| Our AI-Assisted Research Desk Has Uncovered a Potential Upcoming Merger Divesting a Chinese Education Company and Merging with an American Education Products Provider

Update: 6-K filed September 21st, 2023

Gravitas Education Holdings Inc. Announces Special Cash Dividend in the Range of US$11.256 to US$12.17 per American Depositary Share and Reports Status of Merger

BEIJING, Sept. 21, 2023 /PRNewswire/ — Gravitas Education Holdings Inc. (the “Company”) (NYSE: GEHI), a leading early childhood education service provider in China, today announced that the Company’s board of directors (the “Board”) approved a special cash dividend in an amount ranging from US$11.256 to US$12.17 per American Depositary Share (“ADS”), or from US$0.5628 to US$0.6085 per ordinary share. The aggregate amount of cash dividends to be paid ranges from US$16 million to US$17.3 million, which will be funded by cash on the Company’s balance sheet. The payment of the special dividend is conditional upon the Closing (as defined below), and the exact amount of such special dividend is to be determined and separately announced. Following payment of the special dividend and after the previously announced divestiture of GEHI’s PRC education business, the net cash of the Company (excluding the aggregate amount of such special dividend, but including the consideration received for the PRC education business divestiture) will be no less than US$15 million at the Closing (as defined below).

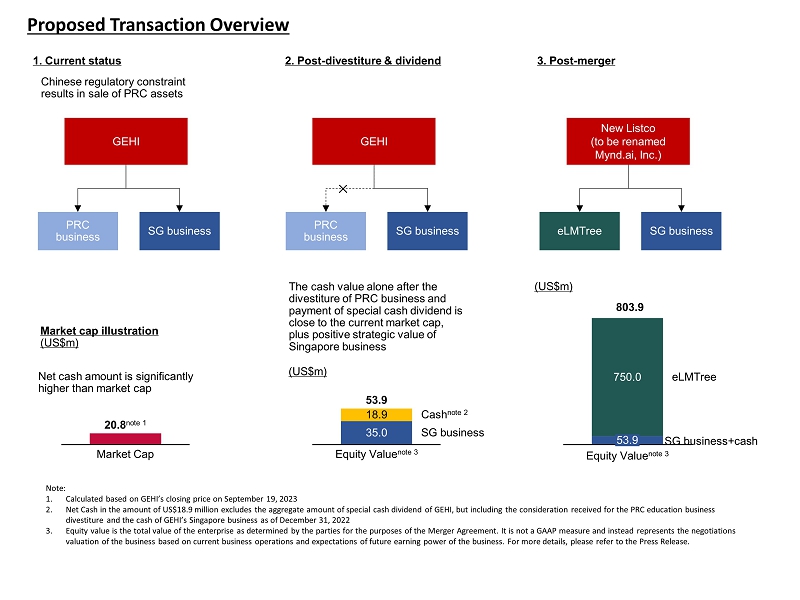

The Company previously announced that it entered into an agreement and plan of merger (the “Merger Agreement”), dated April 18, 2023, with Bright Sunlight Limited, a Cayman Islands exempted company and a direct, wholly owned subsidiary of the Company (the “Merger Sub”), Best Assistant Education Online Limited, a Cayman Islands exempted company (“Best Assistant”) and a controlled subsidiary of NetDragon Websoft Holdings Limited (HKEX: 0777, “NetDragon”), a Cayman Islands exempted company, and solely for purposes of certain named sections thereof, NetDragon. It is contemplated that Best Assistant will transfer the education business of NetDragon outside of the PRC to Elmtree Inc., a Cayman Islands exempted company limited by shares wholly owned by Best Assistant (“eLMTree”). Pursuant to the Merger Agreement, Merger Sub will merge with and into eLMTree with eLMTree continuing as the surviving company and becoming a wholly owned subsidiary of the Company (the “Merger”). The overview of the transaction is described in more details in Annex A.

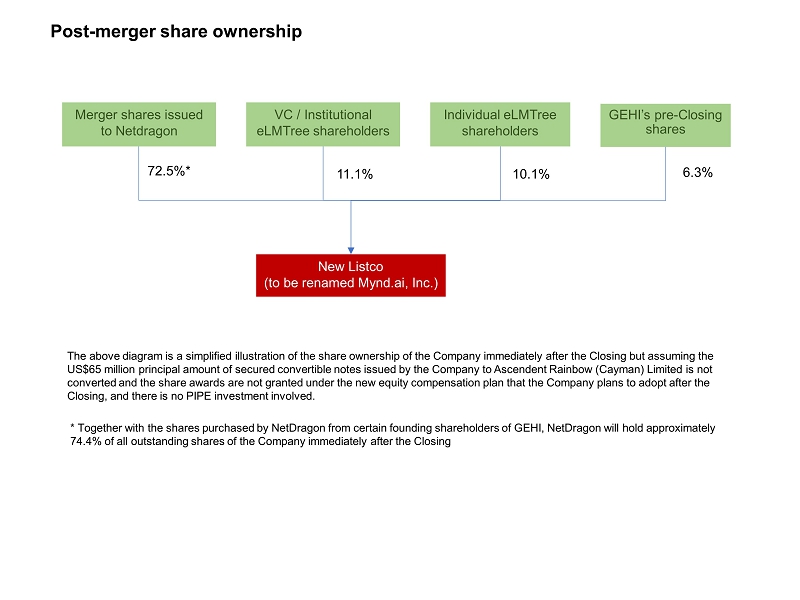

Immediately following closing of the Merger (the “Closing”), the Company will change its name to “Mynd.ai, Inc.” and operate in the global market of interactive classroom technology with its headquarter in Seattle, Washington. The share ownership of the Company immediately after the Closing is illustrated in Annex B.

The cash dividend will be paid by the Company on or before the 21st day after the date of the Closing to shareholders of record at the close of business on the date immediately prior the Closing date (the “Record Date”). ADSs will trade with an entitlement to the cash dividend until the ex-dividend date is established by the New York Stock Exchange (“NYSE”). In order to retain the right to the cash dividend, ADS holders of the Company need to hold the ADSs until the ex-dividend date, which shall be the first business day after the Closing.

As conditions to Closing, among other things, approval by the NYSE of the listing application submitted by the Company shall be obtained and Completion of CFIUS Process (as defined under the Merger Agreement) shall have occurred. The Company is actively working with the NYSE in connection with its listing application. Similarly, the Company and NetDragon are working with CFIUS to obtain approval for the Merger as soon as practicable.

In light of the above updates related to the Merger, once the Closing date is fixed, the Company will issue a separate press release announcing the final amount of special cash dividend to be paid by the Company and the Record Date for purpose of the dividend payment. The said press release will be issued at least 10 days prior to the Record Date in compliance with applicable listing rules.

Annex A

Annex B

About Gravitas Education Holdings, Inc.

Founded on the core values of “Care” and “Responsibility,” “Inspire” and “Innovate,” Gravitas Education Holdings, Inc. (formerly known as RYB Education, Inc.) is a leading early childhood education service provider in China. Since opening its first play-and-learn center in 1998, the Company has grown and flourished with the mission to provide high-quality, individualized and age-appropriate care and education to nurture and inspire each child for his or her betterment in life. During its two decades of operating history, the Company has built itself into a well-recognized education brand and helped bring about many new educational practices in China’s early childhood education industry. GEHI’s comprehensive early childhood education solutions meet the needs of children from infancy to 6 years old through structured courses at kindergartens and play-and-learn centers, as well as at-home educational products and services.

Original Members Only Report Issued September 11th, 2023 Below

Gravitas Education Holdings, Inc. (NYSE: GEHI) to Hold Extraordinary General Meeting of Shareholders on September 11, 2023 FULL PR

There is a link to the full proxy below.

Current $12.69/Share

Highlights

In addition to current offerings, eLMTree plans to offer products that feature artificial intelligence (AI). As a matter of fact, they plan to immediately change their name post-merger to Mynd.ai Inc.

GEHI currently has, pre-merger, 1.38M shares outstanding and a public float of 388.9K shares (Source Yahoo Finance). It could easily get too volatile for some to stomach. Be careful!

The Merger Vote was Approved September 11th, 2023

This will be a completely different USA-listed company should the merger be successful.

Let’s start with a recent press release from Gravitas Education Holdings, Inc. (NYSE: GEHI)

Gravitas Education Holdings, Inc. Reports First Half 2023 Financial Results

BEIJING, Sept. 8, 2023 /PRNewswire/ — Gravitas Education Holdings, Inc. (“GEHI” or the “Company”) (NYSE: GEHI), a leading early childhood education service provider in China and Singapore, today announced its unaudited financial results for the first half of 2023.

The Company’s Acquisition of eLMTree and Divestiture of its PRC Business

The Company announced on April 18, 2023, that it has entered into an agreement and plan of merger (the “Merger Agreement”), dated April 18, 2023, with Bright Sunlight Limited, a Cayman Islands exempted company and a direct, wholly owned subsidiary of the Company (the “Merger Sub”), Best Assistant Education Online Limited, a Cayman Islands exempted company (“Best Assistant”) and a controlled subsidiary of NetDragon Websoft Holdings Limited (HKEX: 0777, “NetDragon”), a Cayman Islands exempted company, and solely for purposes of certain named sections thereof, NetDragon. It is contemplated that Best Assistant will transfer the education business of NetDragon outside of the PRC to Elmtree Inc., a Cayman Islands exempted company limited by shares (“eLMTree”) and currently a wholly owned subsidiary of Best Assistant. Pursuant to the Merger Agreement, Merger Sub will merge with and into eLMTree with eLMTree continuing as the surviving company and becoming a wholly owned subsidiary of the Company (the “Merger”).

Concurrent with the execution of the Merger Agreement, the Company has entered into a share purchase agreement (the “Divestiture Agreement”) with Rainbow Companion, Inc. (the “Divestiture Purchaser”), a purchaser consortium formed by Joy Year Limited, Bloom Star Limited, Ascendent Rainbow (Cayman) Limited (and its affiliates), Trump Creation Limited and China Growth Capital Limited. Pursuant to the Divestiture Agreement, immediately prior to the Closing, the Company will transfer all its education business in China to the Divestiture Purchaser (the “Divestiture”). Upon completion of the Divestiture, the Company will cease to operate any education business in China.

As the Company will divest its China business, the Company’s China operations and its associated assets and liabilities have been reclassified as discontinued operations in the financial results. After the Divestiture, the Company’s Singapore operations and its associated assets and liabilities will continue to remain with the Company. As the Merger has not closed, the financial information of eLMTree is not included in the Company’s financial results for the first six months of 2023. For the unaudited pro forma condensed combined financial information which presents the combined financial information of the Company following the Divestiture and eLMTree after giving effect to the Merger, please refer to the proxy statement for extraordinary general meeting of the Company that was included in our current report on Form 6-K filed with the Securities and Exchange Commission on July 31, 2023. FULL PR

Okay, let’s break this down step-by-step in simpler terms:

What’s Happening?

The Company is making two big moves:

Buying (or merging with) a company called eLMTree which owns Promethean.

Selling (or divesting) its education business in China.

The Merger/Buying eLMTree:

The Company has made an agreement on April 18, 2023, to merge with eLMTree.

How’s it happening?

There’s a middleman involved, named Best Assistant, which is under a big company called NetDragon. Best Assistant will first get NetDragon’s education business outside of China and give it to eLMTree. Then, the Company will merge with eLMTree, making eLMTree a part of The Company.

Selling Their China Business:

- At the same time, The Company made another deal to sell its education business in China.

- Who’s buying it? A group called Rainbow Companion, Inc. which is made up of several other companies.

- After this sale, The Company won’t be doing any education business in China anymore.

Financial Details:

- Because The Company is leaving China, all the money-related things (assets and liabilities) from their China business are now marked as ‘discontinued’ in their financial reports.

- Their business in Singapore is not affected and will continue as usual.

- The financial details about eLMTree haven’t been included in the Company’s reports for the first half of 2023. (See company valuations below)

- If you want more detailed info about how The Company looks after these changes, it is in the (the proxy statement) filed on July 31, 2023, with the Securities and Exchange Commission. (The merger target’s estimated value is below)

- In essence, The Company is making a switch – they’re stepping out of the education business in China but diving into a new venture with eLMTree outside of China.

From the Proxy filed July 31st, 2023 – eLMTree plans to offer products that feature artificial intelligence (AI).

GEHI to Hold Extraordinary General Meeting of Shareholders on September 11, 2023 FULL PR

Highly Recommend Reading The Full Proxy

Alright, let’s break down the general meeting into simpler language:

Main Decision: The company is asking for approval to:

- Go ahead with the merger.

- Issue whatever payment or shares they’ve promised for the merger.

- Update the company’s main document.

- Change the way shares in the company are divided.

- Change the company’s name to “Mynd.ai, Inc.”

- If they get this approval, they won’t need to ask the shareholders again for more permissions related to this merger.

Company Valuations:

- The company’s estimated worth is $50 million, assuming it has $15 million in cash at the time they finalize (or “close”) the deal.

- eLMTree, the other company they’re merging with, is estimated to be worth a much larger $750 million. This valuation considers it having at least $25 million as working capital (money needed for day-to-day operations) at deal closing time. How they figured out eLMTree’s value included looking at its current business and future plans. But, there’s a note saying it’s tough to precisely determine eLMTree’s value since it isn’t publicly traded.

Completion Time:

Both companies expect everything to be wrapped up by the end of the third quarter in 2023. This is as long as they get approvals from their shareholders and some regulators.

Who’s Checked the Plan?:

A special group (or committee) from the company’s board of directors looked at all the details. This group only included directors who have no personal interest in the merger.

On April 18, 2023, they all agreed that the plan was good for the company and its shareholders. They recommended going ahead with it.

In essence, the company is merging with another called eLMTree. They’ve given values to each company and have a plan in place, which a special group has already reviewed and supported. Now, they need final approvals to proceed.

Who is eLMTree?

Ok, eLMTree owns https://www.prometheanworld.com/ This will give you an idea of their product offerings.

They are mainly a hardware and software provider to educational facilities such as Large school districts, Independent schools, Higher education, Remote and hybrid learning, Workplace environments, and Government agencies.

eLMTree / Promethean’s sales consist of 70% here in the USA as most of their partners are in the US and 30% outside the USA.

May have a follow-up to this report as I wanted to get it to you as soon as possible with the merger vote happening today.

Remember to always do your own due diligence and consult with a licensed financial advisor before making any financial decisions. This is not to be construed as financial advice.

Your friend,

Steve Macalbry

Editor BestGrowthStocks.Com |