Riot Platforms, Inc. (NASDAQ: RIOT), a prominent player in the Bitcoin (BTC) mining and data center hosting industry, has released unaudited production and operations updates for October 2023. These updates provide a comprehensive overview of the company’s performance during this period, shedding light on key metrics and significant developments.

In October 2023, Riot achieved remarkable progress in its Bitcoin production and operations:

Bitcoin Production: The company mined a total of 458 Bitcoins during the month, showcasing a substantial 26% increase compared to September 2023. However, there was a slight decline of 10% year-over-year.

Average Bitcoin Production per Day: The daily production rate also surged, averaging 14.8 Bitcoins per day, marking a 22% month-over-month increase but down by 10% compared to October 2022.

Bitcoin Holdings: Riot held 7,345 Bitcoins at the end of October 2023, reflecting a stable performance with no month-over-month change and an 8% year-over-year growth.

Bitcoin Sales: The company sold 440 Bitcoins during the month, indicating a substantial 29% increase compared to September 2023. However, sales were slightly down by 2% year-over-year.

Net Proceeds from Bitcoin Sales: Riot generated $12.5 million in net proceeds from Bitcoin sales in October, representing an impressive 39% month-over-month increase and a remarkable 44% year-over-year growth.

Average Net Price per Bitcoin Sold: The average net price per Bitcoin sold stood at $28,408, reflecting an 8% increase compared to September 2023 and a significant 47% surge compared to October 2022.

Deployed Hash Rate: Riot increased its deployed hash rate to 11.7 Exahashes per second (EH/s), marking an 8% month-over-month growth and an outstanding 71% year-over-year surge.

Deployed Miners: The company deployed a total of 106,674 miners during October, showcasing an 8% increase compared to September 2023 and a substantial 63% increase compared to October 2022.

Power Credits: Power credits for October 2023 amounted to $1.0 million, indicating a significant decrease of 91% compared to the previous month, reflecting fluctuations in power curtailment credits.

Demand Response Credits: Riot received $1.8 million in demand response credits during October, reflecting a 31% decline compared to September 2023. However, these credits remained impressive with a 261% year-over-year growth.

This robust performance in October was attributed to Riot’s strategic focus on expanding hash rate and optimizing mining operations. The company capitalized on cooler temperatures in Texas, allowing for increased mining operations and the generation of Power and Demand Response Credits. These credits equated to approximately 93 Bitcoins based on the average Bitcoin price for the month.

Furthermore, Riot shared its plan to continue improving hash rate by completing repairs to Building G, which had been damaged by severe winter weather in late December 2022. All replacement dry coolers for Building G had been received, and hash rate was expected to increase as installation of the remaining dry coolers progressed during November.

The company’s commitment to staying at the forefront of technological advancements in mining equipment was also highlighted. Riot’s partnership with MicroBT resulted in the adoption of the latest generation M60 series miner, reinforcing the company’s position as a leader in the industry.

Riot anticipates that by mid-2024, with the full deployment of its initial order of miners, its self-mining hash rate capacity will reach an impressive 20.2 EH/s.

In addition to these operational updates, Riot is scheduled to participate in several important conferences, including the 12th Annual Roth MKM Technology Event, the North American Blockchain Summit, and the Wells Fargo TMT Conference. The company recently reported its third quarter 2023 financial results on November 8th, providing further insight into its financial performance and growth trajectory.

Recent Earnings Released November 8th, 2023

Summary

Riot Platforms, Inc. (NASDAQ: RIOT), a prominent player in the Bitcoin (BTC) mining and data center hosting industry, has released its financial results for the third quarter of 2023. The quarter demonstrated significant progress in various aspects of the company’s operations, highlighting its commitment to growth and financial strength.

Financial Highlights:

Total Revenue: Riot reported total revenue of $51.9 million for the third quarter of 2023, compared to $46.3 million for the same period in 2022. This increase was primarily driven by a 6% rise in Bitcoin production and higher Bitcoin prices.

Bitcoin Production: Riot mined a total of 1,106 Bitcoins during the quarter, an improvement from the 1,042 Bitcoins mined during the same period in 2022. This increase was attributed to a significant expansion in the number of deployed miners.

Average Cost to Mine Bitcoin: Notably, the average cost to mine Bitcoin was negative ($6,141) during the third quarter, indicating efficient cost management and operational strength. In comparison, the cost was $8,227 per Bitcoin for the same period in 2022.

Power Curtailment Credits: Riot earned $49.6 million in power curtailment credits during the quarter, a substantial increase from $13.1 million in the same period in 2022.

Revenue Streams: The company’s revenue streams consisted of $31.2 million from Bitcoin mining, $5.1 million from data center hosting, and $15.5 million from engineering.

Net Loss: Riot reported a net loss of $(45.3) million, or $(0.25) per share, for the quarter, compared to a net loss of $(32.4) million, or $(0.21) per share, for the same period in 2022. The net loss included non-cash stock-based compensation expenses, depreciation, and charges related to Bitcoin impairment.

Non-GAAP Adjusted EBITDA: The Non-GAAP Adjusted EBITDA for the quarter was $31.6 million, compared to $4.3 million for the same period in 2022.

Operational Highlights:

Hash Rate Growth: Despite damage to Building G caused by severe winter weather in Texas in December 2022, Riot expects to reach a total self-mining hash rate capacity of 12.5 exahashes per second (EH/s) in the fourth quarter of 2023 as repairs to Building G progress. This growth aligns with the company’s expansion plans.

Long-term Purchase Agreement: Riot signed a long-term purchase agreement with MicroBT Electronics Technology Co., LTD, which included an initial order of 33,280 Bitcoin miners for its Corsicana Facility. This order has been updated to replace approximately 6,000 miners with MicroBT M66 miners. By mid-2024, Riot’s total self-mining hash rate capacity is expected to reach 20.2 EH/s, reinforcing its position in the industry.

ATM Offering: In August 2023, Riot initiated an At-the-Market (ATM) Offering, raising significant capital. During the third quarter and beyond, the company received substantial net proceeds from the sale of its common stock through this offering, providing additional resources for growth and operations.

Financial Position:

Working Capital: Riot maintained a robust financial position with $442.3 million in working capital, including $290.1 million in cash on hand, and 7,327 unencumbered Bitcoins, equating to approximately $197.6 million based on market prices as of September 30, 2023.

These resources enhance the company’s financial liquidity and strength.

Riot’s third-quarter results underscore its commitment to efficient Bitcoin mining, cost management, and strategic growth. The company’s financial and operational achievements position it as a leading low-cost producer of Bitcoin and bolster its ability to navigate the evolving landscape of cryptocurrency mining and energy transformation.

Bitcoin Price Trajectory

Bitcoin Price Surges 39% in a Month, Rare Buy Signal Emerges

The price of Bitcoin has witnessed an impressive 39% surge in the past month, with the cryptocurrency kingpin trading at $37,192.

A notable analyst, @el_crypto_prof, has brought attention to a rare buy signal appearing on the M-Chart for Bitcoin (BTC), a phenomenon last observed eight years ago. Simultaneously, Bitcoin has crossed above the SMA 20 line, heightening expectations of an unprecedented price surge, described by the analyst as “the biggest bull run ever.” The presence of institutional players in the market further bolsters this bullish outlook.

Bitcoin Price Prediction

Analyzing the 1-hour BTC/USD charts, the MACD indicator has shifted into the green zone, while the Relative Strength Indicator is trending upwards. These technical indicators suggest the potential for a significant price increase in the short term.

Multiple Catalysts on the Horizon

It’s worth noting that Bitcoin’s recent price surge coincides with the emergence of several catalysts that could further fuel a bullish case for the cryptocurrency. These developments include the rare buy signal, institutional participation, and favorable technical indicators, all pointing towards a potentially significant upward trajectory for Bitcoin’s price.

RIOT Daily Chart

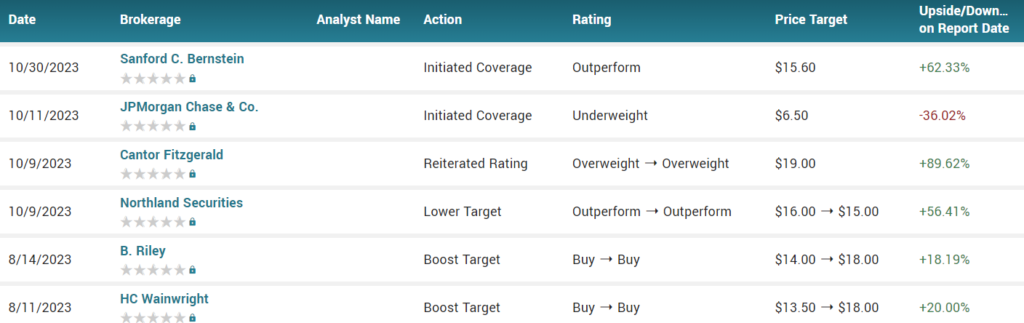

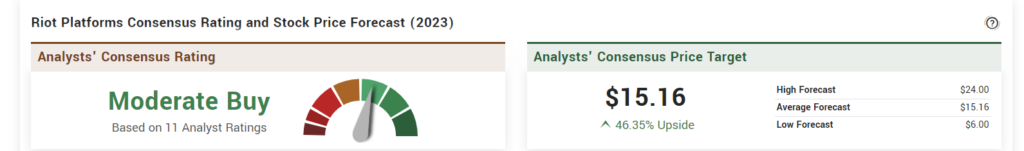

Analyst Ratings

Source: MarketBeat

Short Interest

Short Interest Ratio: 1.33 Days to Cover

Short Interest % Float: 18.51% (Source: NASDAQ – short interest, Capital IQ – float)

Off-Exchange Short Volume: 6,007,386 shares (Source: FINRA, including Dark Pool volume)

Off-Exchange Short Volume Ratio: 46.51% (Source: FINRA, including Dark Pool)

Source: FinTel

Conclusion

Growth Factors:

In conclusion, Riot Platforms, Inc. has showcased impressive growth in both its Bitcoin production and financial results for October 2023. The company’s proactive approach to expanding its hash rate, optimizing mining operations, and capitalizing on favorable market conditions has resulted in substantial achievements.

Increased Bitcoin Production: Riot achieved a significant 26% increase in Bitcoin production compared to the previous month, demonstrating its ability to adapt and thrive in the cryptocurrency market.

Strong Financial Performance: The company reported a remarkable 44% year-over-year growth in net proceeds from Bitcoin sales, reflecting its profitability and efficient cost management.

Technological Advancements: Riot’s commitment to technological advancements, exemplified by the adoption of the latest generation M60 series miner, positions it as a leader in the industry.

Hash Rate Expansion: The anticipated expansion of the self-mining hash rate capacity to 20.2 EH/s by mid-2024 further solidifies its competitive edge in the Bitcoin mining industry.

Risk Factors:

While Riot’s financial performance is commendable, it’s important to acknowledge potential risks:

Cryptocurrency Market Volatility: The cryptocurrency market is known for its inherent volatility, and factors such as regulatory changes, market sentiment shifts, and competition can impact the company’s profitability.

Fluctuating Power Credits: The company’s reliance on power credits is subject to fluctuations, as evident from the significant month-over-month changes. These fluctuations can affect Riot’s financial stability.

Demand Response Credits: Similarly, the demand response credits received by Riot can be subject to volatility, with a significant decline seen compared to the previous month.

Competition and Regulatory Changes: The evolving landscape of cryptocurrency mining and energy transformation is highly competitive and susceptible to regulatory changes that can impact Riot’s operations and profitability.

Final Thoughts

Despite these risks, Riot Platforms, Inc. appears well-positioned to capitalize on the opportunities presented by the cryptocurrency market. Its financial strength, commitment to growth, and strategic initiatives make it a notable player in the Bitcoin mining industry. Furthermore, the positive momentum in the price of Bitcoin, driven by rare buy signals and institutional participation, adds to the favorable outlook for both Bitcoin and companies like Riot Platforms. Riot will remain on our growth stocks watch list for the foreseeable future.

Also see September 2023 Investor Presentation

Your friend,

Steve Macalbry

Senior Editor, BestGrowthStocks.Com

Like this report? Timing is everything. Be sure you’re receiving our Text/SMS notifications and be on top of our latest issuance.

Disclaimer: The author of this article is not a licensed financial advisor. This article is intended for informational purposes only. It should not be considered financial or investment advice. We have not been compensated for the creation or distribution of this article in any way. We do not hold any form of equity in the securities mentioned in this article as of 11/12/2023. Always consult with a licensed financial professional before making any financial decisions. Growth stocks are speculative in nature, and you could lose your entire investment.