As we approach 2024, investors are keen to identify stocks that are poised to thrive in the shifting economic landscape. Two sectors that are expected to experience significant tailwinds are semiconductors and cybersecurity. Here, we delve into three stocks from these sectors that investors should consider adding to their portfolios before the year ends.

A Best Growth Stock for 2024

Tenable (NASDAQ: TENB): A Proactive Approach to Cybersecurity

Recent Drop Following Their Latest Earnings Report May Offer an Opportunity

Tenable, a leading provider of cybersecurity software, is another stock to watch. The company specializes in proactive protection, identifying network vulnerabilities and threats before they cause disruption. Tenable’s Nessus vulnerability management platform is the most widely used in the world, with over 2 million individual downloads. It actively scans cloud networks, operating systems, and endpoints for vulnerabilities, boasting the lowest rate of false positives in the industry.

Tenable’s broad market penetration allows Nessus to serve as a gateway to other Tenable software designed for specific industries. For instance, Tenable has developed a security suite for automotive manufacturers, 82% of whom have experienced more than four hours of downtime over a 12-month period, costing an astonishing $22,000 per minute.

Tenable increased its full-year revenue forecast to $791 million in this year’s second quarter, indicating a steady growth rate of 15.7% compared to 2022. The company is also seeing increased demand from larger business customers with more complex requirements.

Consulting firm McKinsey & Company estimates that cyber-attacks will cause $10.5 trillion in damage per year by 2025, suggesting businesses should be spending around $2 trillion on cybersecurity per year to protect themselves. However, they’re only on track to spend about $189 billion in 2023, presenting a significant opportunity for providers like Tenable. With Tenable’s stock trading 30.52% below its all-time high and an increasingly favorable industry outlook, this could be an excellent opportunity for investors.

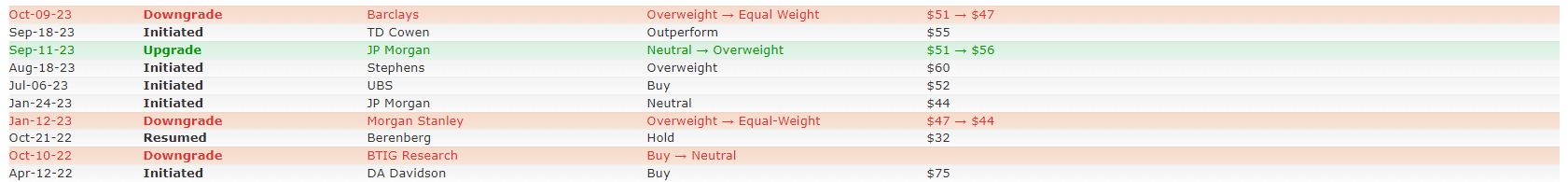

Analyst Targets

Daily Stock Chart

Tenable could be forming a bottom here soon for a nice bounce to the upside.

Nvidia Analysis (NASDAQ: NVDA): A Compelling Long-Term Investment Prospect

Nvidia (NVDA), a leading manufacturer of high-performance GPU chips, has witnessed a remarkable surge in its stock price over the past year. This growth has sparked a debate about the sustainability of these gains. However, for those with a long-term investment horizon, Nvidia presents an attractive opportunity.

Nvidia’s GPU chips are integral to the development of cutting-edge technologies. The recent boom in artificial intelligence (AI) has led to a surge in demand for high computing power, propelling Nvidia’s stock to new heights. The company’s year-to-date growth of 187% is noteworthy, especially considering Nvidia’s size.

Nvidia’s performance has demonstrated that it is a stock worth holding for the long haul, rather than a short-term trading option. The company’s consistent, momentum-driven growth has likely yielded substantial profits for some traders. However, it has also proven to be a valuable buy on pullbacks. Long-term investors who have consistently purchased Nvidia’s stock during every 10% or more pullback have likely outperformed most traders.

While some may anticipate a near-term downside for Nvidia due to its high valuation, it is likely to maintain its status as a long-term hold. Investors are advised to exercise patience with Nvidia’s stock and consider buying during future pullbacks, even if the stock seems overpriced at present.

Nvidia was recently impacted by the news of the U.S. restricting the export of AI chips to China, a significant market for Nvidia. This development, coupled with ongoing geopolitical tensions between the U.S. and China, is one of the few major concerns for the stock. However, these trade restrictions are usually temporary, and Nvidia continues to dominate the AI chip market in China with a market share exceeding 90%. As long as global AI demand continues to grow, Nvidia should have ample opportunities for growth while these geopolitical issues are resolved.

Nvidia’s strength in generative AI is another factor contributing to its appeal. Over the past decade, the Nvidia Jetson platform has been widely adopted across various industries. Generative AI extends beyond text and language to computer vision, benefiting autonomous machines and robotics by offering faster development and greater accuracy than traditional methods. Nvidia’s Jetson Generative AI Lab enables developers to use open-source generative AI models for edge computing, making it an easy start for Jetson developers.

Nvidia is also expanding into CPU design for Microsoft Windows in partnership with Arm Holdings, posing a challenge to Apple, which has gained market share with its in-house Arm-based chips for Macs. Nvidia plans to manufacture PC-chips with Advanced Micro Devices, potentially releasing them as early as 2025.

AI technology offers significant potential for productivity and efficiency gains. As new AI applications continue to emerge, demand for AI chips, like Nvidia’s, remains high. While competitors like AMD and Intel enter the AI chip market, Nvidia’s strong position should mitigate their impact.

In conclusion, despite its currently high valuation, Nvidia’s stock presents an appealing long-term investment opportunity. Investors are advised to be patient and consider buying on future pullbacks. With its strong position in the AI chip market and potential for growth in other areas, Nvidia is a compelling choice for long-term investors.

Micron (NASDAQ: MU): Semiconductor Sector Rebound

Although Micron Pays a Dividend and Does Not Qualify as a Growth Stock, We Think this One Could be a Great Addition to Your Portfolio in 2024.

Despite the overall semiconductor sector experiencing a challenging year, Micron, one of the world’s largest producers of memory (DRAM) and storage (NAND) chips, is set to rebound. These chips are integral to a wide range of devices, from smartphones and computers to data centers. However, the past year’s inflation and rising interest rates have led to a decrease in consumer spending on high-cost electronics, resulting in an inventory surplus for Micron. This surplus has eroded the company’s pricing power, leading to a 49% drop in its total revenue during fiscal 2023 to $15.5 billion.

However, Micron’s CEO has indicated that both inventory and pricing have now bottomed out, suggesting a business upswing is imminent. This is supported by Micron’s guidance for the fiscal 2024 first quarter, which predicts a sequential revenue growth of 10%. Furthermore, Micron is expected to benefit from the growing demand for AI-related hardware, with its new D5 DRAM chip for data centers offering twice the bandwidth of its predecessor, the D4 chip. This increased power and subsequent higher price point could provide a significant boost to Micron’s financials moving forward. With Micron’s stock trading 5.88% below its all-time high, any pullbacks could present opportunity.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: This article is intended for informational purposes only. It should not be considered financial or investment advice. We do not hold any form of equity in the securities mentioned in this article as of 11/02/2023. We have not been compensated for the creation or distribution of this article in any way. Always consult with a certified financial professional before making any financial decisions.