Bonus content: The Next Beneficiaries of the AI Revolution

July 9th, 2024 – Maxeon Solar Technologies has released its 2023 Sustainability Report, showcasing significant advancements and accolades in sustainability. The report highlights Maxeon’s recognition with the APEX Award for Most Sustainable Business by the United Nations Global Compact Singapore and its ranking among the Top 50 Most Sustainable Companies globally by Corporate Knights. Both MSCI and ISS have rated Maxeon highly in sustainability indices, with AA and Prime ratings, respectively.

CEO Bill Mulligan emphasized Maxeon’s role in supporting the global transition to net-zero emissions through its solar energy solutions and sustainable practices. The report details notable achievements, including:

Circular Economy Partnership: Collaboration with Nanyang Technological University in Singapore to enhance solar panel recycling processes.

SunPower Home Energy System: Introduction of a home energy system to optimize energy consumption and utilization of self-generated clean energy.

Maxeon 7 Solar Panel: Launch of a highly efficient solar panel with over 24% efficiency and superior shade tolerance.

LEED Gold Certification: Recognition for Maxeon’s Singapore headquarters for its sustainable design and operations.

Maxeon Impact Areas: Initiatives focused on gender equity, sustainability, and mental wellness.

Customer NPS Scores: A 25% improvement, highlighting exceptional customer satisfaction.

The report also includes Maxeon’s Modern Slavery Statement, providing insights into the company’s human rights protections and supply chain traceability measures.

Chief Legal & Sustainability Officer Lindsey Wiedmann reiterated Maxeon’s commitment to high standards and transparent reporting, aiming to lead the solar industry and promote corporate action against climate change. The report adheres to international standards such as the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), the UN Global Compact, and the Singapore Exchange Sustainability Reporting requirements.

Maxeon Solar Technologies, headquartered in Singapore, is a global leader in solar innovation with over 35 years of experience and more than 1,900 patents. The company serves residential, commercial, and power plant customers worldwide, leveraging a network of over 1,700 partners and distributors. Full Article

Surge in Solar Energy Stocks on Thursday: Here’s Why

July 11, 2024, at 3:42 PM

Key Takeaways

Inflation data came in lower than anticipated, sparking investor speculation about potential interest rate cuts.

Reduced interest rates can significantly benefit the solar industry, prompting a positive market reaction.

Highlighting 10 promising stocks, with a focus on SunPower.

Inflation and Interest Rates: The Catalyst Behind Solar Stock Surge

On Thursday, solar energy stocks saw a significant uptick following the release of inflation data that was better than expected. The Consumer Price Index (CPI) reported a 0.1% decrease month-over-month in June, after a stagnant May. Over the past year, prices have risen by just 3%.

Inflation rates are a critical metric for investors predicting the Federal Reserve’s actions regarding interest rates. The past two years have seen high inflation driving up interest rates, but with signs of inflation cooling, there is speculation that the Federal Reserve might lower interest rates as early as the September meeting to stimulate economic growth.

Interest rates are pivotal for the solar industry because most installations are funded upfront by installers, who then generate returns over 20 to 30 years through power purchase agreements. These agreements involve selling electricity to customers while retaining ownership of the solar system installed on their roofs. Consequently, securing favorable financing is crucial for justifying these installations.

Over the past two years, elevated interest rates combined with policy changes in California have dampened the solar industry, impacting stock performance negatively. Beyond interest rates, companies have limited options to enhance margins: they can either reduce costs, which lowers the initial investment in solar installations, or increase customer prices, which might deter potential adopters of solar energy.

Despite some cost reductions in solar panels and inverters over the past two years, high interest rates have continued to pose challenges for the industry’s growth. However, this scenario might be shifting.

Cautious Optimism About Interest Rates

Bloomberg reports that the 10-year Treasury rate dropped by 9 basis points today, largely influenced by the CPI data. Over the past month, rates have declined by 21 basis points to 4.19%. This rate is a benchmark for the solar industry, and its decline is a positive sign, although the changes are currently modest and won’t immediately turn companies profitable.

Keep an eye on the trends in installation costs to determine if they are decreasing, which would provide a sustainable boost to the industry. Further insights on cost and pricing trends will emerge when earnings reports are released in about a month. If interest rates continue to fall, solar stocks might end 2024 on a strong note.

Company Overview

Maxeon Solar Technologies Ltd designs, manufactures, and sells advanced solar panels and systems under the SunPower brand globally. They focus on producing high-efficiency solar panels using interdigitated back contact (IBC) and shingled cell technologies. These innovations enable Maxeon to deliver superior performance and reliability, making their products suitable for residential, commercial, and industrial applications.

Recent Developments and Potential Catalysts

Patent Infringement Lawsuits:

Maxeon is actively defending its intellectual property. On June 19, 2024, the company initiated a unitary patent infringement lawsuit against Aiko and its partners, continuing their defense of innovation. Earlier in April, Maxeon also filed lawsuits against Hanwha Q CELLS and REC Solar Holdings AS for TOPCon patent infringements. These legal actions could lead to significant settlements or licensing agreements, potentially boosting the company’s financial position and stock price.

Product Innovations and Certifications:

Maxeon continues to push the boundaries of solar technology. On June 17, 2024, the company showcased its latest solar energy innovations and new panel technologies at Intersolar Europe 2024. Earlier, they announced that their IBC solar panels eliminate hotspot risks, enhancing safety and efficiency. Additionally, in April, Maxeon introduced the SunPower Performance 7 solar panels with Cradle to Cradle certification, emphasizing their commitment to sustainable and reliable energy solutions.

Major Installations and Projects:

Maxeon has been involved in significant projects, such as the installation of innovative solar energy systems at the largest dairy farm in the Northeast U.S., announced on June 6, 2024. These high-profile projects not only showcase Maxeon’s capabilities but also expand their market presence and potential revenue streams.

Financial Recovery and Compliance:

After facing compliance issues with Nasdaq listing rules, Maxeon announced on May 31, 2024, that they had regained compliance. This positive development can restore investor confidence and stabilize the stock. Note they are out of compliance with the $1 minimum bid price rule now.

Market Expansion and Strategic Appointments:

Maxeon has made strategic appointments, such as the hiring of Vikas Desai as Chief Commercial Officer in April 2024, to drive commercial success. Furthermore, they have been expanding their market reach with new partnerships and projects worldwide.

Analyst Coverage

Maxeon has a consensus “Reduce” rating from analysts, with an average price target of $4.41. The company’s stock has been subject to numerous downgrades recently, reflecting cautious sentiment among analysts. However, the predicted upside of over 1,500% suggests potential for significant growth if the company can overcome current challenges and capitalize on upcoming catalysts. (MarketBeat)

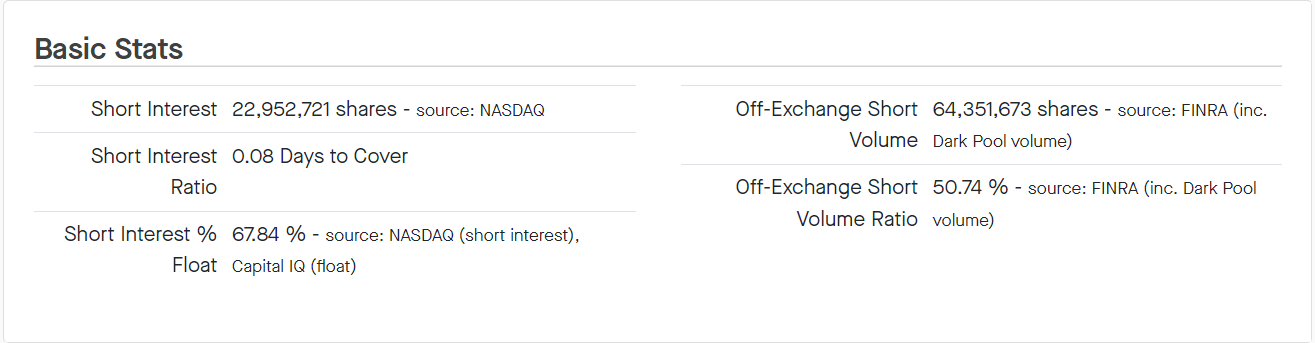

Short Interest

As of June 15, 2024, 64.21% of Maxeon’s float was sold short, indicating a high level of bearish sentiment among investors. The short interest ratio is 5.0 days, suggesting strong negative sentiment about the stock’s future performance. (FinTel)

Financial Performance

For Q1 2024, Maxeon reported revenue of $187.46 million, slightly above the consensus estimate of $186.20 million. However, the company posted a net loss of $1.59 per share, missing the estimated loss of $1.02 per share. Despite the current financial challenges, analysts expect earnings to improve from a loss of $3.34 per share this year to a loss of $1.69 per share next year. (Yahoo Finance)

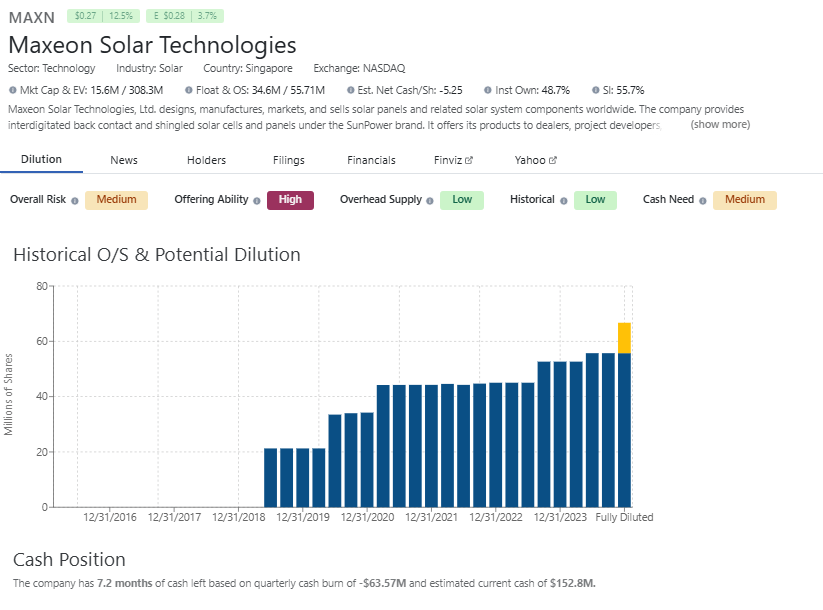

DilutionTracker.Com Premium Information

Current Estimated Cash Position, Cash Runway, Institutional Ownership, and Fully Diluted Share Structure

Short Interest (FinTel a/o July 11th, 2024)

MAXN Daily Chart

Support and Resistance (Tradingview)

As of 07/11/2024, the current price of Maxeon Solar Technologies, Ltd. (NASDAQ: MAXN) is approximately $0.20 per share. Given this price level, the relevant support and resistance levels on the current chart are as follows:

Support Levels:

- $0.17 – $0.18: This is a crucial support zone that has been tested recently. A fall below this could signal further downside potential.

- $0.15: Another significant support level which, if breached, could lead to further declines.

Resistance Levels:

- $0.22: The immediate resistance level that the price needs to overcome for a potential upward move.

- $0.25: A more substantial resistance level that might be targeted if the price breaks above the $0.22 mark.

For a detailed and real-time view, you can access the TradingView MAXN chart which provides comprehensive technical analysis based on various indicators and timeframes (TradingView) (TradingView) (TradingView).

Conclusion

Maxeon Solar Technologies Ltd is navigating through a challenging phase with strategic lawsuits, innovative products, significant projects, and leadership changes. While current market sentiment is bearish, reflected in high short interest and analyst downgrades, the company has several potential catalysts that could drive stock performance in the future. These include the outcomes of patent lawsuits, successful market expansion, and product innovations, which collectively present an upside opportunity for investors willing to take a contrarian view. Maxeon will remain on our watch list for the foreseeable future.

For more information on Maxeon

Key Risk Factors for Maxeon Solar Technologies Ltd (NASDAQ: MAXN)

Financial Instability:

Maxeon has reported substantial net losses in recent quarters. For Q1 2024, the company posted a net loss of $1.59 per share, missing analysts’ estimates. Continued financial underperformance and inability to generate positive cash flow may hamper the company’s ability to fund operations and invest in growth opportunities (MarketBeat).

High Short Interest:

As of June 15, 2024, 64.21% of Maxeon’s float was sold short, indicating strong bearish sentiment among investors. High short interest can lead to increased stock price volatility and reflects widespread investor pessimism about the company’s future performance (MarketBeat).

Litigation and Intellectual Property Risks:

Maxeon is involved in several patent infringement lawsuits, including recent actions against Aiko, Hanwha Q CELLS, and REC Solar Holdings AS. While these lawsuits aim to protect Maxeon’s intellectual property, they also pose financial risks due to legal costs and the uncertainty of outcomes. Adverse rulings could negatively impact the company’s market position and financial health (MarketBeat) (MarketBeat).

Regulatory Compliance and Market Listing:

The company recently faced issues with Nasdaq listing compliance, which it has since resolved. However, future non-compliance with regulatory requirements could result in penalties, legal challenges, or delisting from major stock exchanges, affecting investor confidence and stock liquidity (MarketBeat).

Competitive Market and Technological Advancements:

The solar technology industry is highly competitive, with rapid advancements and numerous established players. Maxeon must continually invest in research and development to stay ahead. Failure to innovate or keep up with technological trends could result in loss of market share and reduced profitability. Additionally, competitive pressures could lead to pricing wars, further impacting margins (MarketBeat) (MarketBeat).

These risk factors highlight the challenges Maxeon faces in maintaining its market position and achieving financial stability. Investors should carefully consider these risks alongside the company’s growth potential and strategic initiatives.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: This article is intended for informational purposes only. It should not be considered financial or investment advice. We do not hold any form of equity in the securities mentioned in this article. We have not been compensated in any way for the creation or distribution of this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.