Let’s Start with Efficiency

FuelCell Energy’s carbonate and solid oxide fuel cell platforms can achieve electrical efficiencies of 47-65%, higher than competing fuel cell technologies:

Polymer Electrolyte Membrane (PEM) fuel cells operate at 50-60% efficiency.

Phosphoric Acid fuel cells achieve 40% efficiency.

Alkaline fuel cells reach 60% efficiency.

FuelCell Energy’s high temperature fuel cell designs avoid the need for expensive platinum catalysts, enabling higher efficiency. Their potential for combined heat and power (CHP) can boost total system efficiency up to 90%.

In electrolysis mode, FuelCell Energy’s Solid Oxide Electrolyzer Cell (SOEC) has demonstrated up to 90% electricity-to-hydrogen efficiency, significantly higher than PEM (65-80%) and alkaline (60-70%) electrolyzers.

The high efficiency lowers hydrogen production costs.

Cost Competitiveness

Recent analysis by the Department of Energy estimates capital costs for FuelCell Energy’s carbonate and solid oxide stationary fuel cell systems in the range of $4000-7000/kW.

This is competitive with costs for PEM stationary fuel cells ($3500-5500/kW) and solid oxide fuel cells from Bloom Energy ($6000-8000/kW).

FuelCell Energy’s high efficiency offsets higher capital costs through lower operational costs over the system lifetime compared to less efficient technologies.

Their fuel cells also use low-cost nickel catalysts instead of platinum.

Technology Maturity

FuelCell Energy has over 50 years of experience developing and commercializing high temperature fuel cells.

They have the most field experience of any company with carbonate and solid oxide fuel cell installations operating on 3 continents.

This experience provides FuelCell Energy with extensive operational data to continue improving the durability and reliability of their fuel cell platforms. Newer competitors have less field experience with their technologies.

Scalability

FuelCell Energy offers carbonate and solid oxide fuel cell systems at scales from 100 kW to multiple megawatts

The modular and scalable power plant design allows capacity to be right-sized for various applications.

FuelCell Energy has deployed utility-scale fuel cell parks up to 59 MW and has a strong track record serving industrial users. Competitors like Bloom Energy focus more on smaller distributed generation systems under 250 kW.

Comparative Conclusion

In summary, FuelCell Energy’s high temperature fuel cell platforms offer higher electrical efficiency, competitive costs, technology maturity based on extensive field experience, and proven scalability for large power generation compared to alternatives. These advantages position FuelCell Energy well to support the growing market demand for clean and efficient fuel cell power.

Pending Legislative Catalysts

As of July 17, 2024, several legislative measures under consideration by the U.S. government could significantly benefit hydrogen energy companies. These measures aim to promote clean energy and reduce carbon emissions, aligning with broader goals of energy transition and climate change mitigation. Key pieces of legislation include:

1. Hydrogen for America Act

This act focuses on establishing a comprehensive national hydrogen strategy and roadmap. It includes:

Funding for Research and Development: Significant allocations for R&D to advance hydrogen production, storage, and utilization technologies.

Incentives for Production: Tax credits and grants for companies involved in green hydrogen production, specifically those using renewable energy sources.

Infrastructure Development: Federal support for building hydrogen fueling stations and pipelines, as well as grants for regional hydrogen hubs.

2. Clean Energy Future Act

This broader clean energy legislation incorporates specific provisions for hydrogen energy, including:

Tax Incentives: Extended investment and production tax credits for hydrogen projects, aimed at making hydrogen competitive with other energy sources.

Emission Reduction Goals: Targets for reducing carbon emissions that indirectly support hydrogen as a zero-emission alternative for industries like transportation and manufacturing.

3. Infrastructure Investment and Jobs Act Amendments

Proposed amendments to this act seek to:

Expand Infrastructure: Additional funding for hydrogen infrastructure projects, such as pipelines, storage facilities, and fueling stations.

Federal-Private Partnerships: Encourage partnerships between the federal government and private companies to accelerate hydrogen infrastructure development.

4. Green Hydrogen Incentive Act

This specific piece of legislation is designed to:

Subsidize Green Hydrogen: Provide subsidies for the production of green hydrogen using renewable energy, reducing the cost disparity with fossil fuels.

Export Credits: Offer tax credits for companies exporting hydrogen technologies, aiming to make the U.S. a leader in the global hydrogen market.

5. National Clean Hydrogen Initiative

A comprehensive initiative that includes:

Grant Programs: Various grant programs for innovative hydrogen projects, including those focused on industrial applications and heavy-duty transportation.

Workforce Development: Programs to train workers for the hydrogen economy, addressing the skill gap in the emerging hydrogen sector.

Impact and Outlook

If enacted, these legislative measures are expected to:

Boost Investment: Attract significant investment into hydrogen technology and infrastructure.

Accelerate Adoption: Speed up the adoption of hydrogen as a mainstream energy source.

Enhance Competitiveness: Improve the competitiveness of U.S. hydrogen companies on the global stage.

These legislative efforts demonstrate a strong governmental commitment to advancing hydrogen energy, which is critical for achieving long-term climate and energy goals.

Recent Developments and Potential Catalysts

Recent Developments

Korean Market Expansion

FuelCell Energy has solidified its presence in South Korea by entering a significant agreement with Gyeonggi Green Energy to supply 42 upgraded 1.4-megawatt carbonate fuel cell modules for the Hwaseong Baran Industrial Complex. This deal, valued at approximately $160 million over a seven-year service agreement, underlines the company’s commitment to the Korean market and its role in supporting South Korea’s Hydrogen Economy Roadmap.

https://www.globenewswire.com/news-release/2024/07/11/2911762/8041/en/index.html

On June 28, 2024, FuelCell Energy held a major event in Seoul to demonstrate its technology and strategic vision for Korea’s energy transition. The event featured presentations by key executives and highlighted the company’s advanced carbonate and solid oxide platforms.

https://www.globenewswire.com/news-release/2024/07/11/2911762/8041/en/index.html

Technological Advancements

FuelCell Energy introduced its solid oxide platform, which plays a crucial role in Korea’s transition to hydrogen. The company also showcased advancements in its carbonate fuel cells, including enhanced carbon capture capabilities.

https://www.globenewswire.com/news-release/2024/07/11/2911762/8041/en/index.html

Sustainability and ESG Initiatives

The company released its 2023 Sustainability Report, highlighting its commitment to environmental stewardship, social responsibility, and corporate governance. Achievements include avoiding 155,000 metric tons of CO2 emissions and commencing operations of the Tri-gen system for Toyota Motor North America in California.

https://www.globenewswire.com/news-release/2024/02/19/2831272/0/en/FuelCell-Energy-Announces-Release-of-Annual-and-Sustainability-Reports-Highlighting-Business-Performance-and-Progress-Towards-Sustainability-and-ESG-Goals.html

Potential Catalysts

Completion of Ongoing Projects:

Continued implementation and scaling of the new solid oxide fuel cell technology in South Korea and other markets.

Expansion of the biogas-to-electricity projects, such as the one recently announced in California, showcasing the versatility and efficiency of FuelCell Energy’s platforms.

New Partnerships and Agreements

Potential new service agreements and partnerships in South Korea and other regions could further enhance the company’s market share and revenue streams.

Future collaborations with major corporations like ExxonMobil on next-generation carbon capture technology, which could significantly impact the industrial sector.

https://www.globenewswire.com/news-release/2024/07/11/2911762/8041/en/index.html

Regulatory and Market Incentives

Policies and incentives supporting hydrogen and clean energy solutions globally, especially in the context of the Hydrogen Economy Roadmap and similar initiatives in other countries, could drive demand for FuelCell Energy’s products and services.

https://www.globenewswire.com/news-release/2024/05/28/2420742/0/en/FuelCell-Energy-and-Gyeonggi-Green-Energy-Announce-Agreement-for-Purchase-of-Fuel-Cell-Modules-and-Service-Agreement-for-World-s-Largest-Fuel-Cell-Power-Platform.html

Financial Summary for March 2024

Q2 2024 Financial Highlights:

Revenue: $22.4 million, a decrease from $38.3 million in the same period last year.

Backlog: Increased by 3.8% to $1.06 billion, primarily due to new service agreements and advanced technology contracts.

Product Backlog: $12.3 million.

Service Backlog: $145.1 million.

Generation Backlog: $852.9 million.

Advanced Technologies Backlog: $51.1 million.

https://www.globenewswire.com/news-release/2024/06/10/2910023/0/en/FuelCell-Energy-Reports-Second-Quarter-of-Fiscal-2024-Results.html

These financials reflect a challenging yet pivotal period for FuelCell Energy, marked by strategic advancements and market expansion efforts that position the company for future growth despite short-term revenue declines.

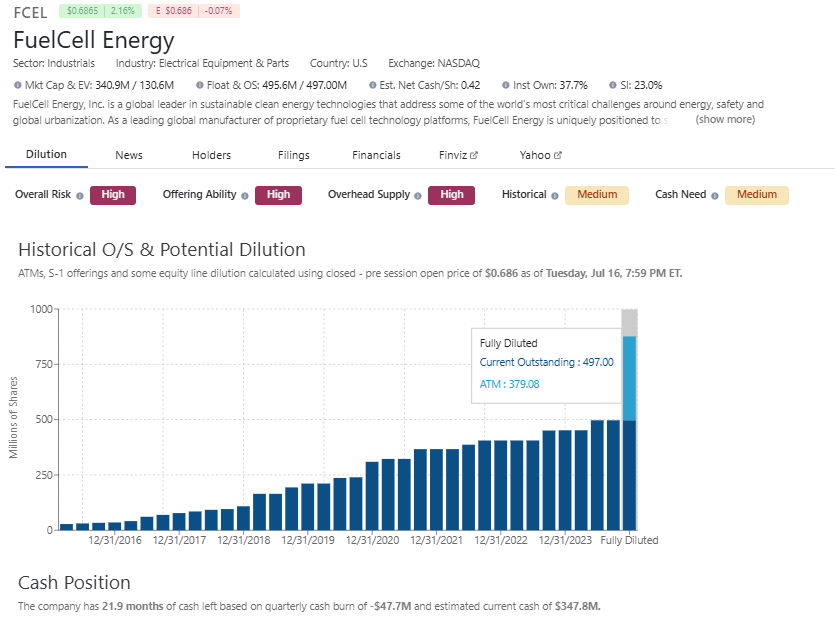

Estimated Cash Position, Cash Runway, Current Float, Institutional Ownership, and Short Interest (SI)

Source: DilutionTracker

FCEL Daily Chart

As of July 17, 2024, here are the support and resistance levels for FuelCell Energy Inc. (NASDAQ: FCEL) based on recent chart analyses from TradingView:

Support Levels

S1 (First Support Level): Around $0.50

S2 (Second Support Level): Approximately $0.40

S3 (Third Support Level): Near $0.30

Resistance Levels

R1 (First Resistance Level): Close to $0.90

R2 (Second Resistance Level): Around $1.10

R3 (Third Resistance Level): Approximately $1.30

These levels are calculated using pivot points and other technical indicators that identify key price levels based on historical price action. The dynamic support and resistance lines adjust to market conditions, providing real-time insights into potential breakout or breakdown areas.

For more detailed and updated charts, visit TradingView’s FCEL page.

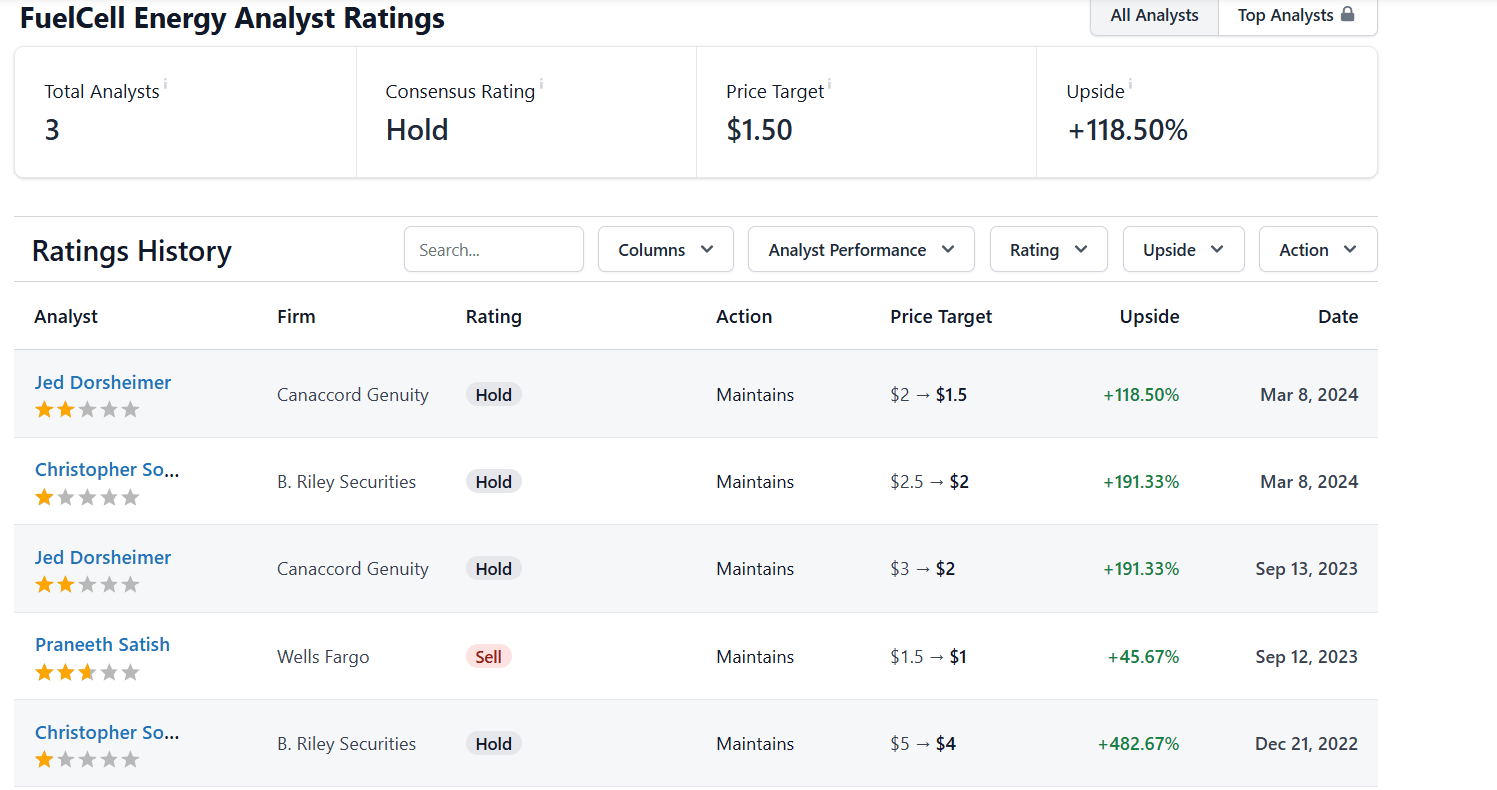

Analyst Ratings

Source: Stockanalysis

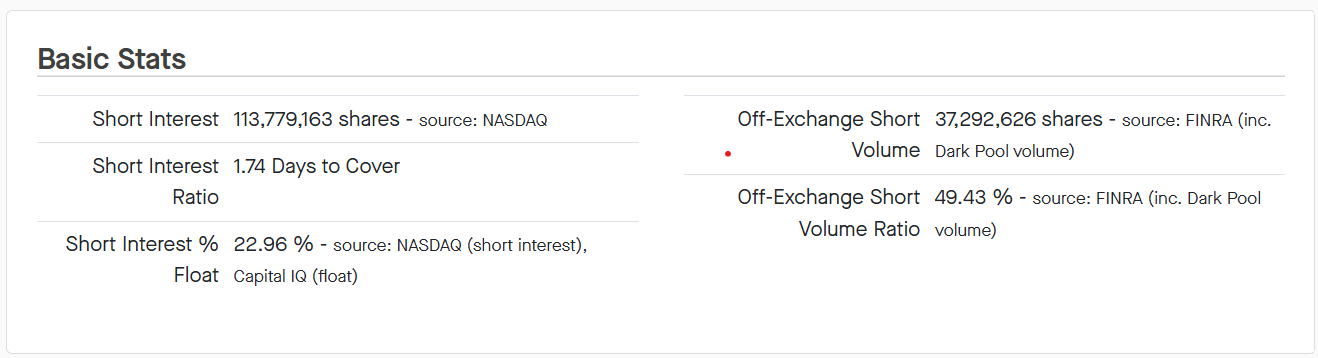

Short Interest Statistics (FCEL)

Source: FinTel

For Additional Information on FuelCell Energy (NASDAQ: FCEL)

Conclusion and Future Outlook for FuelCell Energy (FCEL)

Conclusion:

FuelCell Energy stands at the forefront of the fuel cell industry, showcasing impressive electrical efficiencies, competitive cost structures, and a robust track record of technology maturity. The company’s advanced carbonate and solid oxide fuel cell platforms not only offer superior efficiency, reducing hydrogen production costs, but also demonstrate scalability to meet various power generation needs, from small to utility-scale projects.

FuelCell Energy’s recent strategic advancements, particularly in South Korea, underscore its commitment to expanding its global footprint and leveraging its technological innovations to support the hydrogen economy. With new service agreements, enhanced sustainability initiatives, and ongoing collaborations with major corporations, FuelCell Energy is well-positioned to capitalize on the growing demand for clean energy solutions.

The company’s strong backlog and continued focus on operational improvements reflect a promising future, despite short-term financial challenges. FuelCell Energy’s ability to combine high efficiency with cost-effectiveness and scalability sets it apart as a leader in the transition to a sustainable energy future. Investors and stakeholders can look forward to a company that not only meets today’s energy needs but also paves the way for tomorrow’s clean energy innovations.

Future Outlook:

FuelCell Energy’s focus on developing cost-competitive and efficient fuel cell solutions aligns well with the increasing global emphasis on clean energy sources. The company’s ability to provide energy solutions that meet the demands of both industrial users and utility-scale applications positions it as a key player in the evolving energy landscape. FuelCell Energy will remain a prominent fixture on my alternative energy watch list for the foreseeable future, given its potential to contribute significantly to the shift towards sustainable energy solutions.

Risk Factors:

However, it’s essential to consider several risk factors:

Market Volatility and Competition: The alternative energy sector is highly competitive and subject to rapid technological advancements. FuelCell Energy faces stiff competition from other fuel cell technologies and emerging renewable energy solutions.

Economic Fluctuations: The company’s financial performance, particularly its reliance on large-scale projects, can be affected by economic downturns, changes in energy policies, and fluctuating fuel prices.

Technological Reliability: While FCEL has a long history in the field, ongoing advancements and the need for continual innovation pose risks associated with maintaining technological relevance and reliability.

Regulatory and Policy Changes: The energy sector is heavily influenced by governmental policies and environmental regulations. Changes in these areas could impact FuelCell Energy’s operations and market opportunities.

Financial Stability: As indicated by the recent financial results, the company’s fluctuating revenue streams and significant losses are areas of concern. Managing these financial challenges while investing in growth and innovation is critical for its long-term success.

High Short Interest: The notable short interest in FCEL’s stock could indicate market skepticism about its future performance and may lead to increased stock price volatility.

Bonus content: The Next Beneficiaries of the AI Revolution

Your friend,

Steve Macalbry

Senior Editor, BestGrowthStocks.Com

Like this report? Be sure you’re receiving our Text/SMS notifications and be on top of our latest issuance.

Disclaimer: The author of this article is not a licensed financial advisor. This article is intended for informational purposes only. It should not be considered financial or investment advice. We have not been compensated for the creation or distribution of this article in any way. We do not hold any form of equity in the securities mentioned in this article. Always consult with a licensed financial professional before making any financial decisions. Growth stocks are speculative in nature, and you could lose your entire investment.