First, congrats to all our subscribers that made money from my initial (TELL) analysis October 31st, 2023.

Summary of the Deal

Tellurian Inc. (NYSE-American: TELL) is selling its integrated upstream assets to Aethon Energy for $260 million. This deal includes 31,000 net acres in the Louisiana Haynesville and Bossier shale basins, along with gathering and treating systems capable of handling up to 100 million cubic feet of natural gas per day. Additionally, Aethon will purchase two million tons per annum (mtpa) of liquified natural gas (LNG) from Tellurian’s Driftwood LNG plant under a Heads of Agreement. This agreement lays the groundwork for a 20-year offtake deal indexed to Henry Hub prices plus a liquefaction fee, which is important for financing the Driftwood LNG project. The transaction is expected to close in the second quarter of 2024.

Potential Outcomes for Tellurian

Financial Improvement:

Debt Reduction: Proceeds from the sale will be used to reduce Tellurian’s borrowings and strengthen its balance sheet.

Corporate Purposes: Additional funds can be allocated to other corporate needs, enhancing financial stability.

Project Acceleration:

Driftwood LNG: The agreement with Aethon provides a foundation to secure financing and accelerate the development of the Driftwood LNG project.

Customer Alignment: The offtake agreement demonstrates Tellurian’s ability to align its commercial offerings with customer needs, potentially attracting more investors and partners.

Strategic Progress:

Strategic Plan: The deal aligns with Tellurian’s strategic plan, marking significant progress in its business objectives.

Potential Catalysts for Tellurian

Successful Transaction Closure:

Closing the deal in the second quarter of 2024 will provide immediate financial benefits and operational focus.

Financing for Driftwood LNG:

The offtake agreement with Aethon could lead to securing necessary project financing, furthering the development of Driftwood LNG.

Market Alignment:

Aligning with market needs through the offtake agreement may attract more customers and partners, enhancing Tellurian’s market position.

Operational Efficiency:

Streamlining operations by selling upstream assets could lead to more efficient capital allocation and focus on core LNG projects.

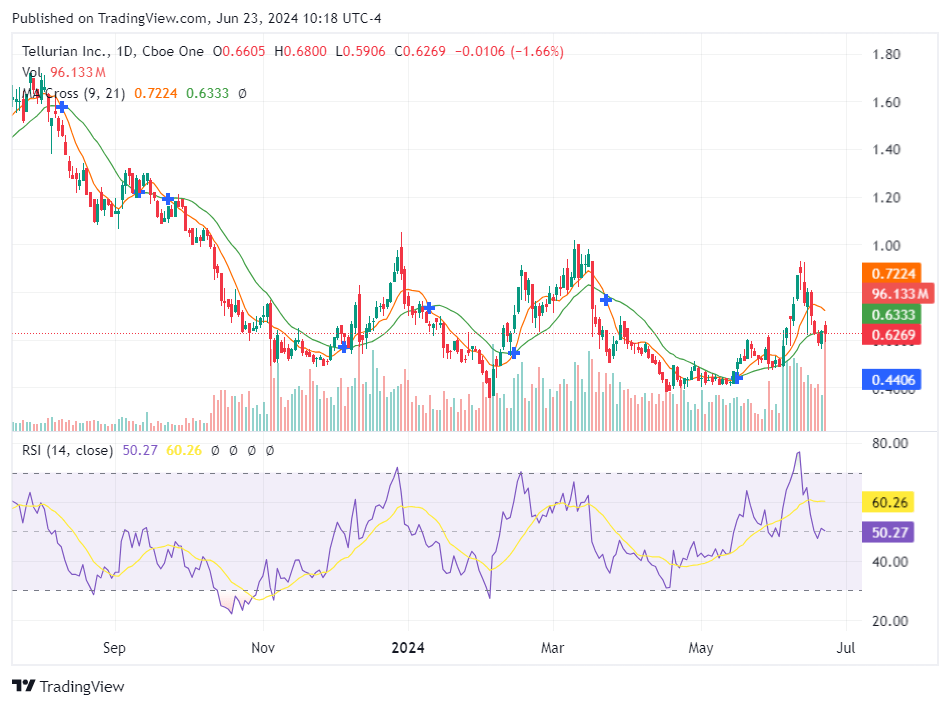

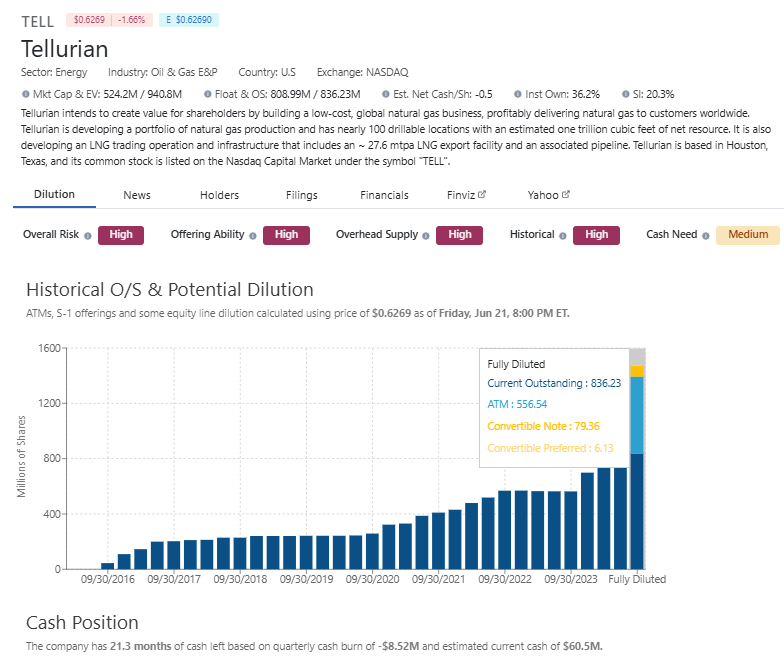

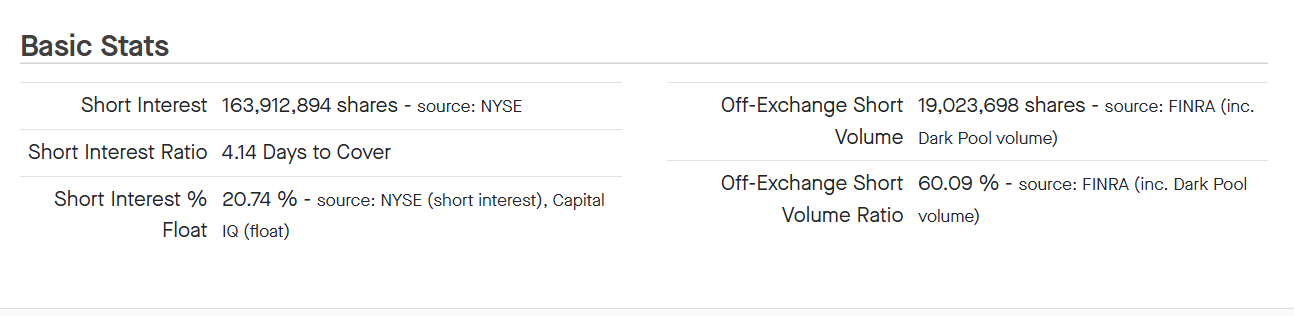

DilutionTracker, FinTel Short Interest, and Daily Chart

(Our information sources estimate their stats based on recent news/filings and may not be 100% accurate to date)

All information below is current as of 06/23/2024 10 AM Eastern

Source: DilutionTracker.com

Source: FinTel.com

Conclusion

The agreement between Tellurian and Aethon Energy is a strategic move that aims to improve Tellurian’s financial stability, support the development of the Driftwood LNG project, and align with market needs. The deal’s success hinges on its closure and the subsequent ability to secure financing for Driftwood LNG. If successful, this transaction will strengthen Tellurian’s position in the LNG market and provide a solid foundation for future growth and development.

Some of the Risk Factors for Tellurian

Tellurian Inc., an independent oil and gas exploration and production company, faces several key risk factors that investors should consider:

Project Financing and Financial Stability:

Tellurian is heavily invested in its Driftwood LNG project, with the total projected cost for the first phase around $14.5 billion. The company’s ability to secure adequate financing is crucial for the continuation and completion of this project. Delays or failures in securing necessary funds could significantly impact Tellurian’s operations and financial health (Tellurian Inc.) (LNG Prime).

Market and Commodity Price Volatility:

The company’s revenue is significantly influenced by the prices of natural gas and LNG. Fluctuations in these prices, driven by global supply and demand dynamics, geopolitical events, and market speculation, can lead to unpredictable revenue streams and financial instability (PitchBook) (Nasdaq).

Regulatory and Permitting Risks:

Tellurian’s operations are subject to extensive federal, state, and local regulations. Changes in regulatory policies, particularly regarding environmental standards and export permissions, can affect the company’s ability to complete projects and conduct business efficiently. Recent regulatory pauses and updates by the U.S. Department of Energy highlight the sensitivity of the sector to policy changes (Nasdaq) (LNG Prime).

Construction and Operational Delays:

The construction of large-scale projects like Driftwood LNG is complex and prone to delays due to technical, logistical, or weather-related challenges. Any significant delays can escalate costs and push back revenue generation timelines, affecting the company’s financial projections and investor confidence (Tellurian Inc.) (OilPrice.com).

Management and Succession Risks:

Changes in the executive team, such as the recent non-renewal of CEO Octávio Simões’ contract, can lead to strategic uncertainties. Leadership stability is critical for maintaining investor confidence and ensuring the smooth execution of the company’s strategic plans (LNG Prime).

Environmental, Social, and Governance (ESG) Concerns:

Tellurian’s activities in fossil fuels bring inherent environmental risks, including carbon emissions and potential spills. The company’s ESG ratings indicate severe risks, which could lead to increased regulatory scrutiny and potential backlash from environmentally conscious investors (PitchBook).

Dependency on Transaction Closure:

The successful closure of the deal with Aethon Energy is critical. If the transaction faces delays or fails to close as expected in the second quarter of 2024, Tellurian could experience financial strain and setbacks in its strategic plans. This dependency adds an element of uncertainty, particularly in terms of securing the $260 million needed to reduce debt and finance the Driftwood LNG project (Tellurian Inc.) (LNG Prime).

Market Price Volatility for LNG:

The offtake agreement with Aethon Energy, which includes purchasing LNG indexed to Henry Hub prices plus a liquefaction fee, introduces exposure to market price volatility. Fluctuations in natural gas prices could affect the profitability of this agreement and, by extension, the financial viability of the Driftwood LNG project (Nasdaq) (OilPrice.com).

Conclusion

Tellurian faces several key risks, including financing challenges, market volatility, regulatory hurdles, and potential delays in its major projects. The recent transaction with Aethon Energy, while potentially beneficial, introduces new dependencies and market exposure risks that could impact the company’s future stability and growth. Investors should carefully consider these factors when evaluating Tellurian’s prospects.

For more information on Tellurian see our 10/31/2023 Analysis

Your friend,

Steve Macalbry

Senior Editor, BestGrowthStocks.Com

Disclaimer: The author of this article is not a licensed financial advisor. This article is intended for informational purposes only. It should not be considered financial or investment advice. We have not been compensated for the creation or distribution of this article in any way. We do not hold any form of equity in the securities mentioned in this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks are speculative in nature, and you could lose your entire investment.