and landing (VTOL) aircraft that represents a significant innovation in aviation, combining the performance of a fixed-wing business aircraft with the convenience of a helicopter. The company aims to complete the construction of the first full-scale piloted test aircraft and commence flight tests, marking a new era in aviation.

The TriFan 600 has garnered conditional pre-orders worth over $7 billion in anticipated gross revenue, based on the current list price of $10 million per aircraft, contingent upon successful development, FAA certification, and delivery. XTI Aerospace, headquartered near Denver, Colorado, is dedicated to developing the TriFan 600, aiming to create a new category of aircraft, the vertical lift crossover airplane (VLCA), with capabilities far exceeding those of current helicopters in terms of speed and range.

The presentation is available live online, with a replay accessible through the company’s Investor Relations website.

For further details, you can visit the Investor Relations section of XTI Aerospace’s website at XTI Aerospace Investor Relations.

Potential catalysts for XTI Aerospace may include progress in the TriFan 600 development, further FAA certification steps, strategic partnerships or orders, technological advancements, and expansion into new markets.

Financials (Last 12 Months)

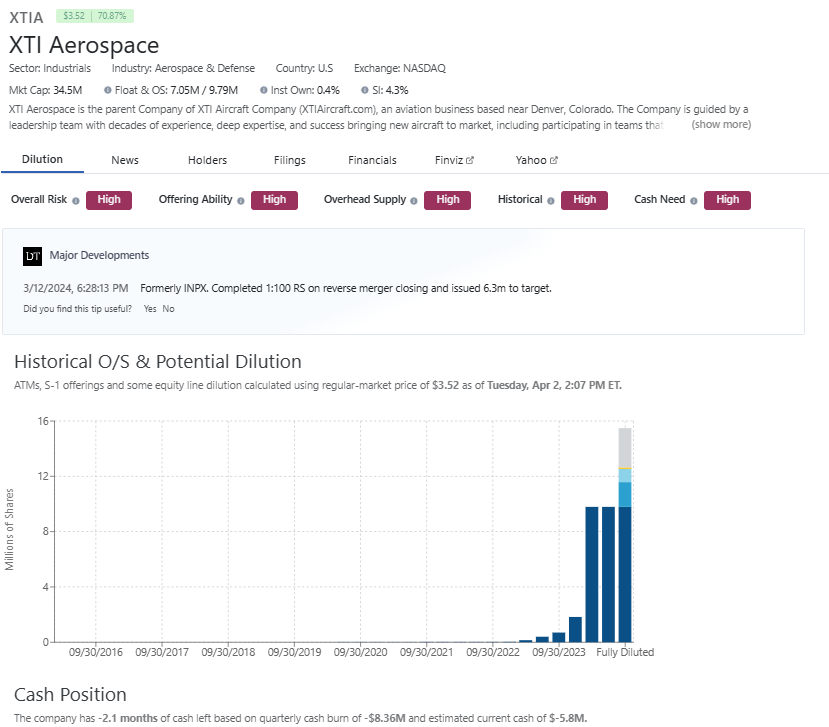

XTI Aerospace has faced financial challenges, with a reported income of -$48.94 million and sales revenue amounting to $12.46 million. The company has experienced a significant share price volatility, with the stock price seeing a dramatic increase to $3.65, a 77.18% change recently, yet still down significantly from previous highs. The company’s market cap is reported at $6.58 million, with a moderate short interest of approximately 4.3% (Source: Finviz and DilutionTracker).

Industry and Competition

XTI Aerospace operates in the aerospace and defense sector, specifically targeting the burgeoning advanced air mobility (AAM) market with its TriFan 600 VLCA. This places the company in direct competition with other firms developing VTOL and AAM technologies, as well as traditional business aircraft and helicopter manufacturers. The unique proposition of the TriFan 600 sets it apart but also subjects it to the challenges of a highly innovative and competitive market.

Estimated Share Structure, Cash Position, Short Interest (SI), and Institutional Ownership

Source: DilutionTracker

Daily Stock Chart

Source: Finviz

Conclusion

XTI Aerospace Inc. stands at a critical juncture, with the development of the TriFan 600 offering a potentially transformational product for the aerospace industry. However, the company faces significant challenges, including financial stability, market competition, and technological development hurdles. Success in overcoming these challenges and leveraging its unique product offering could position XTI Aerospace favorably within the advanced air mobility sector, making it a best growth stock to watch in the coming months and years.

Risk Factors

Based on the recent developments and announcements about XTI Aerospace, Inc. (NASDAQ: XTIA), several risk factors can be identified that could potentially impact the company’s future performance and valuation:

Capital and Financing Risks: XTI Aerospace faces challenges in securing additional capital to finance its operations and development of the TriFan 600 aircraft. The need to raise capital on acceptable terms is critical for the company’s ability to continue as a going concern.

Regulatory and Certification Risks: The company is subject to the uncertainties associated with regulatory approvals, including certification by the Federal Aviation Administration (FAA), which is known to be a lengthy and costly process. Any delays or failures in obtaining such certifications could significantly impact the company’s development timeline and commercialization efforts.

Operational and Development Risks: There are inherent risks in the development of new aircraft, including the TriFan 600. XTI Aerospace’s ability to successfully complete the critical design review, commence flight testing within the projected timeframe, and achieve commercial production is subject to technical, operational, and financial uncertainties.

Market Adoption and Competition: The company’s success heavily relies on the market adoption of the TriFan 600. XTI Aerospace operates in a highly competitive industry, facing competition from other business and regional aircraft manufacturers. The company’s ability to differentiate its offering and capture market share is crucial.

Employee Retention and Management Changes: Following the merger and changes in leadership, XTI Aerospace may face challenges in retaining key personnel. Effective management and integration of new leadership are essential for the company’s strategic execution and operational success (XTI Aerospace, Inc.).

Technological and Production Risks: The decision to start with certified turboshaft engines, postponing the adoption of a hybrid-electric propulsion system, reflects the technological challenges and uncertainties the company faces. Additionally, decisions regarding the supply chain and production facilities, including potential manufacturing outside the U.S., introduce further risks related to quality control, cost management, and logistical complexities (FutureFlight).

Legal and Litigation Risks: The company is susceptible to legal proceedings related to the merger or its operations, which could have adverse financial and reputational impacts (Yahoo Finance).

Market Volatility and Shareholder Value: XTI Aerospace’s share price may be subject to volatility due to factors such as market reception of its business strategy, development progress, and broader market conditions. Ensuring shareholder value in the face of these uncertainties is a key challenge (Yahoo Finance).

XTI Aerospace’s ambitious project to bring the TriFan 600, a vertical lift crossover airplane, to market involves navigating a complex landscape of technical, regulatory, and financial challenges. Successfully addressing these risk factors is crucial for the company to achieve its goals and capitalize on its market potential.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: This article is intended for informational purposes only. It should not be considered financial or investment advice. We do not hold any form of equity in the securities mentioned in this article. We have not been compensated for the creation or distribution of this article in any way. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.