Overview

Bitfarms Ltd. is a vertically integrated Bitcoin mining company founded in 2017, headquartered in Brossard, Québec, Canada. Bitfarms operates 12 Bitcoin mining facilities across Canada, the United States, Paraguay, and Argentina, with one additional facility under development. The company is notable for its environmentally friendly operations, leveraging predominantly hydro-electric power and long-term energy contracts to ensure sustainable mining practices.

Bitfarms’ proprietary data analytics system enhances operational performance and uptime, contributing to its position as a leader in the Bitcoin mining sector. The company continues to expand its capabilities, aiming to significantly increase its hash rate and mining efficiency.

Current Operations and Strategic Initiatives

Bitfarms has been actively expanding its operations and improving its technological infrastructure. As of mid-2024, the company is on track to achieve its 2024 guidance of 21 EH/s and 21 w/TH, representing a substantial 223% increase in hash rate and a 40% improvement in efficiency (Bitfarms Ltd.) (Bitfarms Ltd.). This expansion includes developing a new 120 MW mining facility in the United States, which is expected to be a key growth driver going forward (Bitfarms Ltd.).

The company is also engaged in a strategic alternatives review process aimed at maximizing shareholder value. This process is being overseen by a Special Committee and is supported by financial and legal advisors from Moelis & Company LLC and Skadden, Arps, Slate, Meagher & Flom LLP, respectively (Bitfarms Ltd.).

Financial Performance (June 2023 – June 2024)

- Q1 2024: Bitfarms reported mixed results with revenue lagging estimates but managing to beat EPS projections. The company announced a notable increase in its power capacity at the Yguazu facility in Paraguay, doubling it to 200 MW (Bitfarms Ltd.).

- Annual General Meeting (May 2024): The company successfully held its AGM, where it addressed shareholder concerns and outlined future growth plans (Bitfarms Ltd.).

- Production Updates: Monthly updates have shown consistent growth in mining capacity and efficiency. As of May 2024, the company reported substantial progress in its expansion projects and efficiency upgrades (Bitfarms Ltd.).

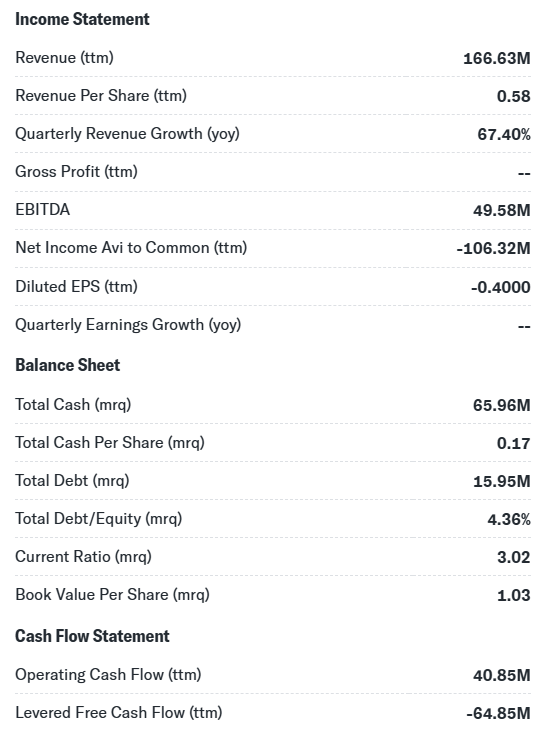

ttm = trailing twelve months

mrq = recent quarter

Source: YahooFinance

Situation with Riot Platforms

Riot Platforms Inc. has been aggressively pursuing an acquisition of Bitfarms, beginning with an unsolicited proposal in late May 2024. Riot initially offered to acquire all outstanding shares of Bitfarms at $2.30 per share, representing a 24% premium over Bitfarms’ one-month volume-weighted average share price (Riot Platforms).

Riot Platforms Ramps Up Its Pursuit of Bitfarms (BITF) with 14% Stake

Riot Platforms, known for its relentless Bitcoin mining efforts, is turning up the heat on Bitfarms, aiming to take over its rival one shareholder at a time. Riot now owns a hefty 14% of Bitfarms’ common stock, showing they’re not just here to mine Bitcoin but to mine a bit of corporate drama too.

Bitfarms, headquartered in Toronto, is not rolling over easily. Despite Riot’s $950 million takeover bid, Bitfarms is busy expanding its operations into the U.S., particularly in Pennsylvania, perhaps sending a cheeky message: “Catch us if you can!”

Meanwhile, BITF stock had a bit of a party, jumping to $3.03 per share and pushing Bitfarms’ market capitalization to $1.25 billion. Riot, on the other hand, was ready to start the day with its stock at $11.05, bringing its market cap to $3.2 billion. It’s like watching a heavyweight boxing match where the contenders keep bulking up between rounds.

In the midst of this, Bitfarms isn’t just passively resisting. They issued a press release accusing Riot of trying to spoil their strategic review process. Bitfarms assured everyone they’re all about maximizing shareholder value, but also slipped in a “poison pill” clause – a defense strategy where they’d issue new shares if Riot’s ownership hits 15%. It’s corporate chess with a bit of checkers’ unpredictability.

Both companies are in the Bitcoin mining business, which, for those unfamiliar, is essentially like running a bunch of supercomputers to solve complex puzzles for virtual gold. As Bitcoin prices have soared 52% in 2024, hitting over $67,000, the stakes are high, and so is the drama.

Despite the thrilling tussle, both companies have had a rocky 2024. Riot’s shares are down nearly 29%, while Bitfarms saw its price nearly halved before Riot’s swoop. Now, thanks to Riot’s unsolicited affection, Bitfarms is down just 1% for the year.

Last year, Riot brought in $280 million in revenue, overshadowing Bitfarms’ $200 million. But in the world of Bitcoin mining, it’s all about how many coins you’ve got. Riot holds a stash of 9,084 Bitcoins, valued at over $608 million, while Bitfarms, after a debt-reducing sell-off, holds about 3,349 Bitcoins.

In this game of digital thrones, Riot is making a bold play, but Bitfarms is standing its ground, adding new chapters to a saga that investors and Bitcoin enthusiasts are eagerly watching unfold.

And just for a dash of humor – as Bitfarms expands its U.S. presence, maybe Riot should send flowers along with their next offer. After all, every great romance starts with a bit of persistence and a touch of sweetness.

Potential Catalysts

- Completion of the 120 MW Facility: The development of this facility in the U.S. is poised to significantly boost Bitfarms’ mining capacity and operational scale (Bitfarms Ltd.).

- Strategic Partnerships or M&A: The ongoing strategic alternatives review process may lead to partnerships or acquisitions that could unlock significant shareholder value.

- Technological Advancements: Continued improvements in mining efficiency and capacity, driven by technological upgrades, will likely enhance Bitfarms’ competitive edge in the industry.

- Market Conditions: Fluctuations in Bitcoin prices and regulatory changes in key markets could impact Bitfarms’ financial performance and growth trajectory.

Dilution Tracker Information, Estimated Share Structure, Cash Position, Short Interest and Institutional Ownership