In the age-old fable, we’re all too familiar with the epic race between the quick-footed hare and the seemingly lethargic tortoise. However, in the realm of finance, this classic tale finds a rather uncanny but amusing parallel – the perpetual face-off between actively managed funds and index funds. The hare, in this case, is the hyperactive, sleek, and sprightly managed fund, forever darting in and out of investments, while the tortoise embodies the slow-and-steady nature of an index fund.

An actively managed fund, much like our ambitious hare, bounces around with high-energy investment strategies. The investment managers are the field’s Olympians, trying to outpace the market by continually shifting assets and making decisive decisions to optimize returns. They jump over the risky rocks, sprint across the uneven terrains, and sometimes even zig-zag into the jungle of volatile securities. It’s an impressive sight, but it does come with an elevated level of risk. After all, in finance, as in life, sprinting usually leads to panting – or in this case, potential losses.

On the flip side, we have index funds, the tortoise in our financial fable. It embodies an unwavering commitment to consistency, methodically tracking the performance of a specific market index. There’s no fancy footwork here, no high-speed chases after the ‘next big thing.’ Instead, this approach is all about maintaining a diversified portfolio, slow and steady growth, and having faith in the long-term upward bias of the markets. And guess what? The tortoise often wins the race!

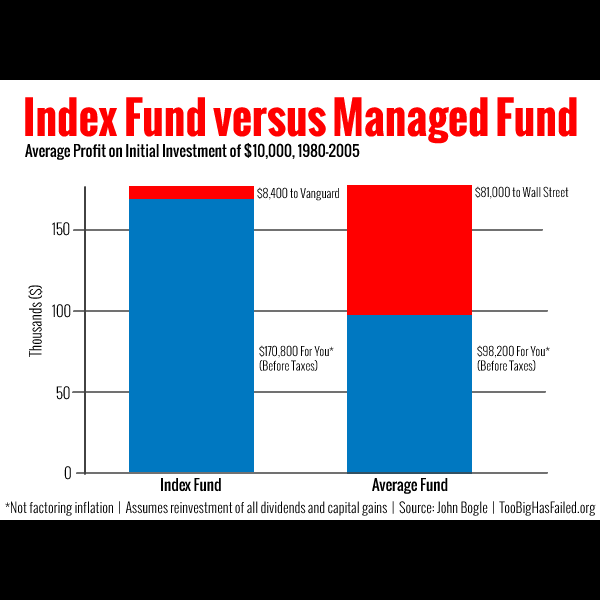

You see, while the hare, or the actively managed fund, is busy taking pit stops, over-analyzing, and making risky bets that sometimes don’t pay off, the tortoise, or the index fund, quietly carries on. It doesn’t stop to celebrate temporary victories or agonize over temporary market downturns. Instead, it focuses on the long game. Moreover, the low operating expenses and absence of fund manager fees make index funds a cost-effective, less complicated, and efficient alternative.

Another secret to the tortoise’s success? Consistency. Index funds, by nature, are diversified and replicate market performance, mitigating the risk and eliminating the need for a “crystal ball” to predict the market’s direction. This steady approach tends to yield better results over time, outperforming their hare-like counterparts in the long run. Just like our fabled tortoise, they may not have the allure of speed, but they make up for it with a stable, dependable performance.

In the financial world’s race, the flashy hare and the unassuming tortoise both have their fans. Some will always back the sprinter, drawn by the potential for high returns, even if they come with a side dish of elevated risk. Others prefer the slow-and-steady approach of the tortoise, believing in the power of consistency, patience, and the magic of compounding. However, historically speaking, it often seems that slow and steady does win the race. A bit of humor in this context, perhaps, but reality often has a knack for being funnier than fiction.

In conclusion, if you find yourself at the starting line, pondering which fund type to back, it might be worth remembering our old friend, the tortoise. After all, we know who ends up winning the race. And as for the hare, well, sometimes a little less sprinting and a little more pacing could go a long way. But then again, who are we to argue with Aesop?

Disclaimer: This article is intended for informational purposes only and should not be construed as financial advice. While the information herein is deemed accurate at the time of publication, the financial markets’ dynamic nature means that situations can change quickly. The author and publisher make no representation or warranty regarding the correctness or completeness of this information. Any action taken based on the content of this article is at the reader’s own risk. Before making any financial decisions, it is advisable to seek advice from a qualified financial advisor.