Overview and Valuation Analysis

Sadot Group Inc. (SDOT) has been an overlooked stock, despite displaying significant signs of undervaluation. This company operates in the agribusiness and commodities trading sectors, and recent restructuring and expansion efforts have positioned it for substantial potential growth.

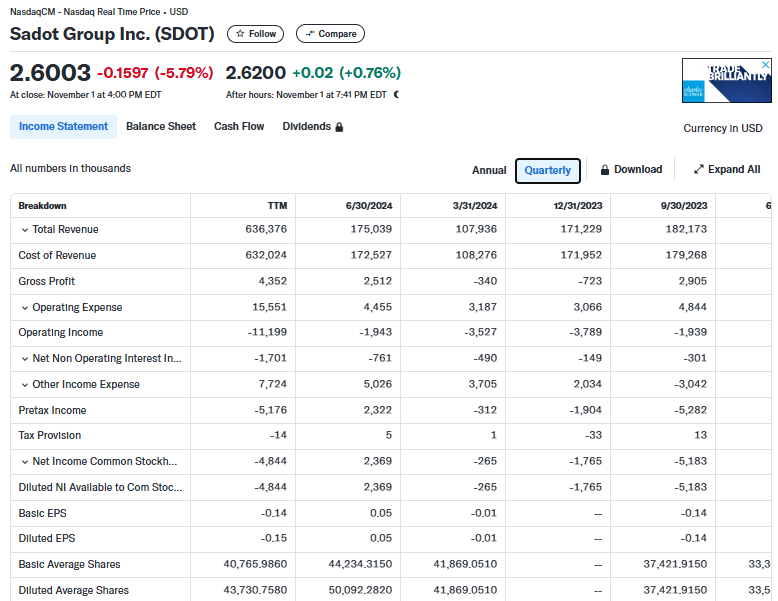

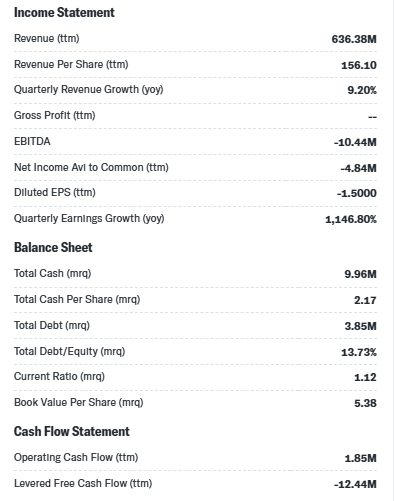

With a tiny market cap of $14.07 million, Sadot Group’s forward P/E ratio stands out at an astoundingly low 1.08, signaling that investors might be underestimating its earnings potential. With a reported trailing twelve-month revenue of $636 million, the company is generating revenue many times larger than its current market cap. Furthermore, Sadot Group has moved to positive EBITDA, highlighting operational efficiency improvements.

Recent Earnings Per Share Growth Q Over Q of 735% and YoY of 1146%

Current $2.60/share

Float 4.58m

Revenue $636m (trailing twelve months)

Book value per share $5.38

Financial Health and Balance Sheet

Sadot Group’s recent quarterly reports reflect a steady improvement in key balance sheet metrics:

Total Assets: Grew from $72.3 million in Q2 2023 to $165.8 million in Q2 2024, illustrating expanded asset holdings.

Total Liabilities: Increased proportionately, from $49.2 million to $137.7 million over the same period, likely as a result of expansion costs but still under control relative to asset growth.

Equity and Book Value: Book value per share is $5.38. Shareholder equity has remained stable, with tangible book value consistently between $16 million and $25 million over the past year, reflecting solid core assets.

Working Capital: Improved from $7.7 million in June 2023 to $16.1 million by June 2024, enhancing liquidity and short-term financial flexibility.

This financial trajectory indicates that the company’s recent expansions and acquisitions are grounded in a sturdy balance sheet, boding well for long-term profitability and reduced financing risks.

Recent News and Developments

Several significant events have shaped the outlook for Sadot Group in recent months, including:

Reverse Stock Split (Oct 16, 2024): The 1-for-10 reverse stock split is aimed at reducing volatility and increasing the perceived value of shares, potentially making the stock more attractive to institutional investors.

New Subsidiary, Sadot Canada (Sep 12, 2024): Sadot Group launched a new subsidiary in Canada to expand its commodities trading operations. The entry into Canadian markets suggests a strategic push toward geographic diversification.

Brazilian Trading Operations (July 29, 2024): Sadot Group began trading operations in Brazil, marking its entry into the South American market and leveraging Brazil’s vast commodities landscape to further boost revenue.

Leadership Appointments (Aug 1, 2024): Key appointments were made in Sadot Canada’s leadership, bringing in seasoned experts who can support the company’s international growth strategy.

Sale of Superfit Foods (Aug 6, 2024): This divestiture signifies Sadot’s intent to streamline its operations and focus resources on higher-growth potential segments in commodities trading.

Catalysts for Potential Upside

Several upcoming catalysts could unlock significant value for Sadot Group in the near term:

Expansion into New Markets: Sadot Canada and Sadot Brasil represent strategic market entries that could fuel revenue growth. The company has yet to fully realize potential earnings from these expansions, which may positively impact stock price as results become evident.

Improved Trading Volumes and Revenue Potential: The commodity trading industry has been volatile, but Sadot’s strategic positioning and diversified markets could lead to increased trading volume and higher revenues as it leverages its global footprint.

Potential for Institutional Investment: The reverse stock split and low forward P/E ratio could attract institutional investors, who may see the stock as an undervalued opportunity with limited downside risk given the strong revenue base.

Additional Strategic Acquisitions and Partnerships: Sadot Group’s recent track record of expansion through partnerships and acquisitions indicates potential future moves to diversify or reinforce its portfolio.

Strengthened Financial Performance: With the company already showing positive EBITDA and robust revenue, a continuation of this trend could prompt a market re-rating, particularly if Sadot can further increase profit margins.

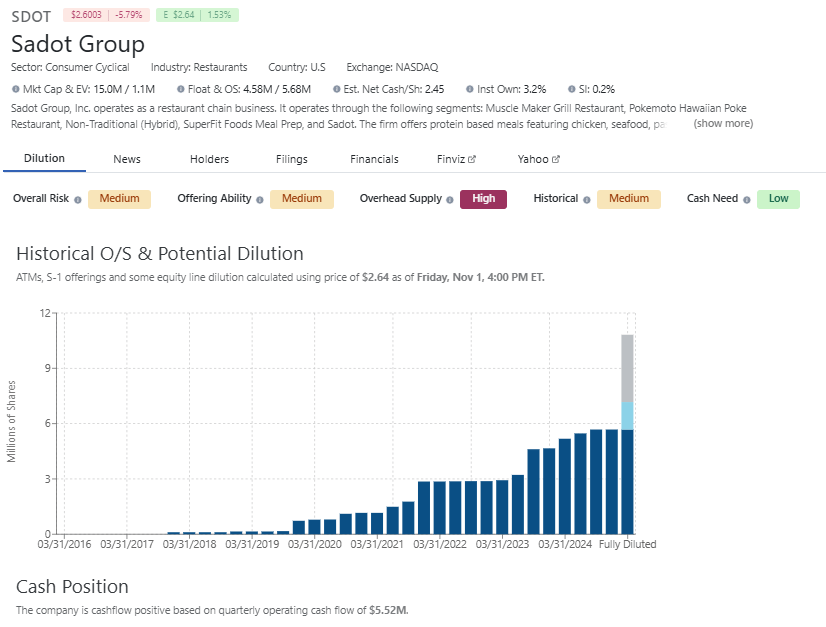

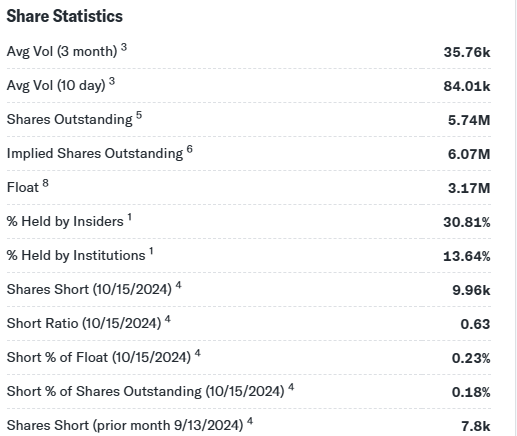

DilutionTracker Information:

Nearly 45% in Combined Insider and Institutional Ownership

Yahoo Finance Q over Q Financials

Yahoo Finance Balance Sheet and Income Statement

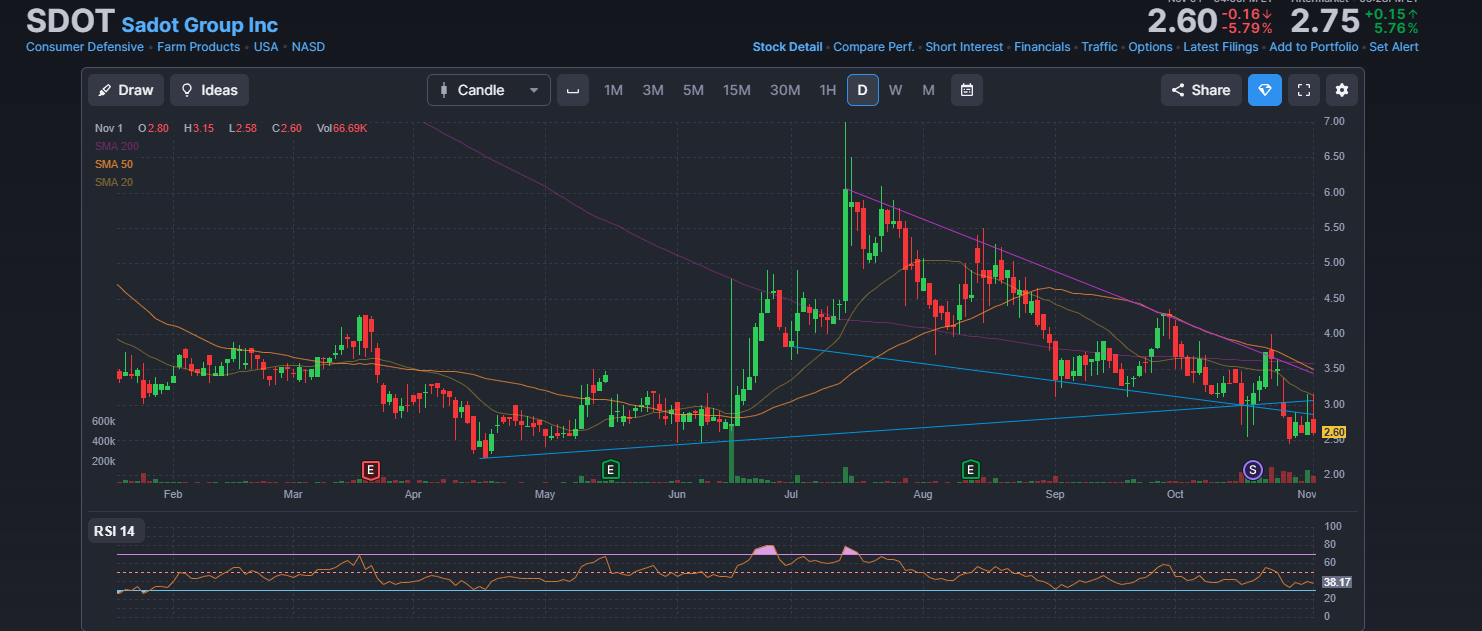

Stock Chart SDOT

Conclusion: Why Sadot Group Could Be Poised for a Rebound

Sadot Group’s current valuation reflects a significant disconnect between its market cap and its financial performance metrics, particularly revenue and earnings potential. The company is making calculated moves to establish a foothold in new markets, reduce volatility, and attract more investor interest. Given its strong revenue performance, expansion into lucrative markets like Brazil and Canada, and a healthy balance sheet, Sadot has numerous avenues for upside.

With a forward P/E of just 1.08 and a market cap far below intrinsic value, Sadot Group appears primed for growth. As these catalysts materialize, traders and investors should closely monitor Sadot’s quarterly results, which could reveal incremental growth and drive stock appreciation. The company’s well-positioned for potential value recognition in the short to medium term, making SDOT a compelling play for those seeking undervalued stocks with room for revaluation.

SDOT is an AI-Desk Exclusive Members Only Report

SDOT was discovered within a list of growth stocks by our AI-model (Algorithm) that may have the potential for near term gains.

Start your due diligence on SDOT now.

The Free Lifetime Premium Memberships to the AI-Desk WILL END 12/31/2024 and a $1000 Winner will be Chosen by January 3rd, 2025. No more Extensions will be Issued.

Edited by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: The author of this article is not a licensed financial advisor. This article is intended for informational purposes only. It should not be considered financial or investment advice. We have not been compensated for the creation or distribution of this article and we do not hold any form of equity in the securities mentioned in this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.