About Clover Health

Clover Health Investments, Corp. (NASDAQ: CLOV), founded in 2014, is a healthcare company that provides Medicare Advantage (MA) insurance plans and operates as a direct contracting entity with the U.S. government.

The company is based in Franklin, Tennessee.

Clover Health’s strategy is powered by its proprietary software platform, Clover Assistant, which is designed to aggregate patient data from across the healthcare ecosystem to support clinical decision-making and improve health outcomes through the early identification and management of chronic disease.

The company’s mission is to bring high-quality, affordable, and easy-to-understand healthcare plans to America’s seniors.

Let’s Start with the Most Recent Financial Results – Clover Health Investments, Corp. (Q3 2023)

Clover Health Investments, Corp. (NASDAQ: CLOV), a leading Medicare-focused healthcare company, reported its financial results for the third quarter of 2023, highlighting notable improvements in financial performance and providing updated guidance for the year.

Financial Highlights:

Total Revenue: In Q3 2023, Clover Health reported a total revenue of $482.1 million. This comprises $301.2 million from the Insurance segment (up 12% compared to Q3 2022) and $176.0 million from the Non-Insurance segment (a 70% decline from Q3 2022). The Non-Insurance revenue decline aligns with the company’s strategic shift.

Insurance Medical Care Ratio (MCR): The Insurance MCR improved significantly to 78.5%, compared to 86.3% in Q3 2022. The year-to-date MCR stands at 80.8%. This improvement indicates better cost management relative to the premiums earned.

Net Loss and Adjusted EBITDA: The company reported a net loss of $41.5 million and an Adjusted EBITDA loss of $5.1 million, a substantial improvement from the $55.5 million EBITDA loss in the same period last year.

Expenses: Salaries and benefits plus General and administrative expenses (SG&A) were $102.3 million, with an adjusted figure of $68.2 million after excluding non-recurring costs and settlements.

Operational Highlights:

Insurance Members: As of September 30, 2023, there were 81,275 insurance members under Clover’s management, compared to 88,136 on the same date in 2022.

Non-Insurance Beneficiaries: The number of non-insurance beneficiaries stood at 51,528, a decrease from 166,432 in 2022.

Management’s Outlook:

CEO Andrew Toy emphasized the quarter’s strong performance, particularly in the Insurance segment, driven by the Clover Assistant’s value contribution and operational enhancements.

CFO Scott Leffler pointed out the momentum towards sustainable profitability, expecting further improvements in 2024 due to efficiencies from the UST HealthProof partnership and the maturation of Clover Assistant.

Revised Guidance for Full-Year 2023:

Insurance Revenue: Projected between $1.21 billion and $1.23 billion.

Non-Insurance Revenue: Expected to be between $0.75 billion and $0.80 billion.

Insurance MCR: Anticipated to be in the range of 81% – 82%.

Non-Insurance MCR: Forecasted to be between 98% – 100%.

Adjusted SG&A: Estimated between $310 million and $315 million.

Adjusted EBITDA: Projected to be between a loss of $55 million and $80 million.

Conclusion for Q3 2023 Financials:

Clover Health’s Q3 2023 results demonstrate a resilient financial performance, marked by revenue growth in the Insurance segment and effective cost management. The improvement in Adjusted EBITDA and the reduced net loss reflect the company’s strategic initiatives and operational efficiencies. The updated guidance for 2023, coupled with the anticipated positive impact of strategic partnerships and technology implementations, positions Clover Health as a potentially lucrative option for investors seeking growth in the healthcare sector.

Potential Catalysts for the Stock

One of the main catalysts for Clover Health’s stock is its proprietary technology platform, Clover Assistant. The platform collects, structures, and analyzes health and behavioral data from various sources, such as electronic health records, claims, lab results, and patient surveys. It uses this data to generate real-time, personalized, and actionable insights and recommendations for physicians and patients.

Recent research released by the company demonstrated that the use of Clover Assistant by Primary Care Physicians (PCPs) correlated with increased medication adherence for patients with common chronic conditions like diabetes, high blood pressure, and high cholesterol.

This indicates that the platform is effectively improving patient care, which could lead to increased adoption and revenue growth.

Another potential catalyst is the company’s strategic focus on innovation and growth, especially in the Clover Assistant segment. The company has invested in research and development, acquisitions, and partnerships to enhance its product offerings and market presence in this segment.

Recent News

Clover Health recently announced its plan to present at the 42nd Annual J.P. Morgan Healthcare Conference on January 11, 2024.

In January 2024, Clover Health released research demonstrating the impact of Clover Assistant on medication adherence.

In December 2023, the company announced its decision to exit ACO REACH to accelerate its path to profitability.

In November 2023, Clover Health partnered with WellBe Senior Medical to bring in-home medical care to Atlanta patients and across rural Georgia.

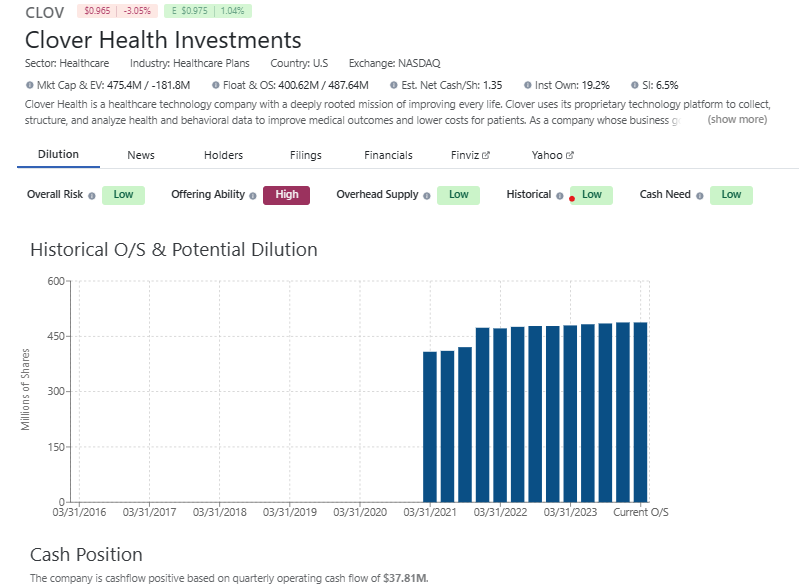

Share Structure, Current Estimated Cash Position and Runway

source: dilutiontracker

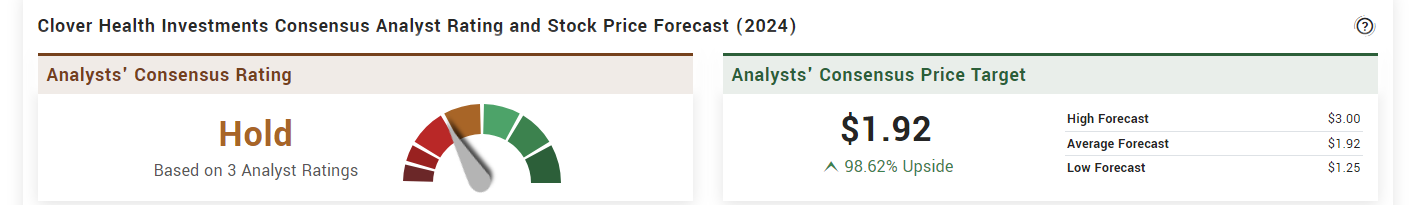

Analyst Targets and Rating

source: marketbeat

Daily Stock Chart

For more information on Clover Health visit:

Investor presentation May 2023

Conclusion

Clover Health Investments, Corp.’s third-quarter financial results for 2023 paint a promising picture of the company’s future. The significant improvements in key financial metrics, notably a 12% increase in Insurance revenue and a substantial reduction in the Adjusted EBITDA loss, reflect the effective implementation of Clover Health’s strategic initiatives. The company’s proprietary Clover Assistant platform has proven to be a game-changer, offering data-driven insights that enhance clinical decision-making and improve patient outcomes, particularly in the management of chronic diseases.

The management’s forward-looking stance, as evidenced by their focus on innovation, strategic partnerships, and operational enhancements, is paving the way towards sustainable profitability. With the revised guidance showing positive trends and the company’s proactive approach to growth and efficiency, Clover Health emerges as an attractive option for investors seeking opportunities in the evolving healthcare sector. The company’s participation in key healthcare conferences and its ongoing commitment to research and development further underscore its dedication to maintaining a leading edge in the Medicare Advantage market.

Risk Factors

While Clover Health’s recent financial performance and strategic initiatives indicate a strong potential for growth, investors should also consider several risk factors:

Market Competition: The Medicare Advantage and healthcare technology markets are highly competitive, with numerous established players. Clover Health faces the challenge of differentiating its services and maintaining a competitive edge.

Regulatory Compliance: As a healthcare company, Clover Health must navigate a complex regulatory environment. Changes in healthcare laws, regulations, or government contracting practices could impact its operations and profitability.

Technology Dependence: The company’s success heavily relies on its proprietary Clover Assistant platform. Any technological failures, disruptions, or limitations in its functionality could adversely affect its performance and customer satisfaction.

Evolving Business Model: Clover Health’s strategic shifts, such as the recent decision to exit ACO REACH, indicate an evolving business model. While these changes aim at long-term profitability, they carry inherent risks and uncertainties in terms of execution and market response.

Financial Sustainability: Despite improvements, the company still reports net losses and negative Adjusted EBITDA. Achieving and sustaining profitability remains a crucial challenge.

Reliance on Partnerships: Partnerships, like the one with WellBe Senior Medical, are vital to Clover Health’s growth. Any setbacks or terminations in these collaborations could impact its expansion strategies and market presence.

Healthcare Industry Risks: The healthcare industry is subject to rapid changes in technology, patient preferences, and healthcare practices. Clover Health must continuously adapt to these changes to remain relevant and efficient.

Investors should weigh these risks against the company’s growth potential, technological advancements, and strategic positioning in the Medicare Advantage market.

Your friend,

Steve Macalbry

Senior Editor, BestGrowthStocks.Com

Like this report? Be sure you’re receiving our Text/SMS notifications and be on top of our latest breakout and growth stock issuance.

Disclaimer: The author of this article is not a licensed financial advisor. This article is intended for informational purposes only. It should not be considered financial or investment advice. We have not been compensated for the creation or distribution of this article in any way. We do not hold any form of equity in the securities mentioned in this article as of 01/09/2024. Always consult with a licensed financial professional before making any financial decisions. Growth stocks are speculative in nature, and you could lose your entire investment.