For the third consecutive month, March witnessed a persistent surge in inflation rates, sparking discussions around the timing of the Federal Reserve’s moves to dial back on interest rates in response to cooling price hikes.

In a detailed analysis, the month saw a 3.5% year-over-year increase in the overall price index, a slight climb from February’s 3.2%, as revealed by the Labor Department’s Consumer Price Index (CPI). This uptick was notably fueled by escalating costs of rent and gasoline. Monthly, the prices witnessed a 0.4% rise, echoing the trend of the preceding month.

A critical measure closely observed by the Federal Reserve is the core inflation rate, which strips out the often fluctuating food and energy sectors. March’s figures mirrored those of February, recording a 0.4% rise, maintaining the annual growth at 3.8%.

The inflation narrative took a dramatic turn since hitting a peak of 9.1% in June 2022, marking a 40-year high. Following a sharp decline in subsequent months, recent months have seen a resurgence in monthly price increases, fluctuating between 0.3% to 0.4%.

The easing of pandemic-induced supply chain constraints has led to a decrease in the prices of commodities like used cars, furniture, and appliances. However, a continuous rise in service costs, including rent, car insurance, and transportation, has been observed, partly due to a gradual reduction in COVID-related wage hikes amidst improving labor shortages.

An analysis by Barclays suggests a gradual moderation in monthly price gains, projecting an annual inflation drop to 3% and core inflation to 3.1% by year-end, figures still above the Federal Reserve’s 2% target.

As of late, Fed Chair Jerome Powell hinted at a potential deviation from the anticipated path to the 2% inflation target, describing it as a “sometimes bumpy path” following an unexpected hike in early-year prices. Despite market predictions aligning with the Fed’s median estimate of three rate cuts within the year, with an initial reduction expected in June, the consecutive 0.4% monthly core CPI rise in recent months has cast doubts on the timing of such rate adjustments.

Economic analysts from Capital Economics and Nationwide have expressed concerns over the March data impacting the Federal Reserve’s confidence in achieving a sustainable inflation reduction, suggesting a potential delay in rate cuts possibly extending into the next year.

Since March 2022, the Fed has escalated its benchmark short-term rate to a 22-year peak of between 5% and 5.25% to combat inflation, with a pause in adjustments since July. These hikes have escalated borrowing costs for consumers and businesses, influencing overall economic activity.

In response to the inflation report, stock markets reacted negatively, with significant indexes like the S&P 500 and Dow Jones Industrial Average experiencing drops, amid growing investor anxiety over delayed interest rate cuts. This sentiment also affected the bond market, where yields on 10-year Treasury bonds rose in response to inflation concerns.

The report also delves into specific sectors, noting a 1.7% rise in gasoline prices in March and a slight moderation in rent increases, despite the consistent upward trend. The article further discusses varying trends in the costs of goods and services, including a notable decline in used car prices and a steady rise in medical care and auto insurance costs.

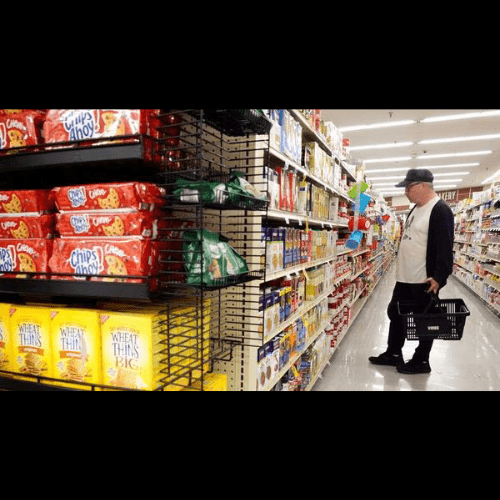

In the realm of food prices, the report offers a mixed picture, with grocery prices holding steady, offering relief amidst slight increases in protein costs, attributed to factors like another bird flu outbreak affecting egg prices.

This comprehensive overview not only highlights the current inflation landscape and its implications for Federal Reserve policy but also underscores the broader economic impacts and consumer experiences amid fluctuating prices across different sectors.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: This article is intended for informational purposes only. It should not be considered financial or investment advice. We do not hold any form of equity in the securities mentioned in this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.