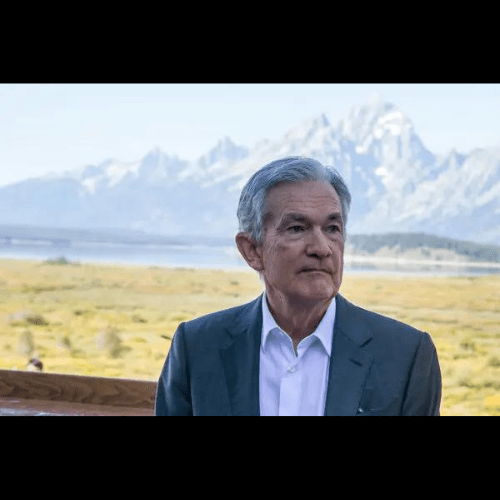

U.S. stocks closed sharply higher on Friday as Federal Reserve Chair Jerome Powell’s dovish remarks at the Jackson Hole Economic Symposium solidified expectations for an interest rate cut in September. This anticipated move comes amid growing concerns over weakening labor market conditions and cooling inflation.

In his much-anticipated speech, Powell stated, “The time has come to lower the Fed funds target rate,” adding that inflation risks have diminished. This statement signaled that a rate cut at the Fed’s next policy meeting would likely be the first in over four years. The chair also emphasized that maintaining labor market strength is a priority as the Fed works to keep inflation in check.

Market participants had long awaited such a dovish shift. Ryan Detrick, Chief Market Strategist at Carson Group, noted, “This was the dovish shift that market participants have been waiting for. The Fed is clearly turning to the dovish camp, and Powell has made it crystal clear that September will be the start of multiple rate cuts this year.”

Following Powell’s comments, all three major U.S. stock indexes surged. The Dow Jones Industrial Average rose 462.3 points, or 1.14%, while the S&P 500 and Nasdaq Composite gained 1.15% and 1.47%, respectively. Mega-cap companies such as Nvidia, Apple, and Tesla were among the top performers, driving significant gains in the tech sector.

Smaller companies and regional banks also saw strong performances, with the Russell 2000 index climbing 3.2% and the KBW Regional Banking Index rising 4.9%. Detrick pointed out that financial stocks are at an all-time high, suggesting that fears of an impending recession might be overstated.

Workday Inc. posted the biggest percentage gain on the Nasdaq, with shares soaring 12.5% after the company reported better-than-expected quarterly revenue and announced a $1 billion share buyback plan. Meanwhile, discount retailer Ross Stores saw a 1.8% rise in its stock after it raised its profit forecast for fiscal 2024.

Despite the upbeat market, some analysts remained cautious about the potential economic slowdown. Stephen Brown, Deputy Chief North America Economist at Capital Economics, described Powell’s speech as “unmistakably dovish” but emphasized that the Fed was keeping its options open regarding the size of the rate cut. While traders widely expect a 25-basis-point cut in September, the odds of a larger 50-basis-point cut increased to 36% from 28% the previous day, according to Investing.com’s Fed Rate Monitor Tool.

As Powell hinted at the possibility of further rate cuts, market observers are closely monitoring upcoming economic data. Next week’s key indicators, including the revised second-quarter GDP and the Fed’s preferred inflation measure, the Personal Consumption Expenditures (PCE) price index, will play a crucial role in determining the pace of monetary easing.

Wall Street’s recent rally underscores the delicate balance the Fed must strike between curbing inflation and supporting economic growth. For months, investors have anticipated rate cuts, but with signs of a slowing economy, these cuts could carry an ominous undertone. Quincy Krosby, Chief Global Strategist at LPL Financial, questioned whether markets truly want the Fed to cut rates due to concerns over the labor market. “What the market doesn’t want is for the Fed to neglect the deteriorating labor market and do nothing about it,” Krosby added.

Ultimately, the Fed’s next move will depend on the evolving economic outlook and incoming data. As Powell stated, “The direction of travel is clear, and the timing and pace of rate cuts will depend on the totality of the data.” Markets will be closely watching the upcoming economic reports ahead of the Fed’s next meeting in mid-September.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com