Nvidia’s Unprecedented Surge

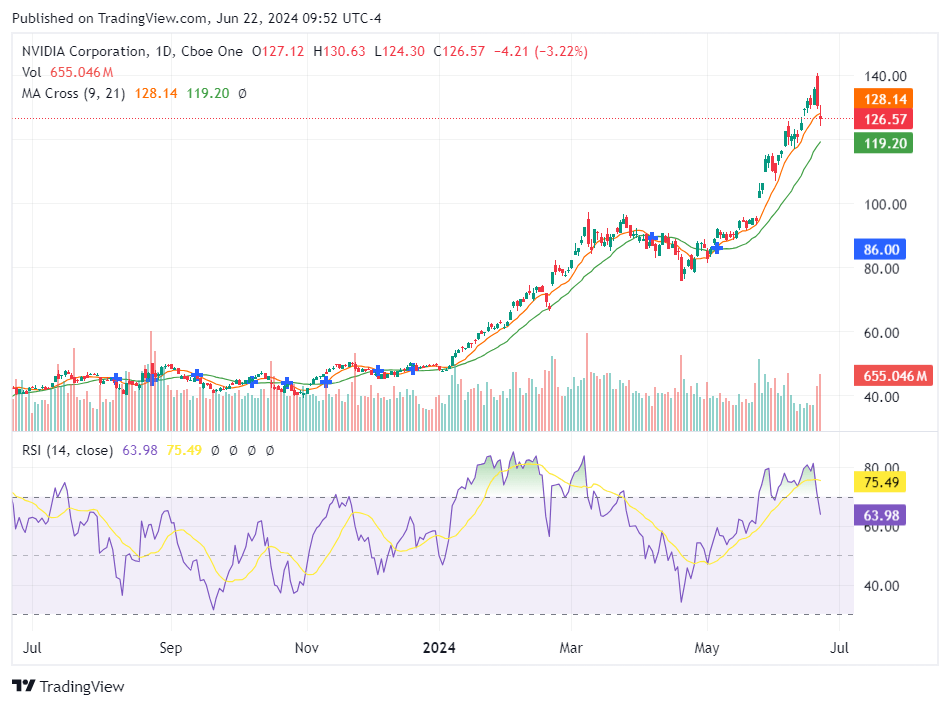

Nvidia Corporation (NASDAQ: NVDA) has experienced an extraordinary rally, leaving investors pondering whether to capitalize on their gains, hold steady, or invest further in a stock that has seen an astronomical rise. Nvidia’s share price has surged over 1,000% since October 2022, and it has increased by 206% in the past year alone. Recently, Nvidia briefly held the title of the largest U.S. company by market value, underscoring its monumental ascent.

NVDA Daily Chart

Driving Factors Behind Nvidia’s Growth

Supporters of Nvidia’s continued growth highlight its dominant position in the artificial intelligence (AI) sector. As the leading supplier of AI-supportive chips, Nvidia is at the forefront of a technological revolution. The company’s revenues are expected to double this fiscal year to $120 billion and further increase to $160 billion the following year. In comparison, Microsoft (NASDAQ: MSFT) anticipates a more modest revenue growth of about 16% for its fiscal year.

Investor Sentiment and Market Valuation

Nvidia’s remarkable performance has attracted a wave of investors eager to avoid missing out on further gains. However, this influx has also inflated Nvidia’s valuation, with its forward price-to-earnings ratio rising by 80% this year. Such high valuations can make the stock susceptible to significant declines if negative news arises.

Chuck Carlson, CEO of Horizon Investment Services, advises caution, suggesting that past performance should not drive investment decisions. Despite this, he acknowledges the difficulty investors face in resisting the stock’s allure.

Nvidia’s Dominance and Future Prospects

Nvidia’s trajectory has consistently rewarded bullish investors while penalizing skeptics. In 2024 alone, the stock has climbed 164%, propelling its market value to over $3.2 trillion and temporarily surpassing both Microsoft and Apple (NASDAQ: AAPL). Optimists cite Nvidia’s unmatched position in the AI-chip sector and its proprietary software framework as reasons for continued confidence in the stock.

Ivana Delevska, founder and CIO of Spear Invest, remains optimistic about Nvidia’s future, predicting earnings growth beyond Wall Street’s expectations. Nvidia is the top holding in the Spear Alpha ETF (NASDAQ: SPRX), comprising nearly 14% of the fund. Delevska emphasizes that Nvidia’s solid earnings support justifies its rising stock price.

Despite its lofty forward price-to-earnings ratio of around 45, this is only slightly higher than its five-year average of 41. Tom Plumb, president of Plumb Funds, believes Nvidia’s potential extends beyond AI, highlighting its capabilities in data processing and access.

Potential Challenges Ahead

Not all experts are convinced of Nvidia’s ability to sustain its rapid growth. Gil Luria, an analyst at D.A. Davidson, has a neutral rating on the stock with a $90 price target, citing concerns about future customer spending and the sustainability of current earnings estimates.

Prominent investor Stanley Druckenmiller recently reduced his holdings in Nvidia, expressing concerns about potential overhype in the short term, despite long-term optimism about AI’s impact.

Competition is another factor that could affect Nvidia’s market position. Companies like Microsoft, Meta Platforms, and Alphabet are advancing their AI capabilities, potentially reducing their reliance on Nvidia’s technology. Morningstar analysts, who have set a fair value of $105 for Nvidia’s stock, warn that successful alternatives could limit Nvidia’s future profitability.

Super Micro Computer’s Rollercoaster Ride

While Nvidia’s story captivates investors, another notable tech stock, Super Micro Computer Inc. (NASDAQ: SMCI), has experienced its own dramatic fluctuations. SMCI’s share price soared to $1,200 in early March 2024 before dropping back to $905 by June 22, 2024. This volatility highlights the unpredictable nature of tech stocks and the importance of careful investment strategies.

Conclusion

As Nvidia continues to dominate headlines with its unprecedented gains, investors must weigh the potential for continued growth against the risks of high valuation and emerging competition. The experiences of other tech stocks, such as SMCI, serve as a reminder of the market’s volatility. Ultimately, whether to cash in, hold, or buy more remains a critical decision for Nvidia investors.