About Sirius XM Holdings Inc.

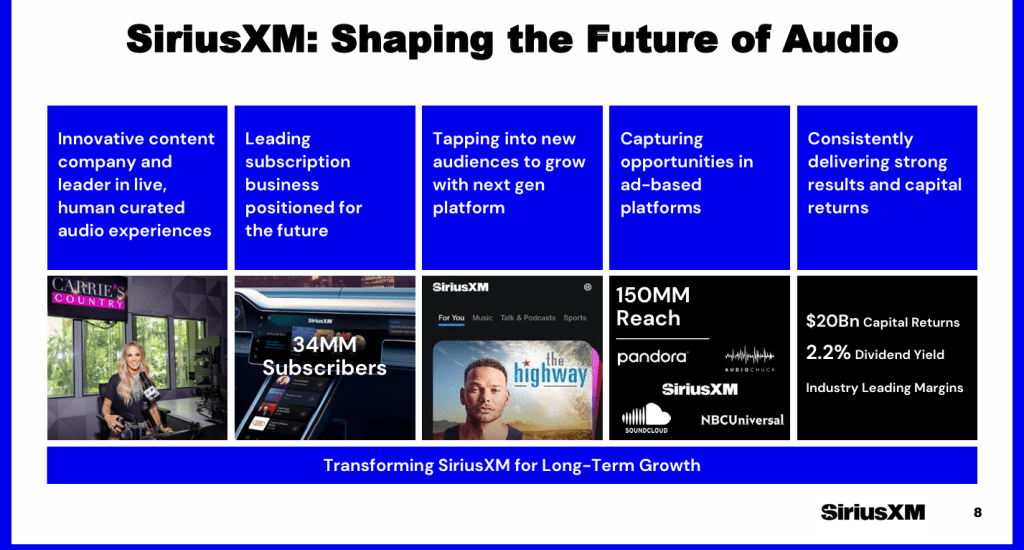

SiriusXM is the leading audio entertainment company in North America with a portfolio of audio businesses including its flagship subscription entertainment service SiriusXM; the ad-supported and premium music streaming services of Pandora; an expansive podcast network; and a suite of business and advertising solutions. Reaching a combined monthly audience of approximately 150 million listeners, SiriusXM offers a broad range of content for listeners everywhere they tune in with a diverse mix of live, on-demand, and curated programming across music, talk, news, and sports. For more about SiriusXM, please go to: www.siriusxm.com.

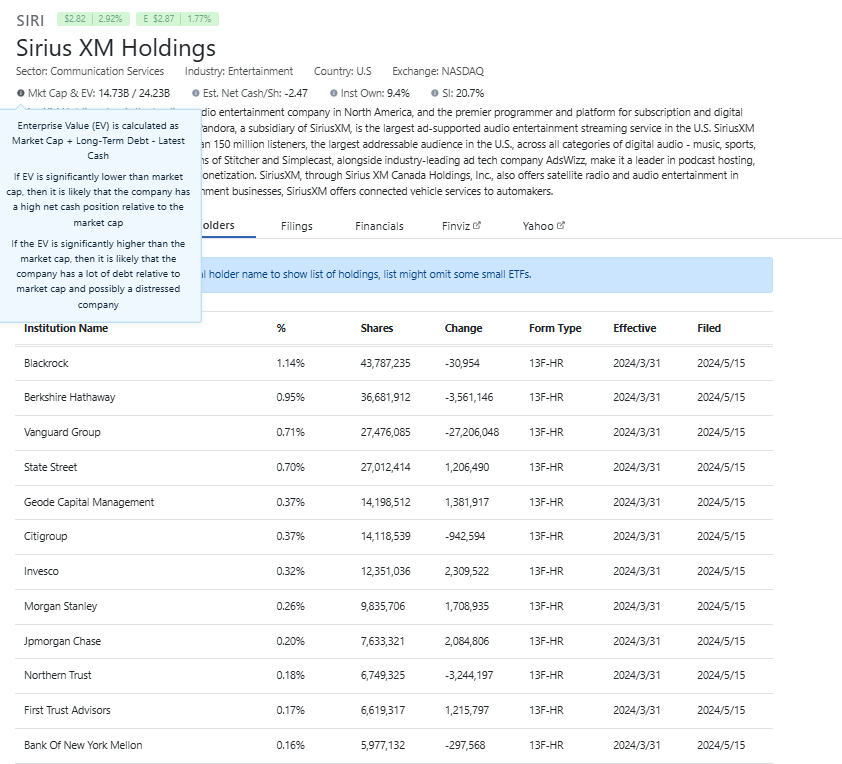

The first couple of things I notice when looking at the DilutionTracker.Com Information is:

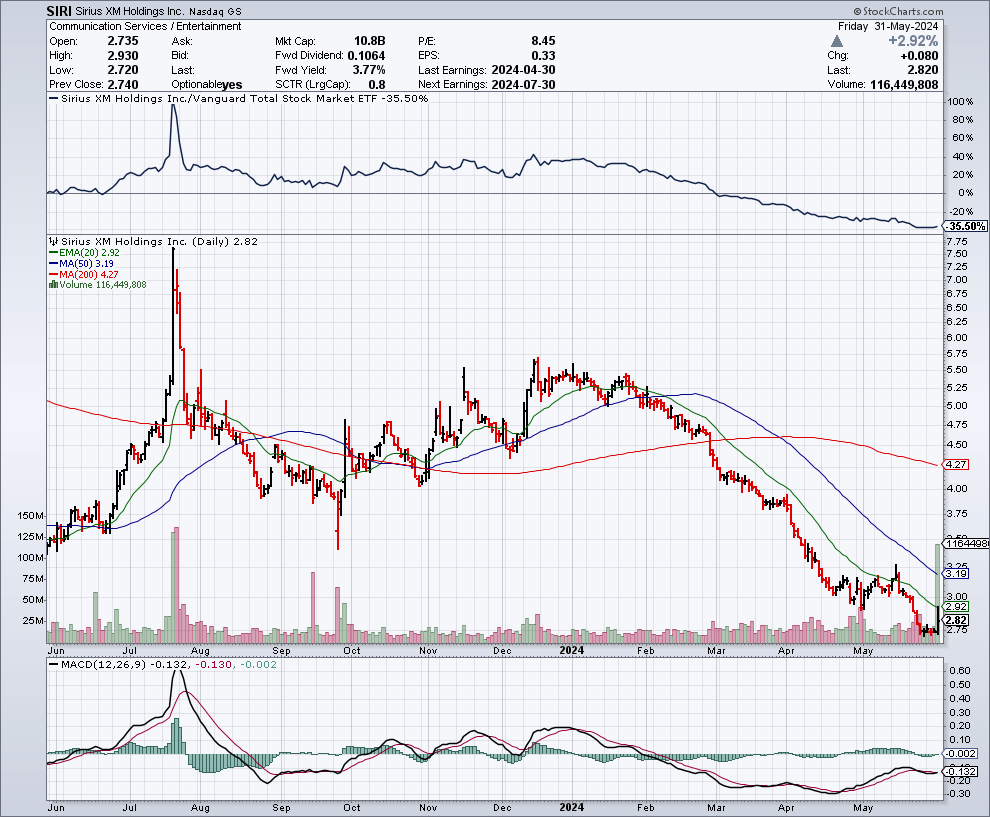

The market cap is $10b less than the enterprise value, suggesting potential upside.

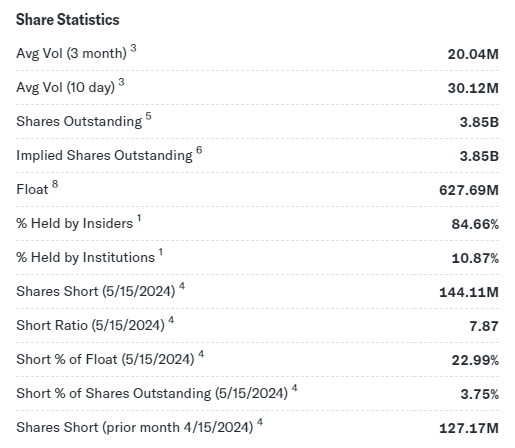

The second thing that stands out is a significant amount of short interest at an estimated 20.7% of the float. (See bull and bear cases below)

The Bear Case

The large short position in Sirius XM (NASDAQ: SIRI) reflects several bearish concerns among investors. Key factors include:

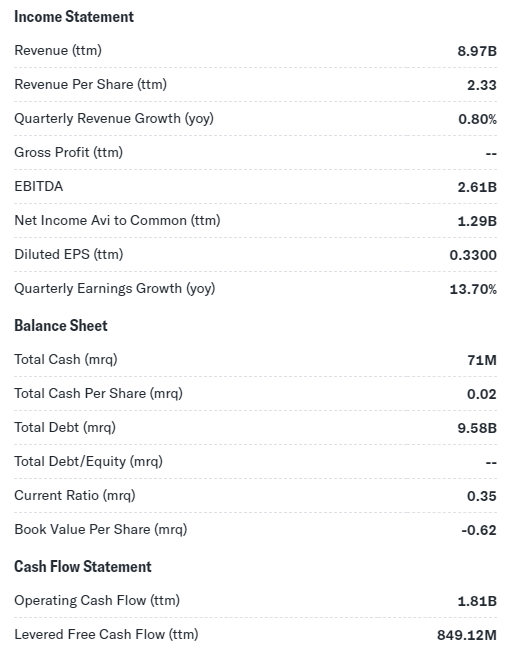

Revenue Growth Stagnation: Sirius XM’s revenue growth has been lackluster, with projections showing minimal increases and flat free cash flow despite cost-saving measures.

High Debt Levels: The company carries significant debt, raising concerns about its financial stability, especially if growth remains stagnant.

Competitive Pressures: The rise of streaming services and evolving media consumption habits pose challenges to Sirius XM’s traditional satellite radio model.

Dilution: Increase in outstanding shares. Currently around 3.85 billion.

These factors collectively contribute to the bearish outlook and substantial short interest in Sirius XM stock.

The Bull Case

The bull case for Sirius XM (NASDAQ: SIRI) revolves around several key factors:

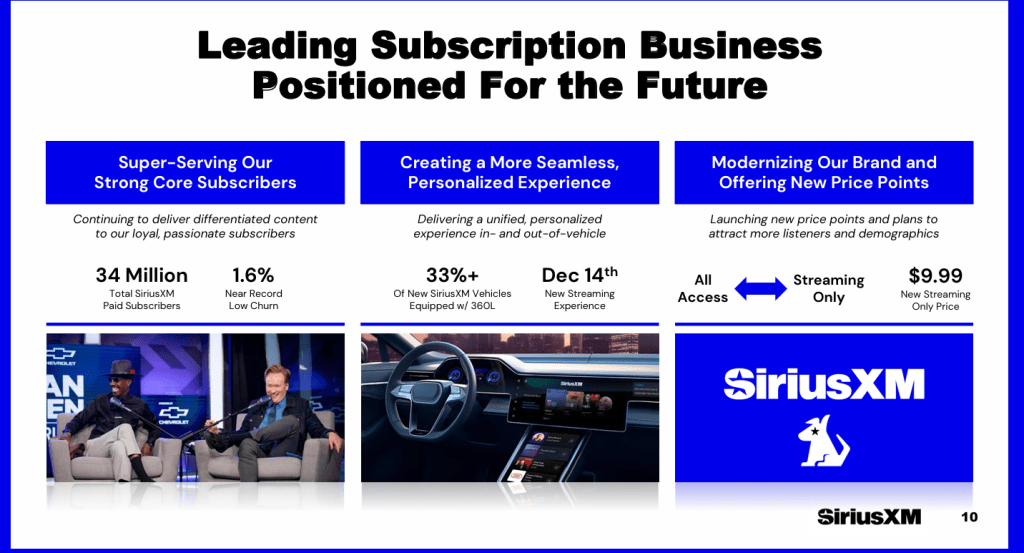

Stable Subscriber Base: Sirius XM maintains a loyal subscriber base of nearly 34 million, providing a steady revenue stream.

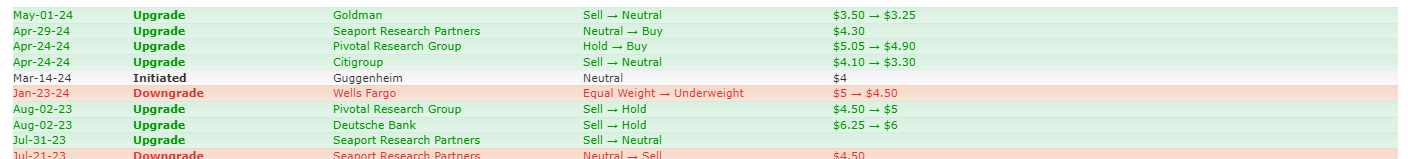

Analyst Upgrades: There has been a flurry of recent analyst upgrades.

Short Squeeze: There is substantial short interest in SIRI at a time when the company may be making a positive turn around.

Expansion into Podcasts: Investments in podcasts and exclusive content help diversify offerings and attract new audiences.

Partnerships and Integrations: Collaborations with automotive manufacturers like BMW and Lucid Group extend Sirius XM’s reach into new vehicle models.

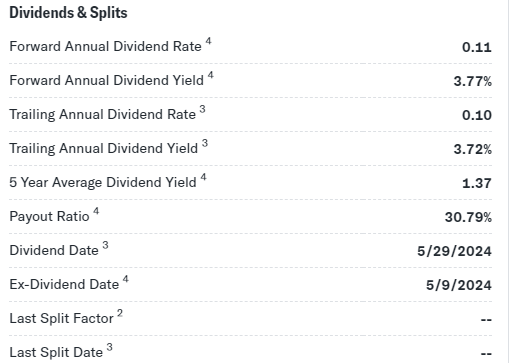

Free Cash Flow and Dividends: Strong free cash flow and increasing dividends reflect financial health and shareholder returns.

Market Position: As a dominant player in satellite radio, Sirius XM’s unique content delivery method differentiates it from traditional and streaming competitors.

Recent institutional Buying:

June 1, 2024

Boulder Hill Capital Management LP has recently acquired a new position in Sirius XM Holdings Inc. (NASDAQ SIRI). According to the company’s latest Form 13F filing with the Securities and Exchange Commission, Boulder Hill Capital Management LP purchased 452,100 shares of Sirius XM during the fourth quarter. This acquisition is valued at approximately $2,473,000.

Sirius XM now represents about 1.3% of Boulder Hill Capital Management LP’s portfolio, making it the firm’s 23rd largest holding.

This strategic investment highlights Boulder Hill Capital Management LP’s confidence in the potential growth and stability of Sirius XM Holdings Inc.

These factors support a positive outlook for Sirius XM despite current market challenges.

Financials, Statistics and Dividends

Source: Yahoo Finance

Source: Yahoo Finance

Source: Yahoo Finance

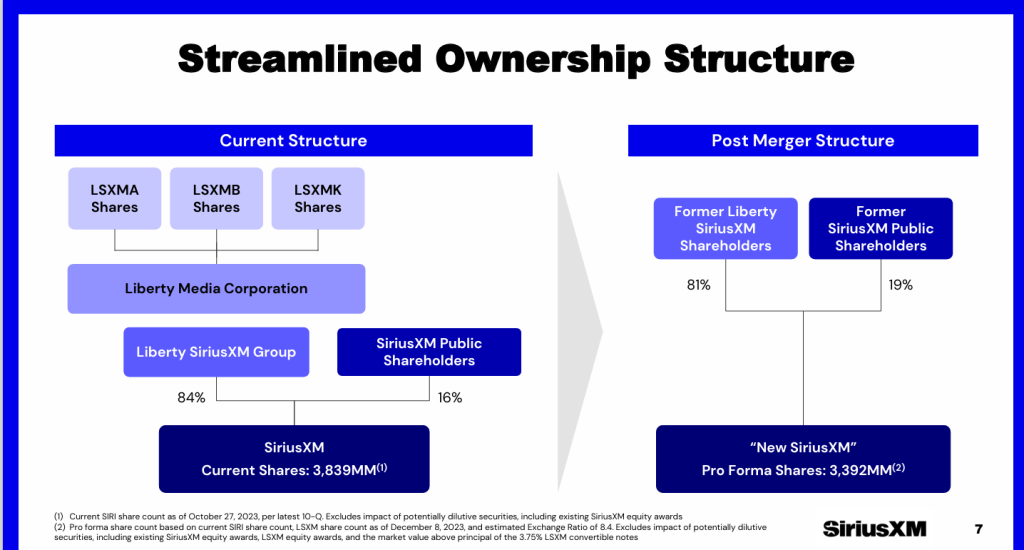

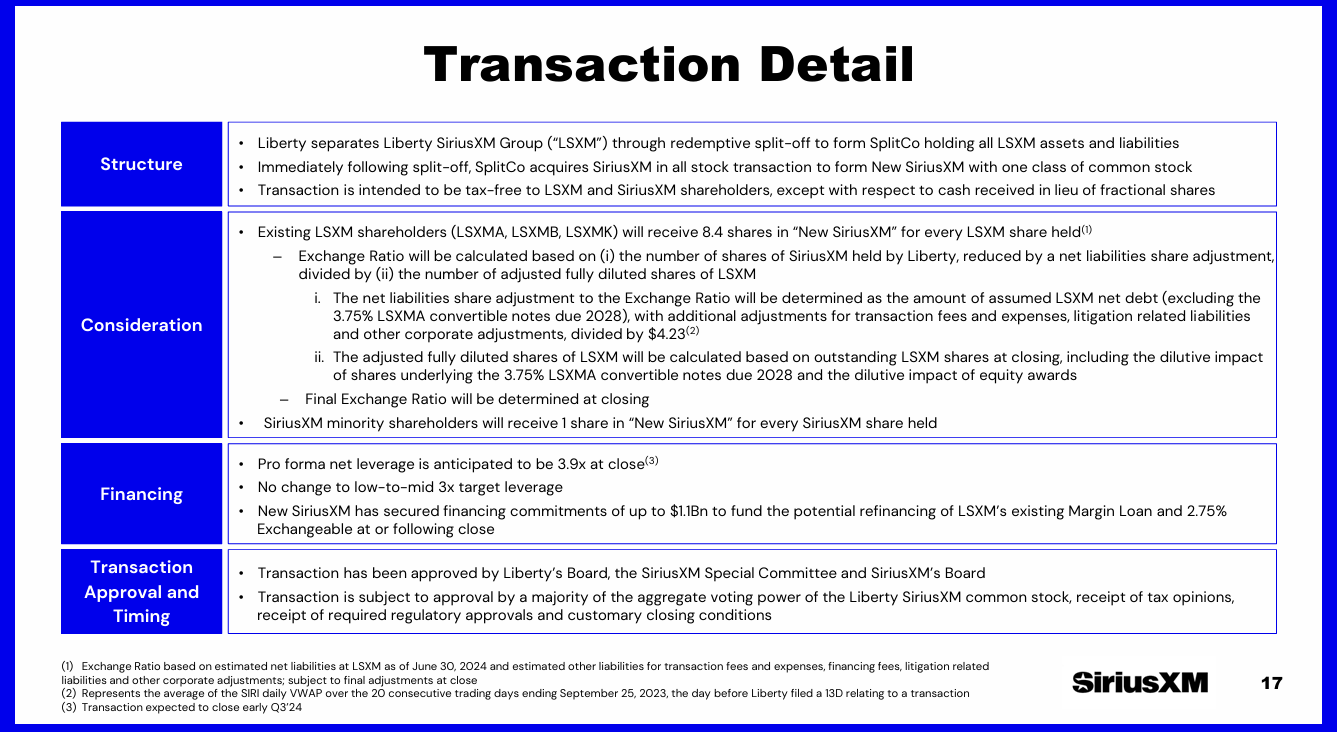

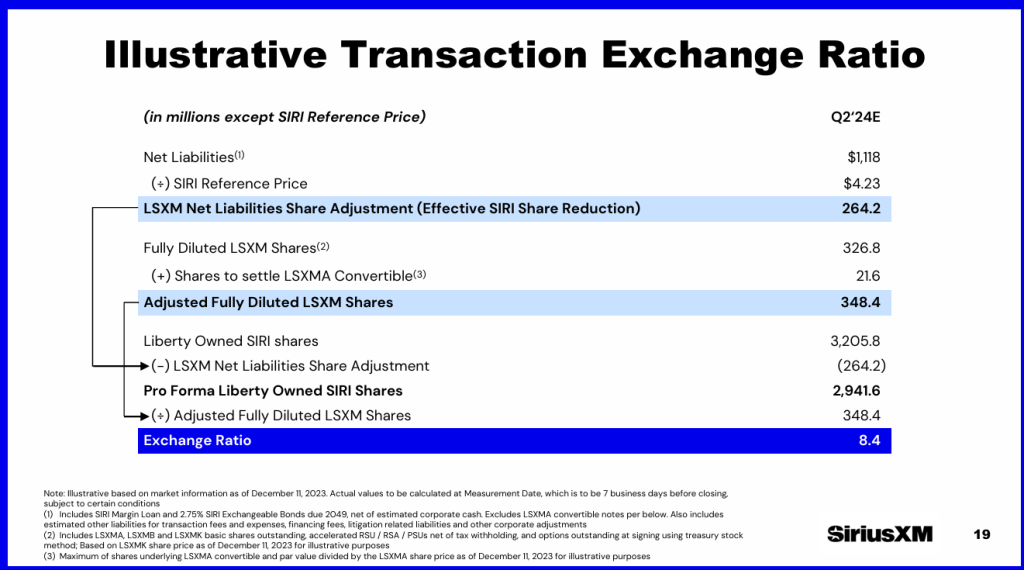

Sirius XM 12/2023 Investor Presentation Summary

Combining Liberty Media and Sirius XM

Overview

Sirius XM, a leading audio entertainment company in North America, is focused on delivering a wide range of audio content through its subscription service, Pandora, and a growing podcast network. The company aims to create personalized audio experiences, leveraging its extensive content and strategic partnerships.

Financial Performance

Revenue and Earnings:

Sirius XM reported stable revenues of approximately $8.95 billion for 2023, driven by its large and loyal subscriber base.

The company maintained strong earnings before interest, taxes, depreciation, and amortization (EBITDA), showcasing efficient operational performance.

Free Cash Flow:

Strong free cash flow generation supports ongoing investments and returns to shareholders through dividends and share buybacks.

Growth Strategies

Content Expansion:

Investments in exclusive content, including high-profile podcasts and strategic collaborations, enhance Sirius XM’s competitive edge.

Notable partnerships with automotive manufacturers like BMW and Lucid Group extend its reach in the automotive sector.

Technological Advancements:

Innovations like SXM Media’s AudioID aim to deliver personalized advertising experiences, boosting ad revenue potential.

Improvements in user interfaces and experiences across apps and in-car systems aim to increase user engagement and satisfaction.

Market Position and Opportunities

Dominant Market Position:

Sirius XM holds a strong market position with nearly 34 million subscribers, indicating high customer loyalty and broad audience reach.

Expansion Opportunities:

Strategic acquisitions, such as the purchase of Team Coco Digital from Conan O’Brien, and the expansion of Pandora in new car models aim to attract new listener segments and demographics.

Risk Management

Financial Stability:

Despite high debt levels, Sirius XM’s consistent free cash flow and strategic debt management ensure financial stability.

Competitive Landscape:

The company differentiates itself from streaming services through unique content and technological innovations.

Future Outlook

Sirius XM aims to sustain its growth by focusing on content differentiation, expanding its automotive market presence, and leveraging technological advancements to enhance user experiences and ad revenues. The company’s strong cash flow and strategic investments are expected to support these growth initiatives.

For detailed insights and specific financial figures, the full presentation can be accessed on the SiriusXM investor relations website.

SIRI Daily Chart – The RSI (14) is Flashing Oversold at 36

Conclusion

Sirius XM Holdings Inc. stands as a formidable entity in the audio entertainment industry in North America, leveraging a robust portfolio that includes subscription services, streaming platforms, and a wide array of exclusive content. Despite challenges such as stagnant revenue growth, high debt levels, and significant competitive pressures, the company’s strong subscriber base, strategic partnerships, and investments in content diversification and technological innovations position it well for future growth. The company’s ability to generate substantial free cash flow supports ongoing shareholder returns and financial stability. While market sentiment remains mixed, with both bullish and bearish perspectives, Sirius XM’s commitment to expanding its market presence and enhancing user experiences underscores its potential for continued growth.

Risk Factors

Investing in Sirius XM Holdings Inc. (NASDAQ: SIRI) involves a number of risks that potential investors should carefully consider. These risk factors include, but are not limited to, the following:

1. Revenue Growth Stagnation

Flat Revenue and Cash Flow: Sirius XM has experienced minimal revenue growth and flat free cash flow in recent years. This stagnation poses a risk to future profitability and may limit the company’s ability to reinvest in growth initiatives.

2. High Debt Levels

Financial Leverage: The company carries a significant amount of debt. High leverage increases financial risk, especially in a low-growth environment, and may constrain the company’s financial flexibility.

Debt Servicing: Large interest payments could impact the company’s ability to fund other strategic initiatives and return value to shareholders.

3. Competitive Pressures

Streaming Services: The rise of various streaming services such as Spotify and Apple Music presents substantial competition, potentially eroding Sirius XM’s market share.

Changing Consumer Preferences: Evolving media consumption habits, especially among younger demographics, may reduce demand for Sirius XM’s traditional satellite radio services.

4. Market Sentiment and Analyst Downgrades

Price Target Cuts: Analysts have repeatedly lowered their price targets for Sirius XM, reflecting broader pessimism about the company’s future performance.

Stock Volatility: High short interest (20.7% of the float) can contribute to increased stock price volatility and may reflect underlying investor concerns.

5. Technological and Operational Risks

Technological Innovation: Rapid advancements in technology require continuous investment. Failure to innovate could render Sirius XM’s services obsolete or less competitive.

Operational Disruptions: Dependence on satellite technology poses risks of service disruptions, which could affect customer satisfaction and retention.

6. Regulatory and Legal Risks

Regulatory Changes: Changes in regulations related to broadcasting and telecommunications could impact Sirius XM’s operations and profitability.

Litigation: The company may face legal challenges, including intellectual property disputes, which could result in significant legal costs and settlements.

7. Dependence on Automotive Industry

Automotive Partnerships: Sirius XM relies heavily on partnerships with automotive manufacturers for distribution. Any downturn in the automotive industry or changes in these relationships could negatively affect subscriber growth.

Integration in New Models: Delays or challenges in integrating Sirius XM’s services into new vehicle models could impact market penetration and revenue.

8. Content Acquisition and Retention

Cost of Content: Acquiring and retaining high-quality, exclusive content is expensive. Rising content costs could pressure margins and profitability.

Content Relevance: The ability to consistently provide relevant and appealing content is crucial for subscriber retention. Failure to do so could result in subscriber churn.

9. Macroeconomic Factors

Economic Downturns: Economic recessions or downturns could lead to reduced consumer spending on discretionary services like satellite radio, affecting Sirius XM’s subscriber base and revenue.

Interest Rate Increases: Rising interest rates could increase borrowing costs for the company, affecting net income and cash flow.

These risk factors, individually or collectively, could materially affect Sirius XM’s business operations, financial condition, and stock price. Investors should consider these risks in conjunction with other information presented in this report when making investment decisions.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer and About Us

Best Growth utilizes a revolutionary fusion of AI-powered analytics and human-led research to distill the vast and complex world of stock trading down to its purest essence. Our proprietary AI, meticulously designed to perform both fundamental and sentiment analysis, scrutinizes an extensive array of data points and trends, providing deep, insightful, and timely market perspectives. This technology operates in concert with our seasoned research team, who apply years of industry knowledge and expertise to refine our AI’s results. The culmination of this unique blend of cutting-edge technology and human expertise is the weekly issuance of one to two stock ideas, carefully selected to offer what we believe will yield the most substantial near-term results (a few days to a few months), thus paving the way for intelligent trading that delivers tangible value. Available exclusively by email or SMS/text message via our newsletter.

Best Growth is your ultimate destination for reliable and insightful stock news and analysis. We are dedicated to providing you with the latest updates and in-depth coverage of the world’s most promising growth stocks. Our experienced financial experts and market analysts work tirelessly to bring you the most accurate and up-to-date information.

At Best Growth, we understand that the investing world can be complex and intimidating. That’s why our primary goal is to simplify the process for you, offering easy-to-understand news articles, market reports, and expert commentary. Whether you are a seasoned investor or just starting your journey in the stock market, we strive to cater to your needs by presenting information in a clear and concise manner.

Our commitment to excellence extends to the quality of our content. We pride ourselves on delivering accurate, objective, and fact-based news and analysis. Our team follows a rigorous editorial process to ensure the highest standards of journalistic integrity.

At Best Growth, we believe in the power of knowledge and education. We go beyond simply reporting stock news; we provide third-party educational resources and investment guides to help you navigate the complexities of the market. We aim to empower you with the knowledge and tools necessary to achieve your financial goals.

We also understand that time is of the essence when it comes to stock analysis and news. That’s why we offer a user-friendly platform that ensures you have quick and easy access to the latest information. be sure you are subscribed to our newsletter and text alerts. Whether you prefer browsing our website or accessing our content through our free or premium subscription, we strive to make your experience seamless and convenient.

We value our community of readers and investors, and we encourage active engagement and participation. Feel free to share your thoughts and contribute to the discussions on our platform (coming soon). We believe that a vibrant and diverse community of investors can enhance the learning experience for everyone involved.

Thank you for choosing Best Growth as your go-to source for reliable stock news and analysis. We are committed to serving you with excellence and helping you stay ahead in the dynamic world of investing. Join us on this exciting journey toward financial growth and prosperity!

Disclosure: The author is not a licensed financial advisor and the content provided is for informational purposes only. Always consult with a certified financial advisor before making investment decisions. Best Growth has not been compensated in any way for the mention of SIRI and we do not hold any form of equity in SIRI.