As of April 2023, the proposed buyout per share price of Spirit Airlines Inc. (NYSE: SAVE) by JetBlue Airways Corp. (NASDAQ: JBLU) was $33.50 per share. This offer was part of JetBlue’s attempt to acquire Spirit Airlines in a deal valued at approximately $3.8 billion.

The Problem

The Future of Air Travel: A New Chapter in the JetBlue (NASDAQ: JBLU) Spirit Airlines (NYSE: SAVE) Merger Saga

Antitrust Blocking of the Merger and Potential Outcomes

In a recent development that has stirred the aviation industry, a federal judge’s decision has cast a shadow over the proposed JetBlue-Spirit Airlines merger. The $3.8 billion deal, which promised to reshape the landscape of low-cost air travel in the United States, encountered a significant roadblock following concerns about its potential impact on competition and airfare prices. However, despite this setback, the evolving situation suggests that this may not be the final chapter in the merger story, with possibilities still on the horizon.

Understanding the Blockade of the JetBlue-Spirit Merger

The core issue leading to the blockage of the JetBlue-Spirit merger centers around competition. The U.S. District Judge William Young, appointed by President Ronald Reagan, concurred with the Justice Department and several state attorneys general that the merger could lead to higher airfares by eliminating Spirit, a major player in the low-cost airline sector. The judge’s ruling emphasizes the need to maintain a competitive landscape in the airline industry, echoing the concerns of the Biden administration, which has been assertively addressing potential monopolistic tendencies across various sectors.

JetBlue’s Position and the Path Forward

JetBlue, currently the nation’s sixth-largest airline by revenue, has expressed disagreement with the ruling, citing its need for the merger to effectively compete with larger industry rivals. The airline, along with Spirit, is contemplating an appeal, indicating that both companies have not yet closed the door on their merger aspirations. In the interim, the status quo remains for both airlines, with no immediate changes expected for air travelers.

A Window of Opportunity for Frontier Airlines?

The ruling’s fallout potentially reopens the opportunity for Frontier Airlines to revisit its initial proposal to acquire Spirit (Original bid $2.9 billion). Recall that in 2022, a cash-and-stock deal between the two budget airlines was overshadowed by JetBlue’s all-cash offer. With the current legal impasse, Frontier might find a renewed chance to advance its acquisition plans, potentially leading to a different but equally significant consolidation in the low-cost airline sector.

Regulatory Landscape and Future Mergers

The Biden administration’s success in this legal battle is part of a broader trend of scrutinizing mergers that might diminish consumer welfare. This stance, seen across industries such as healthcare and technology, suggests a heightened regulatory environment for future mergers and acquisitions. It also casts a speculative light on other proposed airline mergers, such as the Alaska Airlines-Hawaiian Airlines deal, hinting at possible regulatory challenges ahead.

In Summary

The JetBlue-Spirit merger story, while currently at a standstill, remains a developing narrative in the aviation industry. The judicial blockade, while significant, does not entirely preclude the possibility of a future union between the two airlines or an alternative merger scenario involving other players like Frontier Airlines. As the airline industry continues to navigate the delicate balance between consolidation and competition, the outcomes of these merger discussions will undoubtedly have far-reaching implications for the sector’s structure and the air travel experience for consumers.

Potential Outcomes

The antitrust case involving the proposed merger of JetBlue Airways and Spirit Airlines, represented by NYSE: SAVE, has several potential outcomes, each with distinct implications for Spirit Airlines’ stock value and overall market position.

Here is a breakdown of these scenarios and their potential impacts:

Appeal Successful, Merger Approved:

Impact: This would likely lead to a significant boost in Spirit’s stock value. The market would view the approval as a positive development, given the increased scale, network synergies, and competitive positioning the merger with JetBlue would afford Spirit. This outcome could stabilize Spirit’s financial position and improve its long-term prospects.

Market Reaction: Anticipate a surge in investor confidence and an uptick in trading volumes, reflecting optimism about the combined entity’s market potential.

Appeal Rejected, Merger Blocked Permanently:

Impact: This would be a setback for Spirit, potentially leading to a decline in its stock value. The market could perceive Spirit as a weaker standalone entity facing substantial competitive pressures. This outcome might necessitate Spirit seeking alternative strategies or partnerships to remain viable.

Market Reaction: Expect a decrease in investor confidence and possibly a sell-off in Spirit’s shares, reflecting concerns about its future growth and profitability.

Partial Approval or Conditional Approval:

Impact: If the court approves the merger subject to certain conditions (like divestitures or operational changes), the impact on Spirit’s stock could be mixed. While the merger would still provide some strategic benefits, the conditions might limit the full potential advantages of the consolidation.

Market Reaction: Investors might show cautious optimism or mixed reactions, depending on the nature and extent of the imposed conditions.

Further Delays and Prolonged Legal Proceedings:

Impact: Extended legal battles could create uncertainty around Spirit’s future, potentially leading to volatility in its stock price. The ongoing expenses and focus on legal issues could also distract from operational improvements and strategic initiatives.

Market Reaction: Expect fluctuating stock prices and possibly reduced investor interest due to the prolonged uncertainty.

Alternative Outcomes (such as a revised merger proposal, a different merger partner, or a significant strategic pivot by Spirit):

Impact: These scenarios could lead to varied impacts on Spirit’s stock value, depending on the specifics of the alternative outcome. A revised merger proposal might be seen as a positive compromise, while a new merger partner or strategic shift could introduce new variables into the market’s assessment.

Market Reaction: The market response would be contingent on the details of the alternative outcome and its perceived benefits or drawbacks for Spirit’s competitive position and financial stability.

Meme Stock Scenario

There is Another Potential Scenario for SAVE that no one is Talking About. (Purely Speculative)

Our exclusive AI-assisted research desk has recently picked up on a substantial increase in retail trader sentiment for SAVE. So, I would propose the possibility of a GME / AMC type of meme stock trade may be forming here.

Impact of a Potential Meme Stock Scenario for SAVE (Spirit Airlines Inc.):

Increased Stock Volatility:

As observed in previous meme stock scenarios like GME (GameStop) and AMC, SAVE could experience heightened stock price volatility. Retail traders, driven by social media and online forums, may induce rapid and significant fluctuations in SAVE’s stock price, irrespective of the company’s fundamental financial health.

Surge in Trading Volume:

The emergence of SAVE as a meme stock would likely lead to a substantial increase in trading volume. Retail traders, attracted by the potential for quick gains, may engage in high-frequency trading, contributing to increased liquidity and trading activity.

Short Squeeze Possibility:

If SAVE is heavily shorted, a sudden spike in its stock price driven by retail investors could lead to a short squeeze. Short sellers would be compelled to cover their positions by purchasing shares at higher prices, further fueling the stock’s upward momentum.

Detachment from Fundamental Valuation:

In a meme stock scenario, SAVE’s stock price could become disconnected from its underlying financial performance and valuation metrics. The price movements would be more influenced by trader sentiment and speculative behavior than by traditional financial analysis.

Potential for Long-term Investors to Reevaluate:

Long-term investors might reassess their positions in SAVE considering the unpredictability and risk associated with meme stock dynamics. They may either capitalize on the heightened volatility or opt for more stable investment opportunities.

Potential Market Reaction to a Meme Stock Scenario for SAVE:

Initial Enthusiasm and Surge in Price:

The market may initially react positively, with a sharp increase in SAVE’s stock price. Enthusiasm among retail investors and the potential for quick gains could drive significant buying activity.

Possible Regulatory Scrutiny:

Regulatory bodies like the SEC might closely monitor the trading activity around SAVE for signs of market manipulation or irregularities, considering the impact of meme stock phenomena on market stability.

Media Attention and Increased Public Interest:

Similar to the GME and AMC cases, SAVE could attract considerable media attention, further amplifying retail investor interest and participation in the trading frenzy.

Potential for Rapid Corrections:

After the initial surge, SAVE’s stock price could face rapid corrections as the market adjusts and some traders take profits. This could result in sharp declines, leading to significant losses for late entrants to the trade.

Long-term Implications on Stock Stability:

Post-meme stock phenomenon, SAVE’s stock might experience ongoing volatility and possibly struggle to stabilize at a level reflective of its fundamental value. This could impact investor confidence and the company’s reputation in the financial markets.

In summary, while a meme stock scenario could offer short-term gains and excitement for retail traders, it also introduces significant risks and uncertainties, both for the traders involved and for the long-term valuation and perception of SAVE in the market.

In each scenario, it’s important to consider not just the immediate impact on Spirit’s stock, but also the longer-term implications for the company’s market positioning, competitive dynamics in the airline industry, and the broader regulatory environment surrounding mergers and acquisitions.

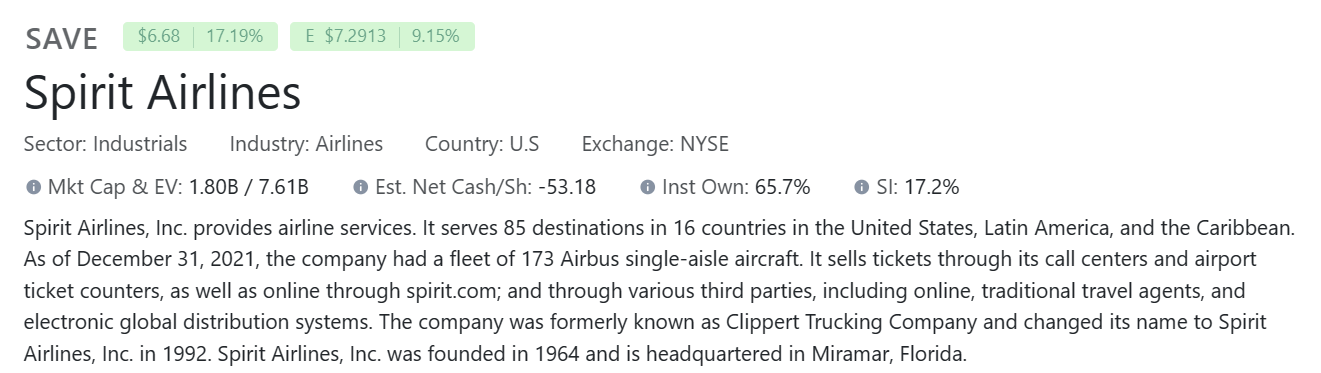

About Spirit Airlines

source: dilutiontracker

Here’s a summary and analysis of the financials for NYSE: SAVE (Spirit Airlines Inc.) for the trailing twelve months (TTM) and the past three years (2020-2022):

Total Revenue:

There’s been a steady increase in total revenue over the past three years.

TTM: $5.43 billion

2022: $5.07 billion

2021: $3.23 billion

2020: $1.81 billion

Cost of Revenue & Gross Profit:

Cost of revenue also increased, but at a slower rate than total revenue.

Gross profit improved significantly from a negative figure in 2020 to a positive figure in the TTM and 2022.

TTM Gross Profit: $799 million

2022 Gross Profit: $757 million

2021 Gross Profit: $232 million

2020 Gross Profit: -$368 million

Operating Income:

Operating income remained negative but showed improvement over the years.

TTM: -$171 million

2022: -$132 million

2021: -$431 million

2020: -$808 million

Net Income:

Net income has been negative for all years, indicating continued losses.

TTM Net Income: -$534 million

2022 Net Income: -$554 million

2021 Net Income: -$473 million

2020 Net Income: -$429 million

Earnings Per Share (EPS):

EPS has been negative, reflecting the company’s losses.

TTM Basic and Diluted EPS: -$4.91

2022 Basic and Diluted EPS: -$5.10

Other Key Metrics:

EBITDA: Negative across the period, indicating challenges in profitability.

TTM EBITDA: -$225 million

2022 EBITDA: -$287 million

Interest Expense: Remained relatively stable, impacting the company’s net income.

TTM Interest Expense: $122 million

2022 Interest Expense: $101 million

source: yahoo finance

Overall Analysis:

Spirit Airlines has shown growth in revenue, suggesting an expanding business scale and market presence.

Despite revenue growth, the company has struggled with profitability, as evidenced by consistent negative operating income and net income.

The negative EBITDA and EPS figures highlight operational challenges and the impact of costs and expenses on the company’s financial performance.

Moving forward, the focus for Spirit Airlines would likely involve strategies to reduce costs, enhance operational efficiency, and move towards profitability.

Spirit Airlines response to TD Cowen and Melius Research expressed concerns of bankruptcy should the merger be denied.

Spirit Airlines Inc., in a clear and assertive response, has dismissed the notion that it is considering a bankruptcy-driven restructuring, despite facing challenges following the unexpected derailment of its proposed sale to JetBlue Airways Corp.

In an effort to strategically reassess and strengthen its financial structure, Spirit Airlines conveyed its proactive stance, emphasizing, “Spirit is not pursuing nor involved in a statutory restructuring.” This statement reflects the airline’s commitment to navigating its current financial challenges without resorting to drastic measures.

Acknowledging the complexities of its situation, Spirit Airlines has embarked on a journey of careful financial evaluation and strategic decision-making. The airline reassured stakeholders by stating that it “has been taking, and will continue to take, prudent steps to ensure the strength” of its financial health and operational continuity. As part of these efforts, Spirit is exploring options for bond restructuring and has successfully completed a sale-leaseback deal for its aircraft, thereby generating a significant influx of cash.

While the stock market has shown some turbulence, with Spirit’s shares experiencing a notable decline in the wake of the court ruling against the JetBlue merger, the airline remains focused on its long-term objectives. Post-trading activity in New York saw the stock stabilize, indicating market resilience in the face of adversity.

Financial experts from institutions such as TD Cowen and Melius Research had expressed concerns about the potential for bankruptcy or liquidation following the court’s decision. However, Spirit Airlines has chosen to address these challenges head-on, demonstrating a commitment to exploring all viable options to secure its future.

The airline has faced operational hurdles, including the grounding of part of its fleet due to engine manufacturing issues, rising operating costs, and fluctuating fares in a competitive domestic market. The proposed JetBlue acquisition was perceived as a strategic opportunity for Spirit.

SAVE Daily Chart

For more information on Spirit Airlines:

INVESTOR CONTACT

Investor Relations Contact

DeAnne Gabel

(954) 447-7920

investorrelations@spirit.com

Upcoming Events

Conclusion and Risk Factors

In the face of significant challenges and uncertainties surrounding its proposed merger with JetBlue Airways, Spirit Airlines Inc. (NYSE: SAVE) has demonstrated resilience and adaptability. Despite the setback in the merger process and the subsequent legal battle, Spirit Airlines has taken a proactive stance in managing its financials and operational strategies. The company has shown commendable growth in revenue over the past years, indicating an expanding business scale and market presence.

However, Spirit Airlines continues to face hurdles in achieving profitability, as evidenced by consistent negative operating income and net income. The airline’s response to these challenges has been strategic and forward-looking. Spirit has actively engaged in financial restructuring activities, such as exploring bond restructuring options and completing a sale-leaseback deal, to enhance its liquidity and financial stability.

The potential outcomes of the merger appeal, ranging from approval to rejection, carry varied implications for Spirit’s future. Each scenario presents its own set of challenges and opportunities, and Spirit’s ability to navigate these will be crucial in determining its long-term success.

Additionally, the speculative emergence of SAVE as a potential meme stock introduces another dimension to the company’s stock performance. While this could lead to short-term gains and heightened investor interest, it also poses risks associated with increased volatility and market speculation.

Overall, Spirit Airlines’ commitment to maintaining operational excellence and financial prudence positions the company to navigate the current challenges and capitalize on future opportunities. This is a very interesting situation; I will be keeping SAVE on our growth stock watch list for the foreseeable future.

Risk Factors

Legal and Regulatory Risks: The ongoing legal battle over the proposed merger with JetBlue poses significant risks. An unfavorable outcome could impact Spirit’s strategic plans and market position.

Market Volatility and Speculative Trading: The potential emergence of SAVE as a meme stock could lead to increased volatility and detachment from fundamental valuation, introducing risks for both short-term traders and long-term investors.

Operational Challenges: Operational hurdles such as fleet grounding due to manufacturing issues, rising operating costs, and fluctuating fares could impact Spirit’s operational efficiency and profitability.

Financial Health and Debt Management: Spirit’s efforts to manage its debt load and improve its financial health are critical. Failure to effectively restructure its finances could have long-term negative impacts.

Competition and Market Positioning: The intensely competitive airline industry poses constant challenges to Spirit’s market positioning and growth prospects, especially as a standalone entity.

Economic and Demand Fluctuations: The airline industry is sensitive to economic conditions and demand fluctuations. Adverse economic developments could negatively impact passenger traffic and revenue.

Regulatory Scrutiny: The merger process and potential meme stock scenario could attract regulatory scrutiny, impacting the company’s operations and stock performance.

Dependency on Key Routes and Markets: Spirit’s reliance on specific routes and markets could pose risks if there are shifts in demand or increased competition in these areas.

Fuel Price Volatility: As with all airlines, fluctuations in fuel prices can significantly impact Spirit’s operational costs and profitability.

Technological and Cybersecurity Risks: Dependence on technology for operations and customer interactions exposes Spirit to risks related to technological failures and cybersecurity threats.

Spirit Airlines’ ability to effectively manage these risk factors will be crucial in ensuring its stability and growth in the challenging landscape of the airline industry.

Your friend,

Steve Macalbry

Senior Editor, BestGrowthStocks.Com

Like this report? Be sure you’re receiving our Text/SMS notifications and be on top of our latest breakout and growth stock issuance.

Disclaimer: The author of this article is not a licensed financial advisor. This article is intended for informational purposes only. It should not be considered financial or investment advice. We have not been compensated for the creation or distribution of this article in any way. We do not hold any form of equity in the securities mentioned in this article as of 01/21/2024. Always consult with a licensed financial professional before making any financial decisions. Growth stocks are very speculative in nature, and you could lose your entire investment.