The recent news from CXApp Inc. announcing its partnership with Google Cloud marks a significant milestone in the company’s journey toward becoming a leader in providing enhanced workplace experiences through its CXAI SaaS platform. This collaboration signifies a deepening of technological and market development strategies that could have broad implications for the company’s growth trajectory, product offerings, and competitive positioning. Below, we break down the key components of this partnership and speculate on potential future revenues and catalysts arising from this news.

Key Components of the Partnership

AI Partnership: CXApp’s AI-native platform, with its 37 filed patents and 17 granted, underscores the company’s commitment to leading in the workspace digital transformation domain. The partnership will leverage Google’s technologies, such as the Vertex AI platform, to develop generative AI applications, enhancing CXApp’s offering.

Modernization of SaaS Infrastructure: Google Cloud’s involvement in powering CXApp’s customer applications promises advancements in security, analytics, and SaaS performance. This collaboration is poised to improve CXApp’s cloud-mobile experience, contributing to its strategy of growing subscription revenues through new and existing customer bases.

CXAI on Google Marketplace: Listing the CXAI platform on Google Marketplace and a go-to-market partnership could significantly expand CXApp’s customer reach and addressable market, providing a standardized solution to Google’s vast clientele.

Future Revenue Implications

Expansion into New Markets: The partnership with Google Cloud and the inclusion of CXAI on the Google Marketplace enhance CXApp’s visibility and accessibility, potentially accelerating customer acquisition and expansion into new market segments.

Enhanced Product Offering: Leveraging Google Cloud’s technologies and infrastructure could enable CXApp to offer more sophisticated, secure, and efficient services, increasing the value proposition to current and prospective clients.

Increased Customer Retention and Upsell Opportunities: Improved offerings and the ability to continuously innovate could lead to higher customer satisfaction, retention, and the potential for upselling more comprehensive solutions.

Potential Future Catalysts

Innovation in AI Applications: The development of new AI-driven applications and services could serve as a major catalyst for growth, particularly if CXApp can introduce transformative features that address unmet needs in the workplace experience domain.

Strategic Collaborations and Expansions: Beyond Google Cloud, CXApp may seek additional strategic partnerships that broaden its ecosystem and enhance its platform capabilities, driving further adoption and revenue growth.

Global Expansion: With a focus on global and cross-sector diversification, CXApp could leverage its partnership with Google to scale internationally, tapping into emerging markets and sectors not yet fully penetrated.

Technology and Patent Portfolio Expansion: Continued innovation and the expansion of its patent portfolio could strengthen CXApp’s competitive position and create new revenue streams through licensing or new product offerings.

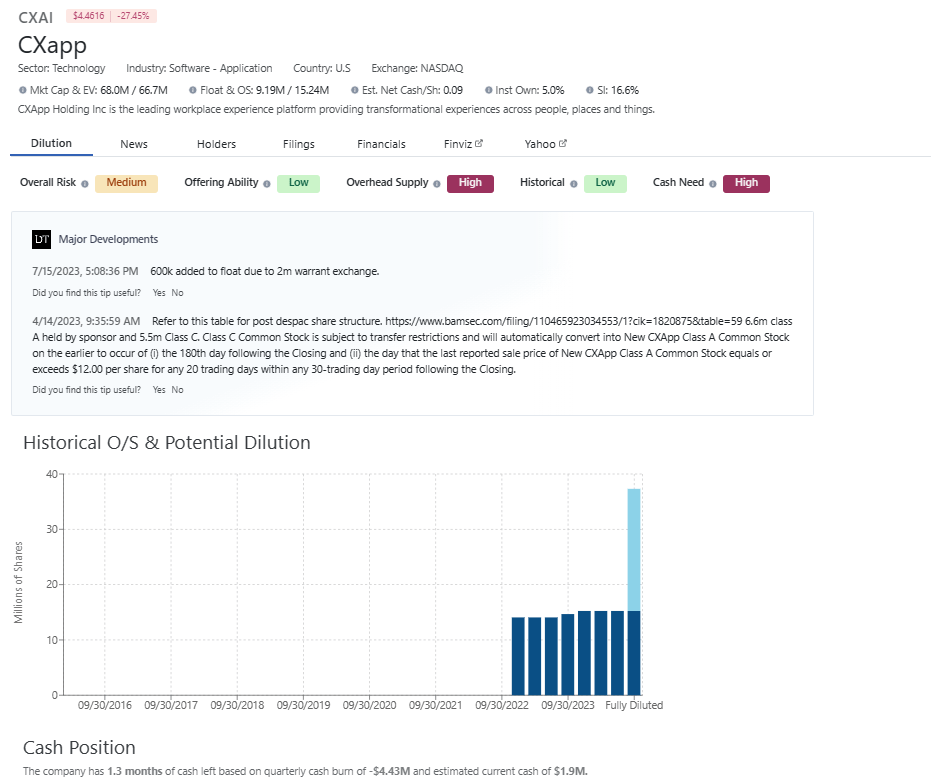

Estimated Share Structure, Cash Position, Short Interest (SI), and Institutional Ownership

Source: DilutionTracker

For more information on CXAI:

Conclusion

In conclusion, the partnership between CXApp Inc. and Google Cloud represents a transformative opportunity for CXApp to solidify and expand its market position as a leader in digital workplace transformation. While specific revenue projections are speculative without detailed financials, the strategic initiatives outlined in the partnership have the potential to significantly impact CXApp’s growth trajectory, market reach, and innovation capabilities. As the partnership unfolds and these initiatives are executed, the financial and strategic benefits are likely to become more evident, potentially making CXApp a compelling story in the tech sector. This is a very interesting growth story that will remain on BestGrowthStocks.Com watch list for the foreseeable future.

Risk Factors

Based on the current information about CXApp Inc. (NASDAQ: CXAI), several risk factors could influence the company’s future performance and investor sentiment:

Market Competition and Innovation: CXApp operates in the highly competitive Software as a Service (SaaS) and Artificial Intelligence (AI) sectors, requiring constant innovation and adaptation to maintain and grow its market share (CxApp).

Capital Requirements and Financing: As a technology company focused on the development and deployment of AI-based solutions for workplace experiences, CXApp may face significant capital requirements. Securing sufficient financing to support research, development, and market expansion efforts could present a challenge (Stock Analysis).

Technological and Development Risks: The success of CXApp’s platform is heavily dependent on the company’s ability to continually enhance and evolve its offerings to meet the changing needs of enterprises and employees navigating the hybrid work environment. Any delays or shortcomings in product development could adversely affect its competitive position (CxApp).

Regulatory and Compliance Risks: Operating within the technology and AI space, CXApp must navigate a complex regulatory environment that can vary significantly across different jurisdictions. Compliance with data protection, privacy laws, and other regulations is crucial to maintaining operations and customer trust (CxApp).

Operational Execution and Growth Strategy: The company’s ability to execute its growth strategy effectively, including international expansion, partnerships, and customer acquisition, is vital for its success. Missteps or failures in these areas could have a detrimental impact on its financial performance and market reputation (Stock Analysis).

Economic and Market Conditions: Fluctuations in economic conditions and market demand for AI and workplace experience solutions can impact CXApp’s performance. A downturn in the technology sector or reduced investment in digital workplace transformations could reduce demand for the company’s products (Stock Analysis).

Dependence on Key Personnel: The success of CXApp is closely tied to its leadership and development teams’ expertise and vision. Any significant changes in its executive team or inability to attract and retain talented personnel could impact its strategic direction and innovation capabilities (Stock Analysis).

Stock Market Volatility and Share Performance: As observed in its recent stock price movements, CXApp’s share performance can be highly volatile. Factors such as market sentiment, investor reactions to company news, and broader market trends can significantly affect its stock price (Stock Analysis).

Investors and stakeholders should consider these risk factors when evaluating CXApp Inc.’s prospects and positioning in the market.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: This article is intended for informational purposes only. It should not be considered financial or investment advice. We do not hold any form of equity in the securities mentioned in this article. We have not been compensated for the creation or distribution of this article in any way. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.