SoundHound AI is a Best Growth Stocks Favorite Among Burgeoning AI Companies.

Bonus content: The Next Beneficiaries of the AI Revolution

About SoundHound AI Inc.

SoundHound AI Inc. (NASDAQ: SOUN) is at the forefront of the AI voice technology revolution, leveraging its innovative technology to redefine how people interact with devices and services. As a pioneer in advanced voice-enabled AI and conversational intelligence technologies, SoundHound is committed to transforming the user experience across a multitude of platforms and sectors. By offering cutting-edge solutions for voice recognition, natural language understanding, and conversational intelligence, SoundHound AI is making significant strides in making technology more accessible and intuitive.

Potential Catalysts for SoundHound AI (NASDAQ: SOUN)

Based on the recent press releases and market movements, several potential catalysts for SoundHound AI (SOUN) could drive the stock’s future performance. These catalysts have not yet occurred but hold significant promise:

Expansion into New Markets:

International Expansion: SoundHound AI has recently launched its voice AI technology in vehicles across Europe, including Peugeot, Opel, and Vauxhall. Continued expansion into other international markets, particularly in Asia and Latin America, could substantially increase their user base and revenue.

Strategic Partnerships and Collaborations:

Partnership with Major Tech Companies: SoundHound AI’s existing collaborations with automotive giants could pave the way for partnerships with other tech companies. Collaborations with firms specializing in AI, IoT, and cloud computing could enhance their technological capabilities and market reach.

New Sectors and Industries: Expanding their technology into new sectors such as healthcare, finance, and home automation could open up new revenue streams. Integration of voice AI in these industries can create a diverse client base and mitigate risks associated with dependence on a single industry.

Product Innovations and Upgrades:

Next-Gen AI Technologies: Ongoing developments in AI and machine learning can lead to new product launches or significant upgrades to existing products. Innovations in natural language processing, voice recognition accuracy, and user interface improvements can attract more customers and improve user retention.

Custom Solutions: Offering tailored solutions for enterprise clients, such as customized voice assistants for specific business needs, can provide high-margin opportunities and strengthen client relationships.

Mergers and Acquisitions:

Acquiring Complementary Technologies: SoundHound AI’s acquisition of the ordering platform Allset indicates a strategic approach to building a comprehensive voice commerce ecosystem. Future acquisitions of complementary technologies or startups can enhance their service offerings and technological infrastructure.

Being Acquired: Given the increasing interest in AI technologies, SoundHound AI itself could become an attractive acquisition target for larger tech companies looking to bolster their AI capabilities.

Regulatory and Policy Changes:

Supportive AI Policies: Favorable government policies and regulations promoting the adoption of AI technologies can accelerate SoundHound AI’s growth. This includes potential subsidies, grants, or tax incentives for AI development and deployment.

Data Privacy Regulations: SoundHound AI’s compliance with stringent data privacy regulations can enhance their reputation and trust among users, potentially leading to increased adoption of their services.

Financial Performance and Market Perception:

Earnings Surprises: Positive surprises in quarterly earnings reports, driven by higher-than-expected revenue growth or cost efficiencies, can lead to significant stock price appreciation.

Analyst Upgrades: Positive revisions of stock ratings and price targets by influential analysts and investment banks can attract more investors and drive up the stock price.

Technological Advancements and Integration:

Integration with Emerging Technologies: Incorporating emerging technologies such as blockchain for secure voice transactions or augmented reality (AR) for enhanced user experiences can set SoundHound AI apart from competitors.

Improved AI Capabilities: Advances in AI that improve the robustness and versatility of SoundHound AI’s voice recognition and processing capabilities can attract high-profile clients and lead to increased market share.

Summary of SoundHound AI (NASDAQ: SOUN) Q1 2024 Earnings Report

Financial Performance

Revenue: Increased by 73% YoY to $11.6 million.

GAAP Gross Margin: 60%; Non-GAAP Gross Margin: 66%.

GAAP Net Loss: ($33.0) million; Non-GAAP Net Loss: ($19.9) million.

GAAP EPS: ($0.12); Non-GAAP EPS: ($0.07).

Adjusted EBITDA: ($15.4) million.

Cash Balance: $226 million as of March 31, 2024.

Annual Revenue Outlook: Updated to a range of $65 to $77 million.

Business Highlights

Acquired SYNQ3, becoming the largest voice AI provider for restaurants.

Launched Dynamic Interaction with a top global QSR brand.

Expanded partnerships with Church’s Chicken and Applebee’s, reaching additional 500 locations.

Added new multi-location customers including a major Planet Fitness franchisee.

Automotive:

Partnered with NVIDIA for in-vehicle voice-enabled generative AI.

Continued ramp-up with Stellantis, including brands like Opel, Peugeot, and DS Automobiles.

Signed multi-year agreements with a large broadcaster and telecommunications company in Europe.

New deals with US-based EV maker and an Asian electric car manufacturer.

Other Partnerships:

Collaborated with Perplexity to enhance SoundHound Chat AI.

Joined ARM’s partner program to showcase advancements in voice AI technology.

Key Metrics

Cumulative Subscriptions & Bookings Backlog: $682 million, up 80% YoY.

Annual Run Rate of Queries: Over 4 billion, up 60% YoY.

Management Comments

CEO Keyvan Mohajer: Emphasized the growing demand for voice AI in customer service and highlighted the company’s technological innovation and market leadership.

CFO Nitesh Sharan: Highlighted the strong top-line performance and accelerating business momentum.

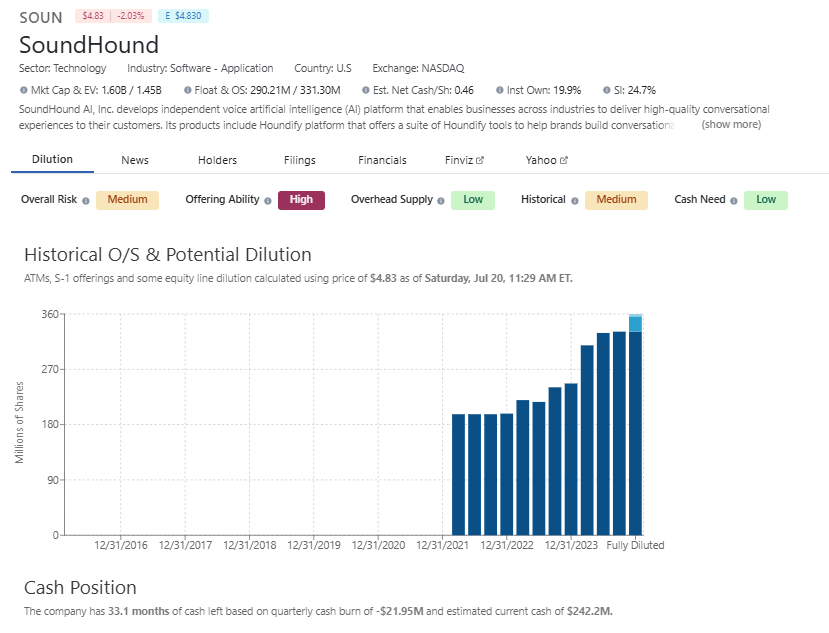

Current Estimated Share Statistics, Cash Position, Institutional Ownership and Short Interest (SI)

(Source: DilutionTracker)

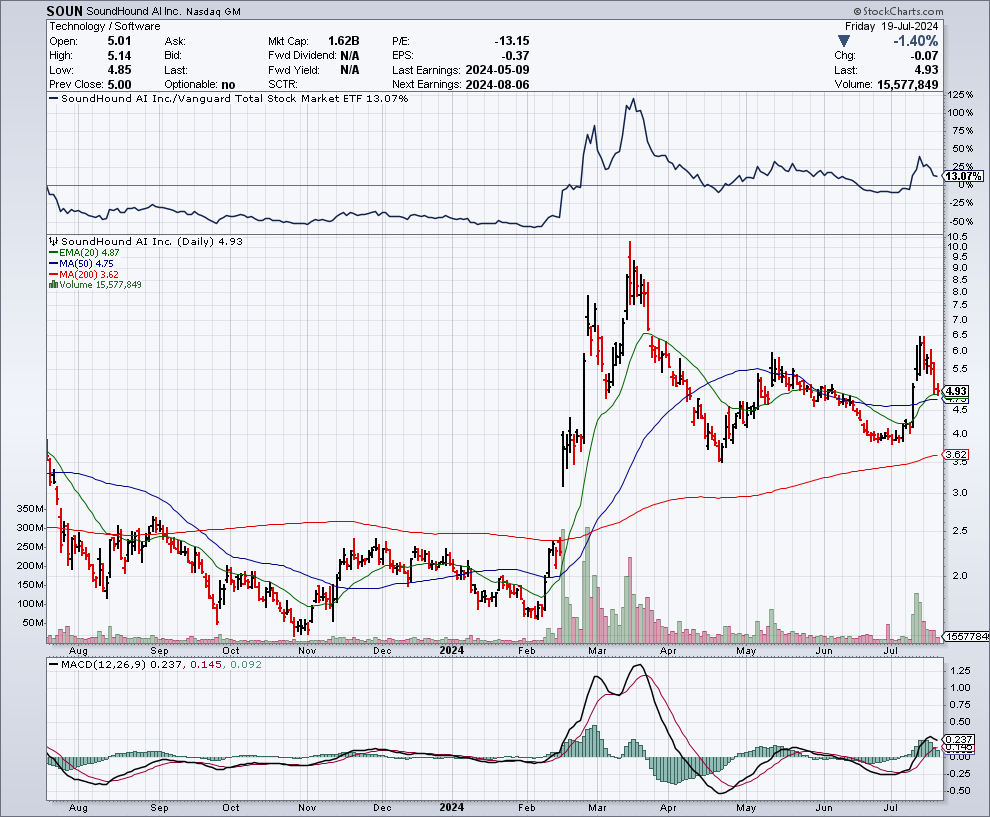

Daily Stock Chart

Conclusion

SoundHound AI Inc. (NASDAQ: SOUN) is positioned for significant growth, with several potential catalysts on the horizon that haven’t materialized yet. These catalysts could further bolster the company’s standing in the AI and voice technology sectors:

By continuing its international expansion, forging strategic partnerships, and innovating its product offerings, SoundHound AI is poised to capture new markets and diversify its revenue streams. Acquisitions of complementary technologies and potential supportive regulatory changes can enhance its technological infrastructure and market appeal. Additionally, positive financial performance and market perception, driven by earnings surprises and analyst upgrades, could attract more investors and elevate the stock’s value.

Technological advancements and the integration of emerging technologies such as blockchain and augmented reality will further differentiate SoundHound AI from its competitors, attracting high-profile clients and increasing market share. With a robust financial position and a clear strategy for growth, SoundHound AI is well-equipped to leverage these opportunities and continue its trajectory as a leader in the AI voice technology revolution.

SoundHound AI Inc. stands as a potentially transformative player in the AI voice technology landscape. Despite recent market turbulences and insider trading activities, the company’s innovative technology, strategic partnerships, and expansion possibilities suggest a promising horizon for bold investors. As with any investment, potential shareholders should conduct thorough research and consider the company’s strategic direction, market position, and the broader sectoral trends impacting its growth potential. SoundHound remains on Bestgrowthstocks.com watchlist for the foreseeable future.

Risk Factors

Market Volatility and Analyst Perception: The company has experienced significant stock price volatility following a short-selling report and an analyst downgrade. Such volatility can reflect negatively on investor confidence and may indicate underlying challenges in the company’s performance or market perception.

Insider Trading Activity: Recent sales by key insiders, including the CEO, COO, and CFO, could be interpreted as a lack of confidence in the company’s future prospects. While insider trading can have various motivations, significant sales by top executives often lead to investor skepticism regarding the long-term value of the stock.

Operational Losses: Despite growing revenues, SoundHound AI Inc. has reported substantial net losses over the last four quarters. This indicates that the company is still in a phase of burning through cash to sustain its growth, which could pose a risk if not managed properly or if the company fails to achieve profitability within a reasonable timeframe.

Dependence on Strategic Partnerships: The partnership with Nvidia, while beneficial, also introduces a dependency on third parties for technological advancement and market penetration. Any disruption in this partnership or failure to meet collaborative goals could adversely affect SoundHound’s business and growth prospects.

Expansion into New Markets: While the expansion into the healthcare AI market represents a significant growth opportunity, it also introduces new risks associated with entering a highly regulated and competitive sector. The company’s success in this new domain is uncertain and will require substantial investment and strategic execution.

Competition and Technological Advancements: The AI voice technology space is highly competitive, with rapid technological advancements. SoundHound’s ability to maintain its competitive edge and continue innovating is crucial for its success. Any lag in innovation or failure to keep up with market trends and technological advancements could significantly impact its market position.

Regulatory and Ethical Considerations: As AI technologies become more integrated into daily life, companies like SoundHound face increasing scrutiny regarding privacy, data security, and ethical use of AI. Compliance with evolving regulations and public expectations can pose a challenge and introduce additional costs or constraints on operations.

Economic and Sector-Specific Trends: The broader economic environment and specific trends within the AI and technology sectors can impact SoundHound’s performance. Factors such as investment in AI technologies, consumer adoption rates, and the economic health of key markets play a crucial role in the company’s growth trajectory.

These risk factors highlight the complexities and challenges SoundHound AI Inc. faces as it navigates the competitive and fast-evolving AI landscape. Potential investors should carefully consider these risks in conjunction with the company’s growth strategies and market opportunities.

For More Information on SoundHound AI Inc.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: This article is intended for informational purposes only. It should not be considered financial or investment advice. We have not been compensated in any way for the creation or distribution of this article. We do not hold any form of equity in the securities mentioned in this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.