About Plug Power Inc. (NASDAQ: PLUG)

Plug Power is building the hydrogen economy as the leading provider of comprehensive hydrogen fuel cell (HFC) turnkey solutions. The Company’s innovative technology powers electric motors with hydrogen fuel cells amid an ongoing paradigm shift in the power, energy, and transportation industries to address climate change and energy security, while providing efficiency gains and meeting sustainability goals. Plug Power created the first commercially viable market for HFC technology. As a result, the Company has deployed over 60,000 fuel cell systems for e-mobility, more than anyone else in the world, and has become the largest buyer of liquid hydrogen, having built and operated a hydrogen highway across North America. Plug Power delivers a significant value proposition to end-customers, including meaningful environmental benefits, efficiency gains, fast fueling, and lower operational costs. Plug Power’s vertically integrated GenKey solution ties together all critical elements to power, fuel, and provide service to customers such as Amazon, BMW, The Southern Company, Carrefour, and Walmart. The Company is now leveraging its know-how, modular product architecture and foundational customers to rapidly expand into other key markets including zero-emission on-road vehicles, robotics, and data centers.

Potential Near-Term Catalyst

Plug Power is one of the strong contenders for the $7 billion federal grants from the U.S. government for regional hydrogen production hubs.

Plug Power is one of the strong contenders for the $7 billion federal grants that the U.S. government is set to announce later this week for regional hydrogen projects. The Regional Clean Hydrogen Hubs Program will fund 10 regional hubs in the U.S. to boost hydrogen production in the country to nearly 10 million metric tons by 2030, as reported by Bloomberg. The U.S. government aims to lower the costs of hydrogen production to meet its climate goals, which could help drive the widescale adoption of hydrogen.

Plug Power’s project, in collaboration with multiple states in New York, is one of the contenders for the federal grants. E-commerce major Amazon is also in the race with a public-private partnership in California, which includes industrial gas provider Air Products and Chemicals. The stakes are high, and the funding can potentially boost the hydrogen industry in the U.S.

Plug Power is a leading provider of comprehensive hydrogen fuel cell turnkey solutions, powering electric motors with hydrogen fuel cells. The company has deployed over 60,000 fuel cell systems for e-mobility, more than anyone else in the world, and has become the largest buyer of liquid hydrogen, having built and operated a hydrogen highway across North America. Plug Power delivers a significant value proposition to end-customers, including meaningful environmental benefits, efficiency gains, fast fueling, and lower operational costs. The company’s vertically integrated GenKey solution ties together all critical elements to power, fuel, and provide service to customers such as Amazon, BMW, The Southern Company, Carrefour, and Walmart.

If Plug Power wins the federal grant, it will be a significant boost for the company and the hydrogen industry in the U.S. The funding will help Plug Power expand its hydrogen infrastructure and accelerate the adoption of hydrogen fuel cells in various industries, including transportation, logistics, and data centers. The hydrogen industry is expected to grow rapidly in the coming years, and Plug Power is well-positioned to benefit from this growth.

Recent News:

Last Week, Plug Power Issued Guidance

Plug Power’s stock rose by 4.3% in premarket trades on October 11, 2023, after the company announced that it expects to generate $6 billion in revenue by 2027 and $20 billion in revenue by 2030. The company is projecting a compound annual growth rate in revenue of about 50% and a 5% gross margin by 2030 as it ramps up production.

The announcement was part of a presentation by the company, which also included a projection of about $1.2 billion in revenue for 2023, compared to the FactSet consensus estimate of $1.28 billion.

Plug Power’s stock initially jumped after making large revenue projections through 2030, but later lost gains due to concerns about hitting internal targets.

The company’s focus on hydrogen fuel cell technology has led to partnerships with companies such as Fortescue Metals and Arcadia eFuels, and the company was recently selected as a preferred supplier for a 550 MW electrolyzer supply contract for Fortescue Metals’ Gibson Island project in Australia.

Plug Power’s stock has seen a significant decline in market cap, falling to $4.5 billion, but the company’s ambitious revenue targets could lead to a boost in gross profits if they are met.

Plug Power’s announcement of its revenue projections has been met with cautious optimism from analysts, with a Moderate Buy consensus rating based on 14 Buys and six Holds. The average PLUG price target of $17.94 implies an upside potential of 133.3% at current levels.

Plug Preferred Supplier Of 550 MW PEM Electrolyzers To Fortescue For Proposed Gibson Island Project

Plug Power is a global leader in comprehensive hydrogen solutions for the green hydrogen economy. The company is building an end-to-end green hydrogen ecosystem, from production, storage, and delivery to energy generation, to help its customers meet their business goals and decarbonize the economy. Plug Power created the first commercially viable market for hydrogen fuel cell technology and has deployed over 60,000 fuel cell systems for e-mobility, more than anyone else in the world. The company is the largest buyer of liquid hydrogen and has built and operated a hydrogen highway across North America. Plug Power delivers a significant value proposition to end-customers, including meaningful environmental benefits, efficiency gains, fast fueling, and lower operational costs. The company’s vertically integrated GenKey solution ties together all critical elements to power, fuel, and provide service to customers such as Amazon, BMW, The Southern Company, Carrefour, and Walmart. Plug Power is now leveraging its know-how, modular product architecture, and foundational customers to rapidly expand into other key markets including zero-emission on-road vehicles, robotics, and data centers

Analyst Day

On June 14, 2023, Plug Power hosted an Analyst Day to showcase revenue growth opportunities and operational scale at Gigafactory. During the event, Plug’s management team presented the exciting revenue growth opportunities in the Applications and Energy business units, as well as provided a financial update. The team also provided valuable insights into the operational scale of Plug’s manufacturing facilities, including the Rochester gigafactory and Vista manufacturing facility, to showcase the company’s ability to deliver innovative and sustainable hydrogen solutions at scale. Plug also highlighted a path to 2030 leveraging today’s growth, with the ambition to produce more than 2,000 tons of hydrogen per day from its green hydrogen network, deploy one gigawatt (GW) of stationary power products, ship five GW of electrolyzers per year, and deliver 500,000 fuel cell-powered forklift trucks by 2030.

Source: Plug Power IR

Recent Earnings:

For the second quarter and six months ended June 30, 2023, Plug Power reported sales of USD 16.13 million and USD 24.07 million, respectively, compared to USD 11.17 million and USD 21.21 million a year ago. Revenue was USD 260.18 million and USD 470.47 million, respectively, compared to USD 292.07 million a year ago. Net loss was USD 442.96 million and basic loss per share from continuing operations was USD 0.75.

For the three months that ended June 2023, Wall Street expected Plug Power to report a per-share loss of 25 cents on revenue of $237.4 million.

Source: Fintel

Plug Power’s Intellectual Property: Importance of Protecting IP

Plug Power, a leading provider of hydrogen fuel cell solutions, has a strong intellectual property (IP) portfolio with a total of 545 patents globally, out of which 285 have been granted.

More than 18% of these patents are active, demonstrating the company’s commitment to innovation and protecting its IP.

Next Section: The importance of protecting IP and how Plug Power’s extensive patent portfolio contributes to its competitive advantage.

Importance of Protecting IP

Protecting IP is crucial for companies in the technology sector for several reasons:

Competitive advantage: A strong IP portfolio can provide a company with a competitive edge by preventing competitors from copying or using its proprietary technology. This allows the company to maintain its market position and continue to innovate without the fear of losing its unique offerings.

Revenue generation: Patents can be a source of revenue through licensing agreements, where other companies pay to use the patented technology. For example, Plug Power has licensed its stationary power technology to IdaTech in the past.

Attracting investment: A robust IP portfolio can make a company more attractive to investors, as it demonstrates the company’s commitment to innovation and its ability to protect its technology from competitors.

Legal protection: Owning patents provides legal protection against infringement claims, allowing the company to defend its technology in court if necessary.

Plug Power’s IP Portfolio

Plug Power’s extensive patent portfolio covers various aspects of its hydrogen fuel cell technology, including a recent grant for a patent on an atmospheric water generator apparatus.

This demonstrates the company’s continuous efforts to innovate and expand its technology offerings.

As of June 2023, Plug Power has a total of 545 patents globally, out of which 285 have been granted.

The grant share, which is the ratio of the number of grants to the total number of patents, is approximately 52.29% (285 granted patents out of 545 total patents). This indicates that Plug Power has been successful in securing more than half of its patent applications, demonstrating the company’s commitment to protecting its intellectual property and securing its position in the hydrogen fuel cell industry.

This also indicates that Plug Power is actively working to secure more patents and strengthen its IP portfolio going forward.

Conclusion Plug Power IP

In conclusion, protecting IP is essential for companies like Plug Power to maintain their competitive advantage, generate revenue, attract investment, and ensure legal protection. Plug Power’s extensive patent portfolio, with 545 global patents and a focus on continuous innovation, demonstrates the company’s commitment to protecting its IP and securing its position in the hydrogen fuel cell industry.

Analyst Ratings:

Consensus Ratings:

Plug Power: Moderate Buy, Predicted Upside 136.56%

Most Recent Ratings:

Northland Securities (Oct 12, 2023): Lower Target, $22.00 ➝ $18.00, +138.41%

Susquehanna (Oct 12, 2023): Lower Target Positive ➝ Positive, $14.00 ➝ $13.00, +72.19%

Citigroup (Oct 10, 2023): Lower Target Buy ➝ Buy, $13.00 ➝ $12.50, +95.01%

JPMorgan Chase & Co. (Oct 5, 2023): Lower Target Overweight ➝ Overweight, $14.00 ➝ $12.00, +83.77%

Truist Financial (Oct 2, 2023): Lower Target Hold ➝ Hold, $9.00 ➝ $8.00, +5.26%

HSBC (Sep 25, 2023): Initiated Coverage Buy, $11.00, +48.05%

Morgan Stanley (Aug 31, 2023): Lower Target Equal Weight ➝ Equal Weight, $15.00 ➝ $10.00, +15.07%

BMO Capital Markets (Aug 24, 2023): Lower Target Market Perform ➝ Market Perform, $10.25 ➝ $8.00, -2.44%

Roth Capital (Aug 10, 2023): Downgrade Buy ➝ Neutral

HC Wainwright (Aug 10, 2023): Reiterated Rating Buy ➝ Buy

Piper Sandler (Jul 18, 2023): Boost Target, $8.00 ➝ $9.00, -29.47%

B. Riley (Jun 27, 2023): Lower Target, $26.00 ➝ $18.00, +97.15%

Seaport Res Ptn (Jun 6, 2023): Reiterated Rating Buy

Royal Bank of Canada (May 10, 2023): Lower Target, $17.00 ➝ $12.00, +46.70%

UBS Group (Apr 21, 2023): Lower Target Buy, $26.00 ➝ $24.00, +171.19%

KeyCorp (Mar 2, 2023): Lower Target Overweight, $31.00 ➝ $25.00, +75.93%

Cowen (Jan 26, 2023): Lower Target, $30.00 ➝ $23.00, +40.76%

Wells Fargo & Company (Jan 6, 2023): Lower Target Equal Weight, $18.00 ➝ $13.00, +2.69%

BTIG Research (Nov 15, 2022): Lower Target, $25.00, +42.37%

Oppenheimer (Nov 9, 2022): Lower Target, $63.00 ➝ $31.00, +102.61%

Cowen (Nov 9, 2022): Lower Target, $33.00 ➝ $30.00, +96.08%

Susquehanna Bancshares (Nov 9, 2022): Lower Target, $30.00 ➝ $28.00, +83.01%

Canaccord Genuity Group (Oct 21, 2022): Reiterated Rating Hold, $16.00, -1.78%

Jefferies Financial Group (Oct 18, 2022): Initiated Coverage Buy, $28.00, +46.37%

Source: Market Beat

Conclusion – Analyst Ratings

Plug Power’s Buy ratings are supported by several factors, including the prospective improvement in the company’s margins, which is crucial to its financial health. The expansion of hydrogen delivery is projected to increase from 65TPD in 2023 to 700TPD in 2027, corresponding with the ramp-up of H2 plants. The company is also confident in obtaining a US$1bn loan from the Department of Energy and exploring other non-dilutive financing options. Lastly, the company’s strategic partnerships, such as being the preferred supplier of 550MW electrolyzers to Fortescue and its selected role in Arcadia eFuels’ sustainable aviation fuel production, also contribute to the favorable Buy rating.

Plug Power is a leading provider of comprehensive hydrogen fuel cell turnkey solutions, powering electric motors with hydrogen fuel cells. The company has deployed over 60,000 fuel cell systems for e-mobility, more than anyone else in the world, and has become the largest buyer of liquid hydrogen, having built and operated a hydrogen highway across North America. Plug Power delivers a significant value proposition to end-customers, including meaningful environmental benefits, efficiency gains, fast fueling, and lower operational costs. The company’s vertically integrated GenKey solution ties together all critical elements to power, fuel, and provide service to customers such as Amazon, BMW, The Southern Company, Carrefour, and Walmart.

Plug Power’s expansion of hydrogen delivery is a significant factor in the recent Buy ratings. The company’s hydrogen production capacity is expected to increase significantly, which will help it meet the growing demand for hydrogen fuel cells in various industries. The US$1bn loan from the Department of Energy will also help Plug Power expand its hydrogen infrastructure and accelerate the adoption of hydrogen fuel cells in various industries, including transportation, logistics, and data centers.

Plug Power’s strategic partnerships are also contributing to the favorable Buy ratings. The company’s partnership with Fortescue and Arcadia eFuels will help it expand its customer base and increase its revenue streams. These partnerships will also help Plug Power develop new technologies and products that will further enhance its position in the hydrogen industry.

In conclusion, Plug Power’s Buy ratings are supported by several factors, including the prospective improvement in the company’s margins, the expansion of hydrogen delivery, the US$1bn loan from the Department of Energy, and the company’s strategic partnerships. These factors will help Plug Power expand its hydrogen infrastructure, accelerate the adoption of hydrogen fuel cells, and increase its revenue streams.

Current Statistics:

Plug Power’s market cap is $5B as of October 13, 2023.

Share Structure:

Average Volume (3 month): 20.71M

Average Volume (10 day): 30M

Shares Outstanding: 601.97M

Implied Shares Outstanding: 601.97M

Float: 540.99M

% Held by Insiders: 10.02%

% Held by Institutions: 56.38%

Shares Short (Sep 29, 2023): 127.83M

Short Ratio (Sep 29, 2023): 8.35

Short % of Float (Sep 29, 2023): 21.40%

Short % of Shares Outstanding (Sep 29, 2023): 21.24%

Shares Short (prior month Aug 31, 2023): 120.69M

Source: Yahoo Finance

Short Interest Including Dark Pool from Fintel a/o October 14th, 2023

Short Interest: 127.83M shares (source: NASDAQ)

Short Interest Ratio: 4.11 Days to Cover (source: NASDAQ)

Short Interest % Float: 24.73% (source: NASDAQ (short interest), Capital IQ (float)

Off-Exchange Short Volume: 8,115,087 shares (source: FINRA (including Dark Pool volume)

Off-Exchange Short Volume Ratio: 59.88% (source: FINRA (including Dark Pool volume)

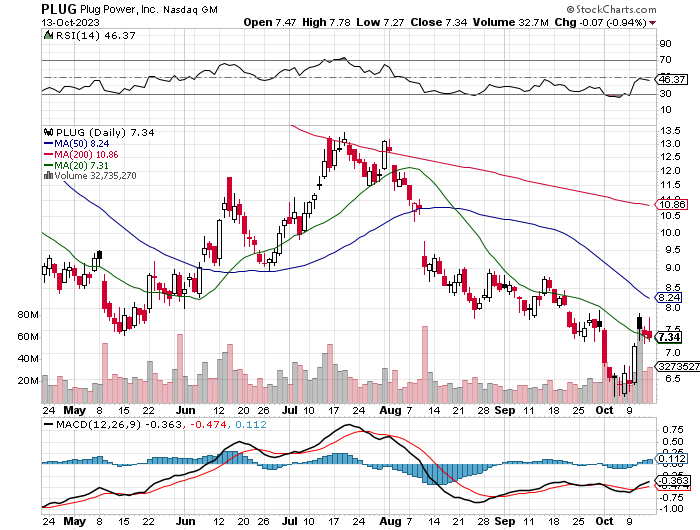

PLUG Daily Chart

Investing in Hydrogen: Opportunities and Challenges

Hydrogen and renewable energy investments have gained significant attention in recent years, driven by increased government support and consumer interest in clean energy. This article explores the potential investments in hydrogen and its applications, focusing on the various companies active in the hydrogen economy.

Applications of Hydrogen

- Feedstock: Hydrogen is primarily used as feedstock in chemical and industrial processes, such as methanol and ammonia production, oil refining, and steel production.

- Clean transport: Hydrogen fuel cells can be used in heavy-duty transport, trains, boats, and material handling equipment like forklifts.

- Stationary power systems: Fuel cells can be used as primary and backup power sources, supporting electricity grids or off-grid applications.

Here are some of the current best applications for hydrogen energy:

Transportation

Heavy duty vehicles like trucks, buses, trains, ships, and airplanes. Hydrogen fuel cells are better suited than batteries for long range heavy transport that requires quick refueling. Major automakers are developing hydrogen prototypes for trucks, trains, and airplanes.

Forklifts, warehouse equipment, and airport tugs. Hydrogen fuel cells provide a clean alternative to propane and diesel for indoor material handling. Companies like Amazon, Walmart, and FedEx are adopting hydrogen lift trucks.

Electricity Production

Backup and emergency power. Hydrogen fuel cells can provide reliable off-grid power for data centers, telecom towers, hospitals, military bases, and more. Fuel cells have advantages over diesel generators in noise, emissions, and reliability.

Grid energy storage. Excess renewable energy can be used to produce hydrogen, which can then generate electricity when needed. This helps overcome intermittency issues with renewables.

Industrial Energy

Providing heat and hydrogen for oil refining, metals processing, electronics fabrication and other industries that already use hydrogen. Enables transition from fossil fuel derived hydrogen to renewable hydrogen.

Replacing natural gas in boilers and turbines for industrial heating and power generation. Hydrogen combustion produces no carbon emissions.

Summary

Heavy transportation, material handling, backup power, and industry are the most promising near-term applications for hydrogen. Significant infrastructure investment and technological advances are still needed for widespread adoption.

Investing in Hydrogen Companies

- Large hydrogen producers: Companies like L’Air Liquide, Air Products and Chemicals, and Linde are major hydrogen producers, mostly producing grey hydrogen. They are shifting towards cleaner solutions, such as green hydrogen production.

- Electrolyzer producers: Companies like Plug Power, McPhy Energy, Nel ASA, and ITM Power focus on producing electrolyzers, which are essential for green hydrogen production.

- Fuel cell companies: Ballard Power Systems, Bloom Energy, FuelCell Energy, Plug Power, and PowerCell Sweden produce fuel cells that convert hydrogen back into electricity for various applications.

- Large industrials: Companies like Cummins, Siemens Energy, and thyssenkrupp have also entered the hydrogen market, focusing on hydrogen strategies and expanding production capacities for electrolyzers.

- Hydrogen-powered vehicles: Companies like Nikola, General Motors, Daimler, and Alstom are developing hydrogen-powered buses, trains, and trucks.

Conclusion Analysis Hydrogen Fuel Investments and Plug Power

While there are many investment opportunities in the green hydrogen economy, the recent surge in share prices has pushed valuations higher, making it risky to enter the market at high price-to-sales ratios. Companies with exposure to electrolyzers are considered the most interesting investments, as they can profit from the transition from grey to green hydrogen. A well-researched selection based on activities, valuations, partners, and management is crucial for investing in hydrogen today.

Overall, Plug Power has been making strides in the green hydrogen economy, with ambitious sales targets and a path to 2030 that includes significant growth in hydrogen production, stationary power products, electrolyzers, and fuel cell-powered forklift trucks. While the company has reported losses in recent earnings, analysts remain bullish on the stock, with recent ratings coming in with an overwhelming positive outlook.

As hydrogen fuel becomes more mainstream, we could see consolidation in this sector. I would think given the IP Plug Power holds they would be a prime takeover candidate. (Pure Speculation)

In my humble opinion Plug Power remains on a solid growth trajectory and will remain on Best Growth Stocks watch list for the foreseeable future.

Senior Editor, BestGrowthStocks.Com

Like this report? Timing is everything. Be sure you’re receiving our Text/SMS notifications and be on top of our latest issuance.

Disclaimer: The author of this article is not a licensed financial advisor. This article is intended for informational purposes only. It should not be considered financial or investment advice. We have not been compensated for the creation or distribution of this article in any way. We do not hold any form of equity in the securities mentioned in this article as of 10/15/2023. Always consult with a certified financial professional before making any financial decisions. Growth stocks are speculative in nature, and you could lose your entire investment.