Update: CNTM Breaking Above Key Levels With Recent Developments

I wanted to share some really exciting news that could be a game-changer for ConnectM. They’ve just secured a major Master Services Agreement (MSA) with Devlin Energy, a well-known solar and battery retrofit installer in New England. This partnership is set to add over $20 million in revenue within the next year and positions ConnectM for significant growth in the clean energy space.

So, what does this mean? Well, Devlin Energy has a stellar reputation for their solar installations and customer service, and by teaming up with ConnectM, they’re about to kick things into high gear. ConnectM will be taking on a range of responsibilities—from HR and supply chain management to marketing and lead generation—helping Devlin Energy scale even faster. Plus, ConnectM has the option to fully acquire Devlin Energy by 2025 if certain financial targets are met. If those targets are hit, we’re talking about some seriously impressive revenue growth over the next few years.

Now, let’s talk about the potential catalysts that haven’t yet happened but could drive ConnectM’s stock price even higher:

Potential Acquisition: By 2025, ConnectM could acquire Devlin Energy outright if Devlin meets certain revenue and income thresholds. This could be a huge value driver, adding an estimated $108 million in revenue by 2029.

Scaling Solar Installations: With ConnectM’s AI-driven platform and Devlin’s customer base, they could see exponential growth in residential and commercial solar installations. We’re still waiting to see how quickly they can scale, but it’s a key point to watch.

Battery Storage Expansion: Devlin’s battery retrofit capabilities could be a major untapped opportunity. As battery storage becomes increasingly critical to clean energy strategies, the rollout of these services under ConnectM’s platform could significantly boost revenue.

Cross-Marketing and Synergies: ConnectM’s existing services and customer base could create new opportunities for cross-selling, adding value that hasn’t been fully realized yet. As they integrate their energy intelligence network with Devlin’s solar solutions, there’s potential for accelerating both top-line and profitability growth.

This partnership could be transformative for both companies, and if all these catalysts come to fruition, we’re looking at some very exciting times ahead. Keep an eye on ConnectM—this is just the beginning!

Original coverage below…

Significant Development for CNTM Suggesting over 80% Upside!

Their recent press release issued 09/17/2024 from ConnectM Technology Solutions, Inc. (NASDAQ: CNTM) offers some significant news regarding the company’s financial health, which could potentially impact its stock and overall business trajectory. In simple terms, ConnectM has made an important move by converting a substantial portion of its debt into equity—meaning they’ve essentially swapped what they owe (debt) for ownership stakes in the company (equity). Here’s a breakdown of what this means, why it matters, and the potential catalysts it creates for the company’s future.

What ConnectM Did

ConnectM announced that it successfully eliminated $7.5 million in debt by converting it into common shares at a rate of $2.00 per share. This is part of a broader initiative to reduce up to $15 million of total debt through similar conversions. The company has already completed over half of this process, which is important because it indicates significant progress in improving their balance sheet.

In simpler terms, instead of paying back $7.5 million in loans or debt, ConnectM gave their lenders shares of the company. This reduces the amount of money ConnectM owes and transforms those lenders into shareholders, who now own part of the company.

Why This Matters: Debt vs. Equity

Debt can be a burden for companies because they have to pay interest on that debt, which takes money away from other important activities like research, growth, or innovation. In ConnectM’s case, reducing $7.5 million of debt saves them $1.8 million annually in interest payments. That means they don’t have to spend this money on interest anymore. Instead, it can go toward growing the company, reinvesting in new technologies, or simply improving their cash flow—freeing up resources that can be used for more productive purposes.

By turning debt into equity, ConnectM no longer needs to worry about paying back those $7.5 million. In return, lenders become shareholders who benefit from the company’s future success. This move also signals confidence from these lenders; by accepting shares instead of cash, they’re betting on the company’s future growth.

Impact on the Balance Sheet and Stock

From an investor’s perspective, this is generally seen as a positive move. Decreasing debt strengthens ConnectM’s balance sheet, making the company financially healthier. A company with less debt is less risky because it has fewer financial obligations, making it more attractive to potential investors.

Additionally, reducing debt means that ConnectM’s earnings aren’t being eaten up by interest payments. Instead, they can direct that money to projects that help the company grow. Since the $1.8 million in savings goes directly to free cash flow, ConnectM now has more liquidity—more cash available for future projects, acquisitions, or even potential dividends to shareholders.

However, one important thing to note is that issuing new shares dilutes the value of existing shares. Since the lenders are being given equity (shares in the company), the total number of shares increases, which can sometimes lower the value of each individual share. Still, if the company’s future prospects are bright, as ConnectM hopes they are, this dilution could be offset by higher stock prices in the long term.

ConnectM’s Broader Strategy and Potential Catalysts

This debt reduction is part of a larger effort by ConnectM to reposition itself in the growing electrification economy. ConnectM operates in a space focused on the transition to solar power, electric heating and cooling, and all-electric transportation—all of which are seen as essential components of the fight against climate change.

The company’s AI-driven platform integrates electrified energy systems, making it easier for residential and commercial buildings to move away from fossil fuels. By cutting costs, reducing debt, and focusing on innovation, ConnectM is better positioned to capitalize on the opportunities in the electrification economy.

Here are some of the key growth drivers and catalysts to watch for, which make the debt reduction even more meaningful:

Electrification Growth: Governments and businesses worldwide are pushing for a transition away from fossil fuels to renewable energy. ConnectM’s business model is well-aligned with this trend. Their products and services, which focus on solar energy and electrification, are in growing demand.

AI Integration: ConnectM’s platform uses artificial intelligence (AI) to make electrification easier, more efficient, and more affordable. The company is integrating cutting-edge technology to ensure that electrified systems (like solar panels, electric vehicle chargers, and HVAC systems) work as smoothly and efficiently as possible.

Cost Savings for Customers: One of ConnectM’s selling points is helping customers reduce energy costs by transitioning to electric systems. As energy prices fluctuate and the push for sustainability grows, ConnectM is offering solutions that can both reduce costs and decrease reliance on traditional energy sources.

Debt Reduction: By halving its debt burden, ConnectM now has more cash on hand for further expansion. The company’s stronger financial position allows it to focus on scaling its operations without the burden of excessive debt repayments.

From the image below: “Major Developments

8/28/2024, 6:12:36 PMBoard of Directors has approved a debt equity swap to deleverage the balance sheet, converting up to $15 million of the Company’s outstanding debt to common equity at $2.00 per share. In addition to the Board’s approval of the debt-to-equity conversion, the Board approved a trading policy for the Company’s officers and directors, opening a window for share purchases by management, beginning today, August 28, 2024.”

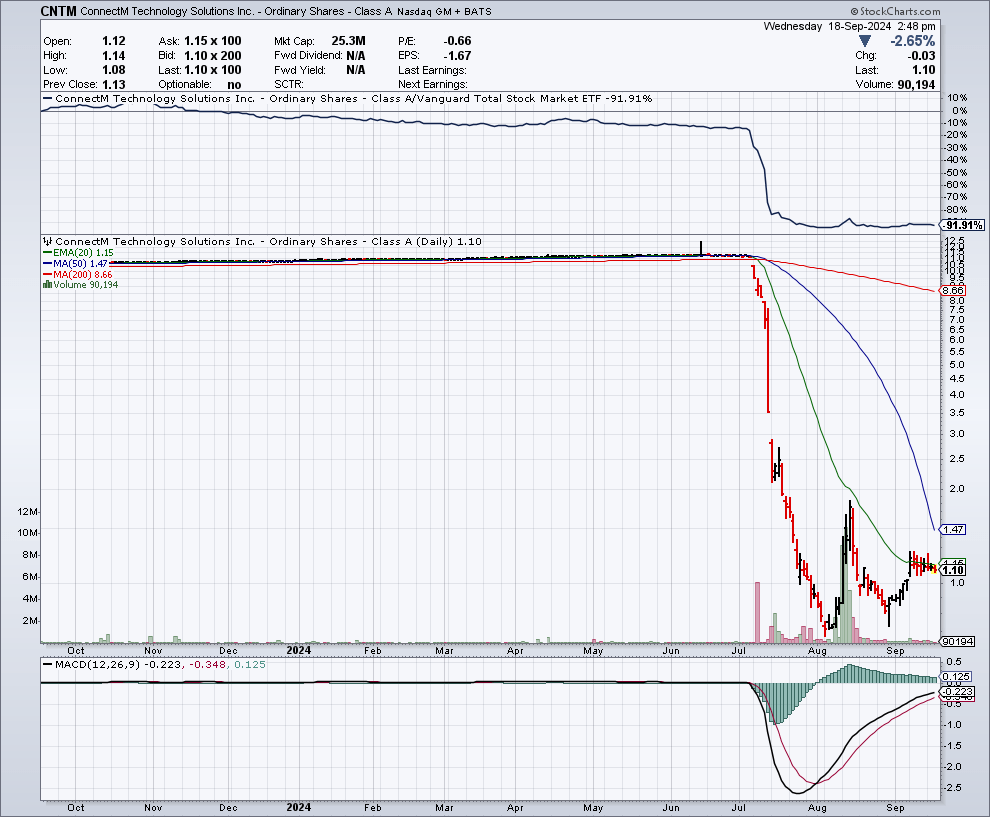

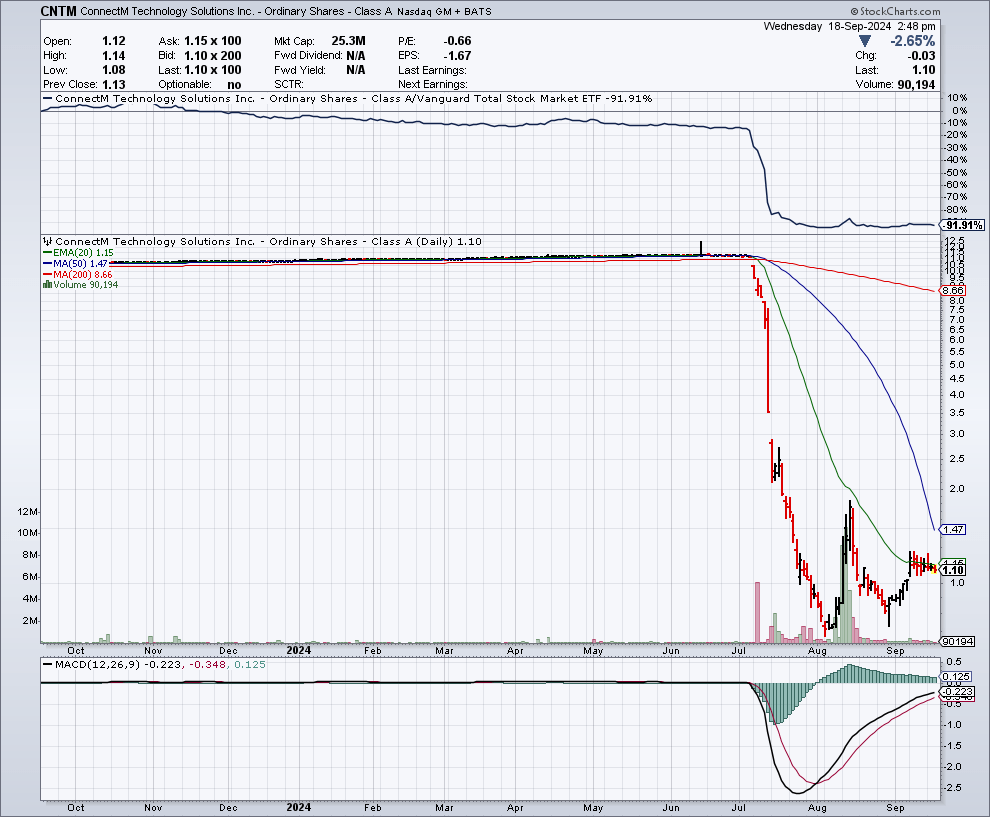

CNTM Chart

Conclusion

In summary, ConnectM’s decision to convert $7.5 million in debt into equity is a critical step toward improving the company’s financial health. By reducing debt, the company saves $1.8 million annually in interest expenses, which can now be used for expansion and innovation. This move also reduces risk, improves liquidity, and strengthens ConnectM’s position in the rapidly growing electrification economy. While there is a potential for dilution in the stock due to the issuance of new shares, the company’s long-term prospects—driven by its focus on solar energy, AI, and electrification—provide a solid foundation for future growth.

Watch for further debt reduction, product launches, and developments in AI and electrification, as these factors could provide strong near-term catalysts for ConnectM Technology Solutions.

See the full original release here: Press Release 09/17/2024

Happy trading,

Your friend,

Steve Macalbry

Senior editor at BGS

Just to remind you, breakout and swing alerts are typically quick trades. AI-desk issuances are labeled as such.

Plan your trade, trade your plan.

Disclaimer and About Us

Best Growth utilizes a revolutionary fusion of AI-powered analytics and human-led research to distill the vast and complex world of stock trading down to its purest essence. Designed to identify situations before a major move. Our proprietary AI, meticulously performs fundamental, sentiment analysis, scrutinizes an extensive array of data points and trends, providing deep, insightful, and timely market perspectives. This technology operates in concert with our seasoned research team, who apply years of industry knowledge and expertise to refine our AI’s results. The culmination of this unique blend of cutting-edge technology and human expertise is the weekly issuance of one to two stock ideas, carefully selected to offer what we believe will yield the most substantial near-term results thus paving the way for intelligent trading that delivers tangible value. Available exclusively by email or SMS/text message via our newsletter.

Best Growth is your ultimate destination for reliable and insightful stock news and analysis. We are dedicated to providing you with the latest updates and in-depth coverage of the world’s most promising growth stocks. Our experienced financial experts and market analysts work tirelessly to bring you the most accurate and up-to-date information.

At Best Growth, we understand that the investing world can be complex and intimidating. That’s why our primary goal is to simplify the process for you, offering easy-to-understand news articles, market reports, and expert commentary. Whether you are a seasoned investor or just starting your journey in the stock market, we strive to cater to your needs by presenting information in a clear and concise manner.

Our commitment to excellence extends to the quality of our content. We pride ourselves on delivering accurate, objective, and fact-based news and analysis. Our team follows a rigorous editorial process to ensure the highest standards of journalistic integrity.

At Best Growth, we believe in the power of knowledge and education. We go beyond simply reporting stock news; we provide third-party educational resources and investment guides to help you navigate the complexities of the market. We aim to empower you with the knowledge and tools necessary to achieve your financial goals.

We also understand that time is of the essence when it comes to stock analysis and news. That’s why we offer a user-friendly platform that ensures you have quick and easy access to the latest information. be sure you are subscribed to our newsletter and text alerts. Whether you prefer browsing our website or accessing our content through our free or premium subscription, we strive to make your experience seamless and convenient.

We value our community of readers and investors, and we encourage active engagement and participation. Feel free to share your thoughts and contribute to the discussions on our platform (coming soon). We believe that a vibrant and diverse community of investors can enhance the learning experience for everyone involved.

Thank you for choosing Best Growth as your go-to source for reliable stock news and analysis. We are committed to serving you with excellence and helping you stay ahead in the dynamic world of investing. Join us on this exciting journey toward financial growth and prosperity!

Sponsored Content Disclosure – In Accordance with the Securities Act Section 17 (b)

Transparency is very important to us. Please read this disclaimer in its entirety to fully understand this segment of our business model.

BestGrowthStocks.com is a wholly owned subsidiary of Media Source LLC, herein referred to as MS LLC.

This website / media webpage is owned, operated, and edited by Media Source LLC. Any wording found on this website / media webpage or disclaimer referencing to “I” or “we” or “our” or “MS LLC” refers to Media Source LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time.

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use. Part of MS LLC’s business model is to receive financial compensation to promote public companies in an investor relations capacity. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our Websites, Email, SMS, Push Notifications, Influencers, Social Media Postings, Ticker Tags, Press Releases, Online or Phone Interviews, Podcasts, Videos, Audio Ads, Banner Ads, Native Ads, Responsive Ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the publicly traded entities mentioned. Therefore, this communication should be viewed as a commercial advertisement only. Note, we periodically conduct interviews and issue stock alerts that we are not compensated for, these are purely for the purpose of building our brands and other portions of our business model. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors. We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct but has not been independently verified and is not guaranteed to be correct.

Please Note: MS LLC and its employees are not a registered investment advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold MS LLC, its operator’s, owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information in our website / media webpage is believed to be accurate and correct but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, MS LLC often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Some of our claims regarding gains could be based on intra-day, pre-market and after-hours trading data.

All information on featured companies is provided by the companies profiled or is available from public sources and MS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. We have been compensated up to twelve thousand dollars cash via bank wire for this additional coverage of CNTM to last two days from 10-9-2024 through 10-10-2024. We were compensated up to twelve thousand dollars cash via bank wire for additional coverage of CNTM to last two days from 09/18/2024 through 09/19/2024. We were previously compensated up to twelve thousand dollars cash via bank wire for our coverage of CNTM 08/11/2024 through 08/12/2024. We do not hold any form of equity in CNTM. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead, MS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

MS LLC is compliant with the Can Spam Act of 2003. MS LLC does not offer such advice or analysis, and MS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in small and micro-cap growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results.

In preparing this publication, MS LLC has relied upon information supplied by its customers, publicly available information, and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, MS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement.

MS LLC is not responsible for any claims made by the companies advertised herein, nor is MS LLC responsible for any other promotional firm, its program or its structure.