Significant News Update 04/30/2024: AGBA and Triller lay out plans post-merger.

Building a Digital Economy Titan: AGBA and Triller Combine in $4 Billion Merger

Executive Summary

AGBA Group Holding Ltd., a leading financial services company based in Hong Kong, and Triller Corp, a top AI-driven social video platform, have announced a definitive merger agreement that will position the combined entity as a $4 billion powerhouse at the forefront of digital content and financial services. This report delves into the strategic motivations, financial implications, and operational synergies of this merger, offering a comprehensive analysis that leverages information from company websites, investor presentations, and other industry data to provide an insightful overview of the future potential of the merged entity.

Company Overviews

AGBA Group Holding Ltd.

Founded in 1993, AGBA Group Holding Limited (NASDAQ: AGBA) serves as a one-stop financial supermarket in Hong Kong. It offers a wide array of services and products across its platform, distribution, healthcare, and fintech businesses to over 400,000 individual and corporate clients. Notably, AGBA has a substantial presence in the Guangdong-Hong Kong-Macao Greater Bay Area, providing access to over 1,800 financial products. This extensive reach and diverse service offering position AGBA as a pivotal player in Asia’s financial landscape.

Triller Corp

Triller Corp operates as a global AI-powered technology platform that revolutionizes the way creators interact with brands and their audiences. With over 500 million quarterly interactions across 436 million consumer accounts, Triller amplifies the presence of creators and brands on major social platforms through its AI technology, Amplify.AI. Its portfolio includes influential subsidiaries such as Triller Sports, FITE (a premier streaming service), and Thuzio (a B2B influencer event service).

Strategic Rationale for the Merger

Expansion and Innovation

The merger represents a strategic alignment that combines Triller’s innovative digital and AI capabilities with AGBA’s financial expertise. This fusion is anticipated to transform the digital ecosystem globally, leveraging Triller’s technological strengths and AGBA’s financial acumen to create a new benchmark in the integration of finance and media technologies.

Market Penetration and Growth

By merging, both entities aim to expand their market reach and capitalize on their existing user and client bases. Triller will benefit from AGBA’s established financial network in Asia to possibly introduce new monetization strategies, while AGBA can utilize Triller’s digital prowess to enhance its digital services and customer engagement.

Financial Synergies

The merger is expected to unlock significant financial synergies. For AGBA, leveraging Triller’s strong brand and creator relationships can enhance client offerings and potentially increase the company’s valuation through new digital revenue streams. Triller, on the other hand, gains a stable financial platform to fuel its growth strategies and innovation, enhancing its market positioning against competitors.

Financial Overview

The merger values the combined company at approximately $4 billion, with Triller shareholders owning 80% and AGBA shareholders owning 20% of the merged entity. This valuation reflects the robust potential for synergistic growth and earnings enhancement post-merger.

Leadership and Future Directions

Post-merger, the combined entity will be led by Bobby Sarnevesht as CEO of Triller and Wing-Fai Ng as Group CEO of AGBA. The leadership is positioned to drive the company towards accelerated innovation and market expansion, focusing on leveraging AI in digital content and expanding financial service offerings in new markets.

Merger Summary

The merger between AGBA and Triller is poised to redefine the landscapes of digital media and financial services. By harnessing the strengths of both companies, the combined entity not only anticipates significant growth and market expansion but also sets a new standard for innovation at the intersection of technology and finance. This strategic move is expected to create substantial value for stakeholders and redefine competitive dynamics in both sectors.

User Growth and Metrics for Triller

Triller has experienced significant growth in user engagement, making it a notable force in the social media landscape. As of the latest metrics, Triller facilitates over 500 million interactions quarterly across its platform, which is frequented by 436 million consumer accounts worldwide. This expansive reach underscores Triller’s effectiveness in capturing and retaining a large and active user base. The platform’s growth trajectory is fueled by its strategic use of AI technology to enhance content creation and distribution, allowing it to scale rapidly across diverse demographics and geographic regions. The merger with AGBA is expected to further catalyze Triller’s growth by integrating financial services into the platform, potentially increasing user engagement through innovative monetization strategies.

Triller as a Competitor to TikTok Amid Potential US Bans

Triller’s position as a direct competitor to TikTok comes into sharper focus particularly as legislative changes threaten TikTok’s operations in the United States. On the same day of announcing their merger, news broke that the U.S. House of Representatives passed a bill aimed at banning TikTok in the USA. This legislative move could significantly alter the competitive landscape in the digital content market.

Triller stands to benefit from this situation, positioning itself as a viable alternative for users and creators seeking a platform free from the geopolitical tensions affecting TikTok. With its robust AI-driven content capabilities and a strong emphasis on user privacy and data security, Triller could attract a substantial number of users transitioning from TikTok should the ban be implemented. Moreover, the merger with AGBA adds a layer of financial stability and innovation potential that could make Triller more appealing to both users and investors, potentially accelerating its growth in a post-TikTok scenario.

Merger Details

The merger between Triller and AGBA Group Holding is a significant transaction aimed at leveraging synergies between Triller’s digital and social media platform and AGBA’s financial services expertise. Here are the specific details regarding the structure of the deal:

Valuation and Ownership: The combined entity resulting from the merger of Triller and AGBA is valued at approximately $4 billion. Under the terms of the agreement, Triller shareholders will own 80% of the merged entity, representing a valuation of $3.2 billion. Meanwhile, AGBA shareholders will hold the remaining 20%, which translates to about $800 million (AGBA).

Share Details: AGBA currently has 74.4 million shares outstanding. With AGBA shareholders owning 20% of the combined entity, the implied value per share of AGBA’s current outstanding shares is approximately $10.75. Due to several variables including Triller’s current financial position, It’s doubtful that the price reaches this market cap anytime soon. Although I’ve been wrong before. (See Prospectus filed with the SEC on 08/02/2024 below)

Corporate Structure: At the closing of the merger, Triller will become a wholly-owned subsidiary of AGBA. Furthermore, AGBA is slated to domesticate to the United States as a Delaware corporation, which will automatically convert all ordinary shares of AGBA into shares of common stock of the new Delaware entity (AGBA).

Regulatory and Closing Conditions: The completion of this merger is subject to various conditions, including regulatory approvals and the approval of the shareholders from both companies (AGBA).

Triller Prospectus (SEC Filing S-1 August 2nd, 2023)

Source: SEC.Gov

HIGHLY RECOMMEND READING THE FULL PROSPECTUS HERE

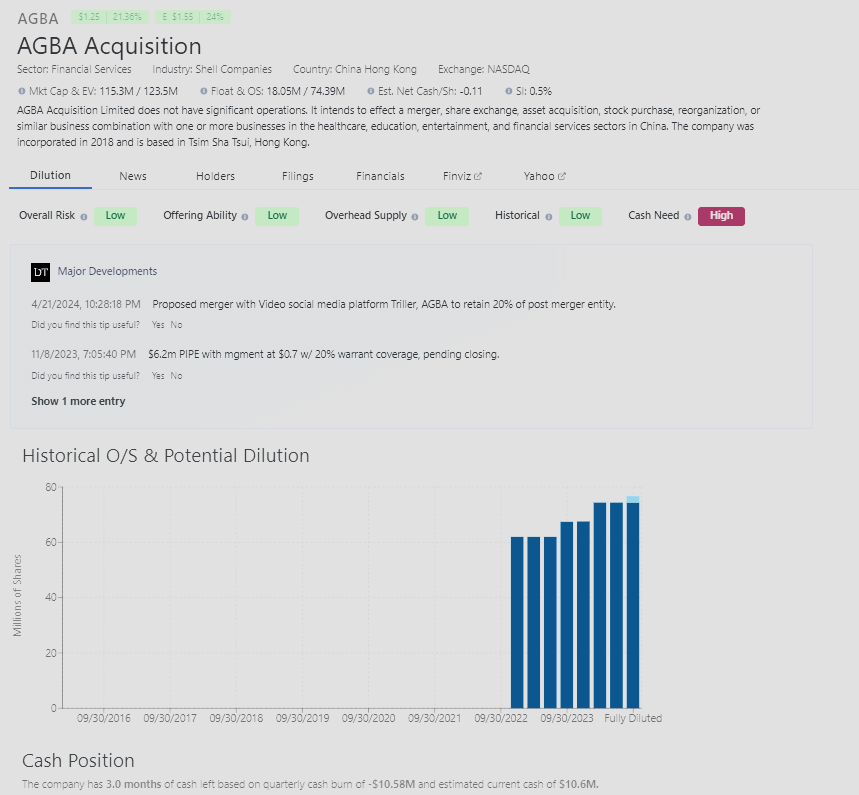

Estimated Share Structure, Short Interest, Institutional Ownership and Cash Position

Source: DilutionTracker

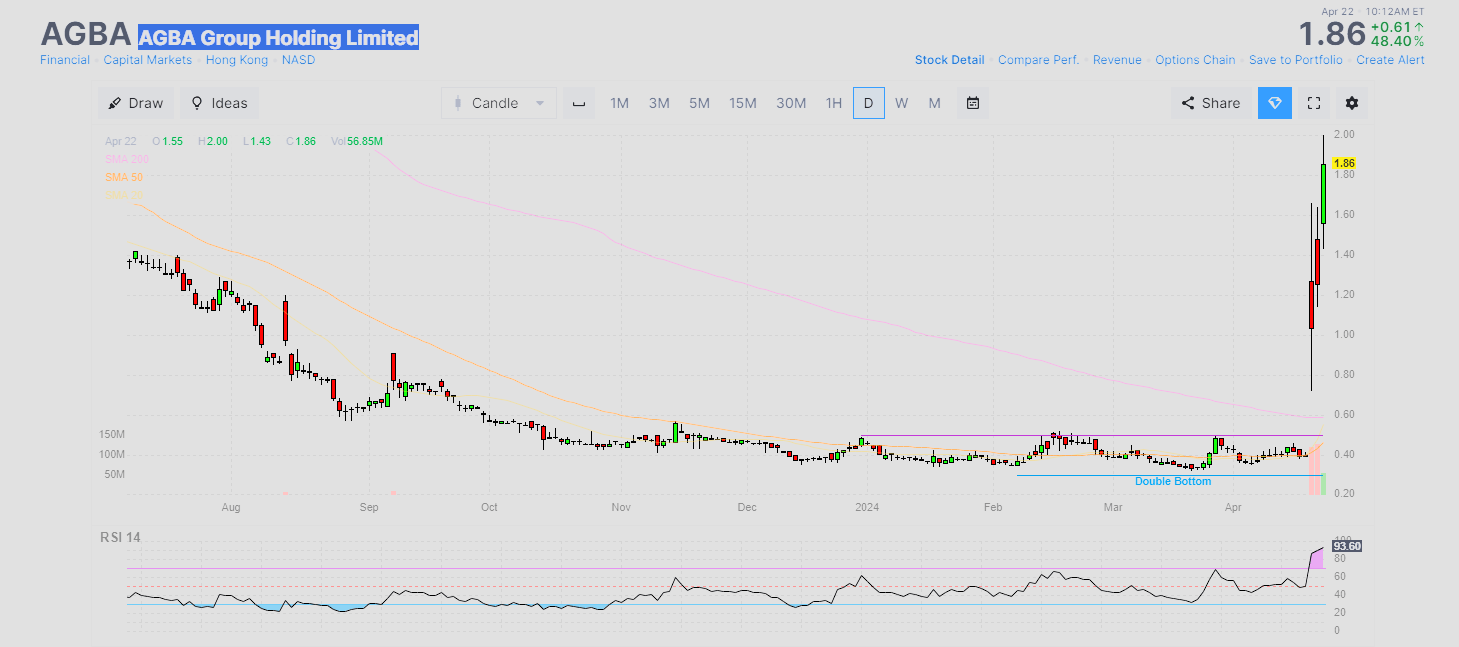

AGBA Daily Chart – From a technical standpoint AGBA is extremely overbought with an RSI (14) of 93

Not saying it can’t go higher. Does appear to need a breather prior to a continuation at some point though.

Source: Finviz

Conclusion

The strategic merger between AGBA and Triller is set to redefine the convergence of technology and financial services, creating a robust platform capable of competing with major players in the digital content sphere. The potential legislative challenges facing competitors like TikTok could further enhance Triller’s market position, making it a preferred platform for millions of users globally. Through innovative technology, strategic leadership, and a clear vision for the future, the merged entity is poised to achieve unprecedented growth and establish a new paradigm in how digital media and financial services interact. This merger not only promises substantial value creation for stakeholders but also positions the company as a leader in the evolving global digital landscape.

Make sure you have realistic expectations on this one post-hype / post-merger. Wall street isn’t very forgiving with companies that consistently lose significant amounts of money. However, Triller is a very intriguing growth story and has the potential to reach the $4b market cap and higher with good leadership. See the Triller prospectus here – HIGHLY RECOMMEND READING THE FULL PROSPECTUS HERE

For more information on AGBA Holdings:

Risk Factors

The merger between AGBA Group Holding Ltd. and Triller Corp presents several compelling strategic and financial advantages; however, potential investors should also consider a range of risk factors associated with the business combination and the future operations of the combined entity:

1. Integration Risks

The successful integration of AGBA and Triller poses significant challenges. Differences in corporate culture, management styles, and business operations may impede the merger’s intended synergies. Failure to effectively integrate could lead to operational inefficiencies, increased costs, and a delay in achieving the projected benefits of the merger.

2. Regulatory and Legal Challenges

Both companies operate in regulatory environments that could impact their business operations. Particularly, Triller’s role as a social media platform may subject it to increased scrutiny and regulatory pressures, similar to those faced by other major players in the industry like TikTok. Changes in data privacy laws, copyright rules, and other regulations could adversely affect the company’s operations and profitability.

3. Market Competition

The digital content and financial services sectors are highly competitive, with rapid technological advancements and frequent changes in consumer preferences. Triller’s competition with TikTok, especially amidst potential U.S. legislative actions against TikTok, provides both an opportunity and a risk, depending on how the legislative measures are finalized and enforced. If TikTok successfully navigates these challenges, Triller’s position as a competitor may be weakened.

4. Economic and Geopolitical Uncertainties

Global economic downturns or geopolitical tensions, particularly involving China where AGBA’s significant operations are based, could negatively impact the combined company’s performance. Market volatility can affect customer behavior and disrupt the company’s supply chains and financial stability.

5. Technological Risks

Triller’s reliance on advanced AI technologies for growth introduces risks related to technological obsolescence and the need for continuous innovation. Any failure to keep pace with technological advancements in AI and digital content creation could impair the company’s ability to compete effectively.

6. Financial Risk

The combined company will need to manage its financing and cash flows prudently. Mismanagement of financial resources, inadequate access to capital markets, or unforeseen expenses related to integration could adversely affect the company’s financial health.

7. Dependence on Key Personnel

The success of the merged entity heavily relies on the vision and expertise of its leadership team. Any significant changes in the executive management or inability to retain key personnel could disrupt the company’s strategic direction and operational success.

Conclusion on Risk Factors

While the merger between AGBA and Triller is strategically aligned to create a robust platform for growth and innovation, these risk factors must be carefully managed to ensure the combined entity achieves its full potential. Potential investors and stakeholders should consider these risks in conjunction with the anticipated benefits of the merger.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Disclaimer: This article is intended for informational purposes only. It should not be considered financial or investment advice. We do not hold any form of equity in the securities mentioned in this article. We have not been compensated in any way for the creation or distribution of this article. Always consult with a certified financial professional before making any financial decisions. Growth stocks carry a high degree of risk, and you could lose your entire investment.