Update regarding 1847 Holdings (NYSE-American: EFSH) 06/10/2024 8PM EST

I regret that today’s alert didn’t meet expectations regarding sustainable upside potential.

You deserve top-notch alerts from me, and I am committed to delivering better results.

Small-cap companies often present some of the most underappreciated opportunities with high gain potential. However, they come with high volatility and uncertainty regarding when or if those gains will materialize.

Some of my previous alerts have achieved impressive double or triple-digit returns in just days or weeks.

I encourage you to create and follow your own trading rules. For example, always set a stop-loss and determine your profit-taking points.

By sticking to your personal trading guidelines, you can increase the likelihood of successful trades.

I am working diligently to find a new alert that offers sustainable upside potential. As soon as I find a promising opportunity, I will share it with you.

Thank you for your patience and continued trust in me.

Dud Report

1847 Holdings (NYSE-American: EFSH)

Current PPS $0.71

The current estimated Float according to Dilution Tracker 5.91m

Just Reported a 15% Increase in Revenue for the First Quarter of 2024

Multiple Potential Near-Term Catalysts

1847 Holdings has several pending developments that could serve as significant catalysts for the company in the near future. These anticipated events are expected to enhance the company’s financial position and operational capacity:

Completion of Strategic Transactions:

Sale of 1847 Cabinets Inc.: The sale of 1847 Cabinets Inc. for $27.6 million is expected to provide substantial liquidity, which can be utilized to reduce debt and invest in new acquisitions or business expansions

Acquisition of a Commercial Cabinet, Door, and Millwork Manufacturer: This acquisition, involving a company with $28.6 million in revenue and $5.2 million in EBITDA for 2023, is poised to enhance 1847 Holdings’ portfolio and drive future revenue growth.

Ongoing Investigation into Trading Activities:

The re-engagement of ShareIntel to investigate potentially improper and illegal trading activities could lead to increased market integrity and potentially boost investor confidence if irregularities are addressed.

Rebranding and Spin-off Initiatives:

The rebranding initiative, particularly the planned spin-off of 1847 Cabinets Inc., could streamline operations and create focused business units, potentially unlocking additional value for shareholders.

Revenue Growth and Financial Performance:

Continued revenue growth, as evidenced by the 15% increase in Q1 2024 and the significant growth in Q4 2023, suggests a strong upward trend in financial performance. Sustaining this growth could be a major catalyst for stock price appreciation.

Expansion and Diversification of Subsidiaries:

Subsidiaries like ICU Eyewear and Wolo Manufacturing are demonstrating strong growth and diversification strategies. ICU Eyewear’s expansion into new manufacturing bases and Wolo Manufacturing’s 40% year-over-year revenue growth in early 2024 highlight the potential for organic growth within the portfolio.

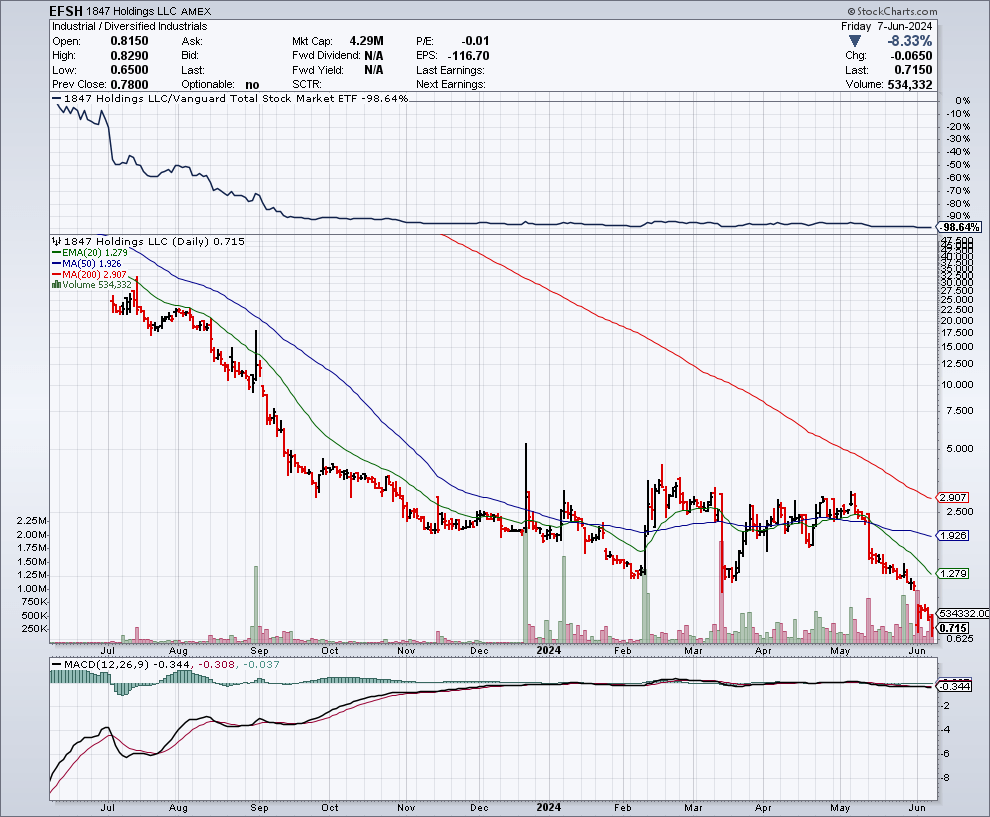

EFSH Daily Chart, RSI (14) is at 23.99 Flashing Oversold, Bounce Could be Imminent

For more information visit: 1847 Holdings | A Publicly Traded Partnership

Conclusion

The company’s strategic initiatives, including the sale of 1847 Cabinets Inc. for $27.6 million and the acquisition of a commercial cabinet, door, and millwork manufacturer with impressive revenue and EBITDA figures, are expected to significantly bolster 1847’s portfolio and liquidity. The ongoing investigation into trading activities, rebranding, and planned spin-offs demonstrate a proactive approach to increasing market integrity and shareholder value. Furthermore, the recent 15% revenue increase in Q1 2024 and sustained growth in its subsidiaries, such as ICU Eyewear and Wolo Manufacturing, underscore a robust upward trend in financial performance. With the current PPS at $0.71 and an oversold RSI indicating a potential bounce, 1847 Holdings presents a compelling near-term bounce opportunity.

by Steve Macalbry

Senior Editor,

BestGrowthStocks.Com

Here are some risk factors to consider for 1847 Holdings (NYSE-American: EFSH):

Market Volatility: The stock price of 1847 Holdings may be subject to significant volatility due to various factors, including market sentiment, macroeconomic conditions, and trading activities. This volatility can lead to rapid and unpredictable changes in the value of the investment.

Execution Risk: The successful completion and integration of strategic transactions, such as the sale of 1847 Cabinets Inc. and the acquisition of the commercial cabinet, door, and millwork manufacturer, are critical to the company’s growth strategy. Any delays, cost overruns, or challenges in integrating these transactions could adversely affect the company’s financial performance.

Operational Risks: The company’s subsidiaries, ICU Eyewear and Wolo Manufacturing, are key contributors to its revenue growth. Any operational disruptions, supply chain issues, or market competition affecting these subsidiaries could negatively impact overall financial results.

Regulatory and Compliance Risks: The re-engagement of ShareIntel to investigate potentially improper and illegal trading activities highlights the importance of regulatory compliance. Any findings of irregularities could result in legal actions, fines, or damage to the company’s reputation, potentially affecting investor confidence.

Economic Conditions: The broader economic environment can impact the company’s performance. Factors such as inflation, interest rates, and economic downturns can affect consumer spending and business investments, potentially leading to reduced revenues and profitability.

Liquidity Risks: While the sale of 1847 Cabinets Inc. is expected to provide substantial liquidity, the effective management and deployment of these funds are crucial. Misallocation or inefficient use of these resources could limit the company’s ability to capitalize on growth opportunities.

Competition: The markets in which 1847 Holdings operates are competitive. The company must continuously innovate and adapt to changing market demands to maintain and grow its market share. Failure to do so could result in a loss of competitive advantage and revenue.

Rebranding and Spin-off Risks: The rebranding initiative and planned spin-offs involve significant changes to the company’s structure and operations. These changes carry risks related to execution, market acceptance, and potential disruption to ongoing business activities.

Dependence on Key Personnel: The company’s success depends on the expertise and continued service of its executive team and key employees. The loss of any of these individuals could disrupt operations and strategic initiatives, potentially hindering growth and performance.

Stock Dilution: Any future equity financing to raise capital could dilute existing shareholders’ ownership, potentially leading to a decrease in the stock price.

By carefully considering these risk factors, investors can better understand the potential challenges 1847 Holdings may face and make more informed investment decisions.

Privacy Policy and Disclosure

At BestGrowthStocks.com, we value and respect your privacy. This Privacy Policy outlines how we collect, use, and protect your personal information when you visit our website and use our services. By accessing or using BestGrowthStocks.com, you agree to the terms described in this Privacy Policy.

Information We Collect

1.1 Personal Information:

We may collect personal information that you voluntarily provide to us, such as your name, email address, cell phone number, and any other information you choose to provide when you join our growth stocks newsletter.

1.2 Non-Personal Information:

We may automatically collect certain non-personal information when you visit our website. This may include your IP address, browser type, operating system, referring URLs, and other technical information that helps us enhance your user experience.

Use of Information

2.1 Personal Information:

We may use your personal information to:

Provide and improve our services, including delivering personalized content. Respond to your inquiries, comments, or requests.

Send you administrative information, such as updates or changes to our policies.

Send you the Best Growth Stocks newsletter by SMS/text and or email.

2.2 Non-Personal Information:

Non-personal information is primarily used to analyze trends, administer the website, track user movements, and gather demographic information. This information helps us understand how users interact with our website and allows us to improve our services.

Information Sharing

3.1 Service Providers:

CRM platforms, Mailchimp and EZ-Texting’s SMS platform we use to send our newsletter to you. These service providers are obligated to maintain the confidentiality and security of your personal information and are prohibited from using it for any other purpose.

3.2 Legal Compliance:

We may disclose your personal information if required by law or if we believe that such disclosure is necessary to comply with a legal obligation, protect our rights, or ensure the safety of our users.

3.3 Aggregate Information:

We may share aggregated and anonymized information with third parties for various purposes, including analytics, marketing, and improving our services. This information does not identify any individual and cannot be linked back to you.

Data Security

We implement reasonable security measures to protect your personal information from unauthorized access, disclosure, alteration, or destruction. However, no data transmission over the internet or electronic storage system can be guaranteed to be 100% secure. Therefore, we cannot guarantee the absolute security of your information.

Third-Party Links

Our website may contain links to third-party websites that are not operated or controlled by us. We are not responsible for the privacy practices or the content of these third-party websites. We encourage you to review the privacy policies of these websites before providing any personal information.

Children’s Privacy

BestGrowthStocks.com is not intended for use by individuals under the age of 18. We do not knowingly collect personal information from children. If you are a parent or guardian and believe that your child has provided us with personal information, please contact us, and we will delete such information from our records.

Changes to the Privacy Policy

We may update this Privacy Policy from time to time to reflect changes in our practices or applicable laws. The updated Privacy Policy will be posted on our website, and the effective date will be revised accordingly. We encourage you to review this Privacy Policy periodically.

Contact Us

If you have any questions or concerns regarding this Privacy Policy or our data practices, please contact us at editor@bestgrowthstocks.com

Sponsored Content Disclosure – In Accordance with the Securities Act Section17 (b)

Transparency is very important to us. Please read this disclaimer in its entirety to fully understand this segment of our business model.

BestGrowthStocks.com is a wholly owned subsidiary of Media Source LLC, herein referred to as MS LLC.

This website / media webpage is owned, operated, and edited by Media Source LLC. Any wording found on this website / media webpage or disclaimer referencing to “I” or “we” or “our” or “MS LLC” refers to Media Source LLC. This website / media webpage is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and promote public companies. By reading our website / media webpage you agree to the terms of our disclaimer, which are subject to change at any time.

Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The disclaimer is to be read and fully understood before using our services, joining our site or our email/blog list as well as any social networking platforms we may use. Part of MS LLC’s business model is to receive financial compensation to promote public companies in an investor relations capacity. To conduct investor relations advertising, marketing and publicly disseminate information not limited to our Websites, Email, SMS, Push Notifications, Influencers, Social Media Postings, Ticker Tags, Press Releases, Online or Phone Interviews, Podcasts, Videos, Audio Ads, Banner Ads, Native Ads, Responsive Ads. This compensation is a major conflict of interest in our ability to be unbiased regarding the publicly traded entities mentioned. Therefore, this communication should be viewed as a commercial advertisement only. Note, we periodically conduct interviews and issue stock alerts that we are not compensated for, these are purely for the purpose of building our brands and other portions of our business model. We have not investigated the background of the hiring third party or parties. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors. We do not guarantee the timeliness, accuracy, or completeness of the information on our website / media webpage. The information in our website / media webpage is believed to be accurate and correct but has not been independently verified and is not guaranteed to be correct.

Please Note: MS LLC and its employees are not a registered investment advisor, Broker Dealer or a member of any association for other research providers in any jurisdiction whatsoever.

Release of Liability: Through use of this website viewing or using you agree to hold MS LLC, its operator’s, owners and employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information in our website / media webpage is believed to be accurate and correct but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, MS LLC often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Some of our claims regarding gains could be based on intra-day, pre-market and after-hours trading data.

All information on featured companies is provided by the companies profiled or is available from public sources and MS LLC makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead, MS LLC strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D.

MS LLC is compliant with the Can Spam Act of 2003. MS LLC does not offer such advice or analysis, and MS LLC further urges you to consult your own independent tax, business, financial and investment advisors. Investing in small and micro-cap growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results.

In preparing this publication, MS LLC has relied upon information supplied by its customers, publicly available information, and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. We have been compensated ten thousand dollars cash via bank wire by ACN LLC for investor relations and marketing services of EFSH starting 06/10/2024 and lasting one day through 06/10/2024. We do not hold any form of equity in EFSH. The advertisements in this website are believed to be reliable, however, MS LLC and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement.

MS LLC is not responsible for any claims made by the companies advertised herein, nor is MS LLC responsible for any other promotional firm, its program or its structure.