Citigroup has adjusted its forecast for the U.S. Federal Reserve’s key interest rate hike, predicting a 25 basis points increase in November. Previously, the bank had anticipated a rise in September. The change comes in light of recent inflation data, which has influenced expectations for the Federal Reserve to maintain its current policy stance in the upcoming meeting. The more robust than anticipated inflation reading suggests that the Fed may keep its 2023 median projection consistent.

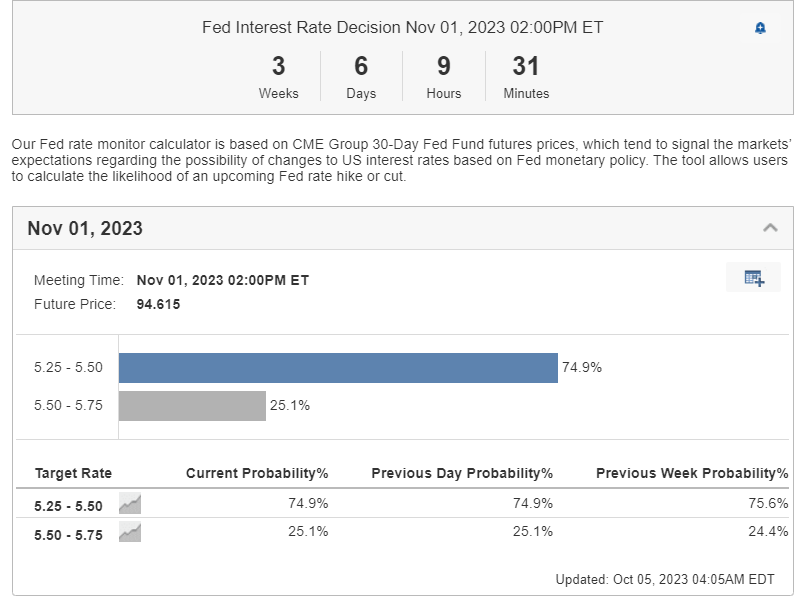

Traders echo these sentiments. According to the CME FedWatch Tool, there’s a 97% probability the Fed will hold rates for September, with approximately a 60% chance for a November pause. Meanwhile, global bond markets have reacted to this, with an accelerated selloff prompted by U.S. government shutdown alleviation and an increase in expectations for a November rate adjustment.

U.S. stock markets exhibited turbulence amidst this climate. The S&P 500 remained largely unaffected by the day’s end, though it recouped some losses in the session’s closing moments. Conversely, the Nasdaq 100 concluded 0.8% up, buoyed by major technology companies like Microsoft Corp. (NASDAQ: MSFT), Apple Inc. (NASDAQ: AAPL), and Nvidia Corp. (NASDAQ: NVDA).

Concerns around interest rates overshadowed the relief that followed a weekend agreement averting a government shutdown. Mike Harris, president of Quest Partners, emphasized that the market’s muted response to this resolution, paired with rising interest rates, signals an awakening to the reality of prolonged higher rates.

Vice Chair for Supervision Michael Barr highlighted the challenges central bankers face in determining the duration of elevated interest rates. Additionally, FOMC hawk Michelle Bowman and New York Fed’s John Williams suggested that high interest rates might persist for an extended period.

This financial landscape also witnessed Treasury yields surge, with the 10-year benchmark rate attaining its highest since 2007 at 4.7%. The 30-year rate reached 4.81%, a peak not seen since 2010.

Global perspectives on interest rates are equally hawkish. Bank of England’s Catherine Mann described herself as a hawk regarding interest rate policies, cautioning about potential recurring inflation shocks.

The dollar has appreciated against major currencies, bolstered by strong quarterly performance and policy signals from the Bank of Japan. In contrast, gold prices continue their decline due to rising bond yields, hitting a seven-month low. The oil market has also seen fluctuations, with West Texas Intermediate prices dropping beneath $90 a barrel, a response to Citigroup’s predictions of reduced demand from China despite OPEC+ supply cuts.

Bloomberg economists alert to a potential U.S. recession, highlighting potential catalysts like an extensive auto strike, impending student-loan repayments, and the perennial risk of a government shutdown.

In the week ahead, several key events are set to influence markets further:

China observes a week-long holiday.

Various Fed officials, including New York’s John Williams and Cleveland’s Loretta Mester, will share their perspectives on economic outlooks and other topics.

Indices and reports, such as the US ISM manufacturing index and the Eurozone services PMIs, are scheduled for release.

Top officials from the European Central Bank, the Bank of England, and the San Francisco Fed will participate in discussions and panels.

With the S&P 500 and Nasdaq showing mixed reactions and commodities like oil and gold facing downward pressure, the overarching theme remains focused on interest rates and their broader market implications.

by Bestgrowthstocks.com

Disclaimer: The author is not a licensed financial advisor and the content provided is for informational purposes only. Always consult with a certified financial advisor before making investment decisions.