The U.S. stock market has been on a high-energy trajectory since the November election, with major indexes hitting record highs, spurred by fresh economic data and an optimistic outlook from the Federal Reserve. It’s been a celebratory week on Wall Street, with both the Dow Jones Industrial Average and S&P 500 wrapping up their best week of the year. Investors seem thrilled by the prospect of sustained growth as new labor and inflation data indicated a strong economy. Here’s a closer look at some key stories and stocks that have driven this optimism.

1. Fed Cuts Rates: A Boost for Growth

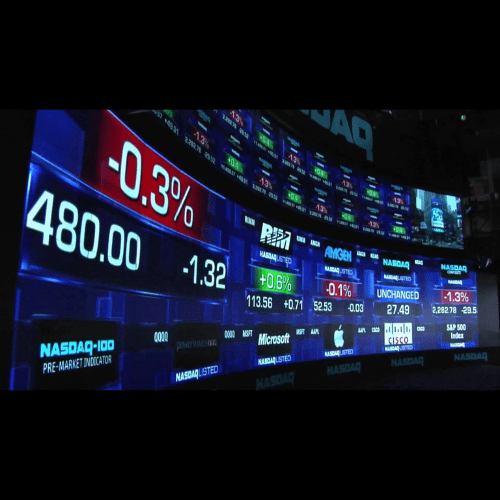

The Federal Reserve’s recent interest rate cut of 0.25% set a positive tone for markets, helping boost investor sentiment as lower rates support borrowing and economic expansion. The tech-heavy Nasdaq, in particular, gained as rate-sensitive tech stocks like Nvidia and Apple benefited from expectations that borrowing costs will stay low for the foreseeable future. Historically, Fed rate cuts outside of a recession have bolstered stocks, and current data suggests that the Fed’s “soft landing” goal might actually be achievable this time. In fact, many analysts are optimistic that growth sectors, including tech and consumer discretionary, will see sustained momentum if the economy maintains its current course of growth and low inflation levels.

2. Earnings Reports: Delta, Meta, and the Market’s Movers

Several companies made headlines with their quarterly earnings. Delta Air Lines reported somewhat weaker-than-expected revenue growth but cited strong passenger demand for the holiday season, which may help bolster results in the fourth quarter. The stock remained relatively steady, as investors took comfort in the broader strength of the travel sector.

Meta Platforms, on the other hand, has been a big winner. Its shares climbed as the company reported better-than-expected ad revenue growth, a positive sign as it continues to recover from previous headwinds in digital advertising. This led investors to believe that Meta’s hefty investments in AI are beginning to pay off, potentially making the stock an attractive buy as it regains traction in digital ad markets.

3. Record Highs for S&P 500 and Dow Jones

By Friday, November 8, the S&P 500 crossed the 6,000 mark, and the Dow Jones topped 44,000, both reaching record highs. Much of this can be attributed to broad optimism around U.S. economic growth and encouraging consumer sentiment data. These highs have sparked a bullish sentiment among investors, with many looking to high-growth stocks for continued gains. Healthcare stocks have also performed well, particularly due to renewed interest in medical technology and AI-driven health solutions.

One standout in healthcare has been Intuitive Surgical, a company specializing in robotic surgical systems. The stock saw impressive gains as more hospitals adopt its minimally invasive robotic systems, which are projected to lower healthcare costs in the long run. Such innovations are positioning healthcare technology as a promising growth sector amidst increased market focus on AI and automation.

4. Energy Stocks Cooling Off

As oil prices eased from October’s highs, energy stocks like Chevron and ExxonMobil saw less interest, with investors instead rotating into sectors that benefit from rate cuts, like tech and consumer discretionary. The drop in energy stocks has provided some relief to the broader market by reducing inflationary pressures, which had been a key concern over the summer. The focus now is shifting to other areas that may provide higher returns in the current rate-cut environment.

5. Geopolitical Concerns and 2024 U.S. Elections: Potential for Volatility

Although the current market mood is positive, analysts are cautious about potential volatility ahead. The ongoing U.S. presidential election cycle and geopolitical tensions, particularly in the Middle East and Ukraine, could unsettle markets if any escalation disrupts oil supplies or other key trade routes. However, some experts believe that even with elevated volatility, the market is well-positioned for gains, especially if investors can find opportunities in undervalued stocks during any dips.

Overall, the November stretch has been one of celebration and optimism for the U.S. stock market, with a series of record highs and a favorable outlook on economic growth. As we edge closer to year-end, investor sentiment remains largely positive, though caution is advised given potential volatility from election-year uncertainties and geopolitical risks. Still, the trend seems clear: U.S. stocks are set to close out 2024 on a high note, with tech and consumer discretionary leading the charge, supported by an economy that shows few signs of slowing down.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com