In a striking display of resilience and strategic foresight, the Trump Media and Technology Group (NASDAQ: DJT) has proactively addressed investor concerns in light of ongoing market challenges. With a focus on bolstering investor confidence and undermining the detrimental effects of “naked” short-selling, DJT has devised a robust 3-step plan to protect and enhance the value of its shares.

The backdrop to this initiative is a contentious dialogue between DJT and some prominent market players, including Citadel. Earlier this month, DJT released a detailed FAQ to clarify its position and strategies, which included advising investors to prevent their shares from being used in short positions. The company’s proactive approach was further underscored on April 19, when it called on the Nasdaq exchange to investigate the naked short-selling practices that, DJT alleges, have unfairly depressed its stock price. The company identified specific market makers believed to be the main drivers behind these manipulations, emphasizing the need for transparency and fairness in trading practices.

The situation escalated when Citadel publicly criticized DJT’s CEO, Devin Nunes, leading to a sharp exchange of words. DJT retorted by highlighting Citadel’s past penalties and controversies, framing them as poor advocates for integrity, especially given their history with regulatory issues, including those related to naked short-selling.

In the face of these challenges, DJT’s 3-step strategy is a testament to its commitment to safeguarding shareholder interests:

1) Encouraging investors to hold their DJT shares in cash accounts rather than margin accounts to prevent lending out shares for short-selling.

2) Advising investors to opt out of securities lending programs to retain greater control over their shares.

3) Recommending the transfer of shares to a Direct Registration (DRS) account with the Company’s transfer agent, Odyssey Transfer & Trust, ensuring further protection and personal handling of their investments.

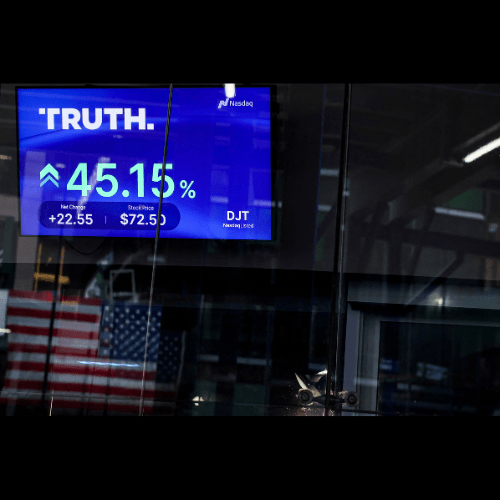

As this corporate drama unfolds, Donald Trump is set to receive a significant performance award, marking a notable success in the company’s stock performance, which has consistently exceeded the $17.50 threshold over a requisite period since its recent listing.

Moreover, despite facing two major sell-offs—one following a disappointing revenue report from its Truth Social platform and another triggered by a new SEC filing for a significant share issuance—DJT remains undeterred. The company continues to advocate for fair market practices and robust investor protection strategies, reinforcing its position as a stalwart defender of shareholder rights in a tumultuous market environment.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: This article is intended for informational purposes only. It should not be considered financial or investment advice. We do not hold any form of equity in the securities mentioned in this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.