Company Profile

Avalo Therapeutics is a clinical-stage biotechnology company developing targeted therapeutics for patients with significant unmet clinical needs in immunology, immuno-oncology, and rare genetic diseases. The company’s lead product candidate, AVTX-002, is a monoclonal antibody that targets a specific protein involved in the development of systemic lupus erythematosus (SLE). SLE is a chronic autoimmune disease that can cause inflammation and damage to any part of the body.

Avalo Therapeutics also has a pipeline of other promising product candidates in development. The company’s pipeline includes product candidates for the treatment of myasthenia gravis, a rare autoimmune disease that causes muscle weakness, and primary sclerosing cholangitis, a rare chronic liver disease.

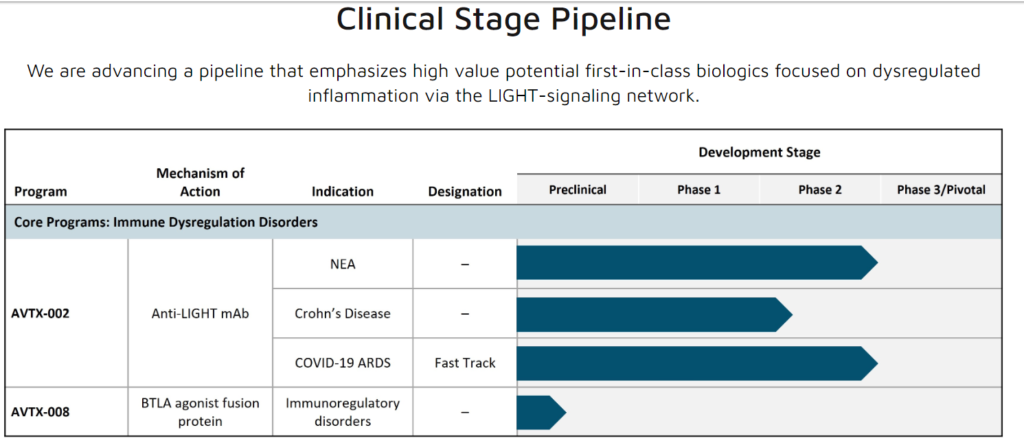

AVTX Pipeline

source: AVTX Website

Last Reported Earnings August 3rd, 2023

Avalo Therapeutics, Inc., located in Wayne, PA, and Rockville, MD, released their second-quarter financial results and business updates for 2023. Despite AVTX-002 (quisovalimab) not meeting its primary endpoint in the Phase 2 PEAK Trial for non-eosinophilic asthma, there was a significant decrease in serum LIGHT levels throughout the study, suggesting strong target engagement. CEO Dr. Garry Neil remains optimistic, expressing confidence in the promise of AVTX-002 for inflammatory-driven diseases, including inflammatory bowel disease (IBD) and other lung, gut, and skin disorders.

Avalo Therapeutics disclosed having cash reserves of approximately $6.3 million as of June 30, 2023. In June, Avalo prepaid $6 million under its loan agreement, leaving $15.2 million in remaining principal payments. To navigate through financial challenges, the company entered a forbearance agreement with lenders on July 20, 2023, after acknowledging a material adverse change in its business. The lenders agreed to temporary leniency in enforcing remedies until August 15, 2023, or upon an earlier triggering event.

The company is contemplating the out-licensing or sale of non-core and possibly core assets to sharpen its focus and minimize future expenses. A non-binding letter of intent for the potential sale of AVTX-801 (D-galactose), AVTX-802 (D-mannose), and AVTX-803 (L-fucose) was initiated in July 2023.

Regarding program updates, the Phase 2 PEAK trial of AVTX-002 did not meet its primary endpoint, as measured by the proportion of patients experiencing an asthma-related event (ARE). However, there was a substantial and sustained reduction in LIGHT levels, with AVTX-002 showing a favorable safety and tolerability profile. A post-hoc analysis revealed that a subgroup of patients with baseline LIGHT levels over 125 pg/mL experienced approximately a 50% reduction in AREs when treated with AVTX-002 compared to a placebo.

Moreover, AVTX-002 has previously shown statistically significant results in reducing respiratory failure and mortality in COVID-19 ARDS patients in a randomized placebo-controlled trial, and positive trends in an open-label study in Crohn’s Disease.

Avalo will continue to assess the Phase 2 PEAK trial’s top-line results while seeking funding to inform future development plans for the program.

As for AVTX-008, it’s a B and T Lymphocyte Attenuator (BTLA) agonist fusion protein, designed to treat a variety of autoimmune diseases. Avalo has identified a lead molecule for AVTX-008 and is planning to advance the asset to Investigational New Drug (IND) application status, provided sufficient funding is secured.

In the financial update for Q2 2023, Avalo reported having $6.3 million in cash and equivalents, reflecting a $6.9 million decrease from December 31, 2022. The decline in funds is attributed to operational expenditures for pipeline development, a $6 million prepayment on the loan, and security agreement, albeit partially offset by $20.3 million net proceeds from equity financings.

There was a notable $17.8 million reduction in total operating expenses in the first half of 2023 compared to the same period in 2022, primarily due to cost-saving measures implemented in early 2022 and a reduction in ongoing programs. The net loss for Q2 2023 was primarily due to operating expenses.

AVTX-002 (quisovalimab) is a fully human monoclonal antibody (mAb) targeting the LIGHT-signaling network, which is believed to be crucial in various acute and chronic inflammatory disorders due to its role in autoimmune and inflammatory reactions in organs. Previously, AVTX-002 demonstrated effectiveness in reducing mortality and respiratory failure in COVID-19 induced ARDS and showed positive signals in Crohn’s Disease.

Lastly, AVTX-008 is in the IND-enabling stage, functioning as a BTLA agonist fusion protein, aimed at mitigating immune dysregulation disorders. Avalo is actively evaluating several disorders for potential treatment with this innovative drug, with plans to expedite its progress to IND status, contingent on securing necessary funding.

Earnings Summary and Comments

In summarizing Avalo Therapeutics’ Q2 2023 earnings release, we observe a period marked by financial and operational prudence amidst clinical uncertainties. Though AVTX-002 (quisovalimab) fell short of meeting its primary endpoint in the Phase 2 PEAK Trial, the silver lining was its evident impact on serum LIGHT levels, hinting at a potential efficacy in treating inflammatory-driven diseases. This unexpected finding might not be a home run, but it definitely keeps hope alive for alternative applications of the drug, illuminating pathways for future investigations and potential uses.

The company’s financial posture, while cautious, has been strategic. With cash reserves sitting at $6.3 million, there’s a clear indication of tightened belts as they navigated through the quarter with reduced operational expenditures and strategic prepayments of loans. The decision to explore the sale or out-licensing of non-core (and possibly core) assets can be viewed as a calculated move to consolidate focus and resources, inherently serving as a buffer against future unpredicted expenditures.

Investors and stakeholders should perhaps approach Avalo’s journey with cautious optimism. The financial dip is indeed a concern, but not an unusual sight in the pharmaceutical landscape, particularly for firms in the thick of drug development. With a keen eye on future announcements, especially on the recalibration of their assets and the unfolding destiny of AVTX-002, observers might witness a company that is not just weathering a storm, but meticulously charting its course through it.

As the pharmaceutical development terrain is always fraught with both risk and opportunity, Avalo’s Q2 2023 encapsulates this delicate balance. The upcoming quarters may hopefully offer clearer signs of the company’s direction, providing investors with firmer ground upon which to anchor their expectations and confidence. For now, the canvas is painted with careful strokes of resilience, strategy, and a dash of hope — a tableau not unfamiliar in the unpredictable but exciting world of biopharmaceuticals.

Recent News and Developments

September 26th, 2023

Avalo Therapeutics has successfully cleared its outstanding $35 million debt to Horizon Technology Finance Corporation ahead of schedule, marking a significant financial milestone for the company. This debt elimination reflects Avalo’s commitment to maintaining financial stability and sets a strong foundation for its future growth and innovative endeavors in drug development.

CEO Dr. Garry A. Neil expressed enthusiasm over this pivotal financial accomplishment, crediting the diligent efforts of the Avalo team. This development is crucial as it signals Avalo’s preparedness to explore new opportunities in addressing immunological diseases and other unmet medical needs. With a now robust balance sheet, Avalo is poised to pursue collaborations, expand its research initiatives, and expedite the process of bringing innovative treatments to the market.

Dr. Neil spotlighted quisovalimab (AVTX-002), a potential pioneering fully human monoclonal antibody (mAb) targeting crucial immunological elements, which has shown promising clinical proofs of concept in treating both acute and chronic inflammatory diseases. He also mentioned AVTX-008, a BTLA agonist fusion protein, which has the potential to be a top-tier molecule addressing a range of immune diseases.

Gerald A. Michaud, the President of Horizon Technology Finance Corporation, commended the professionalism and focus of Avalo’s management team in navigating through the challenging biotechnology market to fully settle the debt. He acknowledged Avalo’s effective strategy, which included cost elimination, asset prioritization, operational excellence, and successful business transactions that brought in substantial non-dilutive funding. Michaud expressed Horizon’s pride in aiding emerging companies like Avalo in reaching their financial targets and wished them future success.

Avalo Enters into Agreement to Divest AVTX-800 Series

September 12th, 2023

On September 12, 2023, Avalo Therapeutics, Inc. (AVTX) revealed that it has struck a deal to sell its rights, titles, interests, and assets related to AVTX-801 (D-galactose), AVTX-802 (D-mannose), and AVTX-803 (L-fucose)—collectively known as the 800 Series—to AUG Therapeutics, LLC (AUG).

Under the terms of the purchase agreement, AUG will make an upfront payment of $150,000. For each compound in the 800 Series, contingent milestone payments of $15 million will be due to Avalo upon FDA approval of indications other than Rare Pediatric Disease, potentially totaling $45 million. If AUG secures any Priority Review Vouchers (PRVs) from the FDA and subsequently sells them, Avalo is entitled to receive up to 20% of the net proceeds from such sales, after deductions for selling costs. Furthermore, liabilities up to $150,000, incurred before the agreement date, will be assumed by AUG, who will also cover all future costs associated with the 800 Series from the agreement date onward.

This transaction is scheduled for completion in Q4 2023, subject to standard closing conditions and the acquisition of specific third-party consents.

Avalo’s CEO and Chairman, Dr. Garry A. Neil, expressed enthusiasm about the deal, anticipating that under AUG’s stewardship, the 800 Series programs targeting congenital disorders of glycosylation (CDGs) would progress to offer reliable treatments for patients. Dr. Neil emphasized that this sale aligns with Avalo’s strategic commitment to concentrating on immunology assets, believed to offer maximal value and potential for shareholders. He noted that the transaction would not only positively influence Avalo’s cash flow immediately but also conserve internal resources by offloading non-core assets, all while preserving significant future earnings potential for Avalo should the programs succeed.

Recent News Comments and Summary

Avalo Therapeutics, Inc. has recently made significant strides in its financial and operational spheres, underpinning a period of consolidation and positive prospects for future endeavors. An array of prudent strategic moves has allowed the company to strengthen its financial standing and concentrate resources on core developmental programs, enhancing its position in the competitive biotechnology market.

One of the pivotal financial achievements for Avalo has been the successful clearance of a substantial $35 million debt ahead of schedule, reinforcing the company’s commitment to financial health and stability. This elimination of debt serves not only as a testament to the diligent efforts of the Avalo team but also lays a robust foundation for accelerated growth and innovation. Such a move signals readiness to seize new opportunities and underscores Avalo’s dedication to transforming patient lives through addressing unmet medical needs in immunological diseases.

Moreover, Avalo’s insightful decision to enter into a purchase agreement with AUG Therapeutics, LLC, selling its 800 Series assets, further illustrates the company’s strategic focus. With an immediate upfront payment and the potential for significant future earnings dependent on FDA approvals and sales, this agreement ensures immediate positive cash flow and resource conservation. It reflects a strategic recalibration that allows Avalo to channel its focus and resources more intensively toward its prized immunology assets, which are perceived to harbor the greatest value and potential for shareholders.

Through these decisions, Avalo has not only boosted its cash flow but also retained a substantial upside potential, ensuring that it remains a significant beneficiary of the success of its divested programs under AUG’s management. These strategic divestitures allow the company to dedicate more of its intellectual and financial capital to its core assets in immunology, most notably its anti-LIGHT mAb (quisovalimab or AVTX-002) and BTLA agonist fusion protein (AVTX-008), which are believed to hold promising therapeutic potentials.

Risk Factors

Avalo Therapeutics, Inc. operates within the inherently volatile biotechnology industry, facing several risks typical to the sector.

Firstly, there is clinical trial risk. Avalo’s leading drug candidates, including AVTX-002 and AVTX-008, are still under development. Success in early-stage trials doesn’t guarantee later-stage effectiveness, and any clinical failure can lead to significant financial losses and a decrease in stock value.

Another substantial risk is regulatory approval. The FDA approval process for new drugs is stringent, and any delay, required modification, or rejection can significantly impact Avalo’s financial condition and market prospects.

Financial risk is also evident. Despite recent moves to improve financial health, Avalo is not yet profitable, with its revenues dependent on the successful development, approval, and commercialization of its drugs. Unexpected expenditures or revenue shortfalls can imperil its financial stability.

Furthermore, the company faces competition risk from other firms developing similar drugs or alternative treatments. The fast-paced nature of the biotech sector means that competitors might bring products to market more swiftly or effectively, influencing Avalo’s market share and profitability.

Lastly, market acceptance risk exists. Even if Avalo’s products secure regulatory approval, there’s no certainty that they will gain market acceptance among physicians, patients, or healthcare providers, affecting the company’s earnings and growth prospects.

These inherent risks underline the uncertainty and volatility involved in investing in or engaging with Avalo, necessitating careful consideration and due diligence by potential investors and partners.

Conclusion

In light of the recent strategic and financial advancements, Avalo Therapeutics is navigating through a promising trajectory of stability and focused growth. The elimination of debt and the smart divestiture of certain assets highlight a period of strategic consolidation, ensuring that the company is well-positioned to advance its core drug development programs. With a fortified balance sheet and a clear vision set on immunology assets, Avalo is not just solidifying its present standing but is also paving the way for future innovative breakthroughs and sustained growth. Investors and stakeholders can approach Avalo with renewed confidence, anticipating a phase of proactive developments and value creation. We will be keeping an eye on this one.

Statistics

Average Volume (3 months): 45.97M

Average Volume (10 days): 226.01M

Shares Outstanding: 20.25M

Implied Shares Outstanding: 62.87M

Float: 20.22M

Percentage Held by Insiders: 1.86%

Percentage Held by Institutions: 35.76%

Source: Yahoo Finance

Short Interest

Short Interest Ratio: 0.01 Days to Cover

Short Interest as a Percentage of Float: 4.89% (source: NASDAQ for short interest, Capital IQ for float)

Off-Exchange Short Volume: 100,253,825 shares (including Dark Pool volume, source: FINRA)

Off-Exchange Short Volume Ratio: 52.81% (source: FINRA, including Dark Pool volume)

Stock Exchange: NASDAQ

Share Price (as of 4:00 PM EDT): $0.15 (a decrease of $0.01 or -7.36%)

Share Price (as of 7:59:59 PM EDT): $0.16 (an increase of $0.01 or 8.48%) – After Hours

Day’s Trading Range: $0.15 to $0.22

52-Week Trading Range: $0.08 to $7.00

Source: FinTel

AVTX Daily Chart

It’s notable that the volume in the securities has seen a substantial increase and price action typically follows.

For more information visit:

H.C. Wainwright Conference Presentation September 2023

Disclaimer: The author of this article is not a licensed financial advisor. This article is intended for informational purposes only. It should not be considered financial or investment advice. We have not been compensated in any way for the mention of AVTX. We do not hold any form of equity in the securities mentioned in this article as of 10/15/2023. Always consult with a certified financial professional before making any financial decisions.