Overview and Technology

Richtech Robotics (NASDAQ: RR) is a Nevada-based company specializing in collaborative robotic solutions, primarily targeting the service and healthcare sectors. The company’s flagship product, ADAM, is an advanced AI-driven service robot that performs a variety of tasks, including beverage service in hospitality and food service settings. ADAM’s advanced AI enables it to execute complex tasks with human-like precision, making it adaptable across multiple industries such as bars, cafes, and stadiums.

Beyond hospitality, Richtech has expanded into healthcare with the launch of Medbot, an elevator-enabled delivery robot designed to streamline pharmacy operations by securely delivering medications 24/7. Medbot operates with high accuracy, allowing healthcare workers to focus on more critical tasks.

Competitors

Richtech Robotics competes with other robotics companies that focus on service industry automation, such as Bear Robotics and Miso Robotics. Bear Robotics’ Servi robot is a direct competitor to ADAM, serving in restaurant and hotel environments, while Miso Robotics’ Flippy targets the kitchen automation space.

In the healthcare sector, competitors include Aethon, which manufactures the TUG robot that automates the transport of medications, meals, and linens in hospitals.

Advantages Over Competitors

Richtech Robotics distinguishes itself through:

Versatility and Scalability: ADAM’s ability to function in diverse settings such as MLB stadiums, ghost kitchens, and cafes offers significant scalability. Its AI-driven, human-like interaction capabilities elevate customer experiences beyond simple automation (Richtech Robotics).

Healthcare Focus: Medbot’s integration into healthcare is a strategic move, addressing labor shortages and operational inefficiencies that plague the industry. Medbot’s unique elevator integration and continuous operation give it an edge in efficiency and versatility over these competitors.

Collaborative Partnerships: Strategic partnerships, such as the one with Ghost Kitchens International, provide significant growth opportunities, with plans to deploy ADAM in 240 locations.

Potential Catalysts

Several potential catalysts could drive Richtech’s growth.

Further Deployment of ADAM: The successful rollout of ADAM across all 240 planned Ghost Kitchens locations will demonstrate the robot’s scalability and improve operational efficiencies.

International Expansion: Richtech’s partnership with Ghost Kitchens includes pilot expansions into Europe, Asia, and India, which could substantially increase its market reach.

New Healthcare Partnerships: Medbot’s success in healthcare facilities could attract more contracts with hospitals and clinics facing labor shortages, expanding the product’s adoption.

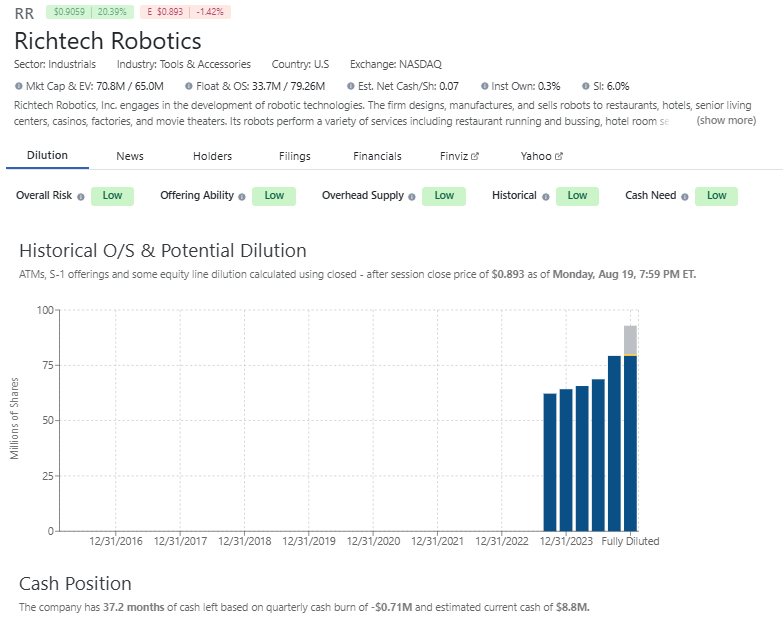

Estimated Share Structure, Institutional Ownership, Short Interest, Cash Position, and Cash Runway

As of 08/19/2024

source: dilutiontracker.com

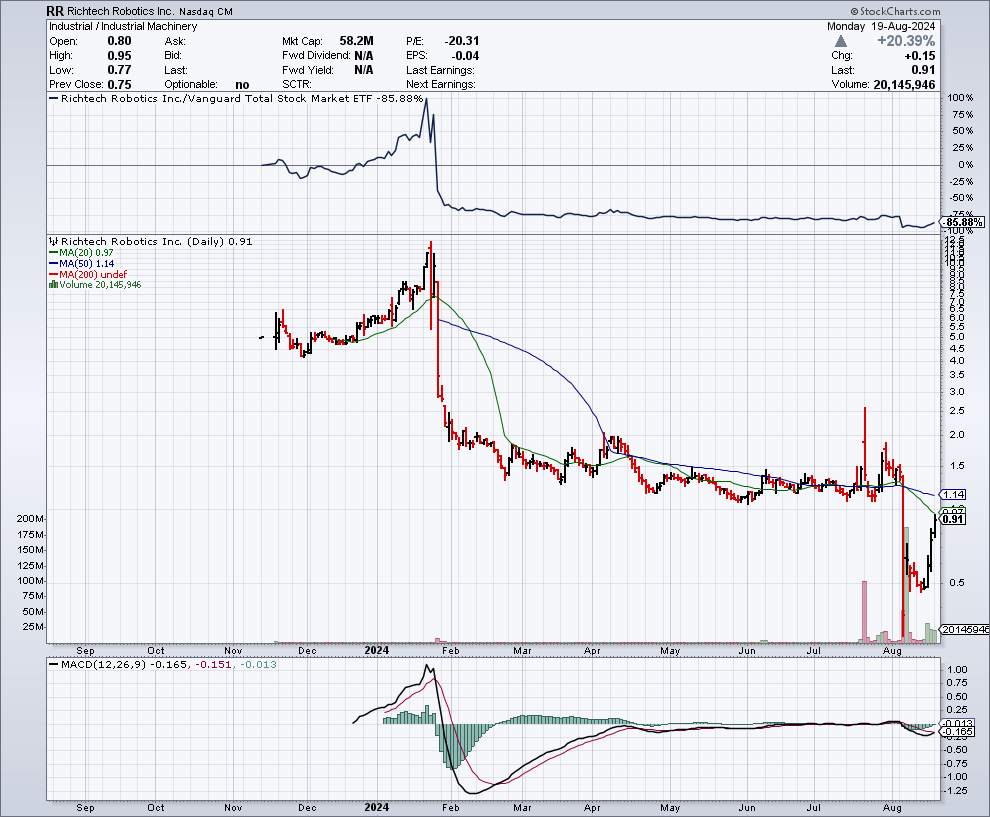

Chart (08/19/2024)

source: stockcharts.com

As of August 19, 2024, Richtech Robotics (RR) closed at $0.91 per share.

Support and resistance zones.

Support Levels

$0.75 – $0.78: This zone was established after the price bounced from this level multiple times in early August. It represents strong buying interest and is currently a major support level.

$0.60 – $0.62: This level served as support during mid-August, marking the recovery after a significant decline earlier in the month. If the price breaks through the higher support, this is the next key area to watch.

Resistance Levels

$1.00 – $1.03: The $1 mark is a critical psychological and technical resistance level. The stock recently approached this area but failed to break through, indicating strong selling pressure.

$1.25 – $1.30: This zone provided resistance in late July and early August and is another significant barrier if the stock manages to break the $1.00 mark. A move above this level could indicate a bullish reversal.

Trend Overview

Short-Term Trend: The stock has been highly volatile, with recent sharp price movements. After a steep decline from over $1.50 in early August, it recovered slightly and is now testing its resistance zones.

Volume Considerations: Recent trading has shown increased volume, particularly during the upward price moves, suggesting strong buying interest. However, selling pressure remains near resistance levels.

In summary, Richtech Robotics is currently trading between key support and resistance levels, and the stock may experience further volatility. Traders should watch the $1.00 resistance zone closely, as breaking it could signal further gains. Conversely, a drop below $0.75 could lead to a retest of the $0.60 support zone.

Conclusion

Richtech Robotics (NASDAQ: RR) is strategically positioned to capitalize on the growing demand for automation across both the service and healthcare sectors. With its flagship AI-driven robot, ADAM, and the newly launched Medbot, Richtech has showcased impressive versatility and scalability. The company’s strategic partnerships with Ghost Kitchens and its planned expansion into international markets offer significant growth potential. Moreover, Richtech’s ability to address labor shortages in critical industries, such as healthcare, through innovative solutions like Medbot, positions it as a leader in robotics technology. As these partnerships develop and the company’s product lines expand, Richtech Robotics is poised to see increased adoption across multiple industries. Watch that key resistance level at $1.00 to $1.03/share. Richtech Robotics will remain on Best Growth Stocks watch list for the foreseeable future.

For more information about Richtech Robotics, Inc. (NASDAQ: RR)

There is some good info on their Twitter/X page.

Key Risk Factors

Market Volatility: Richtech Robotics has experienced considerable volatility in its stock price. With recent swings between $0.60 and over $1.50, the company remains susceptible to fluctuations based on market sentiment and news events. Investors should be cautious of continued volatility (Stock Analysis).

Execution Risk: The successful deployment of ADAM across all planned Ghost Kitchens locations and the expansion into international markets are critical to Richtech’s growth. Any delays or issues in execution could negatively impact the company’s financial performance and stock price (Richtech Robotics).

Competitive Pressure: Richtech faces strong competition from established robotics companies like Bear Robotics and Aethon. If competitors introduce more advanced technology or secure key partnerships, it could limit Richtech’s market share (Richtech Robotics).

Financial Health: While Richtech has made strides in revenue growth, it is still operating at a loss. Continued negative earnings and cash flow issues could limit the company’s ability to invest in R&D and expand its operations, potentially leading to the need for further dilution or debt (Stock Analysis).

Regulatory and Operational Risks: Expanding into international markets introduces new regulatory and operational challenges. Richtech must navigate different regulations in healthcare and service industries across various regions, which could slow down expansion efforts or increase operational costs (Richtech Robotics).

Investors should weigh these risk factors carefully against the company’s growth prospects to make informed decisions.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: The author of this article is not a licensed financial advisor. This article is intended for informational purposes only. It should not be considered financial or investment advice. We have not been compensated in any way for the production or distribution of this article. We do not hold any form of equity in the securities mentioned in this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.