Recent Buyout Rumors for Shift4 Payments (NYSE: FOUR)

The buyout rumors surrounding Shift4 Payments Inc (NYSE: FOUR) have piqued significant interest from investors and industry analysts alike, given the company’s prominent position in the payment processing sector and its substantial market valuation of nearly $7 billion. Fiserv (NYSE: FI) and Amadeus IT Group (OTC: AMADY) have emerged as the leading contenders in the acquisition talks, with both companies preparing to submit their final offers soon. However, other interested parties could enter the ring as well.

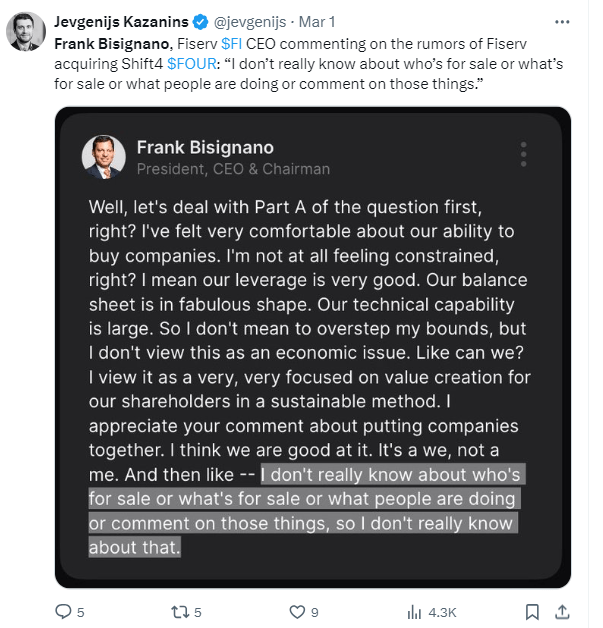

Fiserv’s Response

Frank Bisignano, Fiserv CEO, commented on the rumors of Fiserv acquiring Shift4 Payments Inc.

Source: Twitter (X)

Amadeus IT Group: Not Interested in Transaction for Shift4 Payments

Published: Feb. 29, 2024 at 1:26 p.m. ET

By Sabela Ojea

Amadeus IT Group isn’t looking to acquire Shift4 Payments, a New-York-listed payments processor, an Amadeus spokesperson said Thursday.

The Spanish travel-booking group is “aware of rumors regarding Amadeus and Shift4,” the spokesperson said. However, “Amadeus is not interested in this transaction,” the spokesperson added.

On Wednesday, Reuters reported that Amadeus and global fintech and payments company Fiserv are competing to buy Shift4 Payments and preparing to submit final offers in the coming weeks.

Write to Sabela Ojea at sabela.ojea@wsj.com

Source: MarketWatch

Shift4 Payments has established itself as a key player in the payment processing industry, catering to a diverse clientele that includes restaurants, casinos, hotels, and sports teams, among others. The company has demonstrated robust growth, processing over $200 billion in annual transactions for more than 200,000 customers. Despite facing challenges like heightened competition and inflationary pressures, Shift4 reported strong fourth-quarter earnings and an optimistic outlook for 2024.

The potential acquisition’s strategic significance for Fiserv and Amadeus cannot be overstated. Fiserv, already a giant in financial services technology, could further solidify its market position by acquiring Shift4, enhancing its offerings in the competitive payments landscape. On the other hand, Amadeus, primarily focused on travel software systems, could significantly benefit from integrating Shift4’s payment processing capabilities into its portfolio, especially as the travel industry recovers post-pandemic.

A key figure in this acquisition saga is Shift4’s CEO, Jared Isaacman, who holds substantial voting power within the company. Any acquisition deal would require his approval, making his stance crucial to the transaction’s outcome. Isaacman’s past comments suggest openness to strategic opportunities, signaling potential receptiveness to a buyout.

Consolidation in the Payment Solutions Sector

The financial services sector has witnessed several high-profile deals recently, indicating a trend towards consolidation. A successful acquisition of Shift4 would align with this trend, possibly setting the stage for further mergers and acquisitions in the sector.

From an investor’s perspective, the buyout rumors have already positively impacted Shift4’s stock price. However, stakeholders should closely monitor the unfolding situation, considering factors like the final offer details, regulatory approvals, and potential integration challenges post-acquisition.

In conclusion, the potential acquisition of Shift4 Payments by Fiserv or other interested parties would be a significant development in the financial technology and payment processing industries. The outcome of this deal could have far-reaching implications, influencing competitive dynamics, innovation, and growth trajectories within the sector. As the situation evolves, market participants should keenly observe how these buyout rumors materialize into a potential definitive agreement and the subsequent strategic moves from the involved entities.

Also see BestGrowthStocks.Com updated AI-assisted research desk issuance on (NYSE: FOUR) originally issued on August 20th, 2023.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: This article is intended for informational purposes only. It should not be considered financial or investment advice. We do not hold any form of equity in the securities mentioned in this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.