About MultiSensor AI Holdings Inc.

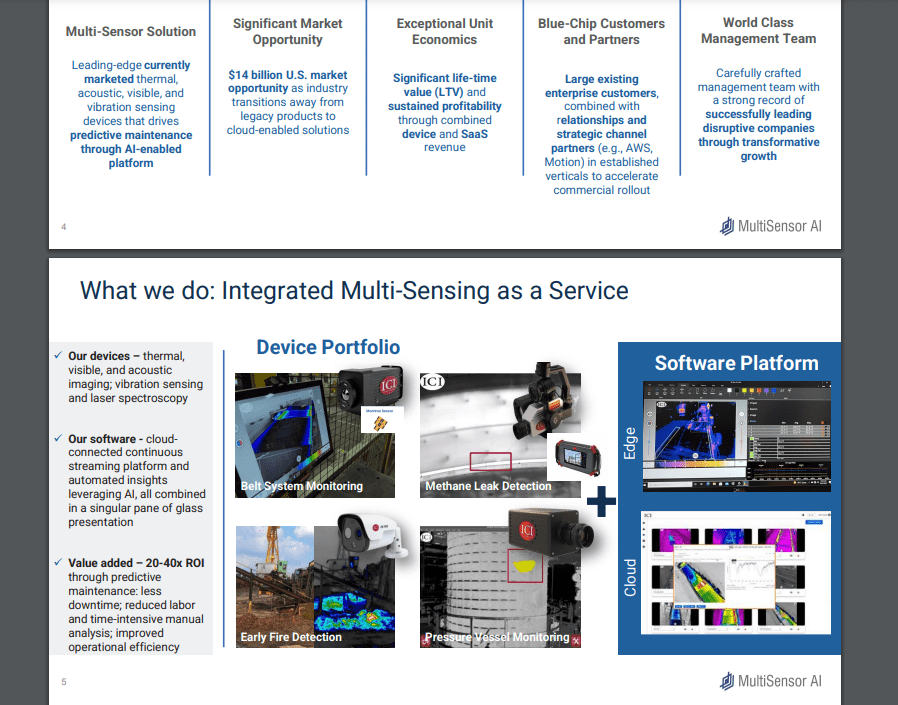

MultiSensor AI Holdings Inc. (MSAI) specializes in predictive maintenance and process control solutions, integrating advanced imaging, sensing technologies, and AI-powered software. Their offerings leverage a stream of data from thermal imaging, visible imaging, acoustic imaging, vibration sensing, and laser sensing devices, providing real-time condition monitoring for critical assets and manufacturing processes across industries like distribution & logistics, manufacturing, utilities, and oil & gas (MultiSensor AI).

To help explain what MSAI’s technology does:

Source: Investor Presentation

Recent News and Developments

Fourth Quarter and Full Year 2023 Results: The company announced its financial results, signaling significant corporate and financial milestones including the commencement of trading after completing a business combination with SportsMap Tech Acquisition Corp. This move demonstrated a strong sales pipeline featuring global blue-chip companies (Stock Analysis).

SmartIR 2.0 Software Platform: In February 2024, MSAI unveiled its SmartIR 2.0 software platform. This update introduced new sensor modalities and enhanced AI-powered analytics capabilities, marking a significant step in predictive maintenance and process control solutions (Stock Analysis).

Key features of SmartIR 2.0 include:

Expanded ‘Single-Pane-of-Glass’ Capabilities: SmartIR 2.0 boasts a 100% increase in integrated sensor modalities, providing users with a comprehensive view of their assets and infrastructure from a single interface.

AI-Powered Analytics: Enhanced analytics capabilities empower users to derive deeper insights from sensor data, with new interactive charting tools for analyzing sensor and imaging patterns and trends.

Live Multi-Region Temperature Monitoring: Real-time temperature monitoring across multiple regions provides users with invaluable insights into thermal conditions.

Expanded Long-Term Sensor Data Capture: SmartIR 2.0 extends the duration of sensor data capture, enabling users to track asset performance over extended periods.

Computer Vision Tools: SmartIR 2.0 includes expanded computer vision tools, including high-resolution thermal object detection and real-time thermal motion detection.

Expanded Enterprise Asset Management (EAM) Integrations: SmartIR 2.0 seamlessly integrates with leading EAM systems, facilitating streamlined asset management workflows.

New Asset and Area-of-Interest (AOI) Sensor Insight Integration: Users can now integrate asset and AOI-based sensor insights into their monitoring and analysis processes.

Customizable View Settings: SmartIR 2.0 offers customizable view settings for the Workstation and Alerts dashboard, enabling users to tailor their experience to their specific needs.

Name Change: The company transitioned from Infrared Cameras Holdings, Inc. to MultiSensor AI Holdings, Inc. in February 2024. This change reflects its evolution into a SaaS leader in industrial predictive maintenance, broadening its focus from primarily thermal-sensing devices to a wider range of sensor-based AI-driven software solutions (Stock Analysis).

Potential Catalysts

Given the comprehensive details about MultiSensor AI Holdings Inc. (MSAI), several potential future catalysts emerge, reflecting the company’s strategic direction and technological innovations. These catalysts can significantly impact its growth trajectory, market position, and financial performance:

Broader Industry Applications: MultiSensor AI’s technologies have vast potential beyond their current markets. As industries increasingly adopt AI and sensor technologies for efficiency and safety, MSAI could expand into sectors such as healthcare, for patient monitoring, and smart cities, for infrastructure management. This diversification could open new revenue streams and partnerships.

Global Expansion: Entering new geographical markets could serve as a catalyst for growth. By leveraging its technology in regions with burgeoning industrial and manufacturing sectors, MSAI can tap into new customer bases, potentially boosting its sales and market presence.

Government and Regulatory Partnerships: Collaborating with government entities for infrastructure monitoring, environmental compliance, and public safety could position MSAI as a key player in essential public services, driving demand for its solutions.

Integration with IoT and Edge Computing: The convergence of MultiSensor AI’s technologies with IoT devices and edge computing can enhance real-time data processing and analytics at the source. This integration could lead to smarter, more efficient predictive maintenance solutions and process controls, appealing to a broader range of industries.

Advancements in AI and Machine Learning: Continuous improvement in AI algorithms and machine learning models could improve the accuracy and predictive capabilities of MSAI’s solutions. Innovations in AI could enable the company to offer more sophisticated analytics and insights, further differentiating its products in the market.

Sustainability Initiatives: As businesses increasingly focus on sustainability, MSAI’s solutions could play a crucial role in monitoring and reducing energy usage, emissions, and waste in industrial processes. This focus could attract customers aiming to meet sustainability goals and regulatory requirements.

Partnerships with Industrial Giants: Forming strategic alliances with large industrial firms and technology providers can amplify MSAI’s reach and impact. Such collaborations could lead to the co-development of industry-specific solutions, leveraging MSAI’s sensing and AI technologies.

R&D and Innovation: Ongoing investment in research and development could lead to the discovery of new applications for MSAI’s technologies or the development of entirely new sensing and monitoring solutions. This focus on innovation could maintain the company’s competitive edge and attract investment.

Acquisitions: Acquiring startups or complementary technologies could rapidly expand MSAI’s technological capabilities, product offerings, and market access. Strategic acquisitions could provide immediate entry into new markets or technology areas, accelerating growth.

Regulatory Changes: Changes in industry regulations related to safety, environmental monitoring, and data privacy could increase demand for MSAI’s solutions. Being ahead in compliance-related technologies could make the company an indispensable partner for businesses navigating these regulations.

These potential catalysts, grounded in technological innovation, strategic expansion, and market dynamics, outline a path for MultiSensor AI Holdings Inc. to enhance its market position, financial performance, and impact across industries.

Financials

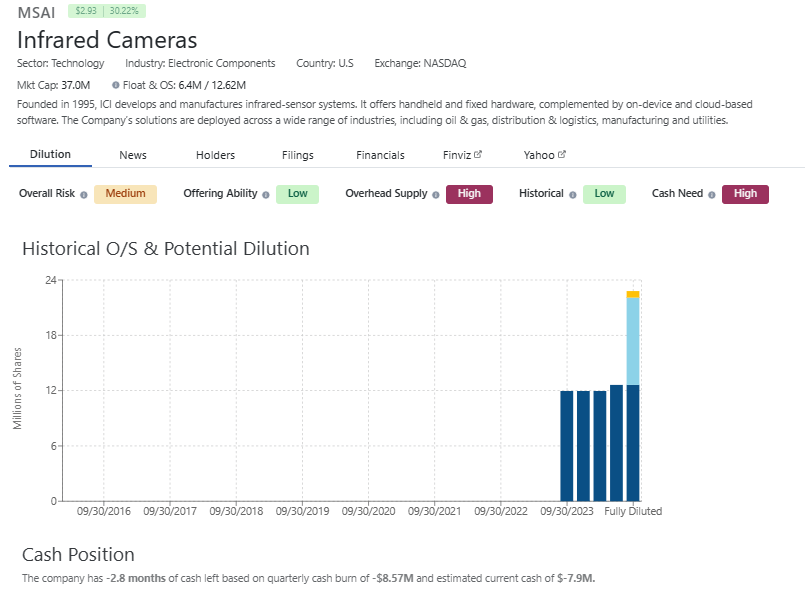

For the year 2023, MSAI reported revenue of $5.43 million, which represented a decrease from the previous year’s $7.27 million. The net income for 2023 was -$22 million, a significant decline compared to -$13 million in 2022. The company’s market capitalization stands at $40.06 million, with a debt reduction from $18.01 million in 2022 to $4.87 million in 2023 (MarketScreener) (Stock Analysis).

Key Partnerships/Collaborations

None announced yet. The company’s strategic direction towards expanding its technology and market presence indicates potential future alliances. The integration of its solutions across various industries suggests ongoing engagements with sector leaders to optimize asset management and process efficiencies.

Estimated Share Structure, Cash Position, Short Interest (SI), and Institutional Ownership

Source: DilutionTracker

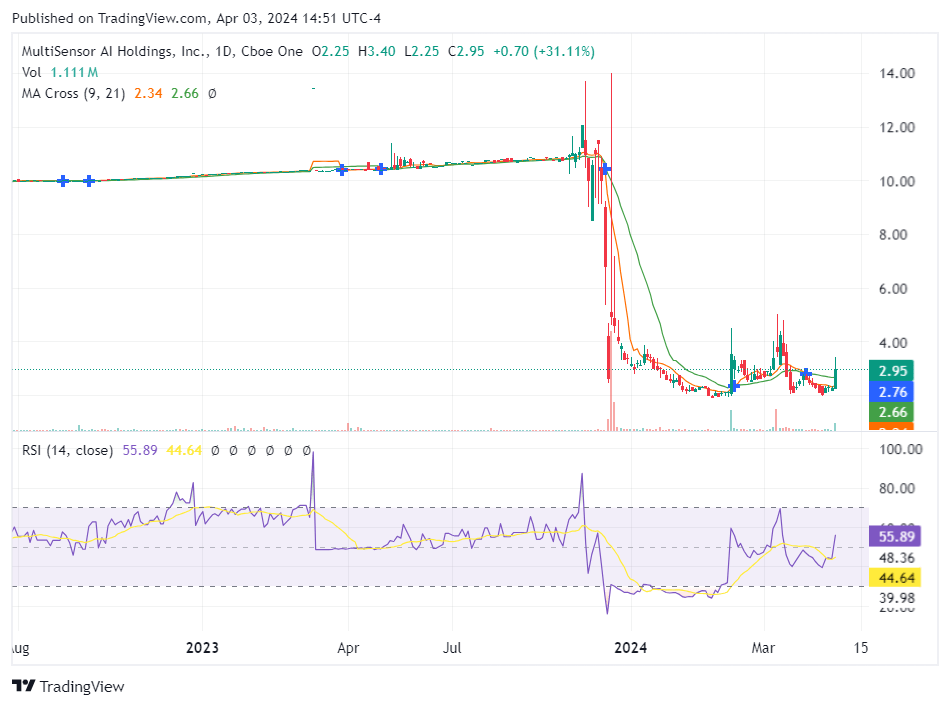

Daily Chart – Potential Breakout Forming

For more information on MultiSensor AI Holdings:

Conclusion

In conclusion, MultiSensor AI Holdings Inc. is at a pivotal point, marked by strategic transformations and technological advancements. Despite financial challenges, the company’s focus on innovation and market expansion positions it interestingly for future growth. The transition towards a more diversified SaaS model could open new avenues for development and collaboration across industries reliant on predictive maintenance and process control technologies. MSAI is an interesting AI tech story that will remain on BestGrowthStocks.Com’s watchlist.

Risk Factors for MultiSensor AI Holdings Inc. (MSAI)

1. Technology Adoption and Market Penetration Risks

Rapid Technological Changes: The industries MSAI serves are subject to rapid and significant technological changes. There’s a risk that MSAI’s technologies could become obsolete if they fail to keep pace with these changes, impacting market position and financial performance.

Market Adoption: The adoption of AI and advanced sensor technologies in traditional industries can be slow due to high costs, regulatory hurdles, and lack of awareness. This slow adoption rate could limit MSAI’s growth and revenue potential.

2. Financial Stability and Growth Risks

Revenue and Profitability: MSAI has experienced a decrease in revenue and an increase in net losses year-over-year. This trend raises concerns about the company’s ability to achieve profitability and sustain operations without additional financing.

Funding and Liquidity: Given its financial results, MSAI may require additional funding to continue operations, develop new technologies, and expand its market reach. There’s a risk that the company may not be able to secure such funding on favorable terms, if at all.

3. Competition and Market Position Risks

Intense Competition: The market for predictive maintenance and process control solutions is highly competitive, with numerous players offering similar technologies. MSAI faces the challenge of distinguishing its offerings and maintaining a competitive edge.

Market Position: MSAI’s market position could be weakened by the entry of new competitors, especially larger firms with more resources for R&D, marketing, and global expansion.

4. Regulatory and Compliance Risks

Regulatory Changes: The industries MSAI operates in are subject to strict regulations, which can change. Compliance with new regulations could increase costs or limit the company’s ability to operate in certain markets.

Data Privacy and Security: MSAI’s solutions involve the collection and processing of data, which subjects the company to data privacy and security laws. Breaches or non-compliance could lead to significant fines, reputational damage, and loss of customer trust.

5. Operational and Technological Risks

Dependence on Key Technologies: MSAI’s solutions rely on complex technologies such as AI, machine learning, and advanced sensors. Any failure or significant downtime in these technologies could disrupt operations and services.

Intellectual Property Risks: Protecting intellectual property is crucial for MSAI. There’s a risk of infringement claims by competitors or the inability to secure patents for new technologies, affecting competitive advantage and revenue generation.

6. Strategic and Partnership Risks

Strategic Execution: MSAI’s growth and expansion strategy involve significant risks, including the success of new products, entry into new markets, and strategic partnerships. Failure to execute these strategies effectively could impact growth and market share.

Dependency on Partnerships: MSAI’s expansion and technology integration efforts may depend on strategic partnerships and collaborations. Risks associated with reliance on third parties include potential disputes, dependency, and partnership failures, which could affect operations and financial outcomes.

Conclusion

Investing in MultiSensor AI Holdings Inc. involves considering these risk factors, which could materially affect the company’s business, financial condition, and operational results. Investors should weigh these risks against the potential rewards of MSAI’s technology and market opportunities.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: This article is intended for informational purposes only. It should not be considered financial or investment advice. We do not hold any form of equity in the securities mentioned in this article. We have not been compensated in any way for the mention of MSAI. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.