JUNE 12, 2024

Today is poised to be one of the most pivotal days of the year for economic news, as investors will closely monitor the path of inflation and the Federal Reserve’s response. This morning starts with the critical consumer price index (CPI) reading for May, followed by the Fed’s policy meeting in the afternoon, both of which are expected to send significant signals regarding the economy’s direction and future monetary policy.

Key Events

Consumer Price Index (CPI) Report

The CPI report, released at 8:30 a.m. ET, is expected to show a modest 0.1% increase from April, translating to an annual rise of 3.4%. The core CPI, which excludes volatile food and energy prices, is projected to post a 0.3% monthly gain and a 3.5% annual rate. While these figures indicate inflation running above the Fed’s 2% target, analysts like Jonathan Pingle from UBS believe they continue to show a broader disinflationary trend.

Federal Reserve Policy Meeting

Later today, the Federal Open Market Committee (FOMC) will conclude its meeting and release updates to its Summary of Economic Projections. This includes key forecasts for inflation, GDP growth, and unemployment, as well as the much-watched “dot plot” of interest rate expectations. Despite recent economic data, market consensus suggests the Fed will hold rates steady, maintaining the current benchmark overnight borrowing rate between 5.25%-5.50%.

Market Expectations and Analyst Insights

Jack Janasiewicz, lead portfolio strategist at Natixis Investment Managers, anticipates minimal market disruptions from today’s releases, expecting the outcomes to fall largely within the realm of current market expectations. However, economists will be closely watching for any adjustments in the Fed’s economic outlook and interest rate projections, especially given recent strong nonfarm payroll numbers.

Goldman Sachs economists forecast two rate cuts this year, with the first potentially coming in September. In contrast, Bank of America predicts just one cut, while Citigroup considers the possibility of three, though it expects the dot plot to indicate two cuts.

Nicholas Colas, co-founder of DataTrek Research, emphasizes that sustained economic growth and wage increases continue to pose challenges for the Fed’s inflation targets, suggesting that significant rate cuts in 2024 may be unlikely unless economic growth cools.

Conclusion

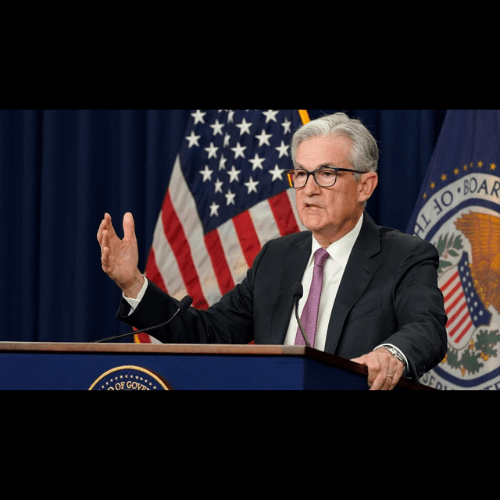

Today’s CPI report and Fed meeting are critical for gauging the future direction of inflation and monetary policy. Investors and market participants are on high alert, as the outcomes could influence economic projections and market strategies significantly. The updates from the Fed, including Chair Jerome Powell’s press conference, will be crucial in understanding the central bank’s stance and potential policy adjustments moving forward.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: This article is intended for informational purposes only. It should not be considered financial or investment advice. We do not hold any form of equity in the securities mentioned in this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.