About GameStop

GameStop Corporation (NYSE: GME) is a Fortune 500 and S&P 500 company that operates as a global, multichannel video game, consumer electronics, and collectibles retailer. The company was founded in 1996 and is headquartered in Grapevine, Texas.

Recent News and Developments

Leadership Changes: GameStop experienced a major leadership shake-up with the firing of CEO Matthew Furlong and the appointment of Ryan Cohen as Executive Chairman. This move was aimed at revitalizing the company’s strategic direction and aligning it more closely with shareholder interests.

Stock Volatility: The stock has seen significant volatility, typical of meme stocks. Notably, in May 2024, Robert F. Kennedy Jr. invested $24,000 in GameStop, aiming to support the “ape retail rebellion”.

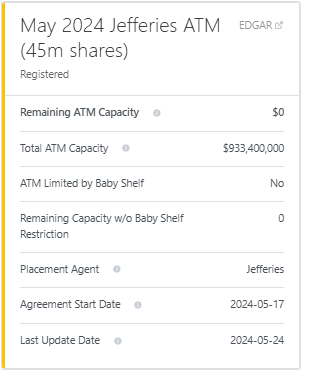

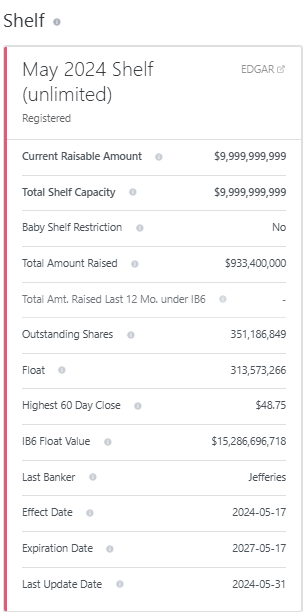

Financial Performance: GameStop reported a decline in quarterly sales and announced plans to issue new shares, causing the stock to drop significantly (See Below). The company has been struggling to sustain the momentum seen during the initial meme stock rally. However, there could be some light at the end of the tunnel.

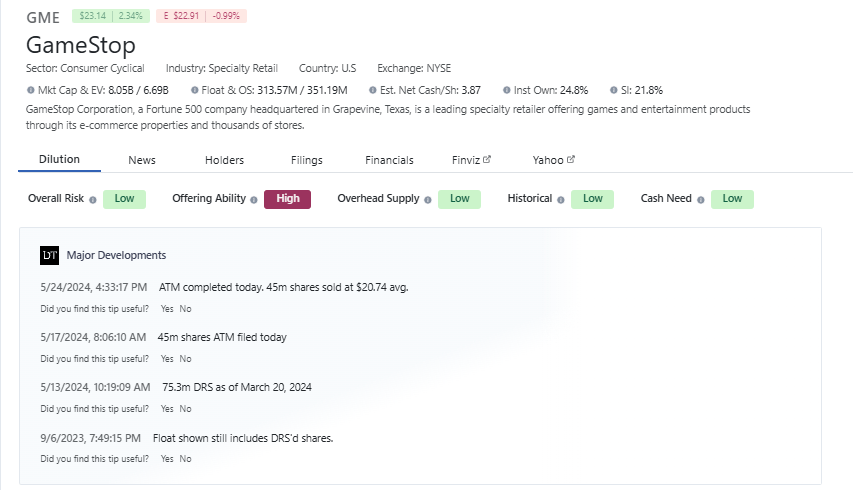

DilutionTracker.Com Information Includes Recent Stock Issuance as of May 25th, 2024

Financial Overview

Market Cap and Shares: As of the latest updates, GameStop’s market capitalization stands around $8 billion with approximately 351.19 million shares outstanding.

Cash Position: The company has 115.6 months of cash left based on quarterly cash burn of -$50.93 million and estimated current cash of $1.96 billion.

Earnings: The company reported a net loss of $50 million for Q1 2024, reflecting ongoing challenges in turning around its financial performance.

Percentage Sold Short: The short interest in GameStop remains high, with around 21.8% of the float currently sold short, indicating continued bearish sentiment among some institutions.

Potential Catalysts

Another Short Squeeze: With a significant percentage of the float sold short, GameStop remains a candidate for another short squeeze. High short interest can lead to rapid price increases if investors are forced to cover their positions, as seen in past short squeeze events.

E-commerce Expansion: Continued efforts to expand its e-commerce platform could provide a significant boost if successfully implemented. This includes improving the online shopping experience and integrating more tech-driven solutions.

New Leadership Strategies: Under Ryan Cohen’s leadership, new strategic initiatives are expected, potentially focusing on digital transformation and new business ventures that align with market trends.

Roaring Kitty: Tweets sparking a retail buying frenzy.

Profitability Improvements

Cost-Cutting Measures: GameStop has been implementing cost-cutting measures to improve profitability, including closing underperforming stores and reducing operational expenses.

Digital and Tech Investments: Investments in digital assets and technologies aimed at transforming GameStop into a more competitive player in the digital retail space are ongoing. These include partnerships with tech companies and enhancing the company’s digital infrastructure.

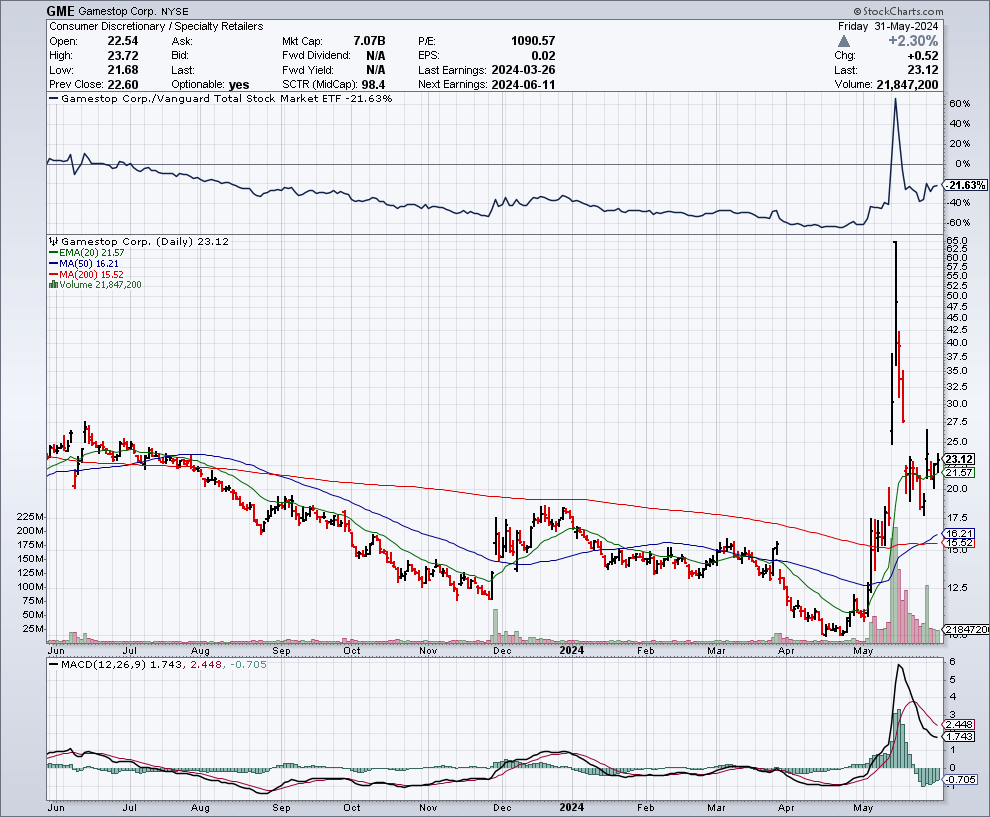

GME Daily Chart

Very Bullish Indicator: The 50 DMA Just Crossed Above the 200 DMA, this is What’s Known as a GOLDEN CROSS

Source: Stockcharts.com

Technical Analysis of GME (GameStop Corp)

Current Barchart.Com Analysis:

- Overall Opinion: 72% Buy

- Short-term Indicators: Strong buy signals from 20-day moving averages and MACD oscillators.

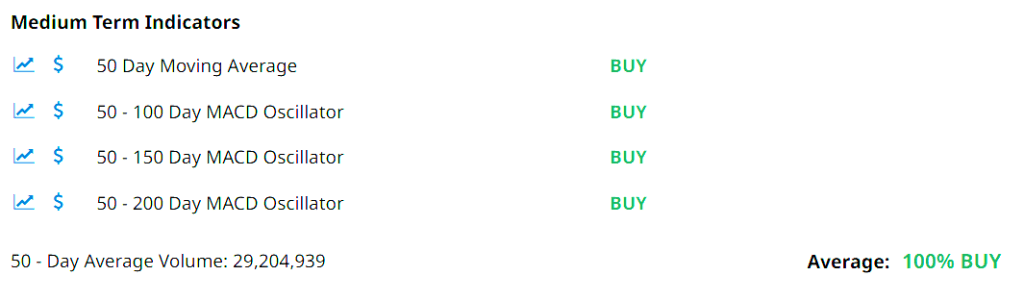

- Medium-term Indicators: Mostly buy signals with a weak sell signal from the 50-200 day MACD oscillator.

- Long-term Indicators: Predominantly buy signals, with a weak sell from the 100-200 day MACD oscillator.

Support and Resistance Levels:

- Resistance Levels:

- 1st Resistance: $23.18

- 2nd Resistance: $24.15

- 3rd Resistance: $25.89

- Support Levels:

- 1st Support: $20.47

- 2nd Support: $18.73

- 3rd Support: $17.76

For more detailed information, visit Barchart GME Analysis.

Conclusion on GameStop (GME)

GameStop Corporation stands at a pivotal juncture, showing promising signs despite recent volatility and financial challenges. The recent leadership shift, with Ryan Cohen at the helm, aims to revitalize the company’s strategic direction. Technical indicators are bullish, highlighted by a “golden cross” and a strong buy consensus from short-term to long-term analyses. Coupled with potential catalysts like another short squeeze, e-commerce expansion, nearly $2b in cash on hand and cost-cutting measures, GameStop seems positioned for a possible upward trajectory, making it an intriguing opportunity.

Risk Factors for GameStop (GME)

Leadership Changes: The recent appointment of Ryan Cohen as Executive Chairman introduces uncertainty regarding the company’s future strategic direction. Rapid leadership changes can disrupt organizational stability and long-term planning.

Stock Volatility: GameStop’s stock remains highly volatile, often influenced by external factors such as social media trends and retail investor activity. This volatility can lead to unpredictable price movements and increased investment risk.

Financial Performance: The company has reported a net loss and declining sales, reflecting ongoing financial struggles. Additionally, the recent decision to issue new shares could dilute existing shareholders’ value.

Short Interest: High short interest in GameStop’s stock suggests that many investors are betting against the company. This bearish sentiment could indicate skepticism about the company’s ability to achieve sustained profitability.

Market Conditions: The broader economic environment and consumer spending trends significantly impact GameStop’s performance. Any downturn in the economy or shifts in consumer behavior towards digital gaming and away from physical retail could further challenge the company.

E-commerce and Digital Transformation: While the expansion into e-commerce presents growth opportunities, successful implementation is critical. Any delays or failures in enhancing the online platform and integrating new technologies could hinder growth prospects.

Regulatory Risks: The retail and gaming industries are subject to various regulations. Changes in regulatory policies or increased scrutiny could pose compliance challenges and impact operations.

Competition: GameStop faces intense competition from both traditional and online retailers. Maintaining market share and profitability requires continuous innovation and effective competitive strategies.

Understanding these risk factors is crucial for investors to make informed decisions regarding their investment in GameStop.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer and About Us

Best Growth utilizes a revolutionary fusion of AI-powered analytics and human-led research to distill the vast and complex world of stock trading down to its purest essence. Our proprietary AI, meticulously designed to perform both fundamental and sentiment analysis, scrutinizes an extensive array of data points and trends, providing deep, insightful, and timely market perspectives. This technology operates in concert with our seasoned research team, who apply years of industry knowledge and expertise to refine our AI’s results. The culmination of this unique blend of cutting-edge technology and human expertise is the weekly issuance of one to two stock ideas, carefully selected to offer what we believe will yield the most substantial near-term results (a few days to a few months), thus paving the way for intelligent trading that delivers tangible value. Available exclusively by email or SMS/text message via our newsletter.

Best Growth is your ultimate destination for reliable and insightful stock news and analysis. We are dedicated to providing you with the latest updates and in-depth coverage of the world’s most promising growth stocks. Our experienced financial experts and market analysts work tirelessly to bring you the most accurate and up-to-date information.

At Best Growth, we understand that the investing world can be complex and intimidating. That’s why our primary goal is to simplify the process for you, offering easy-to-understand news articles, market reports, and expert commentary. Whether you are a seasoned investor or just starting your journey in the stock market, we strive to cater to your needs by presenting information in a clear and concise manner.

Our commitment to excellence extends to the quality of our content. We pride ourselves on delivering accurate, objective, and fact-based news and analysis. Our team follows a rigorous editorial process to ensure the highest standards of journalistic integrity.

At Best Growth, we believe in the power of knowledge and education. We go beyond simply reporting stock news; we provide third-party educational resources and investment guides to help you navigate the complexities of the market. We aim to empower you with the knowledge and tools necessary to achieve your financial goals.

We also understand that time is of the essence when it comes to stock analysis and news. That’s why we offer a user-friendly platform that ensures you have quick and easy access to the latest information. be sure you are subscribed to our newsletter and text alerts. Whether you prefer browsing our website or accessing our content through our free or premium subscription, we strive to make your experience seamless and convenient.

We value our community of readers and investors, and we encourage active engagement and participation. Feel free to share your thoughts and contribute to the discussions on our platform (coming soon). We believe that a vibrant and diverse community of investors can enhance the learning experience for everyone involved.

Thank you for choosing Best Growth as your go-to source for reliable stock news and analysis. We are committed to serving you with excellence and helping you stay ahead in the dynamic world of investing. Join us on this exciting journey toward financial growth and prosperity!

Disclosure: The author is not a licensed financial advisor and the content provided is for informational purposes only. Always consult with a certified financial advisor before making investment decisions. Best Growth Stocks has not been compensated in any way for the mention of GME and we do not hold any form of equity in GME. Growth stocks carry a high degree of risk, and you could lose your entire investment.