Executive Summary

SoFi is a leading fintech company providing lending, personal finance, and wealth management services through an integrated digital platform.

Strong membership and product growth, with members exceeding 4.7 million in Q3 2023. Total products sales grew 57% year-over-year.

Well-positioned to benefit from student loan refinancing demand post federal student loan payments resuming in 2023.

Raised revenue guidance for 2023 and expects to achieve GAAP net income profitability by Q4 2023.

Company Overview & Growth Strategies

SoFi is pursuing rapid growth through:

Cross-selling products to existing members to increase products per member. Average products per member grew from 1.7 to 2.0 in 2022.

Adding new products like SoFi Invest, SoFi Money, SoFi Credit Card, and SoFi Relay to drive user engagement.

Marketing partnerships with major sports leagues like NFL and NBA to drive brand awareness.

Strategic acquisitions like Galileo and Technisys to expand technology capabilities.

Key growth areas:

Lending driven by personal loans and student loan refinancing.

Financial services driven by SoFi Money direct deposits and debit card spend.

Investing fueled by rising assets under management.

Financial Analysis

Q3 2023 adjusted net revenue increased 56% year-over-year. Adjusted EBITDA was $44 million, the first full quarter of positive adjusted EBITDA.

Lending segment delivered record originations of $4.3 billion in Q3 2023, up 31% versus the prior year period.

Positive contribution profit in Financial Services segment with rising member engagement on SoFi Money and SoFi Credit Card.

Member engagement has translated to cross-buying success with nearly 30% of SoFi Lending borrowers holding at least one other SoFi product.

Competitive Landscape

SoFi competes with:

Large banks providing lending and wealth management services.

Fintech lenders like LendingClub and Upstart.

Neobanks like Chime and Current.

SoFi’s advantages are its brand, integrated platform experience, and broad product suite. SoFi also has a partnership with Galileo that enables it to power financial services and products for other businesses.

Analyst Views

The average 12-month price target for SoFi is $8.78, representing 28% upside potential.

Analysts are positive on SoFi’s growth outlook but remain concerned about path to profitability.

Current Short Interest and Potential Squeeze

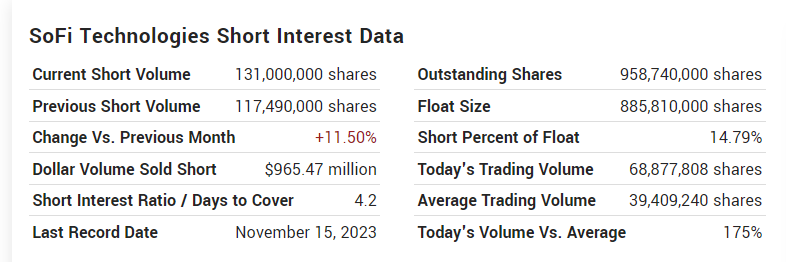

Sofi Technologies is at the highest short interest the stock has seen only being matched once before two years ago at this level of 131m shares, or about 14.8% of total shares outstanding.

Source: Marketbeat

SOFI Daily Chart

Note, there has been a substantial increase in daily trading volume.

Additional information and a Q&A that Could Serve as a Potential Catlayst:

Shareholder Q&A Event to be Hosted Today 12/04/2023

SOFI Investor Relations Website

Conclusion

SoFi is a high growth fintech company well-positioned to gain market share across lending, payments, financial services, and wealth management. The company has strong momentum with membership and product growth to support a positive long-term outlook. We like the 12-month growth prospects for Sofi Technologies, and we will keep this one on our growth stock list for the foreseeable future.

Your friend,

Steve Macalbry

Senior Editor, BestGrowthStocks.Com

Like this report? Be sure you’re receiving our Text/SMS notifications and be on top of our latest issuance. NOTE* the only way to access our research desk is via free subscription to our SMS/text and or emailed newsletter.

Disclaimer: The author of this article is not a licensed financial advisor. This article is intended for informational purposes only. It should not be considered financial or investment advice. We have not been compensated for the creation or distribution of this article in any way. We do not hold any form of equity in the securities mentioned in this article as of 12/04/2023. Always consult with a licensed financial professional before making any financial decisions. Growth stocks are speculative in nature, and you could lose your entire investment.