Overview

Momentus is a space infrastructure company that provides in-space shuttle services and satellite deployment for the orbital economy. The company transports satellites between orbits using its proprietary water plasma propulsion technology to provide orbital shuttle services to satellite operators.

Recent Financial Performance

Here is a summary of the key points from Momentus’ Q2 2023 earnings report:

Q2 2023 Financial Highlights

• $32 million backlog as of June 30, 2023.

• Non-restricted cash and cash equivalents of $20 million as of June 30, 2023.

• Approximately $9 million term loan debt as of June 30, 2023.

• Recognized $1.7 million in revenue, which included V5 and V6 missions.

• Q2 loss from operations was approximately $19 million.

• Q2 Adjusted EBITDA was negative $14.4 million, an improvement over Q2 2022 of $3.8 million.

• Adjusted EBITDA excludes stock-based compensation expense, certain legal matters, and

net mark-to-market gains and losses on warrant liabilities, and other adjusting items.

• Refer to the Appendix of this presentation for reconciliation with equivalent GAAP financials.

Business Highlights

Successful deployment of customer payloads on the Vigoride-6 mission in April, contributing to revenue growth.

Signed new contract with FOSSA Systems for hosted payload services starting in 2024.

Signed contract with Space Development Agency worth up to $1.9 million to tailor vehicles for national security missions.

Introduced new M-1000 satellite bus product based on proven Vigoride technology.

Submitted proposals for major government contracts with Space Development Agency and Defense Innovation Unit

Outlook.

Next mission is Transporter-9 targeted for November 2023, with slots booked through end of 2024.

Continuing to build sales pipeline and backlog with government and commercial customers.

Focused on scaling infrastructure and capabilities to support more customer missions.

Overall, Momentus made strong progress operationally and commercially in Q2, achieving a revenue milestone. But financial performance remains volatile as the company scales up. Momentus continues to target the growing space economy, with government contracts a key near-term focus area.

2022 Financials

In Q4 2022, Momentus reported revenue of $1.8 million, up from $1.1 million in Q4 2021. However, it posted a net loss of $30.4 million compared to $27.0 million loss last year.

For full year 2022, revenue was $7.4 million versus $0.7 million in 2021. Net loss in 2022 totaled $120.7 million compared to $90.0 million in 2021.

The increased net loss was attributed to higher operating costs as Momentus scales its operations and infrastructure. The company expects these costs to stabilize as revenue grows.

Growth Potential

Momentus has a large addressable market in the growing space economy. Satellite launches are rapidly increasing, requiring in-space transportation services the company provides.

Momentus currently has a significant backlog in customer contracts that will drive revenue growth over the next few years as services are delivered.

The company is expanding infrastructure and capabilities, including a new R&D facility, upgraded ground segment, and a second-generation shuttle design. This will support more customer missions in the future.

Momentus has agreements with major launch providers like SpaceX to carry its shuttles as secondary payloads on rockets. This provides regular and affordable access to space.

Risks and Uncertainties

Momentus is still an early-stage company with unproven technology and limited revenue history. The water plasma propulsion needs more flight testing to demonstrate capabilities at scale.

They face competition from other companies developing in-space transportation and satellite servicing technologies.

Dilution from new stock issuances has impacted the share price. More cash may be needed to fund growth, potentially further diluting shares.

Recent Contract Wins

On October 17th, Momentus Inc., a U.S. commercial space company, has entered into a contract with Polish nanosatellite manufacturer SatRev for orbital delivery services in 2024. The agreement will see Momentus transport SatRev’s SOWA-1 payload in the first quarter of the year.

The collaboration between Momentus and SatRev is seen as a significant step in the industry, with Momentus’ Chief Commercial Officer, Chris Kinman, highlighting the importance of earth observation data and commending SatRev’s progress in this area.

On October 11th, Momentus announced it will provide delivery services for RIDE Space in 2025.

This contract is for orbital delivery services for RIDE Space satellites.

On October 5th, Momentus signed a contract with C3S for transportation and orbital delivery services in 2025.

This contract will provide launch services for C3S satellites.

On September 19th, Momentus signed a contract with Aarhus University to provide transportation services for their payload in 2023.

This will launch a scientific payload for Aarhus University.

On August 24th, Momentus announced it will provide hosted payload services for FOSSA Systems.

This contract is for hosted payload services on a Momentus spacecraft.

Recent Events

Summary

On October 11, Momentus announced a contract with French startup RIDE! Space to provide orbital delivery services in Q1 2024.

This expands Momentus’ customer base in Europe.

On October 10, Momentus announced it had integrated and shipped satellites for 4 customers to SpaceX’s launch site in Florida.

This demonstrates continued progress executing its growing backlog of customer contracts.

On October 5, Momentus signed a new contract with Belgian startup C3S for orbital shuttle services.

Adds to revenue backlog and validates demand for in-space transportation.

Recent Events Analysis

The RIDE! Space and C3S contracts show Momentus continuing to attract new customers globally. This is a positive sign as it builds up its backlog and customer pipeline.

Shipping satellites to the SpaceX launch site is a key milestone. It means Momentus is on track to start fulfilling existing customer contracts and generating revenue.

However, the financial impact of these deals may not be seen for several quarters as the shuttle missions still need to be successfully completed.

The new contracts and progress on existing deals help validate Momentus’ business model. But near-term financial results could still be volatile until regular missions are underway.

Overall, these announcements signal positive business momentum, but Momentus still faces execution risks as it scales up operations. The stock could remain volatile in the near term.

Share Structure Ownership and Stats

Current Price: $3.11/share as of market close 10-13-2023

Average Volume (3 month): 2.24 million

Average Volume (10 day): 12.79 million

Shares Outstanding: 2.69 million

Float: 1.92 million

% Held by Insiders: 11%

% Held by Institutions: 6%

Sources: Yahoo Finance and FinViz

Short Interest According to FinTel

Short Interest (shares): 87,450 (source: NASDAQ)

Short Interest Ratio: 0.13 Days to Cover (source: NASDAQ)

Short Interest % of Float: 4.51% (source: NASDAQ short interest, Capital IQ float)

Off-Exchange Short Volume: 6,274,486 shares (source: FINRA)

Off-Exchange Short Volume Ratio: 54.93%

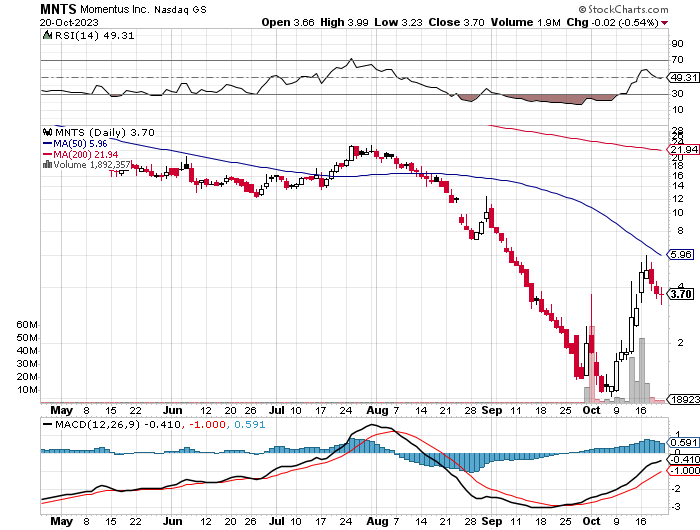

MNTS Daily Chart

Notes: Daily volume is on the rise. Recent cross above the 20 DMA.

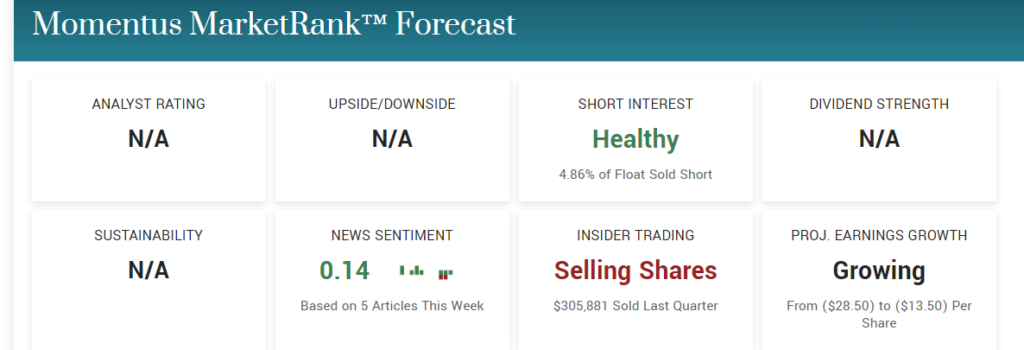

Wall Street Sentiment

Analyst consensus has a “Moderate Buy” rating on MNTS shares.

Image provided by MarketBeat

Price target averages $9, representing significant upside from current levels. However, targets range widely from $2 to $15 reflecting uncertainty. (No current data available, Reflects older 2022 data)

Bull case sees Momentus emerging as a leader in an important new space industry. Bears argue they still have much to prove technically and commercially.

Conclusion

Momentus has strong medium to long term growth potential as the satellite economy expands. But near-term results will continue to be volatile as they scale up operations. The stock remains high risk/high reward at current valuation levels. Momentus will remain on Best Growth Stocks watch list for the foreseeable future.

See Also MNTS Investor Presentation

Steve Macalbry

Senior Editor, BestGrowthStocks.Com

Like this report? Timing is everything. Be sure you’re receiving our Text/SMS notifications and be on top of our latest issuance.

Disclaimer: The author of this article is not a licensed financial advisor. This article is intended for informational purposes only. It should not be considered financial or investment advice. We have not been compensated for the creation or distribution of this article in any way. We do not hold any form of equity in the securities mentioned in this article as of 10/23/2023. Always consult with a certified financial professional before making any financial decisions. Growth stocks are speculative in nature, and you could lose your entire investment.