About Momentus

Momentus Inc. is a U.S.-based commercial space company offering satellite buses, in-space transportation, and infrastructure services. The company is heavily focused on the development of its Orbital Service Vehicles (OSVs) powered by a proprietary water plasma propulsion system, which they believe will revolutionize in-space operations. Their flagship OSV, Vigoride, is primarily designed for low-earth orbit (LEO) missions. Momentus has also been involved in innovative space projects, including deploying satellites for its customers and securing defense contracts for space structures.

Recent News

Momentus has been fairly quiet since since July 18th, 2024.

Recent developments for Momentus have been a mix of financial restructuring and contract wins. On July 18, 2024, the company announced a convertible note issuance and loans to support its operations, alongside the successful conclusion of its annual shareholder meeting. Additionally, the company received a contract from DARPA in May 2024 to aid in designing and demonstrating large-scale space structures, signaling continued confidence from defense agencies in its technological capabilities.

However, Momentus has faced some challenges, including receiving multiple Nasdaq deficiency notifications due to delayed SEC filings, which have raised concerns over compliance and governance.

Potential Catalysts

DARPA Contract Deliverables: The contract from DARPA involves developing technology for large-scale space structures. Successful execution could lead to further defense-related contracts and bolster Momentus’s credibility in the space defense sector.

Further NASA Collaborations: Momentus has a history of securing NASA contracts, such as its March 2024 agreement to provide flight and payload integration services. Continued NASA partnerships could act as a significant growth catalyst.

Expansion of Vigoride Capabilities: Momentus plans to scale its Vigoride platform to larger and more capable versions, potentially opening up new commercial opportunities in both LEO and beyond.

Strategic Partnerships: Momentus’s collaboration with Ascent Solar Technologies to bring advanced solar arrays to the market could position the company as a leader in solar energy applications in space, further enhancing its commercial appeal.

Competitive Advantages and Disadvantages

Advantages:

Innovative Propulsion Technology: Momentus’s water plasma-based propulsion system is environmentally friendly and cost-effective, which sets it apart in an industry often criticized for its reliance on chemical propellants.

Strategic Defense Contracts: The company’s ongoing contracts with DARPA and NASA indicate strong ties with U.S. government agencies, providing a stable revenue stream and high-profile project exposure.

Diverse Service Offering: By offering not only satellite deployment but also orbital service vehicles and in-space transportation, Momentus appeals to a broad spectrum of customers, including commercial satellite operators and government bodies.

Disadvantages:

Financial Instability: The company’s ongoing financial struggles, including the need for convertible debt financing and Nasdaq deficiency notices, highlight challenges in maintaining consistent operational funding.

Compliance Risks: Delays in filing essential reports have led to Nasdaq deficiency notices, casting doubt on the company’s internal controls and governance, which could potentially result in delisting if not rectified.

Intense Competition: Momentus operates in a highly competitive market with both established players like SpaceX and emerging startups offering specialized services, which could pressure profit margins and market share.

Financial Performance

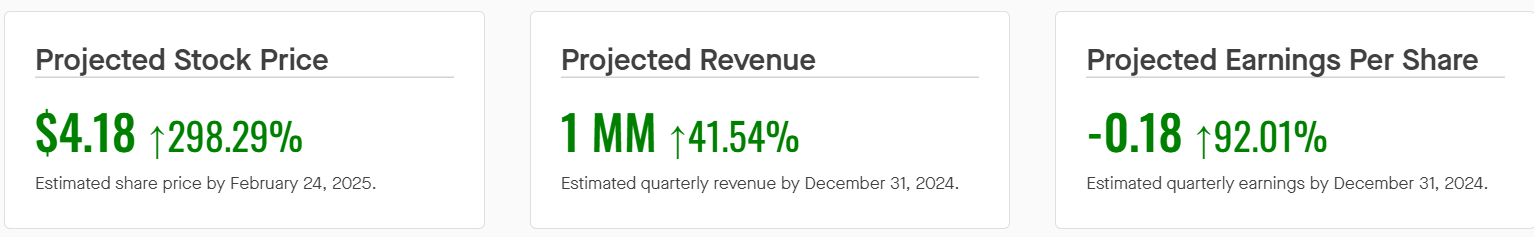

Momentus has seen significant revenue growth in recent quarters, bolstered by its contracts with government agencies and commercial entities. For Q2 2023, the company reported $1.71 million in revenue, a substantial increase from previous quarters. However, the company’s operating expenses remain high, resulting in negative earnings per share. This is typical for growth stocks in this sector.

The company has reported a significant backlog of contracts. Yet, ongoing financial challenges necessitate careful management of cash flow and costs.

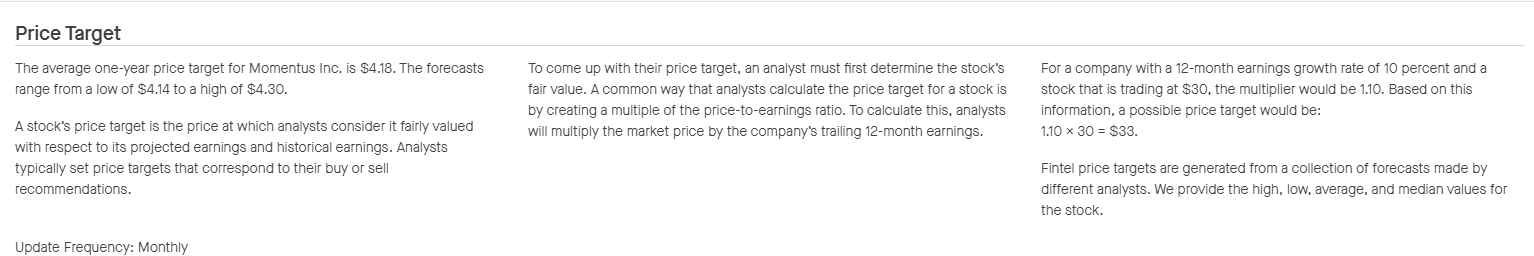

Analyst Price Target

Source: Fintel

Chart Analysis

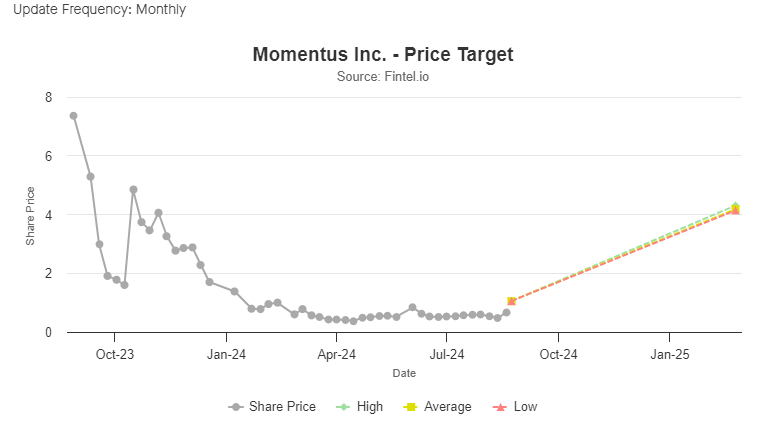

As of the market close on August 23, 2024, Momentus’s stock was trading at $1.05, reflecting a recent surge of 81% due to an uptick in investor sentiment on commercial space related companies. The investment community seems to be searching for the next ASTS like run.

Support Levels: The immediate support is found at the $0.80 level, a key area where buyers have previously stepped in. Below that, $0.60 serves as another critical support, aligning with historical lows during periods of financial uncertainty.

Resistance Levels: On the upside, $1.25 is a significant resistance level where sellers have been active. A breakout above this level could propel the stock towards the $1.50-$1.75 range, which represents a zone of past consolidation.

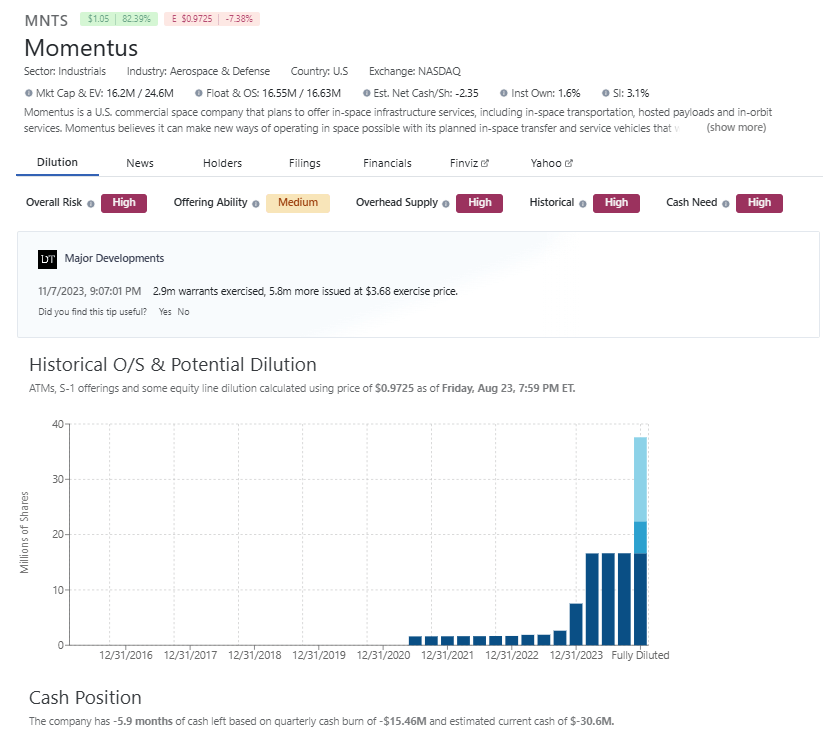

Estimated Share Structure (Current and fully diluted), Cash Position, Cash Runway, Institutional ownership and, Short interest

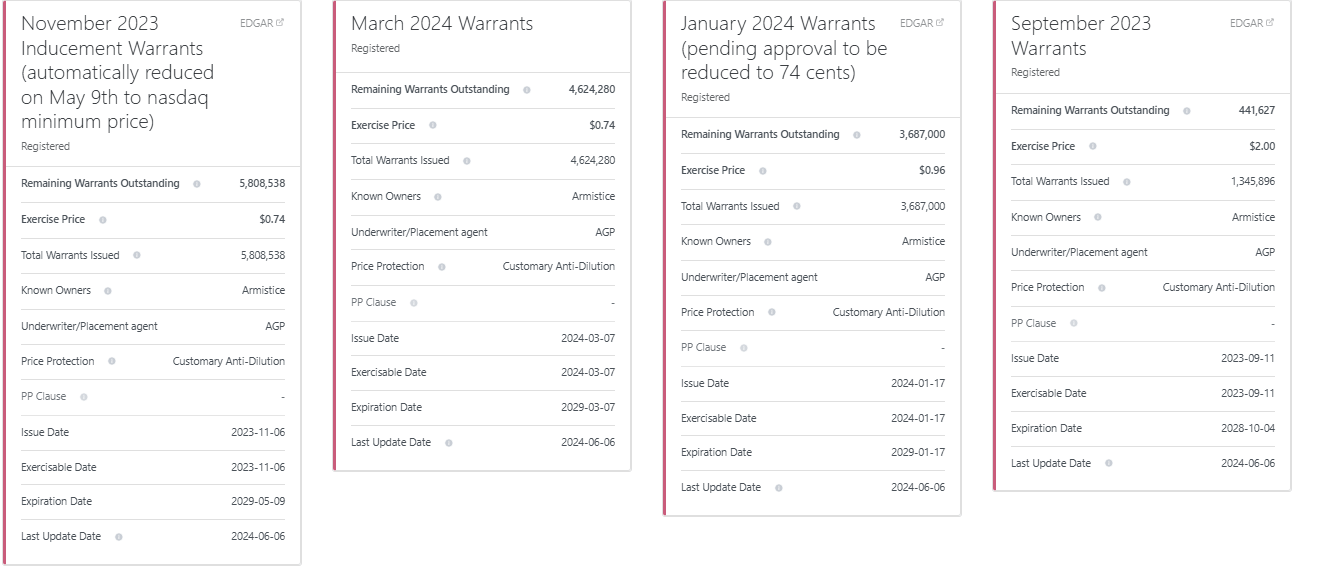

Warrants: Estimated outstanding or in process of converting

Fully diluted share structure total is 37.83m as seen in the graph above.

Source: DilutionTracker.com

Conclusion

Despite the hurdles Momentus faces, including financial uncertainty and compliance risks, the company holds a unique position in the space industry with its cutting-edge technology and strong government partnerships. Upcoming catalysts like the DARPA project, potential further NASA contracts, and the expansion of its Vigoride platform could lead to significant growth opportunities. While Momentus needs to address its financial instability, its innovative approach to space infrastructure and its established partnerships suggest that it has the potential to emerge as a formidable player in the commercial space sector.

For more information about Momentus

Key Risk Factors for Momentus Inc.

Financial Instability: Momentus has faced significant financial challenges, including reliance on debt financing, equity raises, and receiving multiple Nasdaq deficiency notices for delayed filings. These issues could affect the company’s liquidity and its ability to continue operations if not addressed promptly.

Compliance and Governance Issues: The company has experienced delays in meeting SEC filing requirements, resulting in deficiency notifications from Nasdaq. Persistent compliance issues raise concerns about internal governance and could result in the company’s stock being delisted if not corrected.

Execution Risk: As a technology-driven company in a nascent industry, Momentus faces execution risks in delivering its innovative services. Delays or failures in the development and deployment of its Vigoride OSV or failure to meet contractual obligations, particularly with defense and government agencies, could severely impact its credibility and future contracts.

Competitive Pressure: Momentus operates in a highly competitive space market dominated by both established players like SpaceX and a growing number of specialized startups. Competitive pressures could limit Momentus’s ability to capture market share, particularly in areas where larger competitors have a head start.

Dependency on Strategic Partnerships: Momentus’s business model relies heavily on strategic partnerships with entities like NASA, DARPA, and commercial players. Any disruptions in these partnerships or failure to secure new contracts could adversely affect the company’s growth prospects and revenue streams.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: The author of this article is not a licensed financial advisor. This article is intended for informational purposes only. It should not be considered financial or investment advice. We have not been compensated for the creation or distribution of this article and we do not hold any form of equity in the securities mentioned in this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.