Best Growth Stocks in Quantum Computing IonQ Inc (NYSE: IONQ) and FormFactor Inc (NASDAQ: FORM) Full Analysis

AI and quantum computing are two distinct fields of technology that are being explored for their potential to complement each other and create more powerful and efficient systems. This combination is often referred to as quantum machine learning and is being researched due to its potential to revolutionize science and solve complex problems that are currently beyond the capabilities of classical computers.

Quantum computing operates based on the principles of quantum mechanics, utilizing quantum bits or qubits, which possess the ability of superposition, allowing them to exist in multiple states simultaneously. This ability provides possibilities for solving highly complex problems much faster than classical computers. On the other hand, AI is a field of computer science that focuses on creating intelligent machines that can learn from data and make decisions and solve problems like humans.

The merger of AI and quantum computing could potentially lead to more efficient AI systems, as data can be processed faster by quantum computers than by conventional computers. This would enable AI systems to learn and improve at a faster rate, making them more useful in various industries. For example, a product launched by Multiverse Computing uses quantum-inspired software to compress data from a Large Language Model by up to 70%, thus using much less computing power and achieving results that are comparable in quality.

Moreover, quantum computing is expected to complement, rather than replace, classical computers by supporting their specialized functions, such as system boosts. This would enable developers to perform tasks much more accurately and efficiently, giving them a new tool for specific applications.

However, it is important to note that practical, scalable quantum computing is still in its infancy, and there are significant technical challenges to overcome. Building and maintaining stable and error-corrected quantum computers is a complex endeavor. As quantum computing technology advances, researchers and engineers will continue to explore ways to integrate it with AI to unlock new possibilities and address complex problems.

IonQ Inc (NYSE: IONQ) Analysis

Company Overview

IonQ is a quantum computing company that aims to solve complex problems across various industries, including chemistry, medicine, finance, logistics, and more. The company was founded in 2015 and is headquartered in College Park, Maryland. IonQ develops trapped-ion quantum computers, which it believes have substantial advantages compared to other quantum computing systems. The company has produced six generations of quantum computers and has a robust intellectual property portfolio, holding patents for fundamental technologies core to quantum computing. IonQ’s systems are available on all leading cloud platforms, making quantum computing accessible to developers across industries and sectors.

Recent News and Developments

On February 28, 2024, IonQ announced its fourth quarter and full-year 2023 financial results. The company achieved significant milestones, including:

Full-year revenue of $22.0 million, above the high end of the expected range.

Full-year bookings of $65.1 million, above the high end of the expected range.

Fourth-quarter revenue of $6.1 million, at the high end of the expected range.

Achievement of the 2024 technical milestone of #AQ 35 in December 2023, a full year early.

Doubling of compute space performance, reaching #AQ 36 in January 2024.

Achievement of the first major milestone on implementing photonic interconnects for networked QPUs.

IonQ also sold four quantum systems in 2023 and opened a new manufacturing facility in Seattle to produce more systems to fulfill its growing pipeline. The company’s pipeline for 2024 is stronger than ever, with increasing interest in system purchases, especially in Europe.

Potential Upcoming Catalysts

IonQ is well-positioned to benefit from the growing quantum computing market, which is expected to reach a total addressable market of ~$65 billion by 2030. The company’s technological advantages, robust intellectual property portfolio, and strategic partnerships make it a leader in the quantum computing industry. IonQ’s recent achievement of technical milestones ahead of schedule demonstrates its commitment to innovation and rapid progress.

As quantum computing gains traction across various industries, IonQ’s potential upcoming catalysts include:

Increased adoption of quantum computing solutions by businesses and organizations.

Expansion of strategic partnerships with cloud service providers, software developers, and other industry leaders.

Continued advancements in quantum computing technology, leading to more powerful and efficient systems.

Growing interest in quantum computing from governments and research institutions, driving demand for IonQ’s systems and services.

Share Structure, Financials and Ownership

Average Volume (3-month): 7.63 million shares

Average Volume (10-day): 12.77 million shares

Shares Outstanding: 208.23 million shares

Implied Shares Outstanding: 216.27 million shares

Float: 187.8 million shares

Percentage Held by Insiders: 8.73%

Percentage Held by Institutions: 41.07%

Shares Short (as of February 15, 2024): 46.26 million shares

Short Ratio (as of February 15, 2024): 7.83

Short % of Float (as of February 15, 2024): 27.16%

Short % of Shares Outstanding (as of February 15, 2024): 22.60%

Shares Short (prior month, January 12, 2024): 45.12 million shares

As of December 31, 2023, IonQ had cash, cash equivalents, and investments totaling $455.9 million. The company’s net loss for the fourth quarter was $41.9 million, and the Adjusted EBITDA loss was $20.0 million. For the full year 2023, IonQ’s net loss was $157.8 million, and the Adjusted EBITDA loss was $77.7 million.

Sentiment

IonQ has been identified as a potential long-term compounder by some investors due to its high gross margins and growing revenue. The company operates in a rapidly expanding industry, with multiple projections showing strong growth for the global quantum computing market over the next several years.

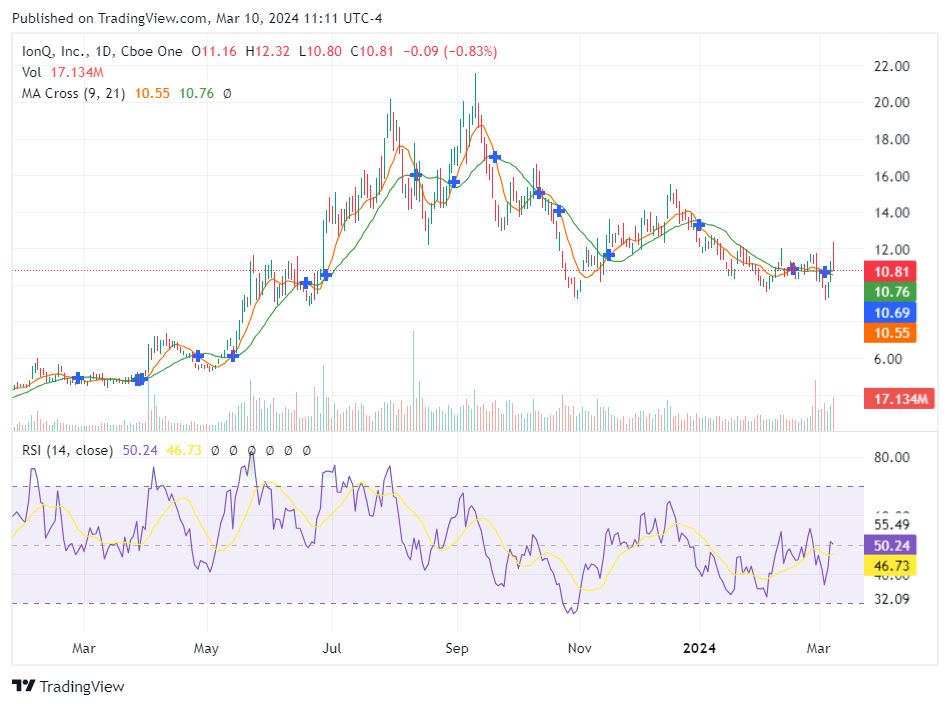

Daily Chart

Conclusion

IonQ is a leader in the quantum computing industry, with a strong technological foundation and a commitment to innovation. The company’s recent financial results demonstrate its ability to meet and exceed expectations, both in terms of revenue and technical milestones. As the quantum computing market continues to grow, IonQ is well-positioned to capitalize on this expansion and deliver value to its shareholders. However, investors should be aware of the risks associated with investing in an emerging technology and the potential for a quantum winter before the technology reaches full maturity.

FormFactor Inc. (NASDAQ: FORM) Analysis

About FormFactor Inc.

FormFactor Inc. (NASDAQ: FORM) is a leading provider of essential test and measurement technologies for the semiconductor industry. The company specializes in probe cards, which are used to test silicon wafers and chips for defects. In addition, FormFactor has a Systems business unit that focuses on cryogenic systems, a critical component in building quantum computers and testing chips at the quantum level.

The company is headquartered in Livermore, California, and operates in a highly specialized segment of the semiconductor industry. FormFactor’s financial results are primarily tied to the semiconductor manufacturing industry. However, its involvement in quantum computing technology makes it an interesting prospect for investors looking to bet early on the development of quantum computing.

Recent News and Developments

As of March 10, 2024, recent news about FormFactor Inc. includes the sale of 10,000 shares by Shai Shahar, the CFO and SVP of Global Finance, on March 4, 2024. The transaction was executed at an average price of $44.51 per share, resulting in a total value of $445,100.

In terms of product developments, FormFactor has added Dilution Refrigeration (DR) Systems to its product lineup, which are critical for quantum computer deployment. This establishes the industry’s most comprehensive lineup of cryogenic products for superconducting and quantum applications from sub-10 millikelvin to 77 kelvin.

Potential Catalysts

FormFactor’s potential catalysts lie in its involvement in the quantum computing and semiconductor industries. As quantum computing technology continues to develop, the demand for FormFactor’s cryogenic systems could significantly increase, providing a potential boost to the company’s financial performance.

Financials

FormFactor Inc.’s market capitalization stands at $3.429 billion. The stock’s price-earnings ratio is 41.64, which is above both the industry median of 30 and the historical median price-earnings ratio for the company. The stock is currently trading at a price-to-GF-Value ratio of 1.32, with a GF Value of $33.64, indicating that the stock is considered Overvalued according to some valuation models.

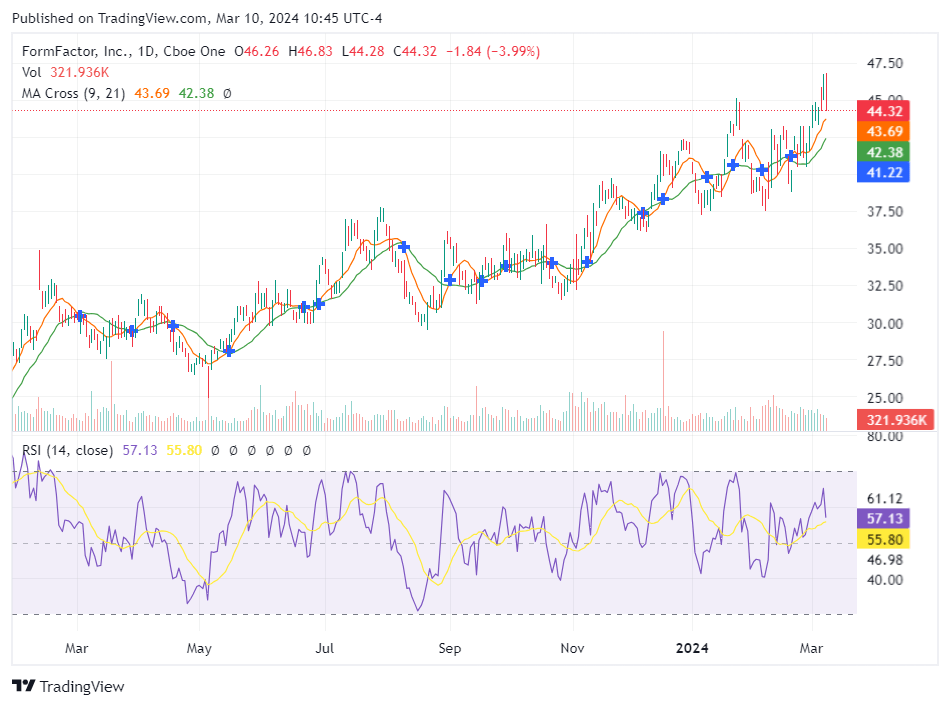

Daily Chart

Analyst Ratings

The average price target for Formfactor is $44.20. This is based on 6 Wall Streets Analysts 12-month price targets, issued in the past 3 months. The highest analyst price target is $52.00, the lowest forecast is $36.00.

Conclusion

FormFactor Inc. is a leading provider of essential test and measurement technologies for the semiconductor industry, with a specialization in probe cards and cryogenic systems. The company’s financial performance is primarily tied to the semiconductor manufacturing industry, but its involvement in quantum computing technology presents potential catalysts for future growth. As of March 10, 2024, the company’s market capitalization stands at $3.429 billion, with a price-earnings ratio of 41.64. However, the stock is considered Significantly Overvalued according to some valuation models. Despite this, FormFactor’s involvement in the developing quantum computing industry makes it an interesting prospect for investors.

While AI and quantum computing may not be married to one another yet, their combination holds promise for solving problems that are currently beyond the capabilities of classical computers. However, significant technical challenges need to be overcome before this potential can be fully realized.

Risk Factors for IonQ Inc. (NYSE: IONQ) and FormFactor Inc. (NASDAQ: FORM)

IonQ Inc. (NYSE: IONQ):

Technological Feasibility and Execution Risk: IonQ operates in the nascent field of quantum computing, where technologies are rapidly evolving and unproven at scale. The company’s future success hinges on its ability to continually innovate and improve its quantum computing technologies, which are subject to significant execution and feasibility risks.

Market Adoption: Quantum computing is an emerging technology, and its market adoption is uncertain. IonQ’s growth depends on the broader acceptance and integration of quantum computing solutions across industries, which may take longer than anticipated.

Competition: The quantum computing field is becoming increasingly competitive, with numerous startups and established tech giants vying for leadership. IonQ must maintain its technological edge and market position against these competitors, some of which have greater resources.

Regulatory and Security Risks: Quantum computing poses unique security risks and regulatory challenges, including data privacy and encryption standards. IonQ needs to navigate these evolving regulations and ensure its technologies are secure against potential quantum threats.

Intellectual Property Risks: Protecting intellectual property is critical in the highly innovative quantum computing sector. IonQ faces risks related to IP infringement, trade secret protection, and patent litigation.

Dependency on Strategic Partnerships: IonQ’s growth strategy involves collaborations with cloud service providers and other technology firms. Any disruptions or failures in these partnerships could impact IonQ’s market reach and development capabilities.

FormFactor Inc. (NASDAQ: FORM):

Dependency on Semiconductor Industry: FormFactor’s performance is closely tied to the semiconductor industry, which is cyclical and subject to fluctuations in demand. Any downturn in the semiconductor sector could significantly affect FormFactor’s business.

Technological Obsolescence: The rapid pace of technological advancement in semiconductors and quantum computing could render FormFactor’s products obsolete. The company must continuously innovate to stay relevant.

Competition: FormFactor operates in a competitive industry with several established players. Maintaining a competitive edge requires ongoing investment in technology and customer relationships, which may strain resources.

Operational Risks: FormFactor’s manufacturing processes are complex and require precision. Any operational failures could lead to production delays, increased costs, and reduced product quality, impacting its reputation and financial performance.

Market Penetration in Quantum Computing: FormFactor’s growth in the quantum computing segment is uncertain and depends on the sector’s overall development and acceptance. The company’s ability to capitalize on this opportunity is not guaranteed.

Global Supply Chain Vulnerabilities: FormFactor’s global supply chain exposes it to risks such as trade disputes, tariffs, and logistical disruptions, which can affect its manufacturing efficiency and cost structure.

Regulatory Compliance: As a player in the semiconductor and quantum computing industries, FormFactor must comply with various regulations, including export controls, environmental laws, and data protection directives. Non-compliance could result in fines, legal action, and reputational damage.

Investing in IonQ and FormFactor entails understanding these risks, as they could influence the companies’ growth prospects, operational performance, and market valuation.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: This article is intended for informational purposes only. It should not be considered financial or investment advice. We do not hold any form of equity in the securities mentioned in this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.