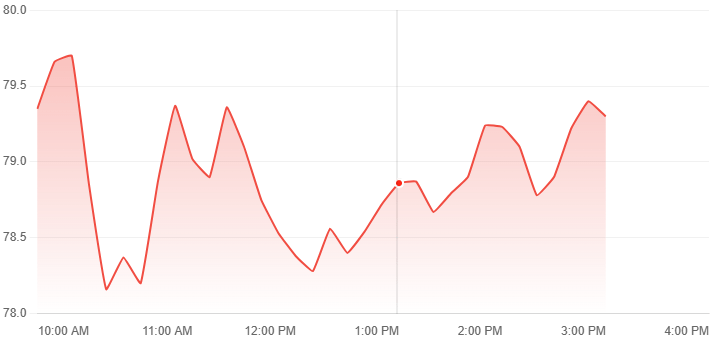

$79.33

-$2.81 (-3.42%)

Today

This impressive ascent can be attributed to several key factors, including robust financial performance, strategic partnerships, and the growing adoption of AI technologies across various industries.

Financial Performance and Market Position

Palantir’s financial trajectory has been notably positive, with the company achieving GAAP profitability for five consecutive quarters. This consistent profitability has not only enhanced investor confidence but also qualified Palantir for inclusion in major indices such as the S&P 500 and the Nasdaq-100, further elevating its market profile.

The company’s revenue growth has been driven by increased demand for its AI platforms, particularly in the government and commercial sectors. In the third quarter of 2024, Palantir reported a significant revenue increase, which contributed to a surge in its stock price. Analysts project continued revenue growth, with expectations of further increases in 2025.

Strategic Partnerships and Government Initiatives

Palantir’s strategic collaborations have played a pivotal role in its recent success. Notably, the company has secured significant government contracts, including a partnership with the U.S. Department of Defense to deploy its AI solutions. Additionally, Palantir’s involvement in large-scale government efficiency initiatives aims to reduce costs through AI-driven automation. This initiative is expected to benefit companies like Palantir that specialize in AI and data analytics.

Furthermore, Palantir has expanded its partnerships with major corporations, including collaborations with IBM and Amazon Web Services (AWS), to enhance its AI capabilities and broaden its market reach.

Market Sentiment and Valuation Concerns

Despite its impressive growth, Palantir’s valuation has raised concerns among analysts. The stock is currently trading at high forward earnings and sales multiples, indicating a premium valuation compared to industry peers. Some analysts caution that the stock may be overvalued, suggesting potential downside risks if growth expectations are not met.

Future Prospects and Catalysts

Looking ahead, several factors could influence Palantir’s future performance:

AI Adoption Across Industries: The increasing integration of AI across various sectors presents significant growth opportunities for Palantir. The company’s AI platforms are well-positioned to capitalize on this trend, particularly in areas such as healthcare, oil and gas, and manufacturing.

Government Contracts: Palantir’s strong foothold in government contracts, especially in defense and intelligence, is expected to continue driving revenue growth. The company’s expanding role in large government initiatives could further solidify its position as a leading provider of AI-driven solutions.

Technological Advancements: Ongoing investments in AI and machine learning technologies are likely to enhance Palantir’s product offerings, making them more attractive to a broader client base. The company’s commitment to innovation positions it favorably in the competitive AI landscape.

Market Expansion: Palantir’s efforts to diversify its client base beyond government agencies to include commercial enterprises could open new revenue streams and reduce dependency on government contracts. This diversification strategy is aimed at sustaining long-term growth.

Conclusion

Palantir’s substantial stock appreciation in recent months reflects its strong financial performance, strategic partnerships, and the growing demand for AI solutions. However, the elevated valuation has prompted caution among some analysts, suggesting that future growth may need to justify the current stock price.

Investors should consider both the potential opportunities and the inherent risks associated with high-growth technology stocks like Palantir. As the AI industry continues to evolve, Palantir’s ability to innovate and adapt will be crucial in maintaining its competitive edge and delivering sustained value to shareholders.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: The author of this article is not a licensed financial advisor. This article is intended for informational purposes only. It should not be considered financial or investment advice. We have not been compensated for the creation or distribution of this article and we do not hold any form of equity in the securities mentioned in this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.