Welcome, market watchers! If you’ve been keeping an eye on the stock market today, you know it’s as unpredictable as ever. From Tesla’s electrifying earnings to the ongoing AI stock frenzy, it’s a rollercoaster ride, and not the kind you can avoid with just a dramamine. Hold tight, because we’re diving into everything from tech trends to dark horse airlines, and maybe even squeezing in some sweet gossip about UPS.

Tesla Electrifies the Market (Again)

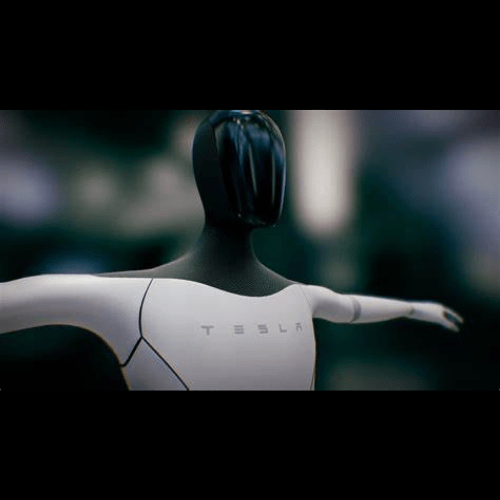

Let’s start with everyone’s favorite tech disruptor: Tesla (TSLA). The company’s earnings absolutely crushed expectations, proving that Elon Musk’s sleep deprivation and cryptic late-night tweets might actually be paying off. Tesla managed to send ripples through the tech-heavy Nasdaq-100 with its soaring stock price.

With EV competitors lurking in the shadows, Tesla’s dominance continues to impress analysts, even though the market seemed to be in a “Who’s the better billionaire?” showdown between Musk and Nvidia’s Jensen Huang. Spoiler alert: Musk doesn’t back down easily. And speaking of Nvidia…

The AI Stock Revolution: No Signs of Slowing

Artificial intelligence, aka the tech industry’s current favorite buzzword, has catapulted some of the top players into stratospheric gains this year. It’s like someone sprinkled rocket fuel on AI stocks and just sat back to watch them soar. The chatbot revolution—led by OpenAI’s ChatGPT—didn’t just change the game; it flipped the whole board over. Everyone from enterprise software companies to robot surgeons is cashing in, with AI stocks posting monster year-to-date performances.

Nvidia (NVDA) has been a crown jewel in this new AI economy, boasting a whopping 188.4% YTD gain. The company’s GPUs aren’t just for gamers anymore—they’re the powerhouse behind nearly every AI application you can think of. Tesla’s cars? Powered by Nvidia’s chips. Your favorite AI bot? Nvidia’s fingerprints are all over it. And while their price-to-earnings ratio looks more inflated than a birthday balloon on helium, investors are shrugging off valuation concerns because, well, AI.

But don’t just sleep on Nvidia; MicroStrategy (MSTR) is also crushing it, boasting a 210.49% gain this year. Known for its analytics software and insane Bitcoin holdings, MicroStrategy has cozied up to AI, and investors seem happy to go along for the ride. Sure, they’re also very into cryptocurrency, so they have a bit of that “wildcard” energy. But when AI and crypto are both giving you tailwinds, it’s a hard ride to resist.

Not everything’s been rosy in AI land, though. Credo Technology Group (CRDO) is up 108.83% in 2024 but has been tagged with a bit of a “volatile” reputation. One misstep, and this stock could slip faster than me on black ice. However, their AI-driven connectivity solutions are keeping them in the game—if only just.

Upcoming Catalysts: Airlines, UPS, and the Fed

Beyond the tech buzz, the market is bracing for some upcoming earnings that could spice up Thursday morning more than your overpriced double-shot latte. Both UPS and American Airlines are set to report earnings, and expectations are high.

Let’s talk airlines. These stocks are a wild ride—pun intended. With the cost of jet fuel and inflation making everything more expensive, including those sad in-flight pretzels, airlines are facing serious pressure. Still, demand for air travel hasn’t exactly fizzled, even if most of us are paying for it by selling a kidney on Craigslist. If American Airlines reports strong results, expect a surge in aviation stocks across the board.

On the freight side, UPS continues to navigate a complex global supply chain situation. Their earnings could give us insight into broader economic trends—if they’re thriving, maybe the whispers of a looming recession are just that. But if UPS fumbles, well, it could be a long winter for logistics.

As for macroeconomic factors, the Federal Reserve remains a looming figure in all market calculations. Investors are dialed into every word they say, like it’s a secret episode of a true crime podcast. Interest rate cuts? Not as imminent as we once thought, but with inflation reports and purchasing managers’ surveys dropping soon, everyone’s nervously glancing at their portfolios.

Meta Platforms: AI, Ads, and the Metaverse Gamble

While we’re on the subject of big moves, let’s not forget Meta Platforms (META). The stock is up 65.08% YTD, and while everyone was initially skeptical of Zuckerberg’s metaverse dreams, the company’s pivot to AI and video integration has proven profitable. In fact, Facebook and Instagram alone have over 2 billion daily active users, making it one of the most powerful ad platforms on Earth. Add to that Meta’s investment in AI-driven video content, and they’re not just riding the AI wave—they’re driving it.

Yet, Zuck’s virtual reality obsession still feels a little like the rich kid who can’t let go of his Sims phase. While the metaverse is intriguing, it remains unclear whether people are willing to strap on headsets and live out their days in a pixelated dream world. For now, it’s the AI push that’s keeping investors glued to Meta’s stock.

Conclusion: What’s Next for the Market?

So where does all this leave us? With Tesla boosting tech stocks, AI stocks continuing to dominate, and airline earnings on deck, the market’s future seems like a choose-your-own-adventure novel. On one page, you’re deep in tech innovation. On the next, you’re soaring over recession fears in a 737, hoping UPS delivers your packages on time.

But don’t forget the undercurrents: dark pools, short squeezes, and rising interest rates are always ready to knock your investment strategy off balance. The best advice? Stay informed, keep your risk in check, and maybe—just maybe—hold out for that metaverse vacation.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: The author of this article is not a licensed financial advisor. This article is intended for informational purposes only. It should not be considered financial or investment advice. We have not been compensated for the creation or distribution of this article and we do not hold any form of equity in the securities mentioned in this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.