Update 02/21/2024 4:30 PM EST

The official announcement just hit and (NASDAQ: BZFD) is up over 70% in after-hours trading!

BuzzFeed, Inc. Announces Sale of Complex to NTWRK in All-Cash Deal

Original Report Below:

BuzzFeed Inc. (NASDAQ: BZFD) had seen a remarkable surge in stock value in January 2023, initially propelled by reports of a partnership with Meta Platforms Inc. and an innovative approach to content creation using OpenAI’s AI technology. This strategic move towards AI-driven content enhancement has been pivotal for the company, signaling a significant shift in digital media dynamics.

Buyout Rumor February 2024: Amidst significant organizational changes and strategic shifts, BuzzFeed Inc. experienced a notable surge in its stock price, increasing by over 70% following reports of discussions with The Independent. These talks involve The Independent potentially assuming control over BuzzFeed and Huffington Post’s operations in the UK and Ireland. This development hints at a broader strategy of consolidation and realignment within BuzzFeed’s operational framework, especially considering recent news about potential sales of its food websites and most of its Complex Network’s business to enhance its market position and financial stability.

Over the past 15 years, BuzzFeed has encountered significant buyout offers, most notably a $650 million proposal from Disney in 2013, which BuzzFeed declined. Despite the urging from BuzzFeed President Jon Steinberg, founder Jonah Peretti chose not to proceed with the deal after a meeting with Disney CEO Bob Iger. This decision was part of a broader narrative of BuzzFeed navigating the evolving digital media landscape, including various strategic decisions like layoffs, expansions, and efforts to go public, as well as other potential sales and acquisitions mentioned over the years.

Source: Finviz

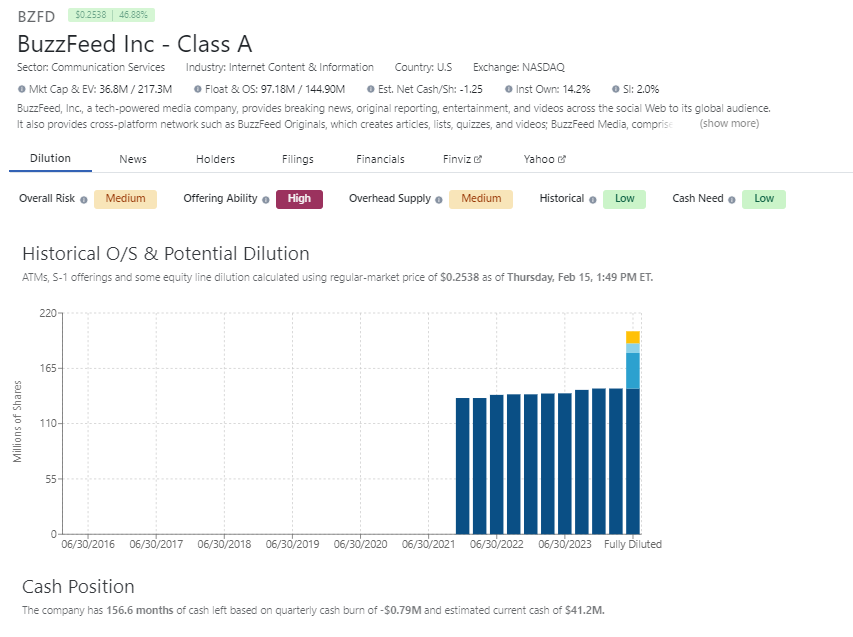

Source: Dilution Tracker

Conclusion:

BuzzFeed Inc.’s journey through strategic partnerships, innovative content creation, and negotiation of buyout offers underscores its adaptability in the rapidly changing digital media landscape. The company’s recent stock surge, propelled by AI integration and potential operational consolidations, highlights its ongoing evolution and ability to capitalize on emerging technologies and market opportunities.

Risk Factors:

Market Volatility: BuzzFeed’s stock performance and valuation are subject to market fluctuations that can be influenced by broader economic conditions and investor sentiments.

Technological Changes: Rapid advancements in AI and digital media technologies require constant innovation and adaptation, posing a risk if BuzzFeed fails to keep pace.

Strategic Decisions: Decisions regarding partnerships, buyouts, and operational changes carry inherent risks that could affect the company’s growth trajectory and financial stability.

Competitive Landscape: The digital media industry is highly competitive, with the risk of emerging platforms and changes in consumer preferences impacting BuzzFeed’s market share and revenue streams.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: This article is intended for informational purposes only. It should not be considered financial or investment advice. We do not hold any form of equity in the securities mentioned in this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.