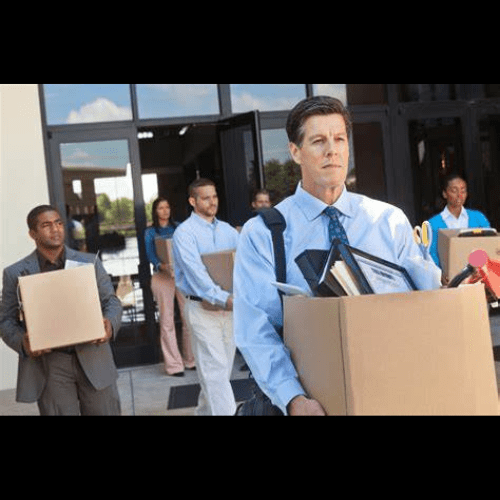

As of mid-August 2024, the U.S. economy is grappling with a combination of inflationary pressures, economic uncertainty, and a continuous wave of corporate layoffs across several industries. This turbulence reflects both sector-specific challenges and broader economic concerns.

Economic Context:

Inflation, while showing signs of moderation, remains persistent. The Federal Reserve’s efforts to combat inflation through interest rate hikes have led to tightening credit conditions, influencing corporate decisions on hiring and investment. Higher borrowing costs and cautious consumer spending have driven many companies to restructure or downsize.

Recent Layoffs:

Several large corporations have recently announced significant job cuts. Key examples include:

Intel (INTC) Facing difficulties in maintaining its financial performance, Intel is laying off approximately 15,000 employees, around 15% of its global workforce (Intellizence). This move comes as part of a broader strategy to reduce operational costs and streamline its business amidst challenges in the semiconductor industry.

Dell Technologies (DELL) Dell has also initiated layoffs, targeting around 10% of its workforce. These layoffs are part of a larger sales reorganization as the company navigates a rapidly changing tech landscape driven by AI and other emerging technologies (Intellizence).

T-Mobile (TMUS) T-Mobile is set to cut around 5,000 jobs as the telecommunications giant seeks to streamline its operations amid competitive pressures and a saturated market (Fox Business).

Tyson Foods (TSN) In the food sector, Tyson Foods announced the elimination of 4,600 jobs, signaling ongoing difficulties in the consumer products sector as inflation impacts input costs and consumer spending (Intellizence).

Broader Implications:

These layoffs reflect a broader trend across industries. Even as some tech companies position themselves for future growth through AI and automation, the short-term cost pressures and economic uncertainties have led to significant workforce reductions. The transportation, telecommunications, and consumer products sectors are also experiencing restructuring as companies try to remain competitive in an evolving economic environment.

Despite some signs of resilience, such as moderate consumer spending and strong employment numbers overall, these layoffs hint at underlying vulnerabilities. As companies continue to adapt to the post-pandemic economic landscape, the balancing act between cutting costs and investing in future growth remains delicate.

Moving forward, the trajectory of inflation, interest rate policies, and global economic trends will play crucial roles in shaping the corporate landscape and job market in the remainder of 2024.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: The author of this article is not a licensed financial advisor. This article is intended for informational purposes only. It should not be considered financial or investment advice. We have not been compensated for the creation or distribution of this article and we do not hold any form of equity in the securities mentioned in this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.