Company Description

MicroCloud Hologram Inc. engages in the research and development, and application of holographic technology. MicroCloud Hologram technology services include holographic light detection and ranging (LiDAR) solutions based on holographic technology, holographic LiDAR point cloud algorithms architecture design, technical holographic imaging solutions, holographic LiDAR sensor chip design, and holographic vehicle intelligent vision technology to service customers that provide holographic advanced driver assistance systems (ADAS). MicroCloud Hologram provides its holographic technology services to its customers worldwide. MicroCloud Hologram also provides holographic digital twin technology services and has a proprietary holographic digital twin technology resource library. MicroCloud holographic digital twin technology resource library captures shapes and objects in 3D holographic form by utilizing a combination of holographic digital twin software, digital content, spatial data-driven data science, holographic digital cloud algorithm, and holographic 3D capture technology.

MicroCloud Hologram

MicroCloud Hologram Inc. (NASDAQ: HOLO) is a company that specializes in the research, development, and application of holographic technology. The company was founded in 2020 and is headquartered in New York, NY.

Proprietary Technology

The company’s proprietary technology was protected by a series of intellectual property rights: including 22 holographic chip design patents, mainly involving digital twin visual imaging, 6D action capture, digital image collection and other related technologies; 312 holographic software copyrights, mainly Involving holographic quantum dynamics, holographic digital light field, 6D panoramic display, digital twin world application system, virtual human, naked eye 6D dynamic imaging control system, etc.; 183 holographic patents and 1695 holographic content copyright works.

Expansion and Business Segments

MicroCloud Hologram has been expanding into new products like virtual holographic human beings, which can answer a variety of questions, similar to ChatGPT. The company has also made a foray into healthcare, providing treatments for patients with functional disorders. In November 2023, MicroCloud Hologram announced that it was providing a Generalized Streaming Media Control System (CMS) for China’s largest new energy vehicle company, which is expected to bring a breakthrough in the new energy vehicle business.

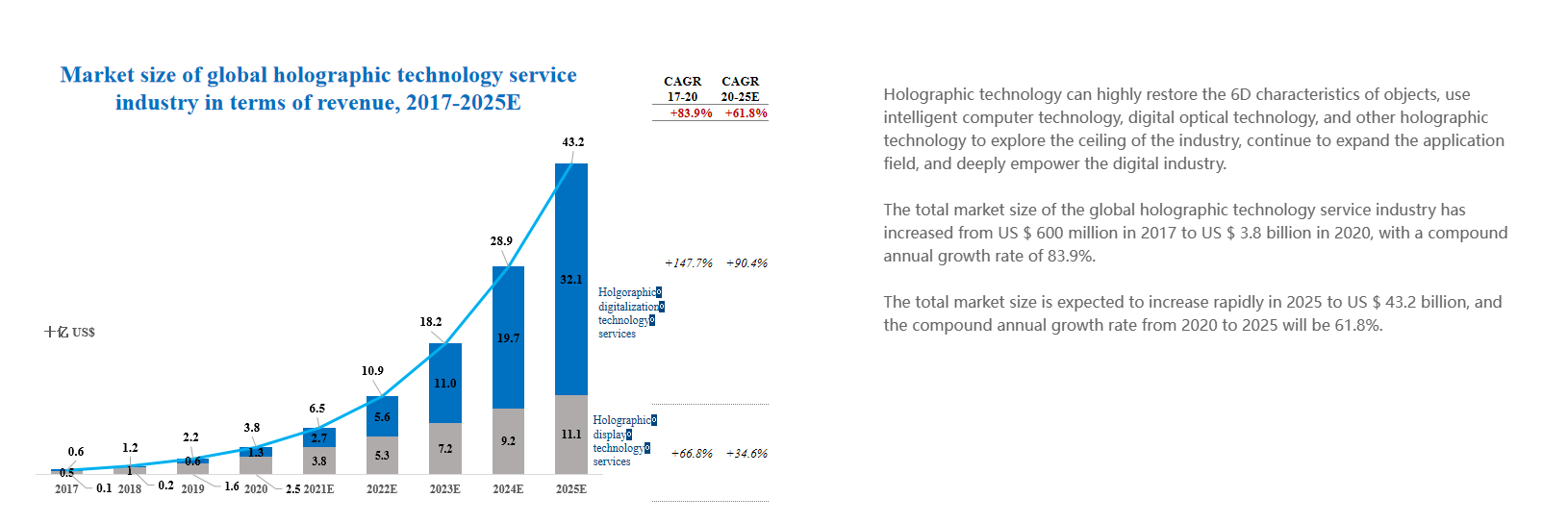

As of the current date, there are no available analyst ratings or price targets for HOLO. Despite the competition from big US-based tech companies, there is substantial potential for the company in the fast-growing holographic market. The holographic AR market, which MicroCloud Hologram is a part of, is expected to reach a market scale of hundreds of billions. The development of the holographic AR industry is strongly supported by government policies at all levels. The upgrade of advanced technology 6G and AI is expected to boost the scale of the industry.

In addition to its healthcare expansion, MicroCloud Hologram has also been working with government agencies and software developers. In November 2023, the company announced a partnership with China’s largest new energy vehicle company, which is expected to bring a breakthrough in the new energy vehicle business.

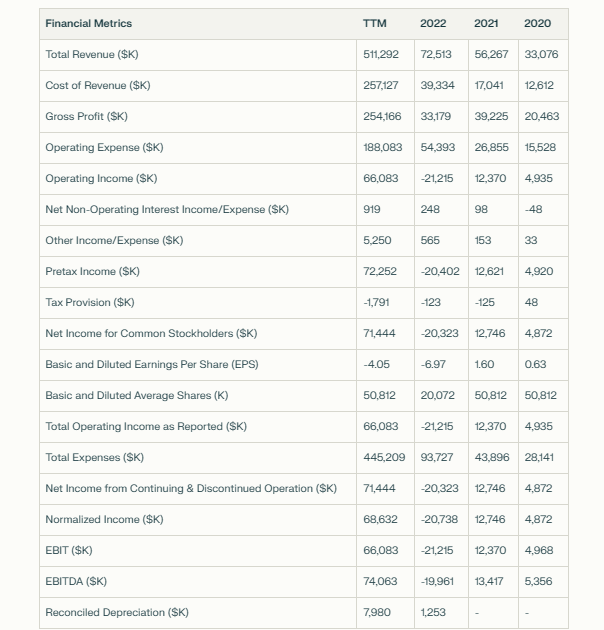

Financial Results

All numbers are presented in thousands (K) and the time frame specified as the trailing twelve months (TTM) and fiscal years ending on December 31st for the years 2022, 2021, and 2020.

Source: Yahoo Finance

The Market Size and Growth

Source: Company Website

Share Structure, Estimated Current Cash Position, and Runway

Source: DilutionTracker

HOLO Current Stock Chart

HOLO has seen a significant increase in trading volume following oversold conditions with a current residual strength index of 34.93. We could speculate that near-term upside on a technical level is in the cards.

For more information on MicroCloud Hologram visit:

IR Website: http://ir.mcholo.com/

Website: http://www.mcholo.com/index.html

Conclusion

MicroCloud Hologram Inc. represents a pioneering force in the rapidly evolving field of holographic technology. The company’s robust portfolio of intellectual property, including patents and copyrights, positions it as a leader in innovations such as holographic LiDAR solutions, digital twin technology, and virtual holographic applications. MicroCloud’s expansion into healthcare and partnerships with key players in the new energy vehicle sector underscore its versatile application of holographic technology and its commitment to addressing diverse market needs.

The company’s financial growth, as reflected in the trailing twelve months and recent fiscal years, demonstrates solid progress and potential for future success. This growth, combined with the expanding market for holographic AR technology, expected to reach hundreds of billions, presents significant opportunities for MicroCloud Hologram. The company’s involvement in sectors supported by government policies and the integration of advanced technologies like 6G and AI further amplify its prospects for substantial growth and industry leadership.

Investors and stakeholders should take note of MicroCloud Hologram’s innovative approach, strategic expansions, and strong financial performance as indicators of its promising future in the dynamic field of holographic technology. We will be keeping this one on our growth stocks watchlist for the foreseeable future.

Risk Factors

While MicroCloud Hologram Inc. exhibits strong potential, several risk factors must be considered:

Technological Evolution: The fast-paced nature of technological innovation means that MicroCloud must continuously evolve to stay ahead. Rapid changes in technology can render existing products obsolete and require substantial investment in research and development.

Market Competition: The holographic technology sector is becoming increasingly competitive, with major tech companies investing heavily. This competition could impact MicroCloud’s market share and pricing power.

Regulatory Environment: Changes in government policies, especially in key markets like the United States and China, could affect operational freedoms and profitability.

Intellectual Property Risks: While MicroCloud holds numerous patents, the risk of infringement or challenges to its intellectual property rights is a constant concern. Legal disputes could entail significant expenses and impact business operations.

Global Economic Conditions: Economic downturns or instability, particularly in key markets, could affect demand for holographic technology products and services.

Dependence on Key Partnerships: MicroCloud’s growth strategy relies on partnerships, such as with China’s new energy vehicle sector. Any disruption in these partnerships could adversely affect business prospects.

Financial Market Risks: As an entity listed on NASDAQ, MicroCloud is subject to market volatility. Fluctuations in stock prices can impact investor confidence and capital availability.

Technology Implementation in Healthcare: Expansion into healthcare involves stringent regulatory approvals and reliability standards. Delays or failures in meeting these standards could impact growth in this sector.

Investors should weigh these factors against MicroCloud Hologram’s growth potential and strategic positioning in the market to make informed decisions.

Your friend,

Steve Macalbry

Senior Editor, BestGrowthStocks.Com

Like this report? Be sure you’re receiving our Text/SMS notifications and be on top of our latest breakout and growth stock issuance.

Disclaimer: The author of this article is not a licensed financial advisor. This article is intended for informational purposes only. It should not be considered financial or investment advice. We have not been compensated for the creation or distribution of this article in any way. We do not hold any form of equity in the securities mentioned in this article as of 01/09/2024. Always consult with a licensed financial professional before making any financial decisions. Growth stocks are speculative in nature, and you could lose your entire investment.