Marathon Digital Holdings Inc (NASDAQ: MARA)

About Marathon Digital Holdings

Marathon is a digital asset technology company that focuses on supporting and securing the Bitcoin ecosystem. The Company is currently in the process of becoming one of the largest and most sustainably powered Bitcoin mining operations in North America.

For more information, visit www.mara.com

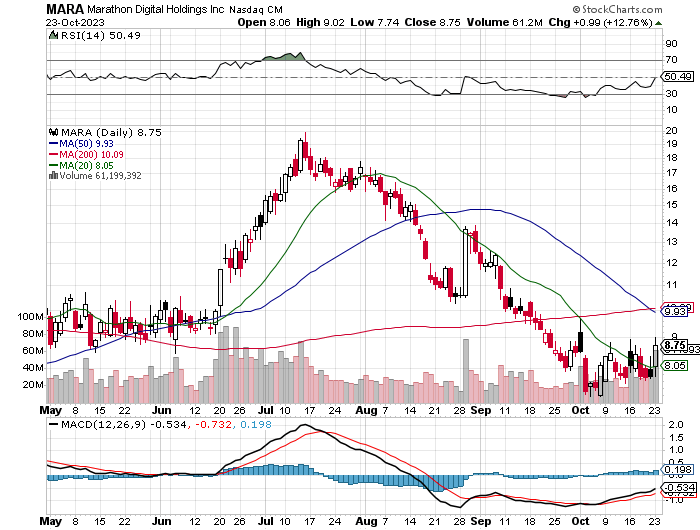

Current Stock Price: $8.75/share – As of market close October 23rd, 2023

Bitcoin Spot Price: $31,631 US – As of October 23rd, 2023 at 5:50 PM EST

What’s Going on with Bitcoin?

Spot Bitcoin ETF Applications Under Review:

12 spot-bitcoin ETF applications are currently being considered for approval. They are from Grayscale, 21Shares & Ark, BlackRock, Bitwise, VanEck, Wisdomtree, Invesco & Galaxy, Fidelity, Valkyrie, Global X, Hashdex and Franklin.

Bitcoin ETFs have been a point of discussion for a long time in the financial markets. They offer an opportunity for investors to gain exposure to Bitcoin without actually owning the cryptocurrency itself. This can be especially appealing for institutional investors or those who are not comfortable managing cryptographic keys.

Stuart Barton’s prediction about the SEC approving all spot bitcoin ETFs at once, similar to the ether ETFs, is interesting and will be significant if it materializes. The competitive landscape of ETF offerings is also evident in the mention of Barton’s team reconsidering the launch of their ether ETF after observing a slow start of other ether ETFs in the market.

The Upside

Increased Demand: Should these ETF’s be approved at once or separately, it may create significant additional demand for Bitcoin bolstering the spot price.

Potential Downsides Or Risks

Market Manipulation: There are concerns that large holders of Bitcoin could potentially manipulate the price of Bitcoin to impact the value of the ETF, although this risk exists in the direct Bitcoin market as well.

The Anticipated 2024 Bitcoin Halving

How the 2024 Bitcoin Halving Could Break Historical Patterns

Bitcoin’s halving event, which has historically been a significant catalyst for bullish price movements, may not have the same effect in 2024 as it has in previous cycles, suggests an expert.

This quadrennial event, which reduces the generation rate of new Bitcoin by 50%, has typically been seen as a significant driver for Bitcoin’s price spikes. Yet, the sheer prominence and understanding of the halving could dampen its impact. Just because Bitcoin’s supply diminishes doesn’t inherently mean its price will escalate. It’s crucial that this limited supply is matched with considerable demand, or else any potential price rise could be subdued.

Considering the halving’s predictability, market players are always aware of its impending arrival. As such, many argue that the price might already incorporate the effects of the halving before its occurrence.

Furthermore, with each subsequent halving, its influence on Bitcoin’s fresh supply diminishes. McGlone believes that as time progresses, this diminishing effect will become inconsequential. Hence, shifts in demand may soon overshadow supply adjustments as the primary determinant of Bitcoin’s value.

Bitcoin has a finite supply of 21,000,000 and that’s all there ever will be.

Ok, now let’s dig into Marathon Digital Holdings Inc

First, is there any Economic Moats?

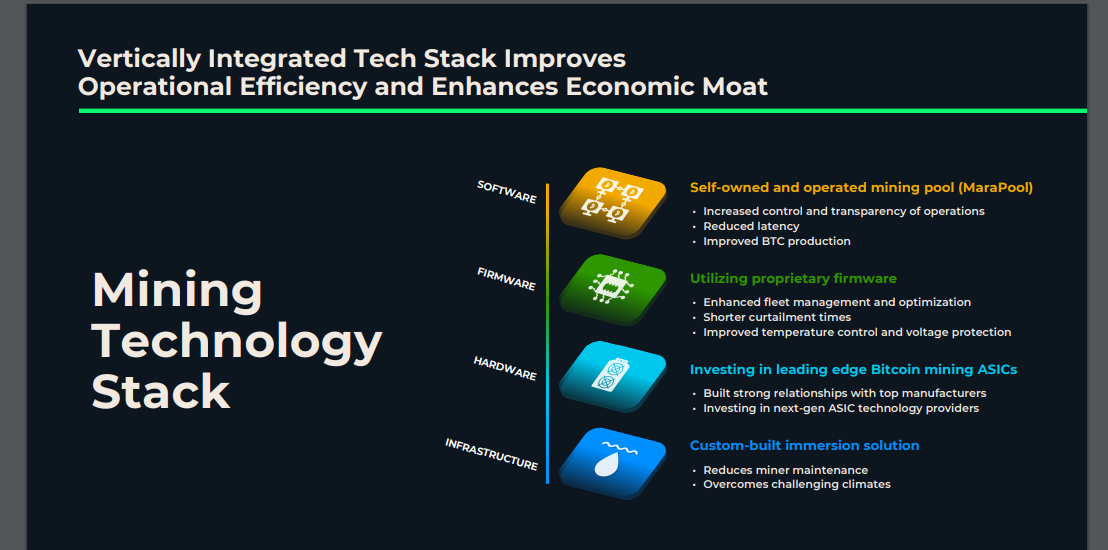

From Page 6 in their September 2023 Investor Presentation we have identified at least two potential Economic Moats.

- Utilizing proprietary firmware

• Enhanced fleet management and optimization

• Shorter curtailment times

• Improved temperature control and voltage protection - Custom-built immersion solution

• Reduces miner maintenance

• Overcomes challenging climates

Source: Page 6 September 2023 Investor Presentation

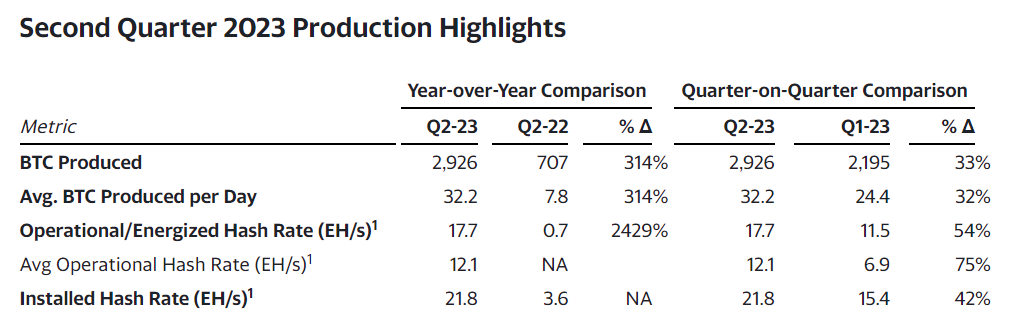

Source: Page 9 from the 2023 Investor Presentation

Financials

Marathon Digital Holdings Detailed Q2 2023 Financial Performance

Marathon Digital Holdings Inc.

Fort Lauderdale, FL – August 8, 2023

Overview:

Financial Breakdown for Q2 2023:

Marathon posted a net deficit of $21.3 million ($0.13/share) for Q2 2023, a marked improvement from the $212.6 million loss ($1.94/share) recorded during the equivalent quarter in 2022.

Revenue for this quarter rose impressively to $81.8 million, showcasing a substantial leap from the $24.9 million in Q2 2022. This was primarily attributed to a 314% escalation in Bitcoin production, which managed to counterbalance the 14% dip in average Bitcoin prices for the current year.

The company realized $23.4 million in profits from Bitcoin sales, having sold 63% of the quarter’s Bitcoin production to cover operational expenses. This period’s positive financial trajectory was further boosted by the diminished impairment of digital assets ($8.4 million), buoyed by the general uptrend in Bitcoin prices. Additionally, the previous year’s figures benefitted from the exclusion of a $79.7 million loss from digital asset investments and a gain of $54.1 million from equipment sales.

Adjusted EBITDA for the period was an impressive $25.6 million, a significant rise from the loss of $167.1 million during the same timeframe in 2022. Along with the above-mentioned profits and reduced impairments, the total margin—excluding depreciation and amortization—amplified to $26.5 million, ascending from the previous year’s $8.2 million.

Operational Milestones for Q2 2023:

Insights from the Management:

Fred Thiel, the visionary chairman and CEO of Marathon, reflected on the company’s growth trajectory: “Our initial momentum this year got a further boost this past quarter, as we expanded our hash rate considerably and enhanced our efficiency metrics.” He added that by outpacing the broader network in growing their hash rate and bolstering uptime, they achieved record-breaking production of 2,926 Bitcoins in Q2—approximately 3.3% of total Bitcoin network rewards available during that period.

“On the financial front,” Thiel continued, “we bolstered our position, ending the quarter with a formidable $113.7 million in unrestricted cash and equivalents and around 12,538 Bitcoins, valued roughly at $380 million as of June 30th.”

While their cash reserves did see a reduction by $11.2 million from Q1, Marathon’s unrestricted Bitcoin assets grew by 1,072 units, pegging their market value at an estimated $32.7 million at the end of June.

Thiel further shared the company’s latest accomplishments: “Having reported our July strides and further installations this August, we’ve achieved our domestic hash rate goal of 23 exahashes. With all our mining apparatus set up in Garden City and energization expected any moment now, we’re also seeing gains from our joint venture in Abu Dhabi. We remain committed to cementing our leadership in the Bitcoin mining sector in upcoming quarters.”

Recent News Developments

October 04, 2023 – Marathon Digital Holdings Delivers Comprehensive September 2023 Update on Bitcoin Production and Mining Operations

Fort Lauderdale, FL – Marathon Digital Holdings, Inc. (NASDAQ: MARA), a foremost figure in the Bitcoin ecosystem, unveiled a series of robust developments regarding its Bitcoin (BTC) production and mining installation for September 2023.

Key Achievements and Highlights:

Operational Efficiency: Marathon witnessed a 20% surge in its monthly average operational hash rate.

Bitcoin Production: September 2023 saw a production of 1,242 BTC, aggregating to a total of 8,610 BTC for the year.

Mining Rewards: The firm marked its highest ever monthly portion of miner rewards at 4.3%.

Financial Strength: The combined assets of unrestricted cash and Bitcoin amounted to $471 million as of September 30, 2023.

CEO’s Perspective:

Fred Thiel, Marathon’s Chairman and CEO, commented, “Our September Bitcoin production soared by 16% from the prior month and an impressive 245% year-over-year. Enhanced operational times and minimized curtailment activities in Texas fueled this uptick. Our current share of available Bitcoin miner rewards stands at a record 4.3%. Anticipated developments in Garden City, Texas are drawing near, while our teams have intensified their focus on enhancing operational time across other sites, predominantly in McCamey, Texas. Our endeavors encompass equipment upgrades, incorporation of unique firmware, and other technical enhancements.”

Thiel further remarked on their international operations, highlighting their joint venture in Abu Dhabi, which mined 50 BTC in September. He emphasized Marathon’s financial strength, especially after the strategic retirement of most of their convertible debt. He also mentioned the forthcoming Special Meeting of Shareholders, urging shareholders to participate and voice their opinion.

Detailed Insights:

U.S. Operations witnessed an upswing in Bitcoin production, with September 2023 marking a 16% increase from August and a staggering 242% increase year-over-year. Energized hash rate remained stable, while the average operational hash rate experienced a 20% rise.

Operational details by site show notable improvements, particularly in McCamey, Texas, where uptime increased significantly, thanks to reduced curtailment and strategic optimization efforts.

Financially, the company showcased a robust position. As of the end of September 2023, Marathon retained 13,726 unrestricted BTC. To harness long-term gains and maintain stability, they’ve employed hedging strategies for a segment of their Bitcoin holdings. The company’s financial reserves swelled from $188.2 million to $471.2 million YoY.

The company will be hosting a Special Meeting of Shareholders on November 10, 2023, to deliberate on multiple corporate propositions.

For an in-depth understanding of the data and further information, please refer to the official documentation filed with the Securities and Exchange Commission on October 2, 2023.

September 5, 2023 – Marathon Digital Holdings Reveals August 2023 Insights on Bitcoin Production and Mining Progress

Fort Lauderdale, FL: Marathon Digital Holdings, Inc., a leading entity in fortifying the Bitcoin ecosystem, has unveiled its unaudited production figures and mining installation metrics for August 2023.

Key Insights:

Growth Metrics: An additional 5 EH/s hash rate is in the pipeline, thanks to recently procured miners.

August Performance: A total of 1,072 BTC were produced this month, culminating in 7,368 BTC for the year thus far.

Financials: Unrestricted assets combining cash and Bitcoin stood at an impressive $445 million as of August 31, 2023.

CEO Commentary:

Fred Thiel, the CEO and Chairman of Marathon, conveyed, “Our August production witnessed 1,072 bitcoins, marking a monthly dip of 9%, yet a year-on-year increase of over fivefold. The short-term decline can be attributed to heightened curtailment activities in Texas spurred by extreme temperatures. Nevertheless, these setbacks were eclipsed by our relentless drive to enhance our operational hash rate and refine our processes.”

Shedding light on the technical front, Thiel highlighted, “Our operational hash rate in the U.S. grew by 2% month-on-month, clocking in at 19.1 exahashes. The installed hash rate showed a 1% monthly growth, reaching 23.1 exahashes. This surge is predominantly credited to the transition to more proficient BITMAIN S19 XPs from the S19 J Pro miners. We eagerly await the activation of our Garden City, Texas facility, which is in its final paperwork stage with Applied Digital. We’re optimistic about its impending energization.”

The partnership in Abu Dhabi, initiated in July, has already mined 50 bitcoins in August, with Marathon’s stake being approximately 10 bitcoins. This joint venture’s operational hash rate has attained 1.5 exahashes, with a target of reaching a complete 7.0 exahashes by the end of 2023.

“As August concluded, we’re thrilled to have achieved our primary domestic benchmark of 23 exahashes. Looking ahead, we’ve secured the necessary resources for an additional 5 exahashes. Counting our current domestic installation, planned international expansion, and the newly contracted capacity, Marathon’s envisioned total hash rate is set to be 30 exahashes,” Thiel added.

Operational Overview:

US Bitcoin Production: For August 2023, the US-only figures stood at 1,062 BTC, a 477% YoY rise but a 10% MoM dip.

Average Daily Bitcoin Production: Recorded at 34.3 BTC, reflecting a 477% YoY increase and a 10% MoM decrease.

Hash Rates: Operational and installed hash rates exhibited a YoY increase of 2884% and 3509% respectively.

With S19 XPs now predominantly fueling Marathon’s US operations, fleet efficiency has seen a slight improvement, and post complete deployment, it’s projected to stand at around 24.2 J/TH.

Financial Highlights:

Liquidity: As of August 31, total assets, including restricted and unrestricted cash and Bitcoin, amounted to $111.2 million. The unrestricted sum was $105.5 million.

Bitcoin Holdings: Marathon reported total holdings of 13,286 BTC, with 13,111 being unrestricted. The restricted BTC stood at 175, unrelated to any borrowing collateral.

In August, 750 BTC were sold by Marathon, and they plan to sell portions of their holdings in the forthcoming months to support ongoing operations, bolster the treasury, and cater to corporate needs. By the end of August 2023, unrestricted cash and Bitcoin saw a significant rise from the previous year, reaching $445.5 million.

In a recent interview, Fred Thiel discussed the future trajectory of bitcoin mining.

With an expansive background in technology leadership, Thiel began by highlighting the critical role of decentralization in bitcoin mining. Although Marathon is among the globe’s most prominent publicly-traded bitcoin miners, it contributes under 5% of the entire network’s computational capacity. From this vantage point, Thiel pointed out the U.S.’s current stake in mining and Marathon’s efforts to expand internationally, prioritizing renewable energy sources.

The dialogue also explored the inherent challenges in the bitcoin mining domain. Thiel remarked on the intensifying competition for bitcoin rewards, resulting in shrinking profit margins. Moreover, with a halving event on the horizon, set to cut the rewards in half next year, the dynamics of bitcoin mining are undergoing a shift. He envisions a landscape dominated by a select few global giants, while smaller operators concentrate on niche solutions.

A compelling part of their discussion centered around “stranded energy” and the misconception of bitcoin as a “dirty energy” contributor. This led to talks on the budding commodity markets springing up around bitcoin mining.

Thiel further discussed innovative collaborations between miners and energy firms. He talked about the potential to trap methane from landfills, a gas more detrimental than CO2, and its conversion to energy for mining activities. He also touched upon leveraging the heat from mining for various uses, from warming greenhouses to drying timber.

Nearing the interview’s conclusion, Nelson broached the topic of potential alliances between bitcoin miners and energy stakeholders. Thiel provided insights into Marathon’s joint ventures, pointing to their projects in Texas and North Dakota that tap into otherwise-unused wind farm energy. He also mentioned collaborations with landfill proprietors to reuse gas that would typically be flared.

The domain of bitcoin mining is in a state of dynamic evolution, stretching beyond just digital currencies. It encapsulates innovation, environmental responsibility, and forming ties in unforeseen sectors. As the sector progresses, it’s evident that bitcoin mining is revolutionizing our perceptions of energy and ecological responsibility in the digital epoch. See Original Interview

Also See: Very Interesting Recent Interview with Fred Theil

Statistics Courtesy Yahoo Finance

Share Statistics

Average Volume (3 month): 27.29M

Average Volume (10 day): 29.49M

Shares Outstanding: 211.55M

Implied Shares Outstanding: 211.55M

Float: 173.47M

% Held by Insiders: 3.50%

% Held by Institutions: 36.18%

Substantial Short Position

Could the Long Shot Catalyst, a Short Squeeze Play Out?

Marathon Digital Holdings Inc

Exchange: NASDAQ

Price: $8.76

Change: +1.00 (+12.89%)

Date: Oct 23, 2023, 3:59:54 PM EDT

Share Price Details

Day’s Range: $8.10 – $9.02

52 Week Range: $3.11 – $19.88

Short Interest Data

Short Interest Ratio: 1.49 Days to Cover

Short Interest % Float: 23.82% (source: NASDAQ for short interest, Capital IQ for float)

Off-Exchange Short Volume: 9,330,822 shares (source: FINRA, including Dark Pool volume)

Off-Exchange Short Volume Ratio: 56.43% (source: FINRA, including Dark Pool volume)

Source: FinTel

MARA Daily Chart

Conclusion

In conclusion, Marathon Digital Holdings is an impressive growth company in the process of becoming one of the largest and most sustainably powered Bitcoin mining operations in North America.

There are Four Potential Big Catalysts for Marathon:

Approval of spot Bitcoin ETFs: 12 spot Bitcoin ETF applications are currently being considered for approval, and if they are approved, it may create significant additional demand for Bitcoin, bolstering the spot price.

The 2024 Bitcoin halving: The halving event, which reduces the generation rate of new Bitcoin by 50%, has historically been a significant driver for Bitcoin’s price spikes. However, it may not have the same effect in 2024 as it has in previous cycles.

Marathon Digital Holdings’ Financial Performance and Expansion: Marathon Digital Holdings posted a net deficit of $21.3 million for Q2 2023, a marked improvement from the $212.6 million loss recorded during the equivalent quarter in 2022. Revenue for this quarter rose impressively to $81.8 million, showcasing a substantial leap from the $24.9 million in Q2 2022. The company realized $23.4 million in profits from Bitcoin sales, having sold 63% of the quarter’s Bitcoin production to cover operational expenses. Marathon Digital Holdings’ operational milestones and financial strength are anticipated to increase in upcoming quarters.

Short Squeeze: While a short squeeze is a long shot, it is possible due to the above-mentioned potential catalysts.

Steve Macalbry

Senior Editor, BestGrowthStocks.Com

Like this report? Timing is everything. Be sure you’re receiving our Text/SMS notifications and be on top of our latest issuance.

Disclaimer: The author of this article is not a licensed financial advisor. This article is intended for informational purposes only. It should not be considered financial or investment advice. We have not been compensated for the creation or distribution of this article in any way. We do not hold any form of equity in the securities mentioned in this article as of 10/23/2023. Always consult with a certified financial professional before making any financial decisions. Growth stocks are speculative in nature, and you could lose your entire investment.