Thu, Apr 25, 11:47 AM EST

From the Best Growth Stocks AI-assisted Research Desk:

Game-Changing Merger in the Uranium Sector

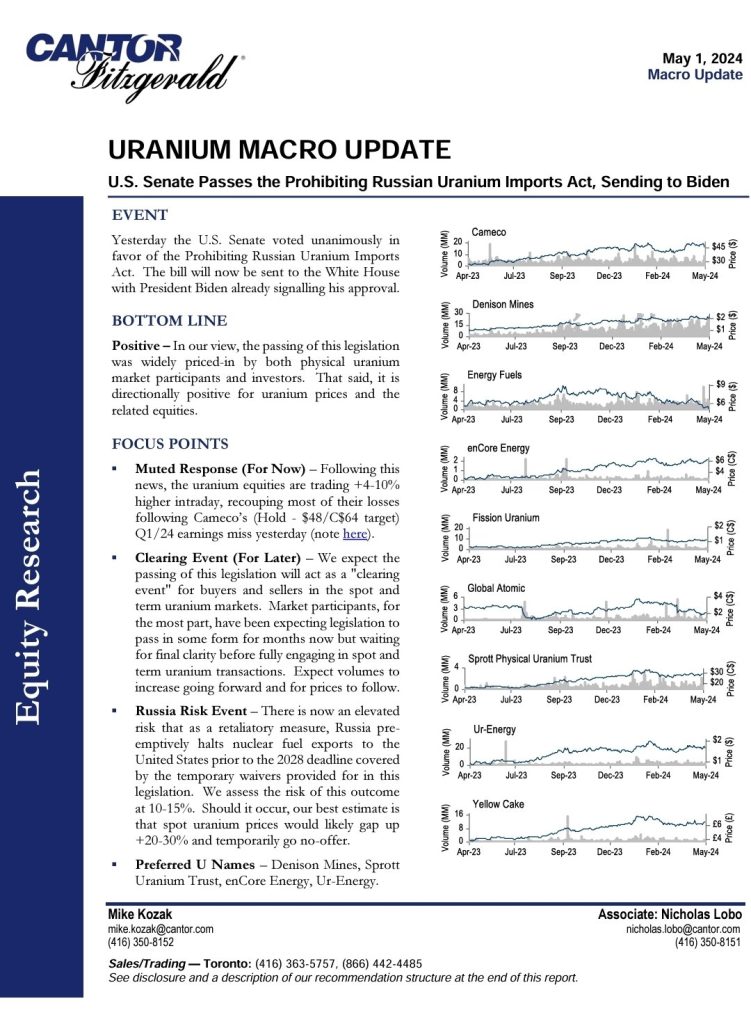

Update May 1st, 2024: Energy Fuels Inc (NYSE-American: UUUU) Cantor Fitzgerald has issued a Uranium Macro Update as “US Senate Passes the Prohibiting Russian Uranium Imports Act, Sending to Biden”

This is “Directionally positive for uranium prices and related equities”

Earnings Coming Soon. Watch for announcement.

The market expects Energy Fuels (UUUU) to deliver a year-over-year increase in earnings on higher revenues when it reports results for the quarter ended March 2024

This uranium and vanadium miner and developer is expected to post quarterly earnings of $0.02 per share in its upcoming report, which represents a year-over-year change of +300%.

Revenues are expected to be $26.25 million, up 33.9% from the year-ago quarter.

Key Earnings Highlights to Consider:

In 2023, Energy Fuels successfully sold 560,000 pounds of uranium (U3O8) at an average price of $59.42 per pound, achieving a gross margin of 54%. Additionally, the company traded 153 metric tons of high-purity, partially separated mixed rare earth carbonate for $2.85 million and 79,344 pounds of vanadium for $0.87 million. By the end of the year, on December 31, Energy Fuels maintained significant inventories, including 685,000 pounds of finished uranium, 905,000 pounds of finished vanadium, and 11 tons of finished rare earth carbonate.

Energy Fuels also reported holding 436,000 pounds of uranium in raw and in-process forms and estimated between 1-3 million pounds of V2O5 in solubilized form within tailings solutions, which could potentially be recovered. These substantial inventory levels positioned the company well to leverage market dynamics as the quarter commenced.

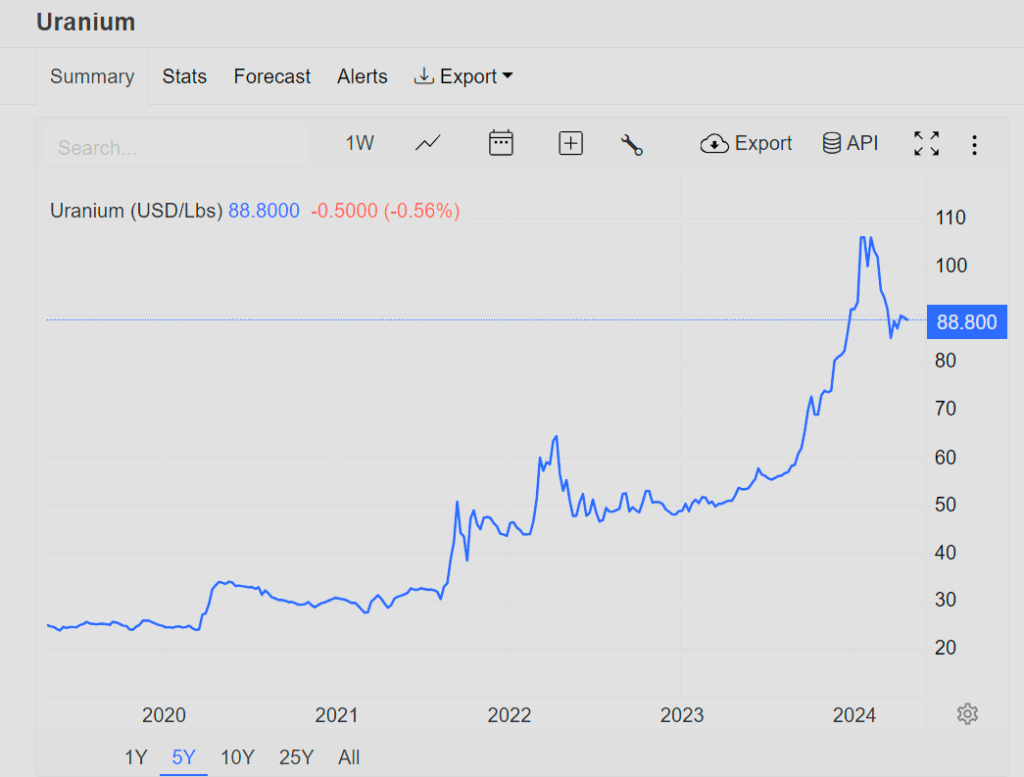

The quarter observed notable fluctuations in uranium prices. Starting at about $92 per pound, the prices soon surpassed $100, reaching a 17-year peak of $106 per pound on January 22, 2024, spurred by anticipated supply constraints after Kazatomprom, the world’s top uranium producer from Kazakhstan, announced a reduction in production to 80% of its maximum capacity. After peaking, prices briefly touched $105 in early February, then adjusted downward, closing the quarter at approximately $88 per pound—a 3.4% decrease from the start, yet significantly higher than the same period in the previous year.

During the fourth-quarter earnings announcement, Energy Fuels revealed its expectation to sell between 200,000 and 300,000 pounds of U3O8 under its long-term uranium contracts in 2024. The company achieved a significant milestone by selling 200,000 pounds in the first quarter at $75.13 per pound, resulting in a gross profit of $38.29 per pound and a gross margin of 51%.

Furthermore, in March 2024, Energy Fuels contracted to sell an additional 100,000 pounds of uranium at an average price of $102.88 per pound, anticipating a gross profit of about $66.04 per pound, equivalent to a gross margin of approximately 64%.

The solid performance in uranium sales and price trends during the quarter likely bolstered Energy Fuels’ results for the first quarter.

Pending Merger

Energy Fuels Inc. announced a transformative acquisition of Base Resources (Positive EBITDA), indicating a significant expansion in their portfolio to include the Toliara project, which is rich in critical minerals like uranium, rare earth elements (REE), and heavy mineral sands (Energy Fuels).

Merger Details:

Acquisition Value: The deal is valued at $241 million.

Strategic Benefits: The acquisition integrates Base Resources’ world-class Toliara project into Energy Fuels’ portfolio. This project, located in Madagascar, is noteworthy for its substantial reserves of ilmenite, zircon, and monazite—the latter being a valuable source of magnet REEs like neodymium, praseodymium, dysprosium, and terbium. These elements are crucial for various technologies, including electric vehicles (EVs) and wind turbines (Energy Fuels).

Operational Synergies: Energy Fuels plans to leverage the monazite from Toliara to enhance its REE processing capabilities at its White Mesa Mill in Utah. This move is expected to significantly increase their production capacity for NdPr oxide, critical for manufacturing EVs (Energy Fuels).

When a US Senator thanks a company for buying another company, it can only be good… “Senator Mike Lee, the Senior Senator from Utah and a member of the Senate Committee on Energy and Natural Resources, stated: “I’m grateful to Energy Fuels for their work to ensure the United States has a domestic critical mineral source. The acquisition of Base Resources and the Toliara project will only further their capacity and ability to produce minerals needed for defense, technology, and everyday life.”

Potential Catalysts

Expansion of REE Production: Post-acquisition, Energy Fuels is ramping up its phase 1 REE separation circuit aiming to boost its output to potentially supply materials sufficient for manufacturing 1 to 6 million EVs annually. Additionally, they are planning a phase 2 expansion that could further increase their production capabilities (Energy Fuels).

Government and Defense Supply Opportunities: Energy Fuels is actively discussing with various U.S. government agencies to potentially secure support and offtake agreements, which could solidify its position as a key supplier of critical minerals for national defense and other technological applications (Energy Fuels).

Energy Fuels is also releasing an AACE International (“AACE”) Class 4 Pre-Feasibility Study (not a Pre-Feasibility Study subject to or intended to be compliant with National Instrument 43-101 (“NI 43-101”) or Subpart 1300 of Regulation S-K (“S-K 1300”)) dated April 22, 2024, prepared by Roger Mason, Engineering Manager, WSP USA Environment & Infrastructure Inc., indicating globally competitive capital and operating costs for its planned Phase 2 expanded REE oxide production at the Mill (the “Mill PFS”), which will be filed on the Electronic Document Gathering and Retrieval System (“EDGAR”) at www.sec.gov/edgar, and will be available on the System for Electronic Document Analysis and Retrieval Plus (“SEDAR+”) at www.sedarplus.ca, and on the Company’s website at www.energyfuels.com.

With the Mill’s unique, globally competitive, U.S.-based REE production capability, Energy Fuels is uniquely positioned to unlock significant value from Toliara’s low-cost Monazite production, in a manner that the Company believes no other facility in the U.S. is capable of at this time.

Monazite from Toliara will also provide material quantities of low-cost uranium production at the Mill over the life of the Project, which will supplement Energy Fuels’ U.S.-leading uranium production capacity.

This addition of a low-cost source of REE raw materials to Energy Fuels’ globally competitive U.S. REE production infrastructure, along with a sustainable low-cost source of uranium production, is expected to be highly accretive to Energy Fuels’ shareholders on a net asset value per share basis, with potential to unlock significant further upside.

As part of this Transaction, Energy Fuels will also access Base Resources’ proven leadership and heavy mineral sands operations team, which has an exceptional record of responsible asset development, construction, commissioning and profitable production in Africa. The Base Resources team will not only continue to oversee the development and operation of Toliara but will also enhance Energy Fuels’ heavy mineral sands teams in Australia and Brazil, thus allowing the Company to maximize the value of all projects to the Company’s shareholders.

The offer is unanimously recommended by Base Resources’ Board of Directors and Base Resources has also received voting intention statements from each of Base Resources’ two major shareholders, confirming that they each intend to vote in favor of the Scheme2. Those two shareholders respectively hold 26.5% and 24.8% of Base Resources’ shares. In addition, each of Base Resources’ directors, holding (in aggregate) an additional 1.2% of Base Resources’ shares, has confirmed their intention to vote in favor of the Scheme2.

Mark S. Chalmers, President and CEO of Energy Fuels stated: “The acquisition of Base Resources and the Toliara project represents a monumental leap forward for the Company, as we continue to execute on a truly revolutionary REE, uranium and critical mineral combined strategy. For the past four-plus years, Energy Fuels has innovated a new way to produce critical minerals, that we believe is more cost competitive than traditional approaches, by leveraging our uranium processing expertise and infrastructure to develop a secure, U.S.-centric REE oxide supply chain.

“At the same time, we plan to maintain our leadership and profitability in our core U.S.-based uranium business without diminishing our uranium capabilities or uranium growth potential in any way. In fact, Toliara will provide a steady, low-cost source of uranium for the Company over the life of the Project.

“To date, we have secured long-term sources of REE concentrate through offtake (Chemours), and direct ownership (the Company’s 100% owned Bahia Project in Brazil once developed, and potentially 100% ownership of Base Resources’ Toliara project, and further potential offtakes through a joint venture being negotiated with Astron Corporation Limited (the Astron Donald Project in Australia)). Toliara is expected to be the cornerstone source of feedstock supply to the Mill, with the scale to provide an average of 21,800 tonnes of rare earth-bearing Monazite per year at a cost that we believe will be at or below other leading global REE producers, including those in China.

“Energy Fuels has proven its REE processing capabilities at our Mill in Utah, as we have commercially produced a high-purity mixed REE carbonate since 2021. We recently completed construction of and are currently commissioning the Phase 1 REE separation circuit at the Mill, designed to produce up to 1,000 tonnes of NdPr oxide per year, which would be sufficient to supply enough ‘magnet’ REE oxides to produce 500,000 to 1 million EVs per year. We have also released the Mill PFS announcing what we believe to be globally competitive capital and REE production costs. Based on these highly compelling economics and the expected consummation of the Base Resources and Astron transactions, Energy Fuels is also planning to update the Phase 2 REE separation infrastructure for the Mill to expand our production capacity to 4,000 to 6,000 tonnes of NdPr oxide per year, along with 150 – 225 tonnes of Dy oxide and 50 – 75 tonnes of Tb oxide per year, which would supply enough ‘magnet’ REE oxides to power 3 to 6 million EVs per year. This would put Energy Fuels in the REE oxide production capacity category of the other major ‘western’ REE suppliers.

“We plan to supply REE oxides to U.S., European and Asian EV, wind energy and other clean energy manufacturers, along with emerging commercial REE metal-making, alloying, and magnet-making facilities now under development in the U.S. We also plan to be a reliable supplier to the U.S. defense industry, which could include offtake for other REE oxides, besides the ‘magnet’ oxides, contained in Monazite. This acquisition, along with the Mill’s current and planned REE separation capability, will go a long way in establishing a ‘western’ REE supply chain. Energy Fuels is also in high-level discussions with numerous U.S. government agencies and offices that support critical mineral projects, and we look forward to advancing these discussions as we continue to build our REE business.

“The transaction will not only secure a world-class project for Energy Fuels at a highly attractive acquisition price compared to the fundamental value of the Project but will also secure a mine development and operations team with a successful track-record of designing, constructing, and profitably operating a world-class heavy mineral sands operation in Africa.”

Tim Carstens, Managing Director of Base Resources, commented: “This transaction reflects the exceptional quality of the Toliara project and the efforts of the Base Resources team over several years to advance the project towards construction readiness. The combined company will have the financial and technical capability to not only build Toliara into one of the best critical mineral projects in the world, but also to develop an integrated value chain for the rare earth elements that are essential to the global energy transition. Shareholders of Base Resources will receive both a compelling and immediate premium, and the opportunity to further participate in the market recognition and development of a company with a unique diversified position in the critical minerals landscape.”

ABOUT TOLIARA

The Toliara project is a world-class, advanced-stage, large-scale critical mineral deposit underpinned by the Ilmenite, Zircon and Monazite-rich Ranobe deposit in southwest Madagascar.

On September 27, 2021, Base Resources released the outcomes of its updated and enhanced Definitive Feasibility Study (“DFS2”)3 for the Toliara project, which calculated an after-tax NPV10 (10% discount rate) of $1 billion, after-tax IRR of 23.8%, undiscounted life-of-mine free cash flows of $5.9 billion, and initial capital expenditures of $520 million to achieve first production. According to DFS2, the Ranobe deposit’s estimated Ore Reserves of 904 million tonnes at 6.1% heavy mineral, are sufficient to support an initial 38-year mine life4. These results are based on the production of Ilmenite and Zircon alone.

The Ranobe deposit also contains large quantities of Monazite, which is a rich source of the ‘magnet’ REEs; neodymium and praseodymium (“NdPr”), Dysprosium (“Dy”) and Terbium (“Tb”), used in EVs and a variety of clean energy and advanced technologies, that can be recovered as a byproduct of Ilmenite and Zircon production at the Project.

In response to rising demand for REEs, on December 14, 2023, Base Resources released a Pre-Feasibility Study for Toliara5 on the production of Monazite through the concentration of the existing waste stream from the DFS2 mineral sands processing facilities (the “Monazite PFS”). Based on the combined outcomes of DFS2 and the Monazite PFS, Toliara has an overall after-tax NPV10 (10% discount rate) of $2.0 billion, after-tax IRR of 32.4%, undiscounted life of mine free cash flows of $10.7 billion, and initial capital expenditures of $591 million, which included additional incremental capital expenditures of $71 million for Monazite production, over the 38-year mine life. As the Monazite is an add-on to the stand-alone Ilmenite and Zircon production and would be produced through concentration of the waste stream from processing of the mined Ore Reserves, the Mineral Resources and Reserves at the Project did not change. The Monazite PFS thus demonstrated that world-class Monazite production capability can be added to Toliara’s already stand-alone, world-class Ilmenite and Zircon production capability at a low incremental cost of production, thereby allowing the Monazite production to withstand low or variable REE oxide markets.

Toliara is expected to be Energy Fuels’ cornerstone source of Monazite supply, providing a long-term and large-scale supply of Monazite (21,800 tonnes per annum (“tpa”) average Monazite production), to the Mill for processing into REE oxides and other advanced REE materials, along with the recovery of contained uranium. As the Monazite will be a very low-cost byproduct of Toliara’s primary Ilmenite and Zircon production, the total cost of production of REE oxides at the Mill is expected to be low-cost and globally competitive.

Processing Monazite from Toliara will also add approximately 75,000 lbs of low-cost uranium production (at an incremental cost of approximately $8 per pound) per year at the Mill, totaling approximately 3 million pounds of recovered U3O8 over the life of the Project. This will provide a reliable low-cost stream of uranium production at the Mill that will be able to withstand lower uranium prices and will supplement Energy Fuels’ U.S.-leading uranium production capacity from other mines and sources.

Base Resources has a proven leadership and mineral sands operations team with an exceptional record of responsible and profitable production at its now winding down heavy mineral sands project in Kwale County, Kenya, all of whom are expected to join the Energy Fuels management team upon completion of the Transaction. The Base Resources team will continue to manage Toliara and will enhance Energy Fuels’ teams in Australia and Brazil, thus allowing the Company to maximize the value of all projects to shareholders.

Although the Toliara project holds a mining permit that allows production of Ilmenite, Rutile and Zircon, development at the Project was suspended by the Government of Madagascar pending negotiation of fiscal terms applying to the Project. With the recent adoption of a new Mining Code in Madagascar and Base Resources and the Government of Madagascar making sound progress on fiscal terms negotiations, the Company believes the suspension will be lifted, and required legal and fiscal stability achieved, during 2024. Aspects intended to facilitate the inclusion of Monazite on the Project’s mining permit as soon as reasonably practicable after fiscal terms are agreed are included in the scope of current negotiations. However, there can be no assurance as to the timing of completion of fiscal terms negotiations and lifting of the current suspension, the timing for achieving sufficient legal and fiscal stability or the timing for approval of the addition of Monazite to the mining permit. If such approvals are not obtained, or obtained on terms less favorable than expected, this could delay any final investment decision in relation to the Project or prevent or otherwise have a significant effect on the development of the Project or ability to recover Monazite from the Project.

MILL SYNERGIES

On April 22, 2024, Energy Fuels will release its Mill PFS projecting globally competitive capital and operating costs for planned expanded REE oxide production at the Mill. The Mill is currently commissioning its Phase 1 NdPr separation facility, which has been constructed within the Mill’s existing solvent extraction building and is designed to process up to 10,000 tpa of Monazite to produce up to 1,000 tpa of NdPr oxide.

The economics detailed in the Mill PFS are for the Phase 2 expansion of REE separation capacity in one or more additional facilities at the Mill, capable of processing 30,000 tpa of Monazite to produce approximately 3,000 tpa of NdPr oxide. The Mill PFS shows globally competitive capital expenditures of $348 million for the 30,000 tpa Phase 2 separation facility and an average processing cost of $29.88/kg NdPr. This analysis does not include any capital or operating costs associated with the recovery of Dy and Tb or any revenues associated with the sales of those “heavy” REE oxides.

Upon completion of the Transaction, Energy Fuels plans to update the DFS2 and the Monazite PFS and re-issue those reports in a form that complies with NI 43-101 and S-K-1300, and that also updates and incorporates the results of the Mill PFS to expand Phase 2 production capacity from a 30,000 tpa Monazite process plant capable of producing approximately 3,000 tpa of NdPr oxide to a 40,000 – 60,000 tpa Monazite process plant capable of producing approximately 4,000 – 6,000 tpa of NdPr oxide, along with Dy and Tb oxides.

TRANSACTION OVERVIEW AND TIMELINE

Under the terms of the Scheme, if approved, each Base Resources shareholder will receive (i) 0.0260 Energy Fuels common shares and (ii) A$0.065 in cash, payable by way of a special dividend, representing an implied price of A$0.30 per Base share4.

The Scheme Consideration represents a premium of 173% to the Base Resources’ 20-day volume weighted average price up to and including April 19, 2024 of A$0.11. Immediately following implementation of the Scheme, Energy Fuels and Base Resources shareholders will own approximately 83.6% and 16.4% of Energy Fuels post-closing, respectively.

The Scheme is subject to customary closing conditions, including: (a) approval by at least 75% of the number of votes cast, and more than 50% of the number of Base Resources shareholders present and voting, at the meeting of the shareholders of Base Resources to approve the Scheme (the “Scheme Meeting”); (b) approval by the Federal Court of Australia; (c) the Independent Expert concluding that the Scheme is in the best interests of Base Resources shareholders; (d) certain government and regulatory approvals, including the Foreign Investment Review Board of Australia, Malagasy Competition Council, the TSX and the NYSE American; (e) no material adverse change or prescribed event to Base Resources or Energy Fuels; and (f) other customary closing conditions.

The SID also contains customary deal protection mechanisms, including a “no shop” and “no talk” provision, “matching rights” and “notification rights” for Energy Fuels, subject to customary exceptions, and a termination fee payable by Base Resources in certain circumstances in the amount of 1% of the Transaction Value (or US$2.4 million). The SID also provides for a reverse break fee in the same amount payable by Energy Fuels in certain circumstances.

A Scheme Booklet setting out the key terms of the Scheme, the Independent Expert’s report, and the reasons for the Base Resources directors’ recommendation will be sent to all Base Resources shareholders in due course. The Scheme Meeting is expected to be held in late July / early August 2024 with the Transaction anticipated to close in the third quarter of 2024, subject to satisfaction of all conditions, including receipt of all necessary approvals.

Full details of the terms and conditions of the Scheme are set out in the SID that will be available on Energy Fuels’ SEDAR+ profile at www.sedarplus.ca, and on Energy Fuels’ EDGAR profile at www.sec.gov/edgar.

BOARD OF DIRECTORS’ RECOMMENDATION AND SHAREHOLDER SUPPORT

The Board of Directors of Energy Fuels has unanimously approved the Scheme, including, without limitation, the Scheme Consideration.

The Board of Directors of Base Resources has unanimously recommended that all Base Resources shareholders vote in favor of the Scheme at the Scheme Meeting, in the absence of a superior proposal and subject to the Independent Expert concluding (and continuing to conclude) that the Scheme is in the best interests of Base Resources shareholders. Subject to those same qualifications, each director of Base Resources intends to vote (or cause to be voted) all Base Resources shares which they own or control in favor of the Scheme, representing approximately 1.2% of the issued and outstanding Base Resources shares.

In addition, Base Resources’ two largest shareholders, Pacific Road Capital Management GP II Limited and Pacific Road Capital II Pty Limited (owning 26.5% of Base Resources shares on issue) and Sustainable Capital Ltd (owning 24.8% of Base Resources shares on issue), have each provided a voting intention statement to Base Resources confirming that they intend to vote all of the Base Resources shares that they hold or control in favor of the Scheme, subject to no superior proposal emerging and the Independent Expert concluding (and continuing to conclude) that the Scheme is in the best interests of shareholders.

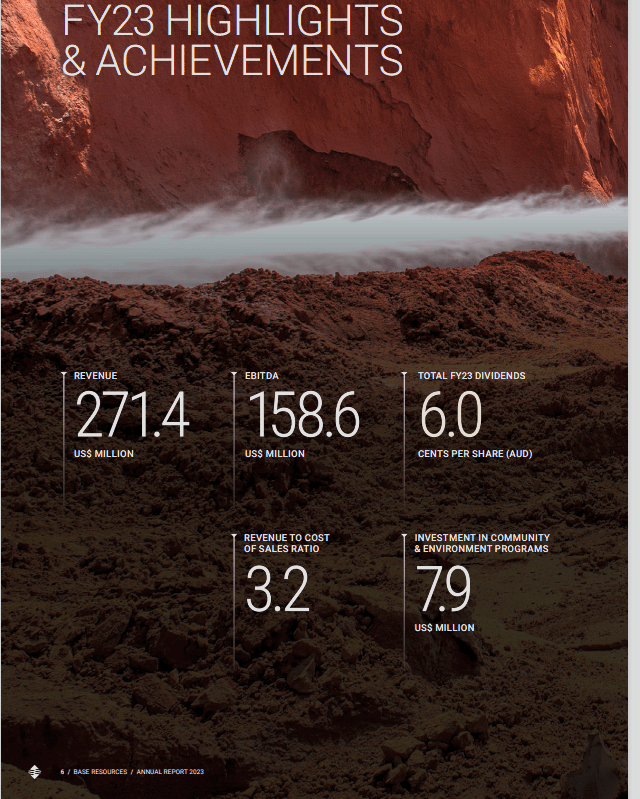

Base Resources FY 2023 Annual Report

Source: Base Resources 2023 Annual Report

Industry Outlook

The acquisition comes at a time when the uranium market is witnessing a significant revival, with prices increasing and a global push towards clean energy that highlights nuclear power as a vital component. This is driven by the need for energy security and a shift away from Russian energy supplies, further underscoring the strategic importance of Energy Fuels’ U.S.-based uranium operations (Stock Analysis).

This merger not only diversifies Energy Fuels’ resource base but also enhances its strategic positioning in this critical market, vital for the global energy transition.

Uranium is being mined near the Grand Canyon as prices soar and the US pushes for more nuclear power

Uranium Price 5 Year Chart

Source: https://tradingeconomics.com/commodity/uranium

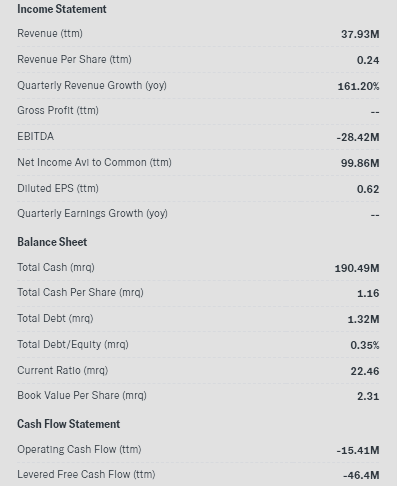

Income Statement (MRQ) NYSE: UUUU

Source: YahooFinance

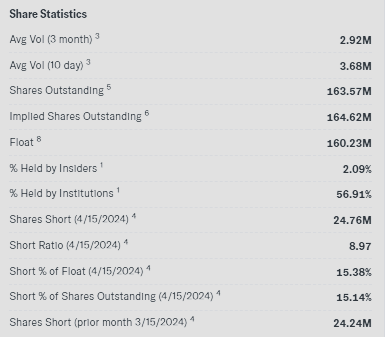

Share Structure

Source: YahooFinance

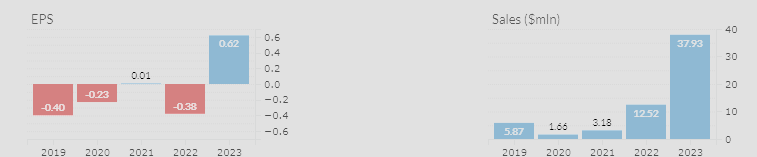

EPS and Revenue Growth

Source: Finviz

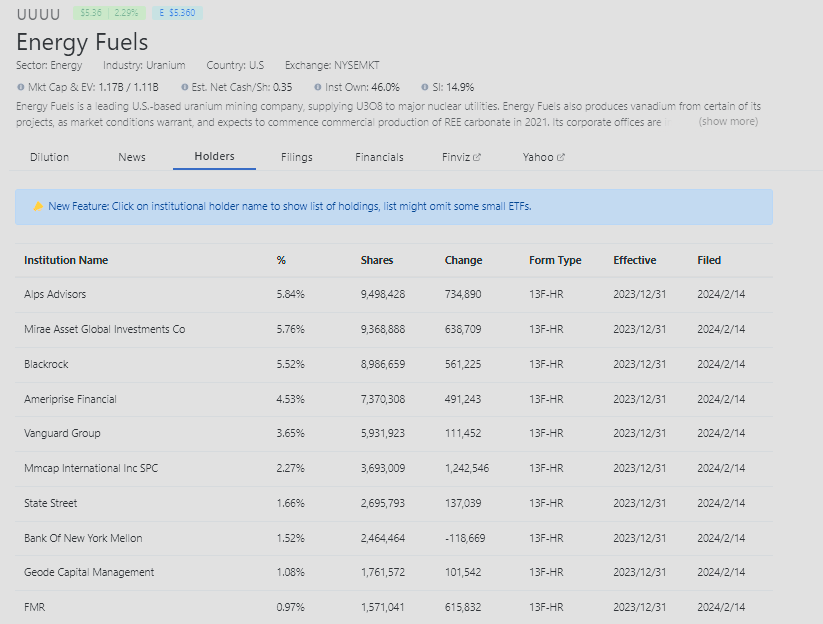

Institutional Ownership, Short Interest (SI) and Major Holders

I like seeing Blackrock with over 5% ownership.

Source: DilutionTracker

For more information visit https://www.energyfuels.com/

Conclusion

This is a significant acquisition at a time when Uranium prices and demand are on the rise. Yet, production for competitors is on the decline. I believe this strategic merger could be the key to unlocking significant value and an uptick in market cap for Energy Fuels. Energy Fuels has under $2m in debt and $190m in cash at most recent quarterly report.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer and About Us

Best Growth utilizes a revolutionary fusion of AI-powered analytics and human-led research to distill the vast and complex world of stock trading down to its purest essence. Our proprietary AI, meticulously designed to perform both fundamental and sentiment analysis, scrutinizes an extensive array of data points and trends, providing deep, insightful, and timely market perspectives. This technology operates in concert with our seasoned research team, who apply years of industry knowledge and expertise to refine our AI’s results. The culmination of this unique blend of cutting-edge technology and human expertise is the weekly issuance of one to two stock ideas, carefully selected to offer what we believe will yield the most substantial near-term results (a few days to a few months), thus paving the way for intelligent trading that delivers tangible value. Available exclusively by email or SMS/text message via our newsletter.

Best Growth is your ultimate destination for reliable and insightful stock news and analysis. We are dedicated to providing you with the latest updates and in-depth coverage of the world’s most promising growth stocks. Our experienced financial experts and market analysts work tirelessly to bring you the most accurate and up-to-date information.

At Best Growth, we understand that the investing world can be complex and intimidating. That’s why our primary goal is to simplify the process for you, offering easy-to-understand news articles, market reports, and expert commentary. Whether you are a seasoned investor or just starting your journey in the stock market, we strive to cater to your needs by presenting information in a clear and concise manner.

Our commitment to excellence extends to the quality of our content. We pride ourselves on delivering accurate, objective, and fact-based news and analysis. Our team follows a rigorous editorial process to ensure the highest standards of journalistic integrity.

At Best Growth, we believe in the power of knowledge and education. We go beyond simply reporting stock news; we provide third-party educational resources and investment guides to help you navigate the complexities of the market. We aim to empower you with the knowledge and tools necessary to achieve your financial goals.

We also understand that time is of the essence when it comes to stock analysis and news. That’s why we offer a user-friendly platform that ensures you have quick and easy access to the latest information. be sure you are subscribed to our newsletter and text alerts. Whether you prefer browsing our website or accessing our content through our free or premium subscription, we strive to make your experience seamless and convenient.

We value our community of readers and investors, and we encourage active engagement and participation. Feel free to share your thoughts and contribute to the discussions on our platform (coming soon). We believe that a vibrant and diverse community of investors can enhance the learning experience for everyone involved.

Thank you for choosing Best Growth as your go-to source for reliable stock news and analysis. We are committed to serving you with excellence and helping you stay ahead in the dynamic world of investing. Join us on this exciting journey toward financial growth and prosperity!

Disclosure: The author is not a licensed financial advisor and the content provided is for informational purposes only. Always consult with a certified financial advisor before making investment decisions. Best Growth has NOT been compensated in any way for the mention of UUU or UUUU and we do not hold any form of equity in UUU or UUUU.